According to statistics, more than 70% of mortgage borrowers are spouses with children or couples planning to get married and start a family. Lending in these cases helps to buy a home without waiting for the required amount to be accumulated. In order to support citizens, including those with many children, the state offers subsidy programs, for example, “Family Mortgage” or “Far Eastern Mortgage.” However, according to judicial practice, the number of divorce proceedings is increasing from year to year. And those who previously took out a joint housing loan with their ex-other half may face questions: how the mortgaged apartment is divided, who is obliged to pay the debt and who will get the property.

One of the most rational and useful advice from legal advice experts, which allows you to avoid difficulties with division, is the need to document agreements when concluding a marriage. According to Art. 34 of the RF IC, material goods acquired during marriage become common property. Therefore, it is worth discussing in advance who will get the mortgage and real estate, and fix this in the marriage contract. This will allow the ex-husband and wife during a divorce to share only what is not included in the agreement.

If there is no agreement, the division of the mortgage is carried out in two ways: by mutual agreement of the parties and through the court. It makes no difference whether during the marriage, during its dissolution or after. Both options should first be discussed with the loan manager (if the procedure for division during divorce was not clarified by the terms of the marriage agreement at the stage of obtaining the loan). In the absence of children, the shares of the spouses will be equal (Article 39 of the RF IC).

Mortgage refinancing from 7.65%

Tired of overpaying? Refinance!

additional amount for personal needs

Up to 90% of the value of the collateral real estate

To learn more

Common options for how to pay a mortgage during a divorce:

- The main borrower remains one spouse, who subsequently becomes the owner of the property. The other party is taken out of the deal.

- Sell the mortgaged apartment, pay off the debt, and divide the remaining amount.

- Pay off your home loan together. After closing the debt obligations, exchange the home or sell it and divide the money received.

If the spouses independently agree on how to divide the apartment under the mortgage and property during a divorce, who will pay the debt and who owes payment compensation to whom, then the agreement should be certified by a notary. In this case, you will not have to file an application with the court.

Section options

Let's take a closer look at the solutions that, according to statistics, husband and wife resort to most often during a divorce:

- Distribution of debt and real estate equally. By default, spouses are co-borrowers and the living space and obligations on it are divided between them (Article 39 of the RF IC). Property purchased by a husband or wife before marriage is not subject to division. Accordingly, the mortgage received during marriage is also divided in half. This means that the spouses can continue to pay off the debt, and after closing the loan, decide what to do with the square meters.

- Selling an apartment to pay off the balance. There are two transaction options:

close the debt to the bank, sell the property and divide the funds;

- re-issue debt obligations to the buyer on the same terms as the mortgage was opened, without changing the interest rate.

Non-target mortgage loan from 10.15%

The loan is provided against existing real estate.

up to 65% of the value of existing real estate

For a period of up to 20 years

To learn more

Regardless of whether the agreement is drawn up for one person, or whether the spouses are co-borrowers, or whether they entered into a fictitious marriage to obtain a loan, the apartment, like the debt, is common and is divided equally (unless we are talking about a military mortgage). Therefore, if one of the parties stops paying after a divorce, this responsibility will pass to the other. Otherwise, if there is no payment for the housing loan, the bank has the right, at the end of the three-month period, to go to court to collect the loan. The choice of scheme for dividing property and responsibilities depends solely on the agreements of the husband and wife.

Who can withdraw from the contract?

It is allowed to change the composition of debtors under a loan agreement. With the consent of the bank, the following rearrangements can be made within the framework of one agreement:

Replacing the title borrower with another individual - transfer of debt obligations.

Loan “New building with state support” TransCapitalBank, Lt. No. 2210

from 5.34%

per annum

up to 12 million

up to 25 years

Get a loan

Replacement of one or more co-borrowers, or their withdrawal from the agreement without the involvement of other (alternative) persons.

Reassignment of status - replacement of the title borrower with a co-borrower and vice versa.

There are no restrictions on such actions. Changes in the composition of debtors are initiated by the main client. Exception: withdrawal or replacement of a co-borrower when it comes to an official family. It is prohibited to remove a spouse from a loan agreement if the marriage has not been officially dissolved, or if a marriage agreement (contract) has not been concluded between the parties.

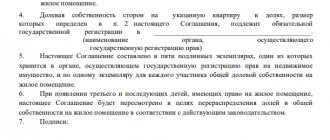

Mortgage in case of divorce of spouses with children

The presence of minor children in the family seriously affects the procedure for dividing mortgages and real estate when a husband and wife divorce. The majority goes to the parent with whom the small child remains. At the same time, regardless of the number of children in the family, when dividing mortgaged housing, the rights of all minors must be respected by law, that is, children must receive shares and be registered in the living space. Property can be divided between spouses only if it has several rooms. A small one-room apartment remains for the wife and child, since the living space cannot be divided into shares. The husband is compensated in the form of part of the cost of the object.

What other options may there be for dividing property under a mortgage in the event of a divorce between spouses and children:

- If the former spouse refuses a share in the apartment in favor of the child, banks agree to transfer the unpaid debt to the wife only on the condition that her solvency allows her to make monthly payments. In the absence of financial capabilities, the husband remains among the co-borrowers.

- If a woman is on maternity leave, has a disability or temporary incapacity for work, a banking organization may allow a reduction in the amount of monthly payments.

- After a divorce and division of the mortgage, the mother has the right to use maternity capital to partially repay the loan. However, she cannot dispose of her share until the ex-spouse completely closes the remaining part of the loan.

- After the birth of the child, the family can use the funds received for a down payment or partial repayment of the debt. Moreover, by law, parents are required to make the minor one of the owners of the mortgaged apartment. In case of divorce, the share of the father or mother remaining as a child will be increased at the expense of the child's share. Debt to the bank, as practice shows, is divided equally between parents.

To avoid intractable situations, lawyers advise drawing up an agreement that will clearly outline the procedure for divorce, the amount of alimony, the rights of the child before and after adulthood, the shares of each spouse, the amount of debt obligations, etc. This will simplify the divorce process and avoid the need to contact court with a statement.

Comments: 4

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Regina

12/16/2021 at 04:46 If we were approved for a mortgage in a new building, but due to deception on the part of the developer, we changed our minds in favor of the secondary market. Do we need to wait again for the bank’s decision on approval? Or can we just make changes to the apartment

Reply ↓ Olga Pikhotskaya

12/16/2021 at 1:13 pmRegina, good afternoon. This depends on the rules of your bank. Contact your credit manager or hotline. It may be possible to make changes to the approved application.

Reply ↓

04.09.2021 at 12:15

Hello! I took out a mortgage from Sberbank 2 years ago. Half a year later he fell ill with a serious illness. I still worked for a while, but now I decided to go on disability. The process is lengthy, and the money from sick leave is not enough to pay the mortgage and live on. If there is a 2nd group disability, then I take the apartment through insurance. But by the time they give me disability, the bank will already take this apartment through the court for debts. Question: what should I do in this situation?

Reply ↓

- Anna Popovich

09/04/2021 at 20:15

Dear Mikhail, submit an application for mortgage restructuring at SberBank Online or at the bank’s office. The bank will analyze your situation and make a decision. The period for consideration of applications for restructuring is up to 10 working days.

Reply ↓

Military mortgage in case of divorce

Military mortgages apply to special cases. In accordance with Art. 34 of the RF IC, funds received as special-purpose payments are not jointly acquired property. That is, an apartment purchased under the NIS program is not subject to division between divorced spouses, including if there are children.

However, if the purchased housing was purchased not only using payments under the military mortgage program, but also using the joint savings of the spouses, then the rights of both parties will be taken into account during the divorce. In this case, as judicial practice shows, the most common are two ways to resolve the situation:

- Husband and wife agree on the division of property;

- The spouses go to court, where they are required to prove that the family budget was used when repaying the mortgage loan. The housing will remain with the serviceman, and the woman will be able to receive compensation commensurate with the funds invested.

It is worth considering separately the situation when there are minor children in the family. They can live in a mortgaged apartment if the spouse does not have her own living space. At the same time, the mother also has the right to live with them.

Preferential new building from 4.49%

The stars have aligned for those who dreamed of buying an apartment in a new building

From 15% down payment

For a period of up to 25 years

To learn more

Who can be a co-borrower?

Any adult who meets the requirements of the credit institution can act in this capacity. Considering that the co-borrower is a full participant in the loan agreement, the involvement of minors for these purposes is not allowed.

For example, you can take the loan program of a conditional bank. Standard requirements for potential clients are as follows:

Loan “Collateral Loan+” Norvik Bank (Vyatka Bank), Person. No. 902

from 8.8%

per annum

up to 8 million

up to 20 years

Get a loan

- Age appropriate.

- Availability of permanent income and employment - the data is documented.

- Permanent registration in the region where the agreement is concluded.

- Positive credit history.

- No heavy credit load.

Whatever requirements are imposed on the borrower, the bank sets the same requirements for the co-borrower. In certain situations, a person becomes a co-borrower automatically - in accordance with legal requirements. This is possible if the mortgage is issued by a person who is officially married. The second spouse enters into the agreement as a co-borrower, regardless of whether he meets the requirements of the credit institution or not.

Mortgage with capital in case of divorce

Judicial practice states that in the event of a divorce with a mortgage issued with maternity capital, part of the real estate that was paid for with the certificate is distributed among family members. The remaining living space is divided between the spouses. Moreover, if the ex-husband is not the father of at least one child and is not indicated in the certificate for maternal capital, then the part of the mortgage apartment paid for with the help of a subsidy does not need to be divided with him.

The shares of minors are managed by the parent with whom they live. This right is retained until the child reaches 18 years of age. A parent does not have the right to manage living space owned by minors without the permission of the guardianship authorities. If the residential property remains with one of the spouses, he is obliged to compensate the other for the cost of the share (Article 38 of the RF IC). In case of disagreement, the amount of payment will be determined by the court.

How to sell a mortgaged apartment after a divorce

If the former spouses do not plan to live in the mortgaged apartment, then they can sell the property or shares and pay off the debt to the bank with the funds received. It is recommended to notify the lender in advance of your intention. It is also worth remembering that this scheme has nuances:

- Not all banks agree to sell a mortgaged apartment that is pledged during a divorce.

- It is quite difficult to find buyers willing to make such a deal.

- If the property was purchased less than three years ago, the divorced spouses will be required to pay sales tax.

So, one of the most important tasks is to obtain the bank’s permission to sell, without which Rosreestr will not register the new owner (Article 53 of the Federal Law “On State Registration of Real Estate”). What solutions exist? To sell an apartment with a mortgage during a divorce, you can discuss with the buyer the possibility of transferring funds to the seller for the latter to repay the debt and remove the encumbrance. After this, all that remains is to re-register the right to the living space to the new owner.

Mortgage loan to buy a house from 8.85%

Tired of the city bustle? It's time to get a mortgage for a country house.

From 30% down payment

For a period of up to 25 years

To learn more

Another option would be to transfer the borrower’s responsibilities to the buyer (Article 391 of the Civil Code of the Russian Federation). As noted above, not all banks agree to such transactions, since the new borrower must meet income and solvency requirements. If consent is received, the sellers waive their share in favor of the buyer. As compensation, they receive the funds contributed on the loan. By the way, this scheme for selling an apartment after a divorce is relevant if one spouse wants to keep the property for himself and is ready to take on debt obligations.

If the seller receives money through the cell

There are still ways out in a situation where the seller receives money not by bank transfer to an account, but through a safe deposit box. If he has not yet collected them, the fact of transfer has not been recorded, so something can still be done.

But here you need to understand that your intentions to refuse the transaction must be shared by the seller. And he is not at all interested in this. And he has every right to take the money from the cell, after which the transaction will be finally completed.

If you managed to come to an agreement with the seller, then you need to quickly formalize the termination of the purchase and sale agreement, register it and submit an application to the bank to change the entry in the Unified State Register (the apartment is already encumbered).

The bank then withdraws the money from the safe deposit box and uses it to close the loan early. But since the loan was valid for some time, during this period the bank will take the required interest, and you will have to pay a little extra. But this is in the interests of the borrower.

How is a mortgage taken out before marriage divided?

This is perhaps the simplest option, which does not require litigation or study of judicial practice. If the mortgaged apartment was registered as a property before marriage, then in the event of a divorce it is not subject to division. It is important to remember that the non-owner spouse who is making mortgage payments may be able to repay the funds. However, this will require you to prove your contribution to the mortgage repayment. To avoid litigation, lawyers recommend drawing up a prenuptial agreement before the wedding, indicating the responsibilities of the parties in the event of a divorce.

If the couple has not registered the relationship, but are co-borrowers on a housing loan, then the citizen in whose name the property is registered will receive the rights. In this case, it is also recommended to specify the terms in the agreement of the parties and it is advisable to have the document certified by a notary.

Refinancing upon divorce

After a divorce, is it possible for a husband or wife to refinance a mortgage with another bank and how does the re-registration take place? Yes, only if one of the parties renounced their obligations and rights, and the other voluntarily accepted them. It is important to remember that the co-borrower’s withdrawal from the mortgage loan agreement must be certified by a notary. Only then can the primary borrower receive full rights to the property.

It is worth finding out in advance about the possibility of refinancing a mortgage after a divorce. This is due to the fact that when applying for a joint loan, the bank considered the income of both spouses. After the divorce, a husband or wife is forced to rely only on their own strength. If the level of solvency is not enough, experts recommend attracting a new co-borrower or guarantor.

How to refuse a mortgage

The ex-husband or wife has the right to refuse the joint mortgage during a divorce and to withdraw from the mortgage agreement. To do this, you must inform the creditor of your intention in advance in order to avoid negative consequences. The bank will need to provide a statement of refusal (a sample can be obtained at a bank branch), a certificate of decrease in income, a certificate of divorce, and a medical report if necessary. The banking organization will issue an agreement to withdraw the borrower from the agreement if there are sufficient grounds.

Before you turn down a mortgage loan, you should weigh all the pros and cons. A borrower who plans to withdraw from the contract loses the opportunity to receive a tax deduction. In addition, this may reduce the chance of re-lending in the future.