Mortgage by force of law and by force of contract - differences

In fact, few people find this information useful. These are some legal subtleties that are usually ignored by the borrower. In fact, what kind of mortgage you take out does not change anything - one is clearly no worse than the other, they have the same result - you receive ownership of the property, leaving the bank as collateral.

Meaning of concepts:

- A mortgage by force of law is a classic mortgage that is issued in the vast majority of cases. A mortgage arises on the basis of Federal Law 102 on mortgages automatically upon registration of a purchase and sale transaction in Rosreestr;

- mortgage by virtue of an agreement - arises when a separate agreement is signed, and not in accordance with Federal Law 102. First, an agreement is drawn up, and only then, after a while, the mortgage is separately registered.

It seems that there is not much difference. Indeed, it is not so easy to distinguish between concepts. Therefore, for ease of perception, we will place the differences in the table.

How does a mortgage by law differ from a mortgage by contract:

| By force of law | By virtue of the contract | |

| Arises | based on Federal Law-102 | on the basis of a special agreement |

| Mortgage registration | simultaneously with registration of the transaction in Rosreestr | separately from transaction registration, later |

| What becomes collateral | property being purchased | any real estate |

| Example | any classic mortgage | loan secured by real estate |

Definition and identification of the subject of mortgage

First of all, it should be taken into account that, according to paragraph 5 of Art. 5 of the Law on Mortgage, the subject of a mortgage can only be rights of claim arising from an agreement for participation in shared construction, drawn up in accordance with Law N 214-FZ and passed state registration. Rights of claim arising from any other contractual structures that mediate the attraction of funds for real estate under construction cannot be the subject of a mortgage in any case.

According to paragraph 2 of Art. 9 of the Law on Mortgage, the subject of the mortgage is determined in the agreement by indicating its name, location and a description sufficient to identify this subject. The mortgage agreement must indicate the right by virtue of which the property that is the subject of the mortgage belongs to the mortgagor, and the name of the body that carries out state registration of rights to real estate and transactions with it, which registered this right of the mortgagor.

Based on this rule, in the agreement for pledging the rights of claims arising from the agreement for participation in shared construction, the following information identifying the subject of the mortgage should be indicated:

- the content of the pledged rights of claim (indicating the name and characteristics of the shared construction object in respect of which these rights of claim arose);

- the term established in the agreement for participation in shared construction by the developer of the shared construction object (accordingly, after which the pledged rights of claim must “materialize” into a specific real estate object);

- details of the relevant agreement for participation in shared construction, the name of the registering authority that registered this agreement, the date and number of state registration.

In the absence of this information in the pledge agreement, the subject of the mortgage cannot be considered sufficiently identified, and, accordingly, the pledge agreement cannot be considered concluded. Registration authorities will refuse state registration of such a pledge agreement.

This is confirmed by judicial practice.

Thus, the Federal Arbitration Court of the West Siberian District in the Resolution of September 2, 2008 N F04-5388/2008 (10993-A70-43) in case N A70-1559/2008 indicated that in order to register an agreement on the pledge of rights of claims arising from the agreement for participation in shared construction, such an agreement must contain information confirming that the mortgagor (shareholder) has the right of claim of the participant in shared construction (date, state registration number), which he pledges under the above agreement. In the absence of such information, state registration of the contract cannot be carried out.

When a mortgage arises by force of law

Most often, it arises precisely by virtue of the law - Federal Law -102: the bank issues a loan for real estate, which is immediately formalized as security for the transaction. All documentation, both the transfer of rights and the mortgage, is carried out at one time in Rosreestr.

Referring to current legislation, Rosreestr indicates that a mortgage by force of law arises in the following transactions:

- an apartment (house) purchased with credit funds becomes collateral at the time of registration of the mortgage in Rosreestr;

- if we are talking about a military mortgage;

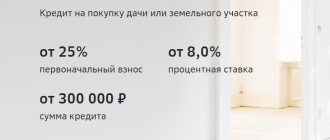

- the plot purchased using credit funds becomes collateral at the time of registration of the mortgage. If a building is being built on the site, the mortgage also applies to it. But within the framework of a separate mortgage agreement, something else may be stipulated;

- if the property is purchased in installments, a mortgage also arises by force of law;

- If a mortgage was previously issued for an unfinished construction project, then after the completion of the project, the mortgage remains valid by force of law.

In both cases, the transaction includes collateral. And the rights of the mortgagee in relation to it will be identical.

Duration of the procedure

The answer to the question of how many days it takes to register a mortgage loan in Rosreestr is simple - from 5 to 12 working days, depending on the situation. If the loan was issued for a house with a plot of land, the procedure period will be 14 days. And for commercial real estate mortgages up to 1 month.

However, if documents are submitted through the MFC, then a minimum of 2-3 days can be added to these deadlines , so the total period for state registration will be a maximum of 15 days. The procedure can be suspended for no more than a month if there are compelling reasons, for example, an incomplete list of documents or a non-compliance of the mortgage agreement with the requirements.

Features of a mortgage by virtue of an agreement

In this case, a separate loan agreement is drawn up, and then the mortgage transaction is registered separately. That is, there is no object purchased on credit that becomes collateral.

A clear example of such a transaction is a loan secured by real estate. That is, there are two separate actions: the first is the conclusion of a standard loan agreement, the second is a separate registration of a mortgage, in which an encumbrance is imposed on real estate that is already owned by the borrower.

The second example, which is sometimes found in the mortgage lending market, is when a mortgage is issued against existing real estate as collateral. Here again, the property is already owned, so the mortgage arises by virtue of the loan agreement and is registered separately.

If, under the terms of a mortgage loan, an encumbrance is placed on the property later, this will also be a mortgage by virtue of the contract. For example, a borrower buys an unfinished house, and according to the terms of the agreement, the mortgage is issued six months later, when construction is completed.

We can say that all mortgage loans that are not classic and are not issued according to the algorithm specified in Federal Law-102 are a mortgage by virtue of an agreement. It specifies these individual conditions.

What do these mortgages have in common?

In general, apart from the process of documenting the transaction, there is no difference for the borrower. He enters into a loan agreement, purchases real estate or receives cash for his purposes by mortgaging his own property.

If we consider the option of purchasing real estate, then mortgages by force of contract and by force of law have the following common features:

- a loan agreement is drawn up, you borrow money at interest and undertake to repay the loan according to the established payment schedule;

- the loan is secured by collateral. In the case of a mortgage under an agreement, this can be any of the borrower’s own property. By law - only purchased;

- Until the loan is repaid, it is impossible to change the owner of the collateral. The encumbrance is removed only after full payment;

- the borrower must fully comply with the bank’s requirements and bring the requested package of documents;

- The borrower must provide a down payment - pay for part of the purchased property from his own funds. Usually banks ask for a minimum of 10-15%;

- To conclude a mortgage transaction, a real estate appraisal is required. The procedure is carried out at the expense of the borrower, and a specialist accredited by the bank is involved;

- The mortgaged property is subject to compulsory insurance. This is how the bank protects itself from the risks of its loss.

Only the transaction registration process itself will differ. In the case of a mortgage by law, the parties or one of the parties brings documents to Rosreestr, at the same time a transfer of ownership rights occurs and a mortgage arises. If this is a mortgage under an agreement, the transfer of rights is first registered, and after a while the mortgage itself is registered.

If this is a mortgage under an agreement, then a state fee of 1000 rubles is required for its separate registration. If the mortgage is issued by a legal entity, then 1000 rubles.

Algorithm of actions

In Rosreestr

- Collect the necessary package of documents (you can find out what documents the borrower must bring for state registration of the mortgage, as well as what package of papers and certificates are required to obtain bank approval, here).

- Fill out the application form and pay the state fee.

- Submit documents to the nearest branch of Rosreestr.

- Receive a registered contract within 5-14 days. If an application to Rosreestr is submitted by a notary (if the contract is notarized), then the borrower may not take part in the procedure at all - everything will be done independently and in a short time - up to 5 days.

At the MFC

- Pay the state fee (you can do it at the terminals on the territory of the MFC).

- Submit an application and documents (copies can be made free of charge at the MFC).

- Receive a registered agreement within 7-30 days.

If you pre-pay the fee at Rosreestr, and then apply with the documents to the MFC, you will have to pay it again, since the documentation will not be accepted.

The details of Rosreestr can be found on the website of this organization , and the MFC can be asked from the employees of this department, since not every center has its own website.

How is a mortgage issued by law?

This is a classic mortgage loan, which is issued in the vast majority of cases. The process looks like this step by step:

- The borrower contacts the bank and provides information. The bank makes a decision. If this is approved, the amount is announced and given 2-3 months to select an object.

- The borrower selects an object that meets the bank's requirements. Collects documents for it, conducts an expert assessment of the property.

- Transferring real estate documents to the bank to check for legal purity and compliance with requirements.

- Concluding a loan agreement, obtaining insurance and visiting Rosreestr to formalize the transfer of rights and the mortgage itself. An encumbrance is immediately placed on the object, but the borrower in any case becomes the owner.

Whatever the mortgage, the borrower can at any time close it completely or partially ahead of schedule. In addition, if you wish, you can refinance - transfer the loan for servicing to another bank.

Give your rating

Filling out an application

The application form for registering a mortgage can be downloaded from the Rosreestr website. The application is submitted in paper or electronic form (if it is signed with an electronic signature).

Main points of the statement:

- information about the mortgaged property;

- transaction amount and value of secured obligations;

- terms of the mortgage and other terms of the contract;

- list of attachments to the application.

The application will need to state a request to register a restriction (encumbrance) on the mortgagor’s right in the form of a mortgage.

For example, the wording may sound like this : a request to register the mortgage of an apartment at the address: Novy Arbat, 14, with cadastral number 456660000000, in connection with the conclusion of loan agreement No. 5678 on the basis of purchase and sale agreement No. 234567 and issue a certificate (name and details of the document) on state registration. The application is signed personally by the borrower.

The application form can be obtained not only on the Rosreestr website, but also in paper form in the departments of territorial authorities.

FAQ

What is a legal mortgage?

This is a classic mortgage, in which at the time of registration of the transaction in Rosreestr, both the transfer of rights is carried out and the mortgage itself is registered. The transaction is executed in accordance with Federal Law-102 On Mortgage.

What is a contractual mortgage?

This is a mortgage that is issued not according to a standard algorithm, but according to the conditions specified in the contract. The mortgage itself is registered separately. Most often, these are loans secured by real estate and mortgages on real estate that the borrower already owns.

Is there a difference between mortgages for the borrower?

It makes no difference to him what type of mortgage it is. He enters into a loan agreement and gets what he wants.

If it is a mortgage by contract, is it illegal?

No, it is also completely legal, it’s just not drawn up in accordance with Federal Law-102 On Mortgages, but under a separate loan agreement.

Which mortgage is best for a borrower?

From the point of view of ease of registration, it is the one that is formalized according to the law. Everything is going according to the postponed scenario, Rosreestr is visited once. In the case of a mortgage under an agreement, there will be more bureaucracy and fuss with papers.

Sources:

- ConsultantPlus: Federal Law “On Mortgage (Pledge of Real Estate)” dated July 16, 1998 N 102-FZ.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Amount of state duty for individuals and payment procedure

The cost of the fee for registering a transaction between individuals will be 1,000 rubles, and between companies – 4,000 rubles.

If the agreement is concluded by the bank and the borrower - 1000 rubles, of which the receipt of an individual is 500 rubles, and the payment order of a legal entity is 500 rubles.

State fees are the same for both the MFC and Rosreestr. The duty is paid regardless of the number of real estate objects that are the subject of the mortgage agreement.

Who should pay the state fee? It can be paid jointly by the bank and the borrower, but most often these costs fall on the shoulders of the client. You can make the payment at any bank branch or terminal .

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya