What is a deposit and what is its essence?

The deposit is a sum of money that is transferred to the seller of the apartment as an advance payment. In this way, the buyer expresses his intention to purchase residential premises, and the seller undertakes not to sell it to others.

The deposit is transferred before the conclusion of the main purchase and sale agreement, and its amount is taken into account later when paying the full cost of the apartment (Article 380 of the Civil Code of the Russian Federation).

The parties can confirm the agreement on the purchase and sale of an apartment with a deposit in the following cases:

- the seller needs time to prepare documents in relation to the apartment being sold;

- the buyer does not have enough funds and takes out a mortgage loan;

- the seller needs to resolve the issue of removing the encumbrance or paying the debt on utility bills.

The agreement between the seller and the buyer on the transfer of the deposit is drawn up regardless of the amount of funds to be paid.

The difference between a deposit and an advance

When making purchase and sale transactions, it is possible to conclude an advance agreement. An advance payment is also made as an advance payment, but unlike a deposit, it does not guarantee the completion of the transaction. If for some reason the transaction does not take place, the advance must be returned to the buyer, regardless of whose initiative this happened.

It is not necessary to formalize the transfer of the advance by contract or agreement; it is enough to write a receipt for receipt of the advance.

The difference between a deposit and a pledge

A deposit, unlike a deposit, is not a payment. When pledging, certain restrictions are imposed on the rights of the mortgagor in relation to his property, which guarantees the fulfillment of his obligations under the contract. The subject of the pledge can be movable and immovable property.

The transfer of property as collateral must be formalized by an agreement (Article 339 of the Civil Code of the Russian Federation) and, if necessary, such an agreement can be notarized. As a rule, a collateral agreement is used when applying to a bank to apply for a loan and is a guarantee for the bank to return the borrowed funds.

Features of registration of a deposit depending on the conditions

Depending on the terms of the transaction, payment of the deposit to the seller may have its own characteristics:

- Multiple owners - all of them must be included in the deposit agreement and sign it. Receipt of a deposit by one of the owners may lead to further claims from other owners.

- With a mortgage encumbrance - if it is necessary to repay the mortgage debt with the seller’s money, the deposit is drawn up based on this amount.

- Under a share participation agreement in construction, the party accepting the deposit will be a legal entity.

- If a representative acts on behalf of the seller, the text of the power of attorney must indicate the authority to receive the deposit instead of the owner. Otherwise, only the owner has the right to accept the deposit.

Registration of a deposit when concluding an agreement for the assignment of the right of claim, as well as a purchase and sale agreement using maternity capital funds, is carried out according to general rules.

Advance agreement for purchasing an apartment

What is the difference between an advance and a deposit when buying an apartment?

Sample (template and form of receipt) for processing a deposit for a garage

Only by remembering all these rules, in the end, it will be possible to correctly draw up the receipt so that it acquires legal force.

Deposit (advance) for receiving money for a car (car), sample Example of a receipt for receiving a deposit for a house (dacha) and land Certificate from the place of work (sample, example, form) Protocol of disagreements to the Agreement, sample (ready-made example) Characteristics in the traffic police , traffic police (samples and ready-made examples) Characteristics of the head of the enterprise (sample from the place of work)

How to properly draw up a deposit agreement when buying an apartment?

The transfer of the deposit to the seller can only be reflected in the preliminary purchase and sale agreement or formalized in a separate agreement. Both of these documents will have legal force from the moment they are signed.

The agreement must necessarily reflect the amount of the deposit as essential conditions and indicate the obligations that are secured by it. Money can be transferred directly at the time of signing the agreement or on the date specified in it.

The agreement must be drawn up according to the number of participants in the transaction and signed by each of them or their representative by proxy.

Agreement form

The requirement to formalize the deposit agreement in writing is regulated in Article 380 of the Civil Code of the Russian Federation. It is not necessary to have it certified by a notary, but this can be done if the parties to the transaction wish. The legal force of the agreement will be the same, however, for the buyer, a certified agreement will be a guarantee that his interests are protected.

The cost of notary services when certifying contracts related to the alienation of real estate depends on the amount of the transaction (up to 1 million rubles - 3000 +0.4%, from 1 to 10 million rubles - 7000+0.2%, over 10 million rubles – 25000+1%).

Contents and sample

There is no legally approved sample deposit agreement, so in order to protect yourself from any possible risks, you need to take the contents of the document seriously.

The agreement must include the following:

- date and place of conclusion of the agreement;

- information about the parties to the transaction (full name, passport details, place of residence and registration);

- information about the subject of the transaction (address of the residential premises, total cost, area, number of rooms, cadastral number);

- the amount of the deposit transferred (in numerical and letter terms) and the legal purpose of the payment (it should be clear from the text of the document that this is a deposit, and not an advance);

- deadline and procedure for transferring the deposit (date, method of transferring money);

- the period by which the main contract must be concluded (if the period is not specified, then according to the general rules the transaction must be concluded within a year);

- actions of the parties before concluding the main contract (for example, preparation of documents by the seller, registration of a mortgage by the buyer);

- rights and obligations of the parties;

- circumstances and procedure for returning funds paid as a deposit, including for reasons beyond the control of the parties (for example, refusal of authorities and organizations to issue the necessary documents and permits);

- number of copies of the agreement according to the number of participants;

- the moment of entry into force;

- signatures of all parties to the transaction.

By agreement between the parties, additional clauses may be included in the agreement, but they must directly relate to the subject of the agreement being concluded.

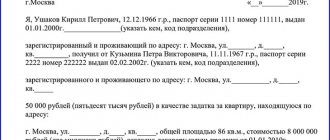

Sample agreement on deposit when purchasing an apartment:

What should be in the deposit agreement?

The more specific conditions you write down, the better. First of all, the document must contain personal information: yours and the owner’s. If there are multiple owners, mention them all. In addition, write down detailed information about the apartment, as well as a list of documents that will be needed for the transaction. The contract must include the amount of the advance payment and for how long you are paying it. And also how the deposit can be returned. Be sure to specify the rights and obligations of the parties, as well as their actions at the time of making the prepayment. For example, the buyer may be selling his property, and the seller will complete the paperwork. In addition, indicate in the contract at what time the old owners must move out and check out. And also, if there are any reasons that may interfere with the transaction, they should also be mentioned. The same applies if the property is under mortgage. And the last thing is the place, time of the transaction and who will bear the costs of its execution.

Transfer of deposit

After signing the agreement, the buyer can transfer money to the seller.

If funds are transferred in cash, the seller must make sure that the amount corresponds to that specified in the agreement by recalculating them in the presence of witnesses. A bank transfer can be easily confirmed with a receipt or account statement. The place where the money is transferred can be the office of a real estate agency, a notary's office, or the apartment being sold.

Amount and term of deposit

As a rule, the amount of the deposit is determined by agreement of the parties and is not tied to any percentage of the transaction amount. Typically this amount ranges from 50 to 100 thousand rubles, except in cases where the deposit ensures the repayment of the seller's mortgage debt.

When setting the amount of the deposit, the parties proceed from their interests. It must be sufficient so that its loss for the seller or buyer in the event of refusal of one of the parties from the transaction becomes significant. This ensures that the buyer does not refuse the transaction, having found a more suitable option in the process of completing it. At the same time, the seller will not want to sell the apartment to another person, realizing that returning the amount in double amount calls into question his benefit.

The duration of the deposit agreement will depend on what actions the parties need to take before signing the main agreement. The period is discussed by the parties in advance and taken into account with a reserve of time, or the agreement may stipulate the possibility of extending the period if necessary. You can complete a transaction on any day before the deadline specified in the agreement.

Transfer receipt

The fact of transfer of the deposit to the seller can be confirmed by a receipt for receipt of funds. Drawing up such a document is not mandatory, but for the buyer this will be a guarantee that the seller will not be able to deny the fact that he has received funds.

It is recommended that the receipt be drawn up by the seller in his own hand, indicating the following information:

- where and when compiled;

- data of the parties to the transaction;

- the amount transferred as a deposit;

- purpose of the transferred amount;

- signatures and transcripts of participants' signatures.

The buyer must keep the receipt, as in the event of litigation it will serve as evidence of the actual transfer of funds.

Sample receipt for receiving a deposit when purchasing an apartment:

Procedure before depositing money

Before paying the deposit, the Buyer will need to approach the process very carefully, since he transfers to the Seller, usually not a small amount of funds.

To protect himself from fraudulent schemes, the Buyer needs to make sure that the Seller will not disappear after receiving the deposit.

Below is a table with a list of actions by the Buyer before handing over the deposit.

| Action | A comment |

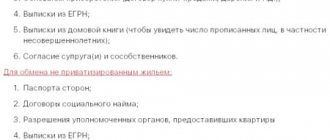

| Checking documents for alienated living space | The Seller will need to provide the Buyer:

|

| Obtaining written consent from the Seller’s spouse for the sale of the apartment, confirmed by a notary. | If the Seller is married, he will need to show the Buyer his partner’s consent to sell the property, otherwise the transaction may be protested by the deceived partner within a 3-year period after taking possession of the property. |

| Checking the housing for restrictions and encumbrances that do not allow free use of the living space. |

|

| Checking the absence of debts for housing and communal services | The buyer needs to carefully study receipts for payment of utility bills for the last 3 years in order to protect himself from additional unexpected payments. |

Transfer of deposit

If there are no comments, after preliminary familiarization with the documents and a preliminary inspection of the apartment, the Buyer can draw up a CoZ with the Seller, with the direct delivery of the deposit after signing the agreement.

The deposit given in cash must be carefully counted (it is recommended to do this in front of witnesses). Then check the authenticity of the banknotes at any bank institution, since the payment is usually a decent amount (for example, 5% of the price of living space can be at least a six-digit figure.

Upon delivery of the deposit, the Seller will be required to write a receipt confirming receipt of the money. The receipt is not a mandatory document, since this condition is specified in the CoZ. However, the Buyer has the right to demand such paper, since the Seller, in the case of fraudulent schemes, may declare that he did not receive the deposit. The receipt for delivery of the deposit is filled out in any style. The sole purpose of this document is to confirm that the Seller has received from the Buyer the amount of the deposit specified in the CoZ. Notarized confirmation of the receipt is not required.

This document is filled out by the Seller, followed by the signatures of the Buyer and the Seller and the transcripts of their names. It is recommended that the receipt be filled out manually (rather than printed) in black or blue ink on an A4 sheet. This is necessary in case of possible proceedings in court, that is, by analyzing the handwriting it will be possible to confirm that the document was filled out personally by the Seller of his own free will. The receipt for delivery of the deposit is filled out in 2 copies for the Seller and the Buyer.

The form reflecting the fact of delivery of the deposit partially displays the information noted in the CoZ, indicating:

- Places and dates of filling out the receipt.

- Full name, passport details, registration address and actual location of the parties to the agreement.

- Full name, passport details, registration address and actual location of witnesses (if any are invited).

- Evidence that the amount being delivered relates to a deposit and not to an advance payment.

- The amount of the deposit is in accordance with the signed agreement (in numbers and in words).

- Signatures of the parties with a transcript of their names.

Below is a form for such a receipt.

What needs to be done after paying the deposit?

After making the payment for the transfer of the deposit, the parties to the transaction begin the procedure for registering the DCP for the apartment, performing the following actions:

- Signing the main DCP for the living space within the time period shown in the CoZ.

- Carrying out a full calculation.

- Registration of the final procedure - re-registration of ownership of the apartment in Rosreestr, with receipt of an extract from the Unified State Register of Real Estate about making changes to the database.

The CoZ and the receipt for the delivery of funds remain in the hands of each party. Note. It is recommended to keep these documents for at least 3 years, in case of possible litigation regarding the acquisition of living space.

Termination of the deposit agreement

Until the main agreement is signed and registered in Rosreestr, the deposit agreement may be terminated at the initiative of either party. The buyer usually insists on termination if the following circumstances exist:

- if significant deficiencies are found in the residential premises that cannot be eliminated and the buyer was not previously aware of them;

- the characteristics of the housing that is transferred to the buyer differ significantly from those initially stated by the seller;

- the seller did not prepare the necessary documents.

The seller and buyer may change their minds about the transaction, but they must be aware of the legal consequences of their actions.

In what case can the deposit be returned?

To avoid disputes upon termination of the agreement, it is better to reflect the circumstances and conditions for the return of paid funds in the text of such an agreement. Article 381 of the Civil Code of the Russian Federation provides for a standard procedure for returns:

- the transaction did not take place due to the fault of the seller (refusal or guilty actions) - the amount paid is returned in double amount;

- the buyer’s actions caused the deal to fail – the amount of the deposit remains with the seller;

- mutual decision of the parties to terminate the transaction - the transferred amount is returned to the buyer;

- unforeseen circumstances - in this case the deposit is also returned to the buyer.

Further developments will depend on the position of the second party - either the deposit amount will be returned (this action also needs to be confirmed with a receipt), or the issue will be resolved in court.

Refund by agreement

Refund of funds by mutual agreement is the best option for the parties (Article 450 of the Civil Code of the Russian Federation). In this case, the buyer does not lose his money and the parties do not waste time on litigation. However, in practice, sellers most often violate their obligations and do not want to return double the amount of the deposit.

Judicially

If it was not possible to return the funds by agreement of the parties, then it is necessary to try to resolve the problem pre-trial. To do this, the initiator of termination of the agreement formalizes his intention in the form of a written demand and sends it to the other party to the transaction.

In addition to basic information about the agreement that is subject to termination, the request must indicate the reasons for which such a need arose and the immediate request for termination and return of funds.

If a party evades the requirements, the dispute can only be resolved in court. Disputes in which the amount of the claim is less than 50 thousand rubles. considered by the world court. If the amount is higher, you need to go to the district court. The burden of proving that a party has failed to fulfill any obligations under the contract will lie with the plaintiff.

Sample statement of claim:

Definition

A deposit is a strict guarantee of fulfillment of all terms of the contract: for these purposes, one party provides the other with a certain amount of money, which they may lose if the contract is not fulfilled due to the fault of this party. If the other party who received the funds is guilty of non-fulfillment, he is obliged to return them in double amount. It is also possible to recover damages associated with non-performance if evidence is provided by the interested party. All these rules are contained in Art. 381 Civil Code of the Russian Federation.

In order not to make a mistake when drawing up such an important document as a deposit agreement, prepared by lawyers, and using it for your tasks is the best decision. But first you need to decide on the type of form.