Purchasing housing using funds from a targeted housing loan for military personnel includes several stages. Almost each of them requires the preparation, collection and provision of certain documents. First of all, a representative of the armed forces of the Russian Federation who wishes to exercise the right to a military mortgage needs to draw up a report on inclusion in the NIS register (savings-mortgage system).

Take the test and we will find you an apartment

After submitting this service document, you should check whether it is registered in the accounting journal of the Ministry of Defense of the Russian Federation. The time of registration determines how soon the state will begin to transfer security funds. A personal NIS participant card is created for the military personnel, which will indicate his registration number, personal information and reasons for inclusion in the program. After a notice of entry into the register has been drawn up, a savings account is opened in the name of the military man.

What documents does the bank need for a military mortgage?

The initial package that needs to be collected for the lender includes the following papers:

- statement from a serviceman;

- original passport and copies of all its pages;

- NIS participant certificate, which can be obtained several months after submitting the report;

- written consent from the serviceman to the use of his personal data.

To obtain a military mortgage, bank employees may require documents about the borrower’s education, the presence of any property and additional sources of income. The serviceman has six months to find suitable housing - this is the period during which the NIS participant certificate remains valid. You need to select a property that will suit Rosvoenipoteka, the lender providing the loan, and the insurance company.

The second package of papers must be provided when the property for purchase has already been selected. Documents for the apartment required by the bank for a military mortgage:

- technical passport for the house where the purchased apartment is located;

- extract from the Unified State Register of Rights;

- certificates F9 and F7 confirming that no one is registered or living in the apartment;

- certificate of absence of debts under the Civil Code;

- cadastral passport of the object;

- certificate of ownership of the property from the current owner (or from each owner, if there are several owners);

- documents from the developer on title, if housing for a military mortgage is located in a new building;

- a report on the assessment of the cost of the apartment being purchased (preferably from a company accredited by the bank that approved the loan);

- marriage (divorce) certificate from the seller;

- written consent to sell the home from the wife or husband of the current owner.

Representatives of the Russian Armed Forces who are married will need to provide additional documents to obtain a military mortgage in order to take advantage of preferential housing loans:

- original passport of husband or wife and copies of each page;

- a copy of the marriage contract (if drawn up) or marriage certificate;

- consent of the spouse to participate in the NIS in writing, which must be certified by a notary.

A divorced applicant, before applying for a military mortgage, needs to prepare a document on divorce; in addition, only this paper will need to be provided.

What did the courts decide when making their decision?

The first instance, having considered both claims, acted as follows. Based on the decision of November 11, 2015, each of the spouses received a car. In addition, the court distributed the available loans equally among family members.

The court did not divide the mortgaged apartment and the income received from renting it out, leaving everything to Roman. The appellate court also agreed with this option, leaving the original decision in force by its ruling dated February 24, 2016.

When dividing the mortgaged apartment, the courts noted that it was acquired using funds with a designated purpose (NIS). This money was provided to the serviceman to solve his housing problem. In this case, the family status of the recipient of payments does not matter.

Anna was not satisfied with the court decision and this option for dividing property, and she appealed to the Supreme Court with a cassation appeal. As a result, the ex-wife, in part of the apartment, achieved a review of previous judicial acts and the transfer of the case for re-examination to the first instance.

State registration of purchased real estate

At this stage, it is important to know what documents are needed to register an apartment purchased with a military mortgage. You will need the same papers as when concluding a purchase and sale transaction. You will need to add to them:

- marriage certificate or statement that the new homeowner is not married;

- written notarized consent of the husband or wife to purchase real estate with a mortgage;

- receipt of payment of state duty;

- power of attorney for the realtor;

- all documents for a military mortgage that were signed at the bank and Rosvoenipoteka.

The beginning of the conflict: is a military mortgage divided in a divorce?

The couple were married for six years and decided to divorce in 2013. A few years later, the ex-wife (let's call her Anna) filed a lawsuit against her ex-husband, Roman (name also changed).

In her statement of claim for the division of property, Anna asked to divide in half the apartment purchased by her husband under the NIS program, as well as the income that the family received from renting it out.

The plaintiff raised the question of the division of loans issued during marriage. At the same time, the woman was not against leaving the car with her ex-husband and paying her compensation.

In turn, the defendant filed a counterclaim. He asked the court to give the plaintiff the second family car with compensation in his favor, and also to recover part of the money against the jointly paid loan.

Final stage

Even when the apartment has already been purchased and registered in the state registry, it is too early to relax. There is a list of documents for a military mortgage that representatives of the armed forces need to provide to the bank and to Rosvoenipoteka after state registration: copies of the DCP (purchase and sale agreement), insurance contract and check confirming payment of insurance, extract from the Unified State Register, original certificate of home ownership.

To receive the keys to an apartment purchased with a military mortgage in a new building, you will have to prepare the following documents: DCT, certificate of ownership, acceptance certificate and notification of the need to obtain keys, which the buyer receives when the house is completed and the apartment is ready for inspection and transfer .

Despite the fact that the list of documents for a military mortgage is quite long, this program allows military personnel to purchase housing on the most favorable terms for housing loans.

Who can count on a military mortgage?

In accordance with the register of participants in the savings and mortgage housing system for military personnel of the Armed Forces of the Russian Federation, the following categories of military personnel have the right to take advantage of a military mortgage:

Mortgages for the military VTB Bank, Individuals. No. 1000

from 6.9%

per annum

up to 3.6 million

up to 25 years

Get a loan

- officers - if their total duration of military contract service is at least three years after January 1, 2005;

- sailors, sergeants, foremen and soldiers - if they entered into a second contract for military service after January 1, 2005;

- graduates of higher military educational institutions (VVUZ) - if they graduated from educational institutions after January 1, 2005, but entered into the first contract for military service before January 1, 2005.

Judicial practice on military mortgages

Lending for military personnel has its own specifics. It is therefore not surprising that there are several categories of litigation. The first of these is related to debt collection. And here one of the requirements is to foreclose on the property.

In case of divorce, the mortgaged apartment is also an object of attention. The subject of the dispute is the division of the apartment itself or the loan issued to obtain it.

There are also cases of eviction of former family members from a mortgaged apartment. Some court decisions are described below. All of them are quite recent and dated 2021.

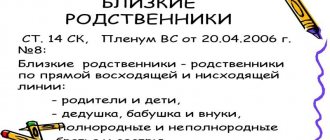

Common joint property

The plaintiff applied to the court for the division of the apartment received by her ex-husband under a military mortgage. At the same time, the appeal included a clause stating that the defendant’s personal funds were also invested in the real estate. The latter objected to the requirements, citing the fact that the living space does not belong to joint ownership.

Having studied the documents and the arguments voiced, the Gagarinsky District Court of Sevastopol granted the claim. The decision dated June 14, 2019 in case No. 2-1870/2019 noted that real estate acquired under the mortgage program for military personnel is the common joint property of the spouses.

The legislation does not contain special clauses regarding this type of apartment. However, the court made an adjustment during the division to the fact that personal funds were also spent on the acquisition of real estate. Therefore, the division did not occur in equal shares.

When the borrower died

The bank filed a claim against the heirs of the citizen who took out the apartment under a military mortgage. The requirements included collection of debt under the loan agreement, as well as foreclosure on the property.

One of the defendants, the wife of the deceased, objected to the claim. She noted that after death, payments should be made by Rosvoenipoteka. And also, the woman noted that she could receive the funds remaining in her husband’s savings account.

Considering the case, the Oktyabrsky District Court of the Amur Region came to the following conclusions. All first-degree relatives of the deceased accepted the inheritance. Therefore, they must be held responsible for their debts.

The defendant’s arguments were also not taken into account, since no documents were submitted to Rosvoenipotek. As for the foreclosure of the mortgaged property, the decision dated June 14, 2019 in case No. 2-64/2019 states that this method of satisfying the creditor’s claims is prescribed in the mortgage agreement itself. And the borrower’s wife gave her notarized consent to its conclusion.

Division of debts after divorce

An interesting case was considered by the Leninsky District Court of Stavropol. A serviceman filed a claim against his ex-wife in court to recognize debt obligations under a military mortgage as general.

However, by decision of July 22, 2019 in case No. 2-1295/2018, the claims were denied. The judge gave the following reasons.

At the time of the divorce, all previous payments on real estate were made by Rosvoenipoteka exclusively from the money contained in the serviceman’s savings account. He himself did not make any contributions. Therefore, the living space is considered to be purchased with funds received under a targeted state program. Therefore, we cannot talk about dividing debt obligations between spouses.

Eviction from a mortgaged apartment

A citizen applied to the court with a demand to evict her ex-husband from her living quarters. The plaintiff emphasized that the apartment was purchased with a military mortgage and, therefore, is her personal property. In addition, the statement indicated that the man abuses alcohol and does not take any part in running the household.

The Seversky City Court of the Tomsk Region, in its decision dated July 3, 2019 in case No. 2-911/2019, stated the following. An apartment purchased under a military mortgage is common property. Therefore, after the divorce, the spouse retains the right to reside in it.

Arguments that a man drinks alcohol and does not take any action regarding the common household are not grounds for his eviction. Therefore, the result of the proceedings was the refusal to satisfy the claim.

Foreclosure of real estate upon dismissal

Rosvoenipoteka filed a lawsuit against the borrower in order to collect the debt under the targeted housing loan agreement and foreclose on the defendant’s real estate. The appeal is justified by the fact that the citizen, who served under a contract, quit and his savings account was closed.

Next, the person was sent a debt repayment schedule, which was not fulfilled. Therefore, a statement of claim was filed.

By the decision of the Kizlyar City Court of the Republic of Dagestan dated July 30, 2019 in case No. 2-347/2019, the claim was satisfied. The apartment was foreclosed on through its sale at public auction. The initial selling price was also indicated in the operative part.

Property division agreement and marriage contract

A marriage contract is concluded upon marriage or at any other time after its registration. The validity of such a contract begins from the moment of marriage. By agreement, the spouses establish rights and obligations that relate to issues related to the property relations of the spouses.

Features of a marriage contract:

- mandatory written notarial form;

- termination of the marriage contract is possible at any time during the marriage, while unilateral refusal to fulfill the clauses of the contract is possible only in court;

- there may be a limited period of validity;

- the provisions of the contract should not limit the rights of the spouses.

Also, an agreement on the division of property can be concluded between the spouses, which is also concluded in mandatory written notarial form. It differs from a marriage contract in that it can be concluded during the marriage or after its dissolution and applies only to existing property.

Division of jointly acquired property: general provisions

The division of an apartment that is jointly owned by spouses can be made both during their marriage and after its dissolution.

It is important to know : in the case of division of joint property, it does not matter which of the spouses worked and who did housework - all jointly acquired property will be divided equally.

If a dispute arises between spouses regarding the division of jointly acquired property, it is necessary to contact the judicial authorities for its resolution.

Division of jointly acquired property: special cases. After marriage, events may occur that may affect the division of marital property in the event of divorce.

Division of property in the case of minor children in the family. According to established practice, in the event of a divorce, the larger share in the joint property is received by the spouse with whom the minor children remain living.

Division of real estate acquired with maternity capital funds. If an apartment was purchased with maternity capital funds, then it is considered to be acquired in common shared ownership between all family members, including children. That is, such property in the event of parental divorce is not subject to division as jointly acquired property.

Moreover, in the event of a parental divorce, the spouse who remains with the children receives their shares until they reach the age of majority.