Business lawyer > Civil law > What is not returned: deposit or deposit, which is more profitable

Modern practice of economic transactions, in particular when purchasing real estate or large movable property, involves the inclusion of a pledge or deposit in the contract. Many are confident that they are well versed in these terms and know the intricacies of using them, however, situations of fraud and deception of citizens are increasingly arising. So when is it more profitable to use one or another term and what is not returned - the deposit or the deposit?

What is a deposit

The legal concept of this type of transfer of money is formulated in the Civil Code of the Russian Federation.

Article 380 clarifies that a deposit is a sum of money transferred by one party to the other as an advance payment from the full amount of payment due under a written agreement. Earnest payment is a mutual method of obligation for the execution of a full-fledged agreement between the parties.

The transfer of money is always accompanied by the conclusion of a written agreement, which specifies the form (deposit), the parties, the subject and the amount of the transferred amount of money. Notarization of the document is not required, however, the concept of deposit must be indicated in its title and text, otherwise it will be considered that the parties have entered into an advance agreement, which entails other obligations.

Oral agreements or written documents that do not comply with legal standards are not recognized as a deposit, and the payment itself will most likely be recognized as an advance payment.

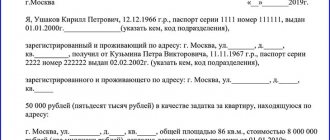

An alternative to a written agreement is a receipt of money, which is written from the person receiving the payment. The receipt also indicates the parties, the subject of the obligations and the amount of the contribution. The receipt must indicate that the financial contribution is a deposit.

Deposit: concept and essence of definition

Article 329 of the Civil Code of Russia lists measures to ensure the fulfillment of contractual obligations, among which are a pledge and a deposit.

Deposit, in accordance with Art. 380 of the Code in paragraph 1., is the amount of money transferred by the preliminary buyer to the preliminary seller to guarantee the fulfillment of the concluded contract.

The deposit is aimed at bringing the contract to completion - the party to whom the deposit was transferred has an incentive to continue cooperation, otherwise he needs to give the money to the buyer, and for the buyer the deposit is a reason not to disrupt the deal and comply with all the agreed points of the document.

The legislative framework

Article 381 of the Civil Legislation describes in detail the situations in which the deposit must be returned to the buyer or left to the seller. Summarizing everything prescribed in the law, we see that if the seller violated the terms of the contract, the money must be returned in double amount. If the transaction does not take place due to the fault of the buyer, the seller does not return the deposit.

As with any law, this one has its exceptions. Sometimes the situation can be ambiguous and contradictory. Previously, the judicial system came into conflict between the Supreme Court and the Arbitration Court. The latter did not recognize a deposit without the main agreement, considering it an advance, which, if returned, would not be in double volume.

However, at the moment the legislation is uniform for all types of court. And the corresponding clauses were introduced into the Civil Legislation, which describe in detail the features of depositing and returning funds as a deposit. To finally understand whether the deposit is returned or not, you need to take into account some more points.

Differences from advance and deposit

The legal concept of advance is not used in Russian legislation, but in practical terms, advance and deposit are close, but not identical terms.

This is also important to know:

How to return car parts back to the store

An advance is also a preliminary payment before the transfer of property, provision of services or performance of work. However, it is not a form of security for obligations and can always be returned or reclaimed without any consequences for the parties. Making an advance payment does not oblige the parties to complete the transaction.

A pledge is a form of security for obligations under a contract. However, it does not apply to the advance payment and is drawn up in a separate agreement. If the deposit is expressed in monetary terms and cannot exceed the amount of the principal amount, then the collateral is usually property whose value is equal to or greater than the value of the subject of the agreement.

Typically, a collateral agreement is concluded as security for a loan agreement, for example, with a mortgage.

Thus, an advance is a preliminary payment that does not ensure the fulfillment of the contract, and a pledge is a form of security for obligations that is not a preliminary payment.

Differences between collateral and earnest money

There are a number of differences between the concepts:

- Item. A pledge is a guarantee not only in monetary terms, but also in the form of any tangible and intangible assets (for example, property rights). The deposit can only be money.

- Transaction form. The transfer of the deposit in accordance with Article 320 of the Civil Code of Russia is formalized in writing as part of the main agreement or by a separate agreement. The pledge must also be put in writing, and in some cases must be certified by a notary. Such cases include situations listed in the legislation. With the exception of them, the parties independently decide whether to have the agreement certified by a notary, which is stated in the main agreement.

- Size. The deposit is a small fraction of the transaction cost, 1/5 or 1/10. The deposit cannot exceed the amount of the contract, because it is included in it, but it can be equal to it. Any property can be used as collateral, including real estate whose value exceeds the value of the main contract.

- Violation of the main contract. In the case of a pledge, the pledgee sells the property in his possession and disposes of the proceeds as follows - he keeps a portion of the cost of the main transaction for himself, and returns the rest to the pledgor. In the case of a deposit, different rules apply - it all depends on who broke the deal. If the holder of the deposit, then he returns the amount to the buyer twice. If the violator is the buyer, then the money remains with the seller and becomes his property without the right to demand return by the seller.

It is not necessary to formalize the transfer of the deposit in the form of a separate agreement; it can be specified in the letter of intent.

In no case should you transfer a deposit without a written agreement simply against a receipt - it will be difficult to prove that it was a deposit, the court may regard such a transfer as an advance payment, and the consequences of an advance payment differ from making a deposit.

In the case of a pledge, in practice, a full-fledged agreement is concluded.

A pledge transaction is more serious, since it involves a larger property or amount than when transferring a deposit.

Civil Code of the Russian Federation on the return of the deposit

The return is regulated by Art. 381 of the Civil Code of the Russian Federation “Consequences of termination and failure to fulfill an obligation secured by a deposit.” According to the article, refunds are made as follows:

- if the contract is terminated due to the fault of the party who paid the deposit, then it remains with the counterparty;

- if the culprit is the party who accepted the payment, then it undertakes to return the payment in double amount;

- if the agreement is terminated by agreement of the parties or due to “force majeure”, then the amount is returned in a single amount.

When is the deposit returned?

The deposit may be returned to the person who transferred it in two cases:

- the transaction was disrupted due to the fault of the person who received the cash tranche;

- the deal was disrupted due to reasons beyond the control of both parties.

In the latter case, the concept of force majeure is applied, due to which the parties were unable to fulfill their obligations. The so-called “force majeure” does not depend on the will of the participants and is not a manifestation of their intentions. Such a circumstance, for example, is the destruction of residential premises as a result of a natural disaster. If a deposit payment has been made for the apartment, it is transferred back to the buyer in a single amount.

Also, the money must be returned to the person who made the payment in situations where the opposite party voluntarily renounces its obligations specified in the text or changes the terms of the agreement. For example, by raising the price of an apartment, the seller violates the terms of the contract, which allows the buyer to terminate the preliminary contract. Since in this situation the refusal was made through the fault of the contractor or the seller, he is obliged to return the financial security in double amount.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Advance or deposit: finding out the difference between the concepts

What are advance and deposit?

What is the difference? One of the serious problems due to which sellers of apartments or private houses insist on non-return of the money transferred to them is confusion in the concepts of “advance” and “deposit”. We have identified the functions of the first one - it only demonstrates the buyer’s intention to purchase real estate, but, unlike a deposit, it is not financial security for the transaction. That is why the transfer of the advance may not even be recorded in a specially drawn up preliminary agreement. All you need is a receipt from the buyer confirming the transfer of a particular amount to the seller. This document will definitely be considered by the court and in the vast majority of cases will become a killer argument that ensures a win.

If we return to the legal requirements, we can find the following standards:

- The deposit is returned only if the fault for the failure of the transaction lies with the seller. If the buyer refuses to purchase the property, the funds remain with the other party (Article 381 of the Civil Code);

- the advance payment is returned in any case, regardless of whose fault the transaction did not take place. At the same time, it is generally illegal to include in the preliminary purchase and sale agreement any requirements and norms regarding the liability of one of the parties (Articles 421, 422 and 1102 of the Civil Code.

The presence of a receipt or agreement is sufficient proof that the money transferred to the seller is an advance. Therefore, in any case, the court must make a decision in favor of the failed buyer.

As practice shows, domestic courts do just that. Moreover, they don't even consider any of the sellers' arguments. Therefore, when filing a claim, you can safely count on success even if you do not have a receipt or any other documents on hand.

When it doesn't come back

The deposit payment is not returned to the buyer/customer in situations where he refuses his obligations specified in the text of the agreement. In such circumstances, the buyer/customer is to blame for the failure of the transaction/contract.

This is also important to know:

Claim for a refund: samples of claims for a defective product, for a service, for an air ticket and more

Since the earnest money payment is a form of security for obligations under a written contract, all transferred money remains with the counterparty (seller/performer).

Functions of the deposit

A deposit is a more accessible and simple tool for ordinary people, which does not require complex contract texts and special conditions. The bottom line is that one person gives money to another to prove the seriousness of his intentions - because he will lose this money if he changes his mind about completing the transaction. But this is not the only task of the deposit.

It has 3 functions:

- securing a future transaction - after transferring the deposit, the seller can be calm and remove the property from sale, because the deposit ensures a high probability of purchase by this counterparty

- confirmation of the conclusion of the agreement - the agreement usually contains a clause stating that it is valid from the moment of transfer of the deposit, i.e. transfer of the deposit is perceived as the conclusion of the main transaction

- the deposit is the buyer’s first payment - being a small part of the transaction cost, the deposit does not increase the buyer’s expenses, but is included in them, for example, if the transaction costs 2,000,000 rubles, and the deposit is 200,000, then the buyer will have to pay an additional 1,800,000 rubles, and not the entire transaction amount.

A deposit is a profitable and convenient mechanism for transactions involving the sale of expensive and large goods.

How to return an advance payment for a service or product if you change your mind about purchasing?

Leading lawyer of the European Legal Service Gennady Loktev .

If you ordered a product in an online store (remote purchase method), you have the right to refuse to receive it at any time before its delivery, and after the delivery of the product - within seven days. That is, if you have not yet picked up the goods at the point of delivery (the courier did not bring it to you), you have the right to refuse to receive it and pay for it without any explanation - this is your right!

If you have received the goods, but you are not satisfied with them, then you have the right to refuse within the period and procedure provided by the seller, if this procedure and period are not established - within 3 months from the date of delivery of the goods. It is important to know that refusal of goods is possible only if the following conditions are met:

- its presentation and consumer properties are preserved;

- and there is also a document confirming the fact and conditions of purchase of the specified product.

Remember! The consumer does not have the right to refuse a product of appropriate quality that has individually determined properties if the specified product can be used exclusively by the consumer purchasing it.

Law of the Russian Federation dated 02/07/1992 N2300-1 (as amended on 04/24/2020) “On the protection of consumer rights.”

Art. 26.1. Remote method of selling goods. Refusal of service.

If you have entered into an agreement for the provision of services and decided that you do not need these services, you have the right to refuse the services at any time, and the contractor, in turn, has the right to withhold money from you for actual expenses incurred.

It turns out that the earlier you announced your refusal of services, the more money you should get back if you paid for it.

Law of the Russian Federation dated 02/07/1992 N2300-1 (as amended on 04/24/2020) “On the protection of consumer rights.”

Art. 32. The consumer’s right to refuse to fulfill a contract for the performance of work (rendering services).

The Contractor has the right to withhold part of the funds if they were actually spent on the requested services.

For example, we entered into an agreement for the manufacture of windows and their installation. 7 days have passed since the conclusion, we made a demand under Art. 32 ZPP, that we refuse services. If the contractor managed to manufacture the windows, then he will retain the money for the manufacturing service, and must return the installation part to the consumer.

Of course, many providers who do not value their reputation, when a consumer applies to cancel services, state that the money is non-refundable, or simply ignore the consumer. In such cases, if the consumer wants to achieve his goal, he should file a claim in court to recover funds, since they are unlawfully withheld within the framework of Art. 1102 of the Civil Code of the Russian Federation.

Return Features

When considering the issue of returning the deposit, it is necessary to take into account that in specific cases certain features and conditions of this procedure are provided. Most often, a deposit is used at the moment in real estate transactions. So in what cases is the deposit returned?

In theory, making a deposit should guarantee the buyer's intention to purchase the property, as well as the seller's intention to no longer search for potential clients. In practice, however, things are somewhat different. The guarantee is quite conditional and depends entirely on the human factor.

The conditions for the return of the deposit in the event of failure to fulfill obligations under the contract are regulated by Civil Law. At the same time, the law provides for the registration of a deposit not only by a full-fledged agreement, but also by a receipt with the relevant details. When drawing up a receipt, you should carefully check all the specified data, since any errors may become a reason for invalidating the document.

Refund of deposit by receipt

A receipt for receipt of funds is one of the options for making an advance payment. The text must indicate that the money is transferred as a deposit for the execution of any agreement. The document must contain the following details:

- passport details of both parties;

- registration address;

- the item for which money is transferred (car, real estate, etc.);

- the exact cost of the item;

- the exact amount of transferred funds (in numerical and letter expressions);

- terms of conclusion and execution of intentions;

- signatures of counterparties.

This is also important to know:

How to return a Biglion coupon if it is unused

If the legal form of drawing up and signing a receipt is observed, it is recognized as a full-fledged agreement and entails full legal liability of the parties in court. It is not necessary to indicate the penalties of the parties in the text, since the concept of “deposit” itself already provides for those for all participants.

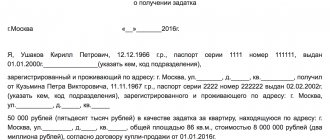

Under contract

When the parties sign a deposit agreement, it has the form of a preliminary agreement, which guarantees the conclusion of the main agreement (alienation of real estate, purchase and sale of a vehicle, etc.). To fully protect themselves, the parties must correctly compose the text and indicate:

- name of the document (deposit agreement);

- accurate passport data of counterparties;

- subject of the contract;

- legal action with the subject (purchase and sale, rent, performance of services, etc.);

- liability of the parties;

- conditions for the return of the deposit;

- signatures with transcript.

Since a written contract is a detailed form, the parties can specify special conditions for the return of the deposit or indicate that the money must be returned on the grounds provided by law. The conclusion of an agreement does not prevent the parties from specifying special conditions: fines for non-fulfillment or penalties.

Actions in case of refusal to return the deposit

If the opposite party refuses to return the deposit, the participant who contributed the funds has the right to demand their return exclusively in court.

Contacting the police or other authorities will most likely not bring the desired result. Cases regarding financial disputes between private individuals are heard by courts of general jurisdiction. You can file a claim only after the expiration of the date specified in the agreement or receipt. After filing a lawsuit, the court will review the case and make a ruling. If the judge determines that the failure of the agreement was due to the fault of the person who received the preliminary payment or due to force majeure obstacles, then most likely a decision will be made to return the money. If the court determines that the transaction was disrupted due to the fault of the participant who transferred the funds, then the deposit will remain with the opposite party.

Additional questions

What is not returned - deposit or deposit

Depending on the conditions specified in the agreement and preliminary contract, as well as on who failed to fulfill their obligations and caused the termination of the transaction, both the deposit and the deposit may not be returned.

This is also important to know:

List of technically complex goods that cannot be returned in 2019

The deposit is not returned to the buyer if he has violated or terminated cooperation under the current agreement. For example, citizen Ponomarev entered into a rental agreement for a banquet hall for a wedding celebration on a certain date and made a deposit of 35,000 rubles. After some time, the wedding had to be cancelled. Ponomarev understands that he has no right to demand the money back, since the deal ended because of him.

If the management of the banquet hall had been the reason for the termination of the deal, for example, because of a fire the hall would not be ready on the specified date, then Ponomarev would have been returned not just the deposit, but its double amount.

The deposit is not returned if the pledgor does not fulfill his obligations under the main agreement. For example, Ponomarev bought a car in installments from a friend with an obligation to pay 45,000 rubles monthly for 11 months. As collateral, he gave the car seller his old car with an estimated value of 190,000 rubles. If Ponomarev does not fulfill his obligations to pay monthly amounts, the mortgagee has the right to sell his old car and distribute the proceeds in his favor in the amount of Ponomarev’s debt.

And if Ponomarev paid money regularly all year, the old car will be returned to him, and he will also become the full owner of the new car.

From the examples it is clear that the deposit is used in cases where the seller wants to protect himself from risks, and the deposit is used as the first step in the further implementation of the transaction.

Deposit when buying an apartment: is it refundable or not?

The deposit transferred as an advance payment during a real estate alienation transaction does not differ from contributions securing other contracts. If the parties enter into a deposit agreement or the money is transferred according to a receipt indicating the form of payment, then in the event of the buyer’s refusal, the money remains with the seller.

The seller's refusal to fulfill the contract obliges him to return the money in double amount. If the transaction fails due to force majeure (for example, the seller died), then only the transferred amount is returned.

In what cases is a deposit required?

The mortgage of property is used as a guarantee for the buyer to fulfill his obligations; in case of failure to fulfill his obligations, the seller, by law, can return the money he has lost from the price of the pledged property.

Deposit is required when:

- in case of obtaining a loan

- Making a large purchase

- In cases where the buyer asks to briefly delay the sale of goods, the seller may request a deposit to ensure the fulfillment of obligations.

If we consider a large deposit, then when it is returned, an agreement is concluded with all the nuances of calculating the debt and actions in case of refusal to pay for the goods received.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

If the loan agreement is taken under the condition of collateral, then if the loan debts are not paid, funds are withdrawn from the value of the property, for this purpose it is sold, and the excess money is given to the buyer. If the buyer has made all payments on time, then after the last payment the pledge agreement is automatically terminated and the pledged property becomes the property of the buyer.

This is also important to know:

How to register the sale of a car according to the new rules in 2019

Property in the personal possession of the buyer can act as collateral. Depending on the amount of the contract, you can leave as collateral:

- Living space (House or apartment)

- Vehicle

- Household appliances

- Jewelry

- You can make cash as an advance payment for the goods

In what cases is it necessary to register a property pledge with government authorities:

- In accordance with the law, the rights that secure the ownership relationship to any citizen are required to be registered with government agencies.

- Provided that the subject of the pledge is the rights of the person registered in the limited liability company.

These conditions are stipulated in Article 339.1 of the Civil Code of the Russian Federation.

When mortgaging property that can be moved, mandatory registration is carried out by means of a census of issued notices of mortgaged property, received from the legislator, or from the person who received the property pledged.

If the property is destroyed, the seller has the right to demand that the buyer replace the collateral or restore it. These facts are stipulated in Article 345 of the Civil Code of the Russian Federation.

The Civil Code describes in detail all types of pledge, also indicates the subject of the pledge and provides a list of property that can act as pledged property. The parties to the pledge agreement and the obligations of the parties are also described in detail. All actions of the parties in the event of the destruction of the pledged property, change of the pledged estate of a person. Also, the rights of a citizen who has pledged property to transfer the right to claim the debt to a completely different person.

When is it possible to return the deposit from customs?

The cash deposit paid to customs can be returned in the following cases (No. 311-FZch. 1, Article 149 of the Federal Law of November 27, 2010):

- the obligation secured by cash collateral has been fulfilled in full, terminated or has not arisen;

- Instead of a cash deposit, a new security for the payment of customs duties has been introduced.

To return money from customs, the holder of the pledge (or his legal successor) must submit a corresponding application to the customs authority where the pledge was made.

Is the deposit returned to the winner and loser of the auction?

Auction and competitive bidding is often accompanied by a preliminary deposit of funds as security for the intentions of the auction participant. According to Art. 448 of the Civil Code of the Russian Federation, the deposit payment is returned to the participant:

- in case of participation, but defeat in the auction;

- in case of auction cancellation.

The refund period is 20 calendar days from the date of the auction or cancellation.

The funds contributed by the winner are taken into account as an advance payment for the subject of the auction. If the winner refuses to pay the full price, the deposit payment remains with the organizers.

Subscribe to the latest news

Why do you need to know this?

Anyone who is unaware of the intricacies of using deposits and collateral when concluding a transaction is at risk of being deceived. There are many ways to deprive a person of money by using a deposit agreement or a pledge agreement.

Here are some common schemes:

- The fraudster rents an apartment for a while—several months. Makes a copy of the certificate of ownership or an extract of ownership, prepares a fake power of attorney to represent the interests of the owner and sells the apartment under an agreement with the transfer of a deposit. The potential buyer gives the scammer money, and he disappears. This small type of fraud is much worse; if the fraudster sells the rented apartment, then the buyer will lose a large amount of money.

- The fraudster operates with a general power of attorney from the owner - received a long time ago or for other purposes, or even fake. After receiving the deposit, such a representative disappears and does not answer calls.

- Sometimes scammers use the method of favorable prices and short deadlines. They assure the buyer that the apartment (usually owned by a fraudster) is being sold urgently and at a low price, that several people are vying for it, and the contract will be drawn up with the one who gives the deposit before others. After receiving the deposit, an agreement is concluded with unrealistically short terms and conditions. The buyer does not have time to fulfill them and becomes the culprit for breaking the contract; as a result, the deposit legally remains with the fraudster.

- A popular scheme is the distribution of lending services to the population. The debtor is asked to secure the transaction with real estate collateral. He mortgages his apartment/house/land and receives a loan that is less than the value of the real estate. Then it turns out that the debtor was given not a collateral agreement to sign, but a purchase and sale agreement, and he is left without housing.

- The traditional scheme of deception using collateral is to gain the trust of the home owner, after some time tell them about your needs and convince the owner to provide housing space as collateral to obtain a loan. The creditor is a figurehead. After the transaction, the fulfillment of obligations by the parties is demonstrated for a certain time, and then the debtor faces insurmountable obstacles and is unable to repay the loan. The creditor sues to recover his money through the mortgaged property. Enforcement proceedings are initiated, the apartment is sold at auction. As a rule, the sales organizer is also a front company; the apartment is sold cheaply. As a result, the owner loses his home, and may still be in debt to the lender.

- We often see advertisements of tempting offers for loans and loans without complex procedures. In fact, you need to be careful with such offers. A home owner turns to such a company, receives a loan secured by an apartment/house/land, lenders convince him to enter into not a loan agreement or a collateral agreement, but a purchase and sale agreement, arguing that this practice is widespread and guarantees the company’s investors a return of money.

To be convincing, creditors draw up a reverse purchase and sale agreement for the property with a trusted person of the owner - a relative or friend. With the same argument, creditors convince him to sign for the receipt of money for the sold home and give power of attorney to creditors to register ownership. Then the owner repays the loan, as agreed, but cannot return the property, since he is not its owner. It is difficult to recognize such a transaction as invalid, since all the conditions are present.

To protect yourself from such schemes and protect loved ones from them, it is recommended to draw up an agreement or contract with the support of a specialist - a lawyer or a notary, and try to make inquiries about the counterparty and other persons involved in the transaction.