In order to confirm the conclusion of the transaction, the parties draw up a receipt for receipt of money.

The paper confirms receipt of the deposit. The document is signed after the transfer of funds.

Is this paper always needed, are there any disadvantages for the buyer and seller, rules for drawing up, and is certification required? Let's consider all the questions in the article.

What is a deposit?

The concept of a deposit is defined in Art. 380 Civil Code. This is a sum of money that is transferred by one party to the contract to the other party:

- against payments due under the transaction agreement;

- to ensure that the main contract will be concluded;

- in order to ensure compliance with the terms of the agreement.

When purchasing an apartment, the deposit is part of the funds from its total cost. Payment under the main apartment purchase and sale agreement will be made taking into account the previously transferred deposit. The transfer of money must be made according to an appropriate receipt, drawn up in simple written form.

Important! The deposit is returned in double size due to the fault of the seller, but if the buyer is at fault, he will have to return the full cost of the transferred amount (Part 2 of Article 381 of the Civil Code of the Russian Federation).

Another type of guarantee payment of part of the funds for the purchased property is an advance payment. Its transfer is also formalized by agreement. The concepts of advance and deposit should not be equated; their essence is different.

Is it possible to return the deposit?

When the deposit sample for purchasing a car is completed, both parties are obliged to fulfill their obligations. But there are two cases in which the deposited amount can be returned, for example:

- Car breakdown or other damage.

- The seller sold the vehicle to a third party.

In such circumstances, the legislation is on the buyer’s side and when going to court, the decision will be to return the deposit and pay compensation.

If the purchase was made from an official representative, in order to get your money back, you first need to make two statements. The first one breaks the sales contract, and the second one is aimed at returning funds. If, when drawing up these requests, the buyer receives a refusal at the car dealership, he needs to contact a lawyer or file a lawsuit in court.

As a rule, the completed application is considered within 10 days, after which the unsuccessful buyer must be informed of their decision.

How to draw up a deposit agreement correctly?

An agreement drawn up correctly and containing all the necessary details acquires legal force from the moment both parties put their signatures. Such an agreement does not require notarization, but the parties to the transaction have the right to seek the services of a lawyer or notary to secure their transaction.

Mandatory details of the deposit agreement:

- Date and place of drawing up the contract.

- Details of the parties to the agreement. An individual registers his full name, place of birth, passport details and registration address in accordance with personal documents;

- Information about the amount of the deposit transferred in numbers and in words (the clause of the contract must indicate that the funds are transferred as a deposit).

- Information about the apartment for which a preliminary amount is paid:

- mailing address;

- cadastral number;

- room area;

- the full cost of the premises, which will be indicated in the main contract;

- and other technical characteristics.

- Method and procedure for transferring the deposit.

- Rights and obligations of the seller and buyer.

- The procedure for returning the deposit in case of refusal to fulfill the terms of the contract.

- The terms or date of the main purchase and sale agreement.

- Full details of the parties to the agreement and their personal signatures.

The deposit agreement can be drawn up on a standard form with modifications made in each specific situation. It is unacceptable to contain errors, typos or corrections in the document.

Compilation rules

In order to avoid making serious mistakes when drawing up a contract, it is necessary to study every detail in detail. You need to look through the sample deposit for a car carefully and delve into every word in order not to become a victim of scammers. The document must contain the following information:

- Time and place of money transfer.

- Passport details of both parties.

- The amount of the cost of the vehicle (in numbers and words).

- The amount of the deposit paid.

- Vehicle data.

- Signatures of the parties.

In addition, you should indicate the date when the buyer must make full payment for the car.

The form of the sample deposit for a car can be any, for example, printed on a form or written by hand. Such a document does not require certification, but the parties can do so by mutual decision.

Terms of the agreement (or contract) on the deposit

The transfer of a deposit for an apartment is always made in writing . The document may be titled “Deposit Agreement” or “Deposit Agreement.” There is no legal difference between them; the main thing is that the word “deposit” must be present in the title and in the document itself. This immediately determines the legal basis of the agreement. The conditions and rules for applying the deposit are specified in the law - in Articles 380 and 381 of the Civil Code of the Russian Federation. If the word “deposit” is not in the contract, then the amount is recognized as an advance (more on this below).

The legislative meaning of the deposit comes down to the fact that if the purchase and sale transaction of the apartment does not take place due to the fault of the Buyer who contributed the money, then the amount of the deposit remains with the Seller. If the transaction fails due to the fault of the Seller, then he must return this amount to the Buyer in double amount . This mutual financial responsibility forces the parties to the contract to take their promises seriously.

The conditions for making a deposit when buying or selling an apartment must necessarily contain the following points in the agreement:

- indication of the full name and passport details of the parties to the transaction – the Seller and the Buyer;

- an indication of what exactly or to secure what the deposit is being made (apartment, address), including the essence of the future transaction (purchase, basic terms of the transaction>);

- indication of the deposit amount;

- indication of the total cost of the apartment;

- an indication that the deposit amount is included in the price of the apartment;

- indication of the period for which the deposit is paid;

- an indication that, in accordance with Articles 380 and 381 of the Civil Code of the Russian Federation, the deposit remains with the Seller (if the Buyer does not buy the apartment within a given period), and the deposit is returned to the Buyer in double amount (if the Seller refuses to sell the apartment);

In addition, you need to take into account that the very fact of transferring money under the deposit agreement must also be recorded - either in the agreement itself or in a separate receipt.

The main conditions of the future purchase and sale transaction can be reflected in the deposit agreement itself (as in the example above and in the example below), or you can draw up a separate “Preliminary agreement for the purchase and sale of an apartment”, to which the agreement will refer (in accordance with clause 4 , Article 380 of the Civil Code of the Russian Federation). This does not change the essence, it’s just that instead of one document, some people prefer to create two.

If there are several apartment owners, then they all must participate in accepting the deposit for their apartment and all must sign the Deposit Agreement . If one of them acts for all the owners, then he must have a power of attorney from the others.

You can draw up a contract (agreement) on the deposit yourself based on the sample (see below), but it is better to entrust this to specialized lawyers (including remotely). After all, if the wording of the agreement is expressed incorrectly, then the legal consequences of such an agreement may not be as expected.

The form of the contract (agreement) on the deposit for the purchase and sale of an apartment can be either notarial or non-notarial (simple written). Legally, both have equal force. But for the Buyer of an apartment, a notary can be beneficial as an official witness to the transfer of money and a guarantor that the terms of the agreement protect his interests. After all, the Buyer’s risks in an apartment purchase and sale transaction are always higher than the Seller’s risks.

Concept and purpose

A deposit agreement is a document according to which the buyer transfers to the seller a certain amount of money towards future payment for real estate, that is, a deposit. This amount is not established by law, so the parties can determine it independently.

Most often, its size is small - 5-10% of the total value of the property.

The deposit agreement acts as security for the obligations of both parties to the purchase and sale. It is documentary evidence of the transfer of these funds and must be attached to the package of documents that are used during the conclusion of this transaction. Although it does not provide a complete guarantee for the parties, it does help to protect their rights and interests as much as possible.

The buyer undertakes to pay the remaining amount of the cost of the property, and the seller - not to sell this property to anyone else for a certain time.

Making a deposit implies that the seller ceases all activities regarding the sale of the plot (removes posted advertisements, suspends showings of the property), and the buyer stops looking for another plot.

The main difference between such a transaction and other similar ones (advance payment, prepayment) is the peculiarities of returning the deposit to the buyer, which usually occurs if one of the parties refuses to fulfill it.

In this case, the fate of the funds depends on who initiated the termination, namely:

- if the seller is at fault, the deposit is returned to the buyer in double amount;

- in case of fault on the part of the buyer, the money remains with the seller.

Obviously, such conditions significantly increase the responsibility of the parties and discipline them to comply with their obligations to the maximum extent possible. If the transaction was concluded without problems, the amount of the deposit is deducted from the total cost of the property, and the buyer pays only the remaining amount. Therefore, he risks practically nothing, unless he decides to refuse to buy real estate.

In order for the above requirements to be met, the transfer of the deposit must be documented, in the form of a special contract or agreement. In this case, the document must be drawn up correctly, and the transferred funds must be called a deposit. Otherwise, the buyer or seller will be able to challenge the transaction and keep the money.

What should be the amount of deposit when buying or selling an apartment?

There is no generally accepted fixed amount of money that the Buyer of an apartment must transfer to the Seller in the form of a deposit. This is always a negotiated value .

And it is determined by common sense. What does it mean? The Buyer understands that the amount of the deposit must be sufficient to restrain the Seller from the temptation to sell the apartment to another buyer who will offer a slightly higher price. Then the Seller will have to return double the amount of the deposit, and his advantage in price will be lost.

The seller of the apartment, in turn, understands that the amount of the deposit should be sufficient so that the Buyer would be sorry to lose it, even if he finds a more profitable purchase option.

In practice, usually, the amount of the deposit when buying and selling an apartment is some convenient round figure (for example, 50 or 100 thousand rubles), and does not exceed 1-2% of the total cost of the apartment.

Features of registration of a deposit depending on the conditions

Depending on the terms of the transaction, payment of the deposit to the seller may have its own characteristics:

- Multiple owners - all of them must be included in the deposit agreement and sign it. Receipt of a deposit by one of the owners may lead to further claims from other owners.

- With a mortgage encumbrance - if it is necessary to repay the mortgage debt with the seller’s money, the deposit is drawn up based on this amount.

- Under a share participation agreement in construction, the party accepting the deposit will be a legal entity.

- If a representative acts on behalf of the seller, the text of the power of attorney must indicate the authority to receive the deposit instead of the owner. Otherwise, only the owner has the right to accept the deposit.

Registration of a deposit when concluding an agreement for the assignment of the right of claim, as well as a purchase and sale agreement using maternity capital funds, is carried out according to general rules.

How to properly draw up a deposit agreement when buying an apartment?

The transfer of the deposit to the seller can only be reflected in the preliminary purchase and sale agreement or formalized in a separate agreement. Both of these documents will have legal force from the moment they are signed.

The agreement must necessarily reflect the amount of the deposit as essential conditions and indicate the obligations that are secured by it. Money can be transferred directly at the time of signing the agreement or on the date specified in it.

The agreement must be drawn up according to the number of participants in the transaction and signed by each of them or their representative by proxy.

Agreement form

The requirement to formalize the deposit agreement in writing is regulated in Article 380 of the Civil Code of the Russian Federation. It is not necessary to have it certified by a notary, but this can be done if the parties to the transaction wish. The legal force of the agreement will be the same, however, for the buyer, a certified agreement will be a guarantee that his interests are protected.

The cost of notary services when certifying contracts related to the alienation of real estate depends on the amount of the transaction (up to 1 million rubles - 3000 +0.4%, from 1 to 10 million rubles - 7000+0.2%, over 10 million rubles – 25000+1%).

Next steps and possible problems

The agreement comes into force from the moment it is signed by the parties; state registration with Rosreestr is not required. Although notarization is also not mandatory, it is still better to contact a lawyer.

He will not only check the document and help you draw it up correctly, but will also guarantee that the transaction was concluded with the full legal capacity of the parties.

It is worth considering that when using a deposit, the parties may encounter certain problems and risks. They are especially high for the buyer, so he should take into account the following points:

- It is better to draw up an agreement after the land with the house has been inspected and all the documents on them have been checked. If the seller promises to do all this later, there is also no need to rush to transfer funds in this way.

- Before signing the document, you need to be 100% sure that the remaining funds for the purchase of real estate will be available at the time of the transaction. If the source of funds is not reliable enough (for example, debt or an unconfirmed bank loan), you should think several times about transferring the deposit and take into account possible delays.

- The amount should not be too large. And this is due not only to the buyer’s desire to minimize his losses in the event of a change in decision. Even if the deal fails due to the fault of the seller, the deposit and fine will have to be returned through the court. And during the trial, it may turn out that he does not have the means to pay this amount (for example, he does not work and does not own any property). Therefore, in this case, it will be quite difficult to return the money.

- It is also worth considering that the name of the agreement should sound exactly like a deposit. Only in this case will the rules of the Civil Code of the Russian Federation, dedicated specifically to this method of depositing money, apply to him. In this case, you should not neglect the services of a notary either - the money spent on his services is usually much less than the amount that could be lost if the deposit agreement is incorrectly drawn up.

The pre-emptive right to purchase a land plot allows you to purchase land without bidding. Are you planning to purchase a plot suitable for individual housing construction? Here is a step-by-step algorithm for this procedure. In some cases, it is more profitable to buy land at cadastral value rather than at market value. Read more about this in our article.

Transfer of deposit

After signing the agreement, the buyer can transfer money to the seller. If funds are transferred in cash, the seller must make sure that the amount corresponds to that specified in the agreement by recalculating them in the presence of witnesses. A bank transfer can be easily confirmed with a receipt or account statement.

The place where the money is transferred can be the office of a real estate agency, a notary's office, or the apartment being sold.

Amount and term of deposit

As a rule, the amount of the deposit is determined by agreement of the parties and is not tied to any percentage of the transaction amount. Typically this amount ranges from 50 to 100 thousand rubles, except in cases where the deposit ensures the repayment of the seller's mortgage debt.

When setting the amount of the deposit, the parties proceed from their interests. It must be sufficient so that its loss for the seller or buyer in the event of refusal of one of the parties from the transaction becomes significant. This ensures that the buyer does not refuse the transaction, having found a more suitable option in the process of completing it. At the same time, the seller will not want to sell the apartment to another person, realizing that returning the amount in double amount calls into question his benefit.

The duration of the deposit agreement will depend on what actions the parties need to take before signing the main agreement. The period is discussed by the parties in advance and taken into account with a reserve of time, or the agreement may stipulate the possibility of extending the period if necessary. You can complete a transaction on any day before the deadline specified in the agreement.

Transfer receipt

The fact of transfer of the deposit to the seller can be confirmed by a receipt for receipt of funds. Drawing up such a document is not mandatory, but for the buyer this will be a guarantee that the seller will not be able to deny the fact that he has received funds.

It is recommended that the receipt be drawn up by the seller in his own hand, indicating the following information:

- where and when compiled;

- data of the parties to the transaction;

- the amount transferred as a deposit;

- purpose of the transferred amount;

- signatures and transcripts of participants' signatures.

The buyer must keep the receipt, as in the event of litigation it will serve as evidence of the actual transfer of funds.

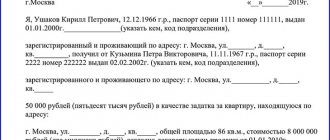

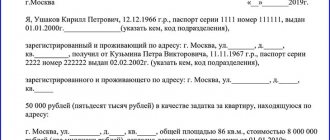

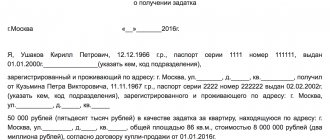

Sample receipt for receiving a deposit when purchasing an apartment:

The amount of the deposit according to the law

In general, the legislator does not directly indicate what the amount should be. But as a general rule, the deposit can range from 5% to 10% of the transaction amount. Of course, the final amount will be determined depending on the agreements between the seller and the buyer, but there are several pitfalls that you need to be aware of when determining the amount of the deposit.

Large deposit, for example, more than 10%:

- The buyer is more interested in making a larger deposit. After all, if he has finally found the home of his dreams, then he wants the deal to be completed successfully. And according to the law, the seller who has not fulfilled the terms of the contract is obliged to return it in double amount. Therefore, if you are buying a house and have found your ideal option, you can put down more than 10%.

- But sometimes the seller may also be interested in a large deposit. For example, when the price of a house is too high, or there are some difficulties with the design, there is a high probability that the buyer will leave. And to protect himself, the seller seeks to increase the amount of the deposit.

Small deposit, less than 5%:

- The seller is interested in such a deposit if he does not stop searching for a buyer, even after agreeing on the sale. Most often this happens when a person has not yet decided how much he wants to get for the house, and is trying to gain time to find a more profitable buyer.

- The buyer may be interested if he is afraid of encountering scammers and is trying to minimize risks. Another option is if he simply hasn’t decided yet and is looking for other options, in which case he can easily abandon the existing arrangement.

Difference between deposit and advance

In addition to the deposit, there is another option for advance payment - advance payment . Unlike a deposit, an advance payment does not carry any guarantee or insurance function.

If, after making an advance payment, the Seller changes his mind about conducting a transaction with the Buyer, then he will simply have to return the advance amount to the Buyer (but not 2 times the amount, as would be the case with a deposit). The return of the advance from the Seller to the Buyer also occurs if the transaction fails due to the latter’s fault (for example, he finds a more advantageous offer, refuses to purchase the apartment as such, etc.). In the case of a deposit, the Seller would have the right to keep the entire amount of the advance payment, but in the case of an advance payment, he does not have such an opportunity.

If the terms of the contract are not fulfilled or the transaction is disrupted, the advance is always returned to the party that originally paid it. In this case, it does not matter whose fault the purchase and sale fell through (the fault of the Seller or the fault of the Buyer).

The payment of an advance does not have to be confirmed by a special written agreement (and, on the contrary, when making a deposit, such a document is always required). For example, the parties may agree to draw up a simple receipt indicating the amount of the advance payment. The participants in the transaction themselves can be sure that they are carrying out the procedure with a deposit, but in fact it will be an advance. How can we make sure that, from a legal point of view, a preliminary cash payment is considered precisely as a deposit, and not an advance?

Additional receipt

In addition to the fact that the parties enter into an agreement on a deposit, when any amount of money is transferred, it is necessary to draw up a receipt, which will be proof of the transfer of funds. This is necessary if the seller turns out to be dishonest and wants to sell the car to a third party.

This transaction is the same as any other purchase in a store. The buyer is always given a receipt, which is the fact that the latter gave his money. When purchasing a car from a private person, a receipt is not provided, but there must be a receipt, which is a guarantee.

When the seller wants to keep the deposit and resell the car, the person who transferred the funds can file a claim in court and provide a receipt as evidence.

Procedure: what needs to be done before, during and after making a deposit

The buyer needs to approach the procedure for making a deposit extremely carefully, because it is he who transfers his funds to the other party.

Before making a deposit

First, the Buyer will need to protect himself from the possible machinations of scammers and make sure that the Seller will not disappear after receiving the deposit. To do this you need:

| Action | Explanation |

| Check the documentation for the alienated residential premises. | The Seller must provide the Buyer with:

|

| Obtain written and notarized permission from the Seller's spouse to sell the property. | If the Seller is married, he must provide the Buyer with written consent from his partner to carry out the transaction. Formally, the apartment can be sold without such consent, but this will be considered an offense. Such a transaction can be challenged by the deceived or uninformed spouse within 3 years after the transfer of ownership. |

| Check the apartment for restrictions and encumbrances that do not allow you to freely own, use and dispose of the living space | Typically, information about restrictions and encumbrances is contained in an extract from the Unified State Register of Real Estate. However, the presence of registered and resident persons in the apartment can also be considered a burden. The Seller can obtain information about them only at the passport office by taking an extract from the house register. If, after checking the documents, the Buyer discovers that restrictive and prohibitive measures have been imposed on the apartment, he will need to ask the Seller to remove all encumbrances. After this, the Seller will have to present updated papers confirming the fact that restrictions and encumbrances have been lifted. There is no need to transfer money as a deposit until this moment , otherwise there is a high risk of getting possession of an apartment with encumbrances still in effect. The same applies to registered residents - the obligation to register them must be assigned to the Seller before making the deposit and before signing the main purchase and sale agreement. If the Seller refuses to do this or does not want to provide an updated certificate from the passport office, any interaction with him should be stopped. |

| Check whether utility bills have been paid. | Before making a deposit, the Buyer must carefully review the receipts for payment of utility bills for at least the last year. In fact, such debts do not affect the transfer of ownership, i.e. they may exist, but no one will specifically warn about them. So here the Buyer will need to protect himself. |

Making a deposit and drawing up a Receipt for receipt of money

If, after a preliminary check of the documentation and an initial inspection of the residential premises, the Buyer has no doubts or complaints, he can enter into a Deposit Agreement with the Seller. After this, the funds are transferred directly.

The amount transferred in cash must be carefully recalculated (preferably in the presence of witnesses). If possible, the parties should check the authenticity of the banknotes at a banking institution, because a deposit even in the most minimal amount (for example, 5% of the cost of an apartment) represents a significant amount of money.

During the transfer of funds, another document is drawn up - Receipt for receipt of money . This document is not considered mandatory, but the Buyer is directly interested in its execution: this way the Seller will not be able to declare that he did not receive any money in principle. Unlike the Deposit Agreement, the Receipt is drawn up in a more free form. The sole purpose of this document is to confirm that the Seller has received the deposit from the Buyer. Notarization of the Receipt is not required.

The document is drawn up by the Seller, and the Buyer simply signs it and deciphers his initials. It is recommended not to print the receipt on a printer, but to write it by hand with a black or blue ballpoint pen on an A4 sheet. In the event of possible legal proceedings, handwriting analysis will confirm that the Seller wrote it personally and of his own free will. A receipt for receipt of money must be drawn up in original copies according to the number of parties involved in the transaction.

The Receipt for Receipt of Money partially duplicates the information from the Deposit Agreement. Here are the following:

- place and date of document preparation;

- Full name, passport details, registration addresses and actual residence of the parties to the transaction;

- Full name, passport details, registration addresses and actual residence of witnesses (if involved);

- the provision that the transferred money acts as a deposit, and not an advance;

- the amount of the deposit previously indicated in the Agreement (in numbers and in words);

- signatures of the parties to the transaction with transcripts.

After making the deposit

After transfer and receipt of the deposit, the parties return to the usual procedure for buying and selling an apartment. They:

- sign the main agreement within the period specified in the Deposit Agreement;

- carry out final calculations;

- proceed to the final stage - re-registration of property rights in Rosreestr and updating of information in the Unified State Register of Real Estate database.

Each participant in the transaction keeps the agreement on the deposit and the Receipt for receipt of money. It is important to preserve these documents, because they may be useful to the parties in the event of possible litigation regarding the apartment.

How to apply

When buying a home, the seller and buyer must have a common opinion on all terms of the transaction, including the price. The negotiation process can take a long time. And here there is a risk that any of the participants can change their mind at any time.

To reduce this risk, transaction participants often practice making a deposit, i.e. part of the transaction amount. Why is this done:

- this proves that the parties have agreed on the issue of completing the transaction;

- the transaction amount will be recorded;

- the parties will be obliged to comply with the agreement to conclude a subsequent purchase and sale agreement on the agreed terms;

- it is also evidence that part of the cost of the house has already been paid.

It is these reasons that explain the popularity of the deposit as a measure to secure a subsequent purchase and sale transaction.

Correct execution of the deposit is always carried out in writing; only in this case will it be possible to protect your rights. It is also mandatory to provide a written receipt of receipt of money paid as a deposit.

It is the written form, in compliance with all the main provisions of the deposit agreement, that will make it possible to secure the future transaction as much as possible and bring it to completion on the original terms.

Mandatory rules

When making a deposit, it is recommended to follow some mandatory rules that will allow you to complete the transaction:

- An oral agreement does not provide any guarantees.

- If the deposit is made receipt, then it must include:

- amount transferred;

- the exact reason for the transfer of money;

- address of the house for sale;

- total selling price;

- expected date of conclusion of the investigation.

- Since it is quite difficult to formalize all this in a regular receipt, it is recommended to formalize the payment of the deposit using an agreement in the established form.

Order a contract from our lawyer Victoria

Order a contract

- The contract is signed by all parties; sometimes it is practiced that each page of the contract is signed by all parties to the transaction in order to exclude the possibility of substitution of pages.

- The amount must be written down both in words and in numbers, and it is advisable to adhere to this rule in all cases when money is involved.

- In the document, the owner must represent the person receiving the funds. If the owner is not indicated, then his rights must be confirmed by a power of attorney to carry out such actions.

Since the deposit agreement does not give rise to rights, but only records the intentions of the parties, it does not need to be notarized or registered.

Rules for drawing up an agreement

Before concluding a transaction, you must study a sample deposit agreement when purchasing an apartment. The text must contain references to Articles No. 380 and No. 381 of the Civil Code of the Russian Federation. In addition to the standard content, additional information or conditions may be specified. The latter should not contradict the legislative framework of the Russian Federation.

When reading the deposit agreement when purchasing an apartment, you need to pay attention to the following points:

- check personal data with passport data – full name, registration, etc.;

- the exact amount of the deposit paid by the buyer;

- fix the final value of the property;

- agree on the time of signing the main contract and the actual payment of the full cost;

- indicate the responsibilities of the parties;

- detailed description of the subject of the transaction - address, technical characteristics, additional terms of sale.

Notarization of the agreement on the deposit for the apartment is not required. In case of controversial situations, this document can be used as an evidence base.

One copy is given to the actual owner of the property, the second to the buyer. Approximate content is not allowed - the text must be agreed upon before signing, and changes can be made if necessary. Otherwise, it will be very difficult to protest the action.

Responsibility of the parties

Such documents are necessary to recognize the intentions of the parties to fulfill previously agreed obligations. For the most part, this applies to the buyer - partial payment should stimulate him. For its part, the seller undertakes to timely prepare the premises, documentation and necessary extracts for the transaction.

It is important to analyze the financial responsibilities of the parties in advance:

- Full return of the deposit by agreement of the parties, if the obligations have not entered into legal effect - Art. 416 of the Civil Code of the Russian Federation.

- You can’t just refuse the deal and say I won’t buy this apartment. In this case, the deposited amount remains with the seller without the mandatory further signing of the final sales agreement - Article 381, paragraph 2.

- In turn, the seller, in case of failure to fulfill obligations, in addition to the funds received, is obliged to pay a penalty in the same amount.

To fulfill the last condition, it is important to indicate in the prepayment agreement for the apartment the deadline for signing the final sale transaction. If this point is not taken into account, filing a claim with the seller will be problematic.

In 2014, an additional 4th paragraph was introduced into Article No. 380. Thanks to him, it is not necessary to sign the final purchase agreement, only a preliminary agreement is enough. Before this, the deposit transaction could be canceled based on a court decision, since it was recognized only as part of the main agreement.

Can the buyer return the money back?

Is the deposit refunded or not? According to Art. 381 of the Civil Code of the Russian Federation, the deposit can be returned to the buyer if the parties agreed on this, but the obligation was not fulfilled. Art. 416 of the Civil Code of the Russian Federation indicates that the deposit is returned if the purchase and sale agreement cannot be executed due to circumstances beyond the control of the parties.

That is, a situation must arise when the parties want to make a transaction, but cannot do so. For example, the house in which the item of sale is located collapsed and the apartment was gone. There is nothing to buy.

On our website you can read other articles about payment for the purchase and sale of an apartment. Find out how to make it through a safe deposit box and letter of credit, as well as using advance payment and cash payment.

What should I do before making an advance payment?

Make sure that the seller is really the owner of the apartment. Ask him or order an extract from the Unified State Register yourself. Check if the bailiffs have any questions for the owner. You can also go to the website of the court at the location of the apartment or the seller’s registration and find out whether the apartment is the subject of a dispute or whether the seller is a defendant in any claims. All this information and other details about the selected property and owner can be found by ordering a check of the legal cleanliness of the apartment.

How much to deposit?

On average, the prepayment is 20-100 thousand rubles, depending on the region. The less you contribute, the better.

If the seller requires a large advance payment for some reason, then first find out why the money is needed. If the reason is compelling, draw up a preliminary purchase and sale agreement with a security deposit, preferably in the presence of a notary. This will give more guarantees that the sale will take place or the payment will be returned.

If something raises suspicions, then it is better to refuse the deal. There are scammers who live precisely by taking “advances” for an apartment.

Vasilisa drew up a preliminary purchase and sale agreement with a lawyer and paid the seller a deposit of 500,000 rubles. After this, the owner stopped answering calls. Vasilisa filed a lawsuit demanding the return of the money and won the case. Now the seller owes her a million, but will transfer 20,000 rubles monthly, since he said that he has already spent it all. Vasilisa does not yet have enough money to buy another property, and as a result, the long-awaited move is postponed indefinitely.

Is it necessary to draw up a deposit agreement when buying an apartment?

Many people think that a separate deposit agreement is not necessary. The money is transferred according to a receipt that simply states the amount. You should be careful with such documents - the court will consider such a sum of money an advance, which entails slightly different consequences. And this rule is directly provided for in Art. 380 of the Civil Code of the Russian Federation.

The deposit agreement must always be in writing. At the same time, it can be an integral part of the preliminary agreement (more details - agreement of intent).

Whatever type of document you choose - a written receipt, a separate agreement (as in our example), as part of a preliminary agreement or an additional agreement, the transferred funds must be designated as a deposit.

Deposit agreement for the purchase of a house with land

What form of agreement should I use when making a deposit?

In general, the Civil Code has norms that establish general rules for registering a deposit. These are Articles 380 and 381 of the Civil Code of the Russian Federation.

380 st. The Civil Code clarifies the concept and establishes some important points, for example, that if the deposit is not filled out correctly, the court may consider this amount an advance. And this causes other consequences. But we will look at the differences between a deposit and an advance in more detail in the next paragraph.

In addition, this article provides for the possibility of specifying the basic terms of the transaction in the preliminary agreement. And if executed correctly, they will be conditions for the main contract.

The second article (381) sets out the consequences in case of failure by the parties to fulfill their obligations. This article also refers to another article of the Civil Code, which provides the concept of termination of an obligation due to the impossibility of its fulfillment.

Thus, compliance with a written form of the contract with the main points will be a good guarantee for the parties that the transaction will be completed successfully.

Sample 2021 download

The latest changes to the legislation regarding the deposit were made in 2015, so in general, the main clauses of the agreement have not undergone significant changes.

Here are the main parameters that must be present in the deposit agreement:

- The details of the participants in the transaction are fully indicated so that they can be accurately identified.

- If the house has several owners, then everyone must be included, because each of them has a vote in the decision to sell the house.

- The price agreed upon by the buyer and seller for a home, as well as the amount of earnest money required.

- The date on which final settlement is expected to be made and the transaction completed.

- Description of the house that is the subject of the transaction, with full characteristics.

- Responsibility for each party. Specifying responsibilities in a contract will more effectively ensure compliance with the terms of the contract than referring to the law.

- Other conditions. Here you can provide for some additional conditions that are important for participants, for example, the absence of debt on utility bills.

The deposit agreement can be written out in detail and carefully, and duplication of conditions in the final purchase and sale agreement may not be required, according to clause 3 of Art. 380 Civil Code of the Russian Federation.

Order a contract

In order to complete the entire procedure as accurately as possible, we recommend that you download on our website a sample contract that is relevant for this year.

Sample receipt

The receipt is very important. If the word “deposit” does not appear in it, the court will be inclined to believe that the transfer of money is an advance. And this entails other legal consequences for the parties.

At the same time, it is also recommended to include the full details of the seller and buyer in the receipt so that, if necessary, they can be accurately identified. It is also recommended to indicate the property in respect of which the contract has been drawn up and the deposit amount is transferred according to the receipt. The seller must also include the date of receipt of funds and a handwritten signature.

If you have any doubts about how to correctly issue a receipt for the deposit, we also offer you receipts on our website.

Is it possible to terminate the deposit agreement: how and when

The deposit agreement may be terminated. However, this is only possible until the parties register the transfer of ownership in Rosreestr. If this happens, the transaction will be considered completed. It turns out that you will need to challenge and terminate the entire purchase and sale, and not a separate document.

The agreement may be terminated on the following grounds:

| Base | What will happen |

| The buyer changed his mind about purchasing housing and/or did not fulfill his obligations. | The seller has the right to keep the deposit. However, the situation will develop differently if the Buyer changes his mind about buying a home due to objective reasons. Sometimes the Buyer discovers that the apartment has fatal defects that were hidden and not described by the Seller in any of the official documents (preliminary agreement, main agreement, etc.). Here the Seller can be considered the actual culprit for the failure of the transaction, therefore the Buyer must receive the deposit - in double amount. As a rule, such conflicts are considered in the courtroom, and the money goes to the one who proves his position more thoroughly. |

| The seller changed his mind about selling his home and/or did not fulfill his obligations. | The Seller must return the deposit to the Buyer in double amount. Sometimes Sellers begin to delay or simply refuse to return the money, in which case the Buyer will need to go to court. |

| Mutual decision of the parties ( Article 450 of the Civil Code of the Russian Federation ). | The advance payment is returned to the Buyer in the original (not double) amount and in an amicable format. |

| Force majeure circumstances. | One of the parties may become seriously ill, face the need to leave, etc. All these situations must also be taken into account and spelled out in the Agreement (clause “procedure for action in case of failure of the transaction”). Usually, in the presence of force majeure or extenuating circumstances, the deposit is returned to the Buyer in the original (and not double) amount. |

Regardless of the reason, it is recommended that the payment return procedure be documented. The Buyer draws up and sends to the 2nd party a written Request for the return of the deposit . Here are the following:

- Full name and residence addresses of both parties to the transaction;

- details of the PDCP and the Deposit Agreement, under which the Seller received a payment in the amount of ... rubles;

- grounds for termination of agreements;

- the Buyer's request for a refund;

- Buyer's signature and date of document preparation.

The seller can either transfer the money in a non-cash format, or transfer it personally - in the presence of witnesses and with a repeated receipt. Now it will have to be written by the Buyer who accepts the funds back.

When the parties cannot reach a consensus regarding the return or non-return of the deposit, they need to go to court . If the price of the claim (the amount of the preliminary payment) is less than 50,000 rubles, the magistrate’s court . If the price of the claim (the amount of the preliminary payment) is over 50,000 rubles, the district court . Usually the request for the return of the deposit comes from the Buyer, because he does not have access to the money, is ignored by the Seller, etc. To initiate proceedings, it is necessary to draw up a statement of claim “ For recovery of the amount of the deposit ” or “ For recovery of double the amount of the deposit ”. In addition, the claim may contain a request “ For compensation of losses in the part not covered by the deposit .”

Arbitrage practice

Judicial practice in cases concerning the payment of a deposit is heterogeneous. It all depends on the conditions and circumstances of a particular transaction. In order for the Earnest Money Agreement to ensure maximum protection of your interests, you will need:

- monitor the correct preparation of papers (the agreement itself, receipts for receipt of money);

- fulfill their obligations under the PDCP in good faith;

- motivate your claims against the 2nd party, support them with factual materials.

Example: The Plaintiff appealed to the district court with a demand to recover double the deposit from the Defendant, as well as to compensate for the losses incurred and compensation for moral damage. The Plaintiff based his claim on the fact that the Defendant unexpectedly refused to sell him the apartment. However, the Defendant stated that he returned the entire advance payment to the Plaintiff, equal to 100,000 rubles. The seller insisted that this money should be considered as an advance.

After studying all the materials, the court ruled that the preliminary payment was a deposit, and not an advance. This was stated in the corresponding Agreement, drawn up as an annex to the PDCP. The text of the Agreement clearly stated that the amount paid acts as a deposit and performs a security function. Because failure to comply with the terms of the PDCP was due to the fault of the party that accepted the deposit, the court ruled that this party (Seller) is obliged to return the funds in double amount. The Defendant had to pay the Plaintiff another 100,000 rubles , as well as compensation for losses and moral damage.

Drawing up a deposit agreement when purchasing an apartment is not an easy procedure, requiring sufficient legal knowledge from the parties. The parties to the transaction will need to decide on the amount, draw up the appropriate agreement correctly, and not confuse the deposit with an advance or pledge.

Nuances of document preparation

The agreement is drawn up directly by the owner of the property to be sold, or his official representative. The money is also transferred directly into his hands, and not to the realtor supervising this procedure.

Important! All documents relating to the object of the transaction must be carefully examined by the buyer and checked for authenticity.

When transferring the deposit, it would be useful to request the seller to write a receipt confirming its receipt. This recommendation is not included in the list of mandatory requirements, but if disputes arise, the receipt can act as documentary evidence of this type of calculation.

Is it possible to make a deposit when buying an apartment with a mortgage?

It is possible to make a deposit when purchasing an apartment with a mortgage loan, maternity capital and other additional conditions. It’s just that the deposit agreement, in addition to other essential conditions, indicates the procedure for registering maternity capital, the procedure for settlement with the seller using mortgage funds, or other nuances depending on what funds you use to purchase real estate.

Sources

- https://kupiproday-kvartiru.ru/dokumenty/dogovor-zadatka-pri-pokupke-kvartiry/

- https://kvartira-bez-agenta.ru/melochi/kak-oformit-zadatok-pri-pokupke-kvartiry/

- https://SocPrav.ru/soglashenie-o-zadatke-pri-pokupke-kvartiry

- https://ros-nasledstvo.ru/soglashenie-o-zadatke-pri-pokupke-kvartiry/

- https://FreeLawyer.guru/grazhdanskoe/dogovor-zadatka-pri-pokupke-kvartiry.html

- https://blog.DomClick.ru/post/avans-ili-zadatok-kak-pravilno-oformit-predoplatu-za-kvartiru

- https://iskiplus.ru/soglashenie-o-zadatke-pri-pokupke-kvartiry/

- https://law-divorce.ru/soglashenie-o-zadatke-pri-pokupke-kvartiry/

- https://dogovor-urist.ru/%D0%B4%D0%BE%D0%B3%D0%BE%D0%B2%D0%BE%D1%80%D1%8B/%D0%BE%D0% B1%D1%80%D0%B0%D0%B7%D0%B5%D1%86-%D0%B4%D0%BE%D0%B3%D0%BE%D0%B2%D0%BE%D1%80_ %D0%B7%D0%B0%D0%B4%D0%B0%D1%82%D0%BA%D0%B0_%D0%B7%D0%B0_%D0%BA%D0%B2%D0%B0%D1 %80%D1%82%D0%B8%D1%80%D1%83/

- https://J.Etagi.com/ps/zadatok-pri-pokupke-kvartiry/

[collapse]

Features of compilation and structure

The deposit agreement must be drawn up in writing; an oral form of the transaction is not allowed.

Notarization of the document is not required, but if it involves a large sum, it is better to involve a lawyer in the transaction.

There is no approved structure or form for this document, but it usually includes the following information:

- Details of the parties. In this part, you must write the full name of the seller and buyer, their passport details (series and number), registration addresses and dates of birth.

- Subject of the agreement. The subject is a real estate object for which the amount is paid. In this case, it is necessary to describe in detail both the land plot and the house. The following information is provided for the site:

- cadastral number;

type of permitted use;

- address and location;

- square.

- Deposit size. As already noted, the parties determine its amount independently, but you should not agree on an amount that is too high - the risk of losing it is still present. The method of transfer and storage of funds (for example, using a safe deposit box) may also be indicated here.

- Responsibility of the parties. This part of the document notes that in case of violation of the agreement by the seller, he will be forced to pay the buyer the amount of the deposit in double amount , and if there is guilt on the part of the latter, the money will remain with the seller. Exceptions to this may also be noted (for example, a list of force majeure circumstances that are beyond the control of the parties).

- Deadline for concluding the main contract. The parties can also determine when exactly (or after what period) the purchase and sale agreement should be signed. This period should be enough to remove all obstacles to completing the transaction.

- At the end there is the date and place of its signing, as well as the signatures of both parties.

For a house, in addition to the last two characteristics, you also need to indicate the number of storeys. In addition, the seller notes under what rights he owns these objects and what documents confirm this.

To draw up a contract you will need a certain set of documents, namely:

- passports of the parties;

- cadastral plan (passport) of the site;

- title documents for it;

- title documents for the house.

This set of papers is minimal; depending on the specific situation, other documents may be required:

- power of attorney (if one of the parties acts on behalf of the legal representative);

- consent to the transaction from the spouse;

- certificate of absence of debts on utility bills for the house;

- consent to the transaction from other owners of the plot or house, etc.

Deposit agreements for the purchase of land with a house can be found here.

The agreement itself must be drawn up in two copies, so that after signing each party receives one document. If one of them violates the agreement on the further sale of real estate, he will be the main reason for going to court to demand compensation.