According to the tax legislation of the Russian Federation, the right to a tax deduction for the purchase of real estate is granted to all taxpayers. This is a partial refund of personal income tax paid, the amount of which is determined by the income received for the year. But how can you get a tax deduction if you don’t work? Temporarily unemployed, officially unemployed citizens or unemployed pensioners may find themselves in this situation. Let us consider in what cases and when financial compensation is possible for this category of citizens.

Certain categories of people in certain life situations have the right to get their taxes paid back.

Who is entitled to a tax deduction for an apartment?

Taxpayers who pay 13% income tax on their earnings to the treasury can receive a property deduction after purchasing a home. But not everyone can take advantage of such a benefit. A list of citizens to whom it is not available has been established:

- persons who have executed a purchase and sale agreement for a property with close relatives (spouses, parents, sisters, brothers);

- individuals who received housing as an inheritance or under a gift agreement;

- those who incorrectly filled out a tax return or did not provide supporting documents in full;

- individuals who have already received a tax deduction for an apartment;

- persons who are not home owners.

As you can see, this list does not clearly indicate that unemployed people and pensioners cannot return their taxes.

In 2021, the maximum deduction is based on an amount of 2 million rubles. If before 2014 this restriction applied to the property, now it applies to its owner. This means that 13% is not deducted from the cost of housing, but only from 2 million rubles. A person can receive a maximum of 260 thousand rubles. provided that during the reporting year he received an income of at least 2 million rubles. If the amount of income is less, then the remainder of the deduction is carried over to the next reporting period. And so on until the state returns the entire amount in full.

Now it is allowed to transfer the remainder of the deduction to other objects, but only when purchasing housing. In the case of mortgage interest, this rule does not apply: the deduction is given only for one object. If housing was purchased on credit, the citizen can receive compensation for the interest paid to the bank. It does not exceed 1 million rubles. Therefore, the maximum calculated amount for personal income tax refund for a mortgage is 3 million rubles.

The bank offers its clients assistance in preparing documents for the return of paid obligatory payments to the budget

What amounts can be returned for purchasing an apartment?

An unemployed person, like any other taxpayer, has the right to return tax in the amount of:

- Up to 260,000 rubles - buying an apartment with your own funds

- Up to 390,000 rubles – purchase with a mortgage (for interest actually paid)

Since the main tax deduction is limited by law to 2 million rubles, you can return a maximum of 13% of this amount.

When purchasing an apartment with a mortgage, you can additionally receive a tax deduction on interest - 3 million rubles and return 13% of this amount.

Thus, an unemployed person can return a maximum of 650,000 rubles when purchasing an apartment with a mortgage.

Features of receiving a personal income tax refund for unemployed people

All these rules also apply to the temporarily unemployed. To understand how they can get their taxes paid back, you need to pay attention to 2 points:

- The right to receive a property deduction arises from the year in which the ownership of the acquired housing was registered, i.e. It is not the date of purchase that is recorded, but the registration of ownership of the property. When purchasing under an equity participation agreement, this is the signing of an acceptance certificate; when building a house on a purchased plot, this is after registering the house. You can exercise your right to a refund at any time. The law does not establish term limits.

- But there are temporary restrictions on personal income tax returns. Compensation is possible only 3 years before filing the declaration. For pensioners and the unemployed - 3 years before retirement or leaving work. The money overpaid to the budget can only be returned for the time when the person was officially employed.

Based on this, an unemployed person needs to choose the right time to submit an application for a deduction:

- The employment relationship was interrupted for less than a year. The taxpayer submits the return as usual and gets a chance to get the funds back.

- When a citizen eventually gets a job officially and is able to make contributions to the tax treasury, he can submit applications for reimbursement. Or you won’t have to pay personal income tax under the terms of the offset until the limit is completely exhausted. During this time, you can even sell your home, the right to deduction will remain.

You might be interested in:

Reimbursement of taxes to the budget - Sberbank service

Unemployed citizens can take advantage of the right to compensation if they have income from which 13% is deducted:

- sale of real estate and movable property;

- renting out an apartment or other real estate

- provision of services under a civil contract.

The Federal Tax Service reveals where citizens get funds for expensive purchases

Currently, it is a common practice when citizens are called to give explanations and, if they have unconfirmed income, are asked to fill out a declaration, or correct an existing one, and pay a tax of 13% of the purchase price. Therefore, if you have documentation confirming income for purchasing property, it is better to provide it to the inspector. If you are summoned for questioning, you will have to give an explanation, since a fine of 3,000 rubles is provided for a witness’s unlawful refusal to testify, or giving knowingly false testimony in accordance with Article 128 of the Tax Code of the Russian Federation.

Despite the fairly wide range of topics and questions that tax authorities can raise, there are a number of universal rules that are best followed if you want to avoid future claims.

1. Prepare for interrogation. Before going to the tax office, it is better to think through your answers well in advance. As a rule, inspectors are interested in the sources of funds and their documentary evidence. If income was not declared, then it is necessary to explain why. For example, if you received money as a gift, then the amount received is not subject to declaration, and tax on it is not subject to payment. Tax authorities often ask the same question using different wording. However, stick to your pre-planned plan and insist on your position.

2. Stay calm and do not give in to provocations. It should be remembered that tax authorities often use the questioning of a witness as a way to exert psychological pressure. All statements about the liability that threatens you are often nothing more than an attempt to extract the necessary testimony from you. Take your time to answer questions, think carefully about your answer before voicing it.

3. During interrogation, answer clearly and consistently. Try to give answers that are relevant to the questions asked to you. There is no need to voice unnecessary information, especially if it could be interpreted against you. Do not overuse the answer “I don’t know” or “I don’t remember.” Such answers should be used only as a last resort, when you are caught off guard by some inconvenient question. Otherwise, tax authorities may sense your weaknesses and continue their investigation in these areas. But if you feel that it is better not to answer the question, then refer to the need to clarify the information in the documents or remember certain circumstances.

4. Before signing the interrogation protocol, study it carefully. Based on the results of the interrogation, the tax inspector must draw up a protocol. Please read this document carefully and check that the protocol does not contain any distortions. If you find that your testimony is not recorded entirely correctly or can be interpreted in two ways, do not be afraid to ask to rewrite controversial points. Only when you are sure that everything in the protocol is stated correctly, sign it and do not forget to get a copy.

5. Bring a tax attorney with you to the interview. Firstly, it will give you confidence during interrogation. Secondly, the lawyer will help you prepare for the procedure. Thirdly, he will check the correctness of the interrogation protocol.

It is important to remember the right of every citizen not to testify against himself and his loved ones in accordance with Article 51 of the Constitution of the Russian Federation. Refusal to provide explanations in these cases will not entail sanctions, which is confirmed by the explanations of the Federal Tax Service (clause 5 of the letter of the Federal Tax Service of Russia dated July 17, 2013 N AS-4-2/12837). However, a witness’s refusal to answer absolutely all the inspector’s questions may be considered unlawful, and in this case the citizen may be fined 3,000 rubles under Article 128 of the Tax Code of the Russian Federation.

How to get a tax deduction for an apartment for an unemployed person

In the absence of official employment, a citizen has the right to reimburse part of the taxes paid in two ways: through the Federal Tax Service or through a previous employer. In the first option, you will need to deal with this procedure yourself, and in the second, you will need to shift some of the responsibilities to your former employer. In the latter case, the procedure will be delayed in time.

Before submitting an application, you should develop a strategy that will benefit you:

- Assess the situation. You may find that your family is entitled to a double deduction. It may be more profitable if the second spouse submits the application. Or you will need to redistribute the deduction in a married couple. Pre-calculate the financial benefits of all options.

- Decide on the method of compensation - through the tax office or through the employer. It is allowed to alternate them until the entire amount is returned.

- Monitor deduction balances so that in the next reporting period you can return them in full or distribute them over several periods.

You might be interested in:

Sberbank for the self-employed - what services are there

Through the Federal Tax Service

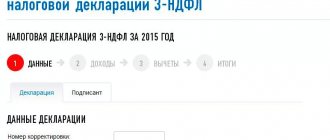

The procedure for tax refunds for the unemployed through the tax service is no different from the same procedure for officially employed Russians:

- you will need to take a certificate in form 2-NDFL from the organization where you were employed before or where you are now receiving additional income;

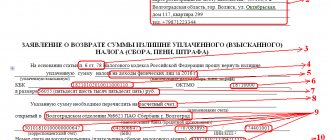

- write an application to the Federal Tax Service for a deduction, indicating the details for transferring money;

- prepare certified copies of documents (list below);

- fill out the 3-NDFL declaration for submission to the tax service, supplementing with the collected certificates;

- a maximum of 3 months is provided for checking the provided documentation according to the instructions, after which the taxpayer receives a response from the Federal Tax Service;

- If the answer is positive, compensation is transferred within 1 month to the account specified in the application.

This site offers a wide range of services to its clients

Required documents

In addition to the completed declaration, income certificate, passport, TIN and application, the taxpayer provides:

- documents confirming the right to own real estate (purchase and sale agreement of an apartment, house, room, land plot for further construction);

- a certificate for maternity capital, if the funds from it were used to purchase housing (the same applies to other subsidies);

- equity participation agreement, if housing was purchased under such a scheme;

- bank statements, payment documents, checks confirming the fact of payment.

List of life situations that allow you to receive compensation for tax payments

Registration at previous job

In this option, the registration algorithm is similar to the previous one, but the former employer is responsible for issuing some certificates:

- certificate of income for previous periods;

- documents confirming the transfer of tax from the salary of the applying employee to the budget.

Briefly, how to pay taxes on the sale of property?

- First, determine whether you should pay tax. If you sold your only home that you have owned for more than three years and the property was purchased after January 2021, you will not have to pay tax.

- If you bought a new home and sold your old one within 90 days, you will not have to pay tax. The 90 day rule is in effect.

- You do not have the only home, but you sold an apartment that you owned for more than five years. In this case, you will not have to pay to the state treasury either.

- The rate for calculating personal income tax is 13% for residents of the Russian Federation and 30% for foreign citizens.

- If the value exceeds the cadastral price by more than 70%, the amount of the contract is taken into account, and if less, the tax base is calculated from 70% of the cadastre.

- To reduce the tax base, use a tax deduction or the amount of expenses for the purchase of real estate.

- The declaration for payment of taxes on the sale of property must be submitted by April 30. And the deadline for paying debts from the sale of an apartment is until July 15 of the next year.

If you have any questions, ask them to an IBC specialist by filling out an online application. We consult for free.

Sberbank service for tax refunds

In order to simplify the procedure for reimbursement of paid tax payments, the bank, together with its partner, launched a special service.

Groups of expenses for which it is possible to return the money paid

With its help, you can return annual expenses associated with:

- Purchasing any real estate (apartment, house, plot, cottage), including mortgage. The maximum amount of compensation is 650 thousand rubles.

- Trading activities and receiving investment income from trading securities (maximum 1 million rubles).

- Opening an investment account, conducting transactions using an individual investment account (maximum 52 thousand rubles)

In addition, clients of a banking institution can return 15.6 thousand rubles. behind:

- insurance services;

- in connection with treatment, receipt of medical services and purchase of medications;

- teaching children at school, on educational courses, and also for paying for kindergarten.

Two tariff options to choose from: optimal and maximum.

To use the online service, you need to choose a service tariff:

- “Optimal” (RUB 1,499). The tariff includes the service of a personal consultant, connection to a special mobile application “Return Tax” and preparation of a declaration online.

- “Maximum” (RUB 2,999). In addition to these services, the tariff additionally includes courier services for delivering the declaration to the Federal Tax Service).

The procedure for registering a tax deduction on the service is as follows:

- The client submits an application on the website. A personal consultant contacts the user and helps him choose the desired tariff and calculates the amount of deduction.

- The user installs the “Tax Refund” application on his phone. Then you need to take a photo of the necessary documents, upload them to the application and send.

- After this, the consultant, taking into account the provided documents, fills out a declaration to the Federal Tax Service.

Three simple steps to return paid tax payments

If the user purchased the “Optimal” tariff, then he will need to submit a completed declaration himself, sending it through his personal account to the Federal Tax Service or by personally contacting the tax service. For clients with the “Maximum” tariff, this function will be performed by bank employees.

Standard deductions for children and disabled children for an unemployed person

Since the main condition for providing a standard tax deduction, including a deduction for children and disabled children, is the availability of income to an individual in the reporting period, an unemployed person cannot receive it. It is also impossible to transfer such a deduction to a working spouse.

The main condition for providing a double deduction to a spouse is the monthly presentation by the party who refused the deduction of a 2-NDFL certificate, which will indicate the amount of his income. The lack of income and, accordingly, such a document determines the impossibility of an unemployed person to count on such a deduction.

Can a pensioner receive a tax deduction?

Pensioners can also count on a tax deduction when purchasing a home. There are 2 options here:

- While retired, a citizen has additional income subject to personal income tax. In this case, the benefit is provided to him as an ordinary taxpayer.

- An elderly person has no additional income other than a pension, and he has nothing to pay taxes on. Therefore, there is nothing to subtract from.

In the second case, you need to take into account an important nuance - from what source does the non-working pensioner receive pension payments? If it is a state pension, it is not subject to tax. The situation is different with NPFs. A 13% tax is deducted from his payments, so the benefit applies to such a pension.

Pensioners who bought housing can also receive compensation for 4 years of tax payments

Compared to the unemployed, pensioners have some privileges. A person who is retired and purchased housing at this time has the opportunity to return taxes for the year in which the property was purchased and 3 years before that. This means that within 4 tax periods he can apply for a personal income tax refund.

This rule is provided by the state so that retirees have the opportunity to receive more funds when they have taxable income. Or they were able to return personal income tax while they were saving for the purchase of housing. With the onset of retirement and the absence of official earnings, they are no longer subject to taxation (except for the situation with non-state pension funds), so they will not be able to return anything from the budget.

Features and nuances

The right to a tax deduction remains with the unemployed only when purchasing an apartment. If a person spent money on treatment, but did not receive an official salary for the same year, then he will not be able to transfer the right to deduction to a later date. The period for social deductions is no more than 1 year; the balance cannot be transferred.

Individual entrepreneurs who pay taxes under the simplified tax system cannot claim compensation. If you are on the general taxation system, you have the right to deduction.

Country houses in gardens are not accepted for deduction.