Any purchase and sale agreement serves as a tool for recording agreements between the parties who entered into it. It often happens that one of the participants, for whatever reason, no longer wants to adhere to the terms of the agreement. This means that the previously concluded purchase and sale agreement is subject to termination.

Unfortunately, when it comes to terminating transactions related to the sale and purchase of real estate, various legal subtleties must be taken into account. If you are not trained as a lawyer, seek outside help from experts in the field.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

308 lawyers on RTIGER.com can help with this issue

Solve the issue >

What is a deposit

To understand, it is necessary to understand the legal definition of a deposit. In Russian legislation, the corresponding term is set out in Article 380 of the Civil Code, clause 1. In essence, this is a guarantee payment, which serves as a reason that the buyer and trader will not refuse the contract if more profitable offers arise. If the goods were given to the buyer, then the transferred preliminary amount is actually recognized as an advance payment.

When drawing up a document for the sale and purchase of a car, real estate, land or other property, it is necessary to confirm in writing the presence or absence of a preliminary security payment. Otherwise, when resolving a conflict situation through the court, the transferred financial resources are recognized as an advance and must be returned to the individual or legal entity.

The fact of transfer of cash resources is confirmed by a receipt.

How to request a refund of the deposit

Registration of a refund occurs in the same way as registration of a deposit (see sample receipt above). To do this, you need to draw up a receipt for the return of the deposit. It does not have any accepted form, and can be written on a form or by hand. When drawing up this document, you must specify the following :

What does a receipt look like?

- the corresponding name of the document;

- date and place of compilation;

- detailed information about the seller;

- the exact amount of the deposit in words;

- data on the purchase and sale agreement;

- detailed information about the object of sale and its full cost:

- detailed information about the buyer;

- signatures of the parties.

In case of disputes regarding the return of the deposit, it is necessary to file a claim in court. If a negative decision is made, you can appeal to a higher authority, the last of which is the Supreme Court of the Russian Federation.

In order not to lose the money paid as a deposit, it is necessary to correctly draw up the contract itself and obtain a receipt from the seller. If you do not have experience in drawing up such documents, you may receive documents that have no legal force. In this case, it may be better to contact an experienced lawyer. This step will ensure that the money is not wasted.

[author_bq]

Under what conditions is it issued?

The parties, having come to a preliminary oral agreement on the need to transfer a security transfer, draw up a written document. Especially often, the need for a guarantee payment arises when purchasing land or real estate with a mortgage. Points of the advance transfer agreement include:

- Full name and passport details of all parties to the transaction.

- Reason for transfer of the guarantee payment.

- The amount of transferred financial resources.

- Total transaction volume.

- The period during which the main payment must be transferred and the goods must be transferred.

An important point in the contract is to indicate that the amount being deposited is part of the overall trading contract. According to the Civil Code of the Russian Federation, if the potential beneficiary refuses the transaction, the deposit is not returned. If the seller refuses the contract, the deposit will be returned in double amount.

The deposit must be accompanied in writing

Grounds for returning the deposit

Signing a deposit agreement encourages participants to comply with all clauses of the purchase and sale agreement, since their violation has tangible material consequences. If the buyer is the violator, he will forfeit the entire deposit amount. If the seller violates the conditions, he is obliged to return double the amount of the deposit to the buyer.

Buyer's refusal

A buyer may refuse to purchase an object for various reasons. However, he does not always have legal grounds for returning the deposit to him. In practice, purchases are often refused for the following reasons :

- The purchase and sale transaction follows a chain (there are several buyers and sellers), one of the participants was unable to fulfill their obligations.

- Upon re-inspection of the purchased item, previously unnoticed defects were discovered.

- The buyer did not have time to prepare all the necessary documents for the transaction on time.

When a transaction goes through a chain and several participants are involved at once, some of them may, for various reasons, fail to fulfill their obligations. Then, in the event of a specific buyer’s refusal, a refund of the deposit is possible only if the deal fell through through no fault of his.

It also happens that the buyer, upon initially inspecting the property, did not notice its defects, for example, did not identify faulty wiring or sewerage. All this was discovered by him after he paid bail. In this case, a controversial situation arises that may have to be resolved in court. But, most likely, the deposit will not be returned, since the cause of the dispute was the buyer’s carelessness.

If the buyer does not meet the deadline for preparing documents without a good reason, the money will not be returned to him. A valid reason in this case may be the illness of the buyer himself or the death of his close relative, confirmed by documentation.

Bank refusal

If a bank is involved in the transaction between the buyer and the seller, the situation with the return of the deposit may be controversial. According to the law, if we are talking about purchasing real estate with a mortgage, when independently choosing an object, the client is obliged to notify the credit institution in writing and obtain written permission to conduct such a transaction.

In practice, the bank may initially give such permission and subsequently refuse the mortgage. The same applies to issuing a real estate loan. Therefore, when the purchase of an object is carried out through a bank, it is necessary to include in the contract a clause on the return of the deposit to the buyer in the event of the bank’s refusal. Otherwise, an ambiguous situation may arise.

Seller's refusal

The seller is financially responsible for failure to comply with the terms of the contract. So, when selling an object for which a deposit was paid to third parties, he is obliged to return the deposit amount to the original buyer in double amount .

In practice, this often happens when real estate prices rise sharply. In this case, it is sometimes more profitable for the seller to give the original buyer a double deposit, but at the same time offer the property at a higher price.

If the seller refused to sell the property because the buyer did not fulfill the terms of the transaction, he is not obliged to return the amount received.

When is the deposit refundable?

Whether the deposit is returned or not depends on the outcome of the agreement. Practice shows that clients who have changed their mind about purchasing housing are interested in the question of how to return the deposit for the apartment. By law, the guarantee payment is returned in a couple of cases:

- When a transaction is canceled for reasons beyond the control of the participants.

- The purchase of a house, car or other valuable property for which a deposit was made did not take place due to violations of the terms of the contract by the seller.

Cancellation of a contract always has valid reasons. It could be a natural disaster that destroys the property being sold.

If the money was contributed as a guarantee when selling under the hammer, then it can be returned. Returning the deposit at an auction is an ordinary, ordinary procedure that does not require judicial intervention. If the public auction does not take place, then the funds are returned to the participants’ accounts using standard bank transactions. Funds transferred by losing participants in the auction are returned. When a prospective bidder decides to withdraw from the auction, their deposit will be returned to them before a certain deadline. If the cancellation occurs after the specified date, the deposit will not be returned.

The winner's funds are transferred as payment under the concluded agreement. The use of financial security at auctions is regulated by 448 articles of the Civil Code. If, after the agreed time, the auction organizer delays the completion of the transaction or refuses, thereby violating the rights of the participant, then the auctioneer must return the deposited funds in double amount.

A special option for bidding is organizing the sale of a company in relation to which bankruptcy measures are being taken. The deposit is paid by corporations or individuals wishing to purchase the company. Money will be returned to losing bidders.

How to terminate a deposit agreement

I am a salesperson. A preliminary contract for the apartment has been concluded.

1. The parties, the subject of the PDCP, the period by which the object must be transferred

2. Agreed price of the property

3. This agreement is a PDCP

Signatures of the Seller and Buyer parties.

Further, the Deposit Agreement contains provisions including the subject, obligation, responsibility of the parties, additional conditions regarding cases of return of the deposit, as well as dispute resolution.

The validity of the deposit agreement is from the moment of signing and receipt by the Seller of the deposit “ensuring the obligation of the Deposit Holder to sell in the purchase and sale agreement and in this agreement the real estate and the Buyer’s obligation to buy the above property on time and at the price of the PDCP and the Deposit Agreement”

In the Deposit Agreement at the end of June 25, Signatures of the parties and

There is a phrase where the Buyer (instead of the Seller) mistakenly wrote “I, the full name (BUYER), hereby confirm that I have received funds in the amount of 30,000 rubles 00 kopecks.” Signature (signed by the Buyer), transcript (Buyer).

Below is a retroactive date of June 1, instead of the day the PDCP was signed.

So, we have the PDCP dated June 25 and the Deposit Agreement (June 1) with an erroneous confirmation and signature of the BUYER that EXACTLY the Buyer received the deposit and not the Seller. This error with the deposit was already revealed to me the next day, it is on both copies. Not fixed.

Another point, the PDCP was previously signed (June 1), which has not been terminated and will expire in the coming days. A deposit was received based on the previously signed PDCP. The Buyer was offered an extension of the first PDCP dated June 1 instead of signing a new PDCP or a return of a single (NOT double) amount of the deposit (since the bank recently turned out to be refusing to issue borrowed funds to the Buyer).

In fact, 1) there is a FIRST PDCP expiring in a day and an Agreement under which there is confirmation of receipt by the Seller of a deposit to secure the terms of the PDCP dated June 1.

And, 2) there is a new PDKP with a Deposit Agreement where the Buyer signed that he received the deposit, not the Seller.)

It was agreed with the Buyer that he would apply to another bank to obtain a loan since the first one refused. In view of this, a new PDCP was concluded at the request of the Buyer. Where the mistake was made by the BUYER by writing that he confirms receipt of the amount.

There is no desire to wait until another bank refuses or issues a mortgage loan to the Buyer. According to the new PDCP and the Agreement upon signing, the seller did not receive any deposit (in fact and in documents) since the deposit for the first PDCP remained (expires soon). It is not stated anywhere that the deposit for the first PDCP goes into accounting for the new PDCP and the Agreement.

Questions: -What is the legal force of the new PDCP and the Agreement of June 25, which the seller did not confirm because I did not receive any deposit on that day from the Buyer. And moreover, the buyer himself wrote in this Agreement that HE “received the amount in the amount of the deposit and signed”?

— If the new PDCP does not have any force, taking into account the lack of confirmation on my part that I received the deposit in a new PDCP on the day of signing in order to fulfill the terms of the SALE AGREEMENT, I should wait for the expiration (the other day) of the first contract and return the one-time amount of the deposit ? Or did the first agreement lose its force when the parties signed a New Agreement without terminating the old one?

When it doesn't come back

As for whether the earnest money is refunded if the buyer backs out of the agreement, the most common answer is no. The financial meaning of the deposit is to guarantee the execution of the transaction; the return of the invested money will be a violation of the logic of the contract.

The deposit may or may not be returned.

In addition to purchase and sale transactions, the guarantee applies to rental agreements. Realtors and representatives of car dealerships offer a client who wants to rent a car or rent an apartment, cottage, garden plot, garage, to make a deposit, usually in the amount of a certain percentage of the value of the property. If the client damages it while using rented housing or other property, the owner takes the deposit as compensation.

Whether or not the deposit is returned when purchasing an apartment or cottage depends on the reason why the sale did not take place. In the event that the buyer is at fault, the money remains with the potential seller.

Legislation

The deposit agreement is drawn up only in writing and is considered a guarantee that none of the parties to the transaction will refuse to conclude the purchase and sale agreement within the established time frame. Let's consider whether the deposited amount is returned upon purchase or not.

- If the buyer refuses to purchase the apartment, the deposit remains with the seller.

- If the seller refuses to sell the apartment, then he is obliged to pay double the amount of the deposit. In addition, the seller is obliged to compensate for losses if they are documented by the other party (Article 381 of the Civil Code of the Russian Federation, clause 2).

- If the buyer cannot fulfill the terms of the agreement due to the fault of the creditor (bank), then he does not have the right to demand the return of funds (Article 416 of the Civil Code of the Russian Federation, clause 2).

When the deposit is returned in double amount

The fundamental difference between a deposit and other types of advance payments is the presence of an additional function. The return of double the amount is important as a measure of influence on the unscrupulous participant in the transaction. The buyer transferred the deposit, thereby increasing the owner’s assets. By returning the transferred money, the owner of the property, in fact, remains with the original capital. The return of double financial security is a material loss for the selling party.

The deposit in double amount is transferred to:

- If the seller fails to fulfill his obligations to sell real estate or other valuable property (apartment, house, restaurant, yacht club, car, motorcycle, etc.).

- If the auctioneer refuses to enter into an agreement with the auction winner.

- If the landlord refuses the tenant to enter into an agreement.

- In other cases, when the agreement provides for a deposit, the transaction did not take place due to the fault of the person who received it.

What to do if the seller does not return the money?

In cases where the parties cannot reach an agreement, the injured party may go to court. If the buyer can prove that the transaction did not take place solely through the fault of the seller, then he will be able to recover double the amount paid.

Pre-trial claim

Before filing a claim, a pre-trial claim must be filed and an attempt must be made to resolve the conflict amicably.

To do this, you must send an application to the seller, indicating the following:

- date and time of the failed transaction;

- buyer requirements;

- reasonable terms of return of funds.

The document is drawn up in two copies. It can be transferred personally to a legal entity if a transaction with a Developer was planned, or to the owner of housing on the secondary market.

It is preferable to send your claim by registered mail. An inventory of the documents sent must be included in the envelope. The court will need to provide a notice of service as evidence of an attempt to resolve the conflict pre-trial.

Going to court

If the seller refuses to return the money, the buyer can go to court.

To file a claim, you must do the following:

- Prepare documents proving the seller’s failure to fulfill obligations.

- Contact the court at the place of registration of the defendant.

- Wait for the documents to be accepted.

- Attend the meeting on the appointed date and time.

- Get a court decision.

- Submit the document to the FSSP for debt collection.

If the seller refuses to return the deposit, then he violates Ch. 25 Civil Code of the Russian Federation. When writing a claim, you should indicate the articles that were ignored by the other party.

The basis for filing a claim may be Law No. 2300-1 “On the Protection of Consumer Rights” if the apartment was purchased in a new building and the defendant is a legal entity. In such a situation, you will not need to pay state duty.

In this case, the reason for going to court may be improper information about the product and the buyer’s right to receive complete information about the object of the transaction. According to the legislative act, the consumer has the right to apply for moral compensation, as well as payment of legal costs.

If it was planned to buy an apartment on the secondary market, then the defendant will be an individual, the owner of the apartment. In this case, you will need to pay a state fee, the amount of which depends on the amount of the claim (Article 333.19 of the Tax Code of the Russian Federation).

Attention! The court will side with the buyer and decide to return the deposit in double amount only if there is an agreement or preliminary agreement. With a receipt, the seller confirms the receipt of funds.

Registration of the contract

The process of drawing up an agreement on the transfer of a deposit is not very difficult if you prepare for its preparation in advance. The document must indicate all significant points that allow identifying the parties to the agreement, the amount of the transferred amount, and the conditions for its transfer. It is important to indicate that the funds are a deposit, otherwise, even in the Supreme Court it will be extremely difficult to prove that this is not an advance. The deadline for the execution of the main contract and the responsibility of the parties for improper execution are indicated.

Correct execution of the document is a guarantee that the participants will fulfill their obligations.

All documents must be prepared in accordance with the rules in order to avoid controversial situations in the future.

The deposit agreement is signed simultaneously or later than the main purchase and sale agreement, since it has a subordinate position to it.

Is the amount refunded if the transaction does not take place?

If force majeure occurs, when one of the parties cannot fulfill the terms of the contract for reasons beyond its control, the obligations under the contract are terminated and the deposit is returned (Article 416 of the Civil Code of the Russian Federation, clause 1). Such reasons may be:

- illness or death of one of the parties to the transaction;

- emergency condition of the house;

- causing significant damage to the apartment;

- errors in the preliminary agreement;

- the occurrence of an encumbrance on the apartment (ban);

- violation of the rights of minor children;

- other reasons that the court considers objective.

If you refuse to purchase

If the buyer refuses to purchase the property, he loses the deposit amount. You can demand termination of the contract and a refund under certain circumstances:

- Delaying the transaction by the seller without objective reasons. A notification letter is sent and, in case of refusal, a statement of claim is filed in court.

- Overrated. The apartment is being purchased with a mortgage and has not been appraised. In this case, you can demand a refund if the seller does not compromise on price.

- Unsuitability of housing as a result of fire, flooding, etc.

- Providing knowingly false information about registered and temporarily absent persons.

- Imposition of a ban by bailiffs.

- Inconsistency of documents for the apartment with the extract from the Unified State Register of Real Estate.

The reason must be objective. If the owner refuses, it is necessary to file a statement of claim in court. The losing party pays the legal costs.

At the initiative of the seller

According to the law, if the seller refuses to sell the property, he is obliged to pay double the amount of the deposit. But there are situations when the owner asks to terminate the contract and is ready to return the deposit.

Objective reasons:

- Owner's illness or serious physical injury (incapacity).

- Causing damage to the apartment as a result of fire, flooding, etc.

- Third Party Claims. The apartment was inherited, but a relative showed up, whom the seller did not know about.

- Imposition of a ban by bailiffs on registration actions.

In this case, the contract is terminated and the property owner returns the money.

Cannot be considered objective:

- the owner changed his mind due to the fact that the counter option was sold;

- the owner learned that he needed to pay sales tax.

The buyer may demand a double amount of the deposit.

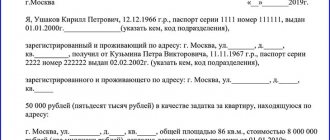

Registration of receipt

When transferring funds in cash or non-cash form, a receipt is issued. The main part of it duplicates the significant clauses of the agreement:

- Full name and registration details of participants.

- The reason for receiving the money.

- Amount.

- An indication that the finances were transferred as a deposit.

- Date of transfer of money.

The receipt is drawn up by computer, but when resolving disputes through the courts, a document written in the recipient’s own hand is more acceptable. At the request of the seller, the document can be drawn up in two copies.

Arbitrage practice

Judicial practice shows that a decision can be made in favor of both the defendant and the plaintiff.

It is important that both parties provide as much evidence as possible that their rights have been violated. The buyer appealed to the Krasnoyarsk court, demanding a double deposit from the seller on the basis that the purchase and sale agreement was not concluded due to the fault of the seller. The defendant did not inform the plaintiff that the apartment was encumbered and pledged to the bank. The buyer previously transferred 50,000 rubles to the seller’s account. as a deposit, committing to purchase the property within a specified period, but the transaction did not take place.

Decision No. 2-5985/2019 of November 29, 2021 of the Krasnoyarsk Court is based on the fact that in the extract from the Unified State Register of Real Estate, presented by the defendant, and dated the day before the date of the transaction, no encumbrances were indicated. Accordingly, nothing prevented the conclusion of the contract. The court ruled that the requirement to pay double the deposit does not comply with current legislation. In this case, the defendant was awarded to return the funds received from the buyer in full.

The Kolomna City Court of the Moscow Region received an application to collect from the seller of the apartment a deposit, interest for the use of other people's funds, compensation for moral damage and legal costs. The plaintiff transferred part of the cost of the apartment to the defendant as an advance payment. Subsequently, he refused to conclude the deal. A preliminary agreement was drawn up between the buyer and seller. The owner of the property refused to return part of the funds, arguing that they were a deposit.

Based on the study of the case materials, the court adopted Decision No. 2-2296/2019 2-2296/2019~M-2321/2019 M-2321/2019 dated November 27, 2019. According to the document, the defendant is obliged to return the money paid to him, since the agreement payment of the deposit was not concluded; accordingly, the funds are considered an advance. At the same time, the plaintiff was denied moral compensation.

Buying an apartment is always fraught with difficulties. The buyer can transfer an advance or deposit to the seller's account before the transaction is concluded. These concepts are different from a legal point of view. In the first case, the amount is returned in full if the deal is not concluded. The deposit remains with the seller in full in the event that the buyer refuses to sign the contract without compelling reasons. If the owner is the initiator of the cancellation of the transaction, then the second party can claim a double refund.

How can I make a refund?

By prior agreement

If the preliminary contract and agreement on the deposit are drawn up correctly and without errors, then the deposit can be returned only by a court decision or by the good will of the seller. When signing the documents, the parties agreed that in case of refusal to purchase, the deposit amount remains with the owner of the apartment and the buyer cannot count on a refund (clause 2 of Article 381 of the Civil Code of the Russian Federation).

When going to court, the buyer must provide reasoned reasons why he cannot purchase an apartment. Arguments such as changing your mind or being denied a loan cannot be objective, and the trial will be lost. If an agreement cannot be reached and there are no compelling reasons to cancel the purchase, then the deposit amount will be lost in full. There is no point in going to court, as you will not only have to waste time, but also pay additional legal costs.

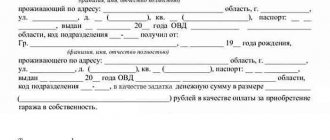

By receipt

If the seller and buyer are preparing the documents on their own, then they will not be able to correctly draw up a preliminary agreement and an agreement on the deposit. In this case, a receipt is drawn up. A receipt is a document confirming the transfer of money from one person to another.

It must indicate:

- passport details of the parties to the transaction;

- data about the property;

- transferred amount (indicated in numbers and words);

- for what and when it was transferred;

- Below, the recipient indicates his data (full name), puts a number and signature.

Help: By and large, a receipt is an analogue of an advance payment, only in a simplified version.

The receipt does not carry a security function, but only confirms the fact of transfer of money . Compiled by hand or in printed form. It does not stipulate penalties and obligations of the parties, since this is not provided for by the legislation of the Russian Federation. If the deal fails, the money is returned in exchange for a receipt.