Last modified: October 2021

The owner of property has the right to dispose of it at his own discretion, including transferring it free of charge to another person. According to the Civil Code, the presence of both parties to the agreement when signing documents is mandatory. However, situations often arise when the donor cannot be present in person at the transaction. For example, he is in another city or is seriously ill. In this case, the law provides the opportunity to carry out the procedure using an apartment donation agreement by proxy. In this case, the third party receives from the donor the authority to carry out the necessary actions.

Cases of compilation

It is usually drawn up in the following cases:

- If the homeowner cannot be present at the transaction, for example, for health reasons. Or it may be located far from the place where the contract is to be concluded.

- If the owner wants his interests to be represented by a specialist who understands the intricacies of the law.

Sample power of attorney to donate an apartment.

Find out on our website about the specifics of donating housing between close relatives, in particular how to draw up a deed of gift and what papers are required for the transaction. You can also find a sample agreement for donating an apartment between close relatives here.

Is it possible to issue a deed of gift to a third party?

Due to one or another circumstance, it is not always possible for the owner of real estate to independently formalize the transaction of donating an apartment. In this case, current legislation requires the involvement of third parties who will represent the interests of the property owner. To do this, you need to draw up a special document - a power of attorney.

According to Article 185 of the Civil Code of the Russian Federation, a power of attorney is a written authority that is issued by one person to another for representation before a third party.

Any capable citizen can obtain an agreement to grant the rights of an apartment owner. As a rule, close relatives or acquaintances who are trusted by the property owner become the trustee. However, if there is no person in the donor’s circle for whom the paper can be drawn up, you can turn to professional lawyers for help. This can also be done if the owner is not confident in his legal competence or does not want to carry out the transaction.

Advantages and disadvantages

advantages and disadvantages to using the help of a trusted person The first include:

- There is no need to collect the necessary papers yourself, conclude a transaction, and then register it. This saves time.

- Signing this document allows you to donate real estate, even if it is not possible to be physically present at the conclusion of the contract and other formal procedures.

The disadvantages of this solution include:

- Lack of awareness about how the preparation process and the registration of the gift itself take place.

- Possibility of fraud on the part of a trusted person.

Samples of a gift agreement by power of attorney:

From the donor.

From the donee.

From both sides.

Find out on our website about the pros and cons of a gift agreement, its types, as well as what is better to draw up: a donation, a will or a purchase and sale.

Registration

The registration procedure also requires the provision of a package of documents. However, you should not worry and form it again. You will only need to fill out your package of documents with other papers.

Thus, the gift agreement, which was drawn up in a notary’s office, is attached to the above package of documents.

IMPORTANT. Since the gift transaction is a paid government service, you need to pay a state fee for its registration.

So, you need to pay the state fee according to the details that you will receive from the Rosreestr authority. Today, the amount of state duty is 2,500 rubles.

Kinds

A representative on behalf of the donor has the right:

- Submit applications and requests to various authorities to collect papers.

- Receive them.

- And also sign them in favor of the donor.

Thus, it is possible, having the authority, to collect all the required papers, transfer the rights to own real estate to another person and register the transaction with the Cadastral Chamber.

There are several types of papers :

- general;

- special;

- one-time

The general gives the broadest powers , including the right to conduct other transactions, in addition to the transfer of property as a gift: sale, exchange, lease, and so on.

It provides more opportunities for fraudulent activities. Therefore, if it is necessary to conclude such a document, the powers granted should be defined as precisely as possible. As a rule, notaries and lawyers treat donations under a general power of attorney with caution.

A special and one-time power of attorney provide the authority to perform one specific action. A special one is used if it is necessary to perform several similar operations, and a one-time one is used for one specific action.

To donate living space, it is enough to sign a one-time power of attorney.

Sometimes the question arises whether someone who receives a gift of real estate can be the owner's representative. Is it possible to use this paper to give an apartment to yourself?

This is impossible, since according to Article 182 of the Civil Code of the Russian Federation, a trusted person does not have the right to make transactions in relation to himself . Otherwise, it would turn out that the same person signs the contract for two parties.

Read about the specifics of registering the donation of an apartment at the MFC or through Rosreestr on our website.

Apartment donation agreement by power of attorney

A power of attorney for gifting is a document that allows the authorized person to act in accordance with the interests of the donor when executing a gift transaction. You can register three forms of power of attorney that are valid in Russia. This:

- One-time form;

- Special or regular;

- General form of power of attorney.

Let's start with a one-time document.

It allows you to perform only one action, which is why the document is called that way. For example, it can be used when you need to sign a document confirming the donation process, but the owner, due to some circumstances, is unable to come. In this case, he can transfer this authority to a trusted person. Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 Moscow,

Moscow region

+7 Saint Petersburg,

Leningrad region

+7 Regions

(toll-free call for all regions of Russia)

As for a special power of attorney, it is signed if the principal needs to entrust someone with representation in a number of similar actions. It is also often drawn up for registration of deeds of gift.

A general trust is a document that provides a trusted citizen with unlimited powers, that is, almost completely transferring to him the process of preparing and collecting documents, concluding a transaction and carrying out other related procedures. Therefore, when a general power of attorney to make a gift is issued, the donor should describe the duties of the trustee in as much detail as possible.

As for the gift agreement itself, it is drawn up in such a way that no encumbrances are imposed on the agreement in favor of anyone. If this moment is missed, the agreement will be considered void, which means they will not be able to fulfill its terms.

By the way, the terms of the transaction oblige the donor to perform the following manipulations:

- The donor is forced to transfer the donated property to the second party;

- If the gift has any defects, the donor must warn the recipient about this;

- It is the donor who undertakes to pay the monetary expenses that arise when transferring the gift.

In turn, the execution of a deed of gift for the donee may be undesirable. That is why the recipient can refuse the gift that is offered to him. Of course, there must be compelling reasons for this, in particular, a significant decline in living standards. Here are the rights of the donee for whom they want to draw up a gift deed:

- Refuse or agree with the gift;

- Change the purpose of receiving a gift if all rights to it have already been re-registered;

But the person who is given the rights to property also has responsibilities:

- Maintain the gift in good condition;

- Use the property.

How is it processed?

The document is drawn up in writing by a notary and certified by him.

The cost of legal and technical work to prepare such paper for an apartment donation agreement is 1000 rubles , the notary fee is 200 rubles .

Thus, registration will cost 1200 rubles.

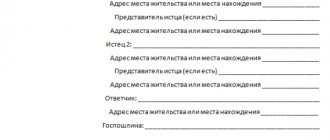

The text of the document must contain:

- Place (city) of issue.

- Date of issue.

- Passport details of the transferor, including last name, first name, patronymic and address.

- Information about the property: address, area.

- Information about documents confirming ownership of it: number and date of the certificate of ownership and the document justifying the acquisition of the right.

- Information about the representative (similar to the principal).

- Powers vested in a fiduciary. Includes the right to submit, receive and sign all documents that may be needed to carry out the assignment (i.e., donation of an apartment). You will also need the right to represent the interests of the principal in all authorities related to the transaction.

- Information about to whom the apartment should be donated.

- Validity period of the document.

- An indication of the possibility or impossibility of entrusting received powers.

- Signature of the principal.

- Data and signature of the notary, which certifies that the paper was signed in his presence.

- Registry number and amount paid to obtain it.

It cannot be more than 3 years old. If the period is not specified, it is valid for no more than 1 year (under Article 186 of the Civil Code of the Russian Federation).

All dates and deadlines must be indicated not only in numbers, but also in words .

Difference from the procedure with the participation of the owner

Donating an apartment with a power of attorney differs from donating it without it in that in the first case the presence of the owner of the real estate is an optional condition, while the second situation implies his mandatory presence.

You can also highlight the difference in that donation without a power of attorney allows the owner of the property to change the donee or change the object of the donation at any time before the transaction. A transaction with a power of attorney excludes this option, since paragraph 5 of Article 576 of the Civil Code of the Russian Federation states that the document must indicate the donee and the object of the donation, and, accordingly, the trustee can act only within the framework specified in the agreement.

Reflection of information about the trust agreement in the contract

Indication in the text of the gift agreement of information about the trust agreement is not necessary in the case when the deed of gift is signed by the donor and the donee, and the representative of the former only submits documents for registration.

If it is necessary for a deed of gift to be signed by a trustee, indicating information about the power of attorney is mandatory.

As a rule, in this case, at the beginning of the contract, the personal and passport data of the representative, the number of the power of attorney in the notary register, the date of certification of the document, as well as the notary’s data are indicated.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 302-76-94

Required documents

for registration :

- principal's passport;

- passport details of the trusted person (to avoid mistakes, it is better to provide a passport or a copy of it);

- passport details of the donee (similar);

- certificate of ownership of the apartment;

- documents on the basis of which the property was transferred into ownership. This could be a purchase and sale agreement, a certificate of inheritance, or a deed of gift.

Requirements for real estate donated

By law, you can donate any real estate (both residential and commercial). In addition, a citizen has the opportunity to donate both the entire housing and its share.

If the new owner subsequently wants to sell his share, he will first have to offer it to the co-owners, and if they refuse, put it up for general auction.

Regarding the size of shared ownership, the law also does not define clear boundaries. The co-owners themselves decide who gets what part of the property, and therefore the donated share can be either 2/3 or 1/8 of the total living space.

There are also no restrictions on the condition of the donated property. It may be located in old buildings and have encumbrances. In the latter case, the apartment passes to the new owner with all debts.

By signing a gift agreement, he automatically receives all encumbrances of the previous owner.

That is why unilateral conclusion of a deed of gift is prohibited - the recipient must know what he is getting into, taking into account the possible negative consequences.

This is the option where you really look a gift horse in the mouth.

Invalid

A document may be declared invalid if:

- The principal canceled his action.

- The representative refused it.

- His term has expired.

- Issue date missing.

- In case of death, absence, limited legal capacity or incapacity of the principal.

- In case of death, absence, limited legal capacity or incapacity of the trustee.

- The real estate on which the bumana is registered is inhabited by minor children adopted or under the guardianship of the donor.

In what cases can this procedure be refused?

If the power of attorney is executed by a notary, the specialist may refuse to provide services:

- the procedure violates the law;

- provided false documents;

- a power of attorney is issued by an incapacitated person;

- has the fact of coercion or threats from the attorney;

- incomplete provision of papers for the procedure.

The same applies to concluding a gift agreement.

If a notary reveals incompleteness or inconsistency of documents, establishes the incapacity of one of the parties, or suspects a violation of the law, the deed of gift will be refused.

As they say, measure seven times...