Any citizen of Russia has the right to give another person an item that he or she owns. But an ordinary thing can simply be handed over, informing about its transfer as a gift, and property such as a plot of land that is registered with the state should be donated correctly.

Land plots are classified as property protected by the state, and all transactions with it are under control.

What is donation of land

A deed of gift for a land plot is a document, an agreement between 2 people, according to which one person (he is the owner of the land and can dispose of it) donates it free of charge to another person (the donee, who has the right to accept or not accept the subject of the transaction into his possession) piece of land. The main feature that distinguishes donation from other transactions for the alienation of property rights is gratuitousness.

The subject of donation, that is, a land plot, can be transferred only of good will and only free of charge. If doubts arise on these points, the transaction can be challenged in court.

Important! You can donate land to anyone - a close relative or a stranger. The question is the taxation of the gift and the procedure for registering it upon transfer.

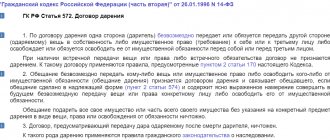

A deed of gift for a plot of land is drawn up in accordance with the provisions of the Civil Code of the Russian Federation. Donating a plot of land to a relative or other person has its advantages and disadvantages.

Advantages of registering a gift agreement

We can highlight:

- possibility of appealing the transaction. Donation of land is an expression of goodwill towards a third party; the subject of the expression is the allotment. It is possible to challenge a transaction for the gratuitous donation of a plot of land, but it is difficult compared to other civil transactions for the alienation of rights;

- taxation. More often, a deed of gift for a land plot is drawn up between close relatives. This makes it possible to obtain property rights now, without waiting for a will. In addition, such transactions are not subject to tax;

- simplicity in design. If the parties are close relatives, then a simple written form is sufficient. Notarization of a gift agreement is required only when the parties do not have family ties or are not close;

- the recipient becomes the owner of the land after signing the agreement, and not after the transaction is registered in Rosreestr. Registration of the agreement with Rosreestr is a prerequisite, since the subject of the transaction is a real estate object;

- Land donated cannot be common property. Therefore, the risk of disputes with another owner is minimized.

Important! Donating a plot of land can be an alternative to alienating a share in shared ownership. For example, if another owner does not want to sell his share of the site, others can donate theirs to third parties.

Disadvantages of drawing up a gift agreement

Like any other transaction for the alienation of civil rights, donation has its drawbacks. These include:

- the deal is unconditional. That is, the donor does not have the right to establish any additional conditions for the transaction;

- if the parties are not close relatives, then it is necessary to pay a tax of 13% of the transaction value. It is determined through cadastral valuation. If the donee is not a resident of Russia, then he will have to pay 30% of the cadastral value.

Important! To pay the tax, you must independently submit a declaration in Form 3-NDFL. Payment occurs upon submission of documents. Tax officials are conducting a desk audit.

The legislative framework

Despite the fact that the land plot, and therefore all legal relations that arise as a result of transactions with it, fall under the jurisdiction of the land code, we still have to turn to the civil code.

The fact is that civil legislation best establishes the main stages of transactions that can be carried out between citizens.

A gift transaction is no exception.

Let us stipulate in advance the fact that we are talking about real estate, which can participate in civil circulation and is not limited in it. The deal and its features are enshrined in Article 572 of the Civil Code. It is in this norm that you will find the concept of a transaction, as well as the main stages and principles of its implementation.

Before using this procedure in practice, be sure to familiarize yourself with the theory. In addition, in the process of formalizing the donation of a land plot, a relative may need information from the Tax Code, as well as other civil legislation that accompanies such a procedure.

Now that you know all the stages of the transaction, and most importantly, where to go in order to get clarification, we will inform you that there is another, no less important source of information.

Reference! Sources of law include court decisions that were made in similar cases.

For example, there was a dispute between the parties about the appropriation of a land plot, or an appeal against a transaction such as a donation. Based on the court's decision, you can draw a conclusion about which actions may be legal and which can be appealed by other owners.

Therefore, in order not to get burned and not to be accused of non-compliance with any rights, be sure to read such documents.

List of required documents

How to draw up a deed of land? To do this, you need to draw up an agreement in simple written form, read it carefully, sign it and submit it for registration. But the following documents are needed:

- passports of both parties;

- an extract from the Unified State Register of Real Estate confirming the property right of the donor and the absence of encumbrances;

- the document on the basis of which the owner has his right;

- technical passport for buildings, if they exist on the ground. These documents are necessary to verify the legality of these buildings;

- cadastral documentation for land. Its presence means that the site has a cadastral number. But before concluding a deal, it is recommended to carry out land surveying and approve the boundaries of the land;

- if the plot was acquired during marriage, then the notarized consent of the spouse.

Based on technical and cadastral documentation, as well as an extract from the Unified State Register of Real Estate, a donation agreement for a land plot is drawn up. You need to prepare 3 identical documents. One copy for the parties to the transaction, and one copy in Rosreestr in the “personal file” of the allotment.

Sample deed of gift

A land donation agreement may look like this:

Features of land donation

Spouse

Since land that was acquired during marriage is jointly acquired property, this means that in fact, unless otherwise stipulated in the marriage contract, the property is equal in rights and is owned by each of the spouses .

Therefore, by making a gift in relation to your spouse, you are making an absolutely useless transaction.

Important! In fact, your spouse already has real estate that was acquired during marriage, and in the event of a divorce, it will go to him in the amount of one second part.

If you want the land to belong entirely to your spouse, then you can donate your share.

For a minor child

When making a gift to a minor child, remember that the minor does not realize how beneficial this transaction can be for him.

Therefore, it is logical that his legal representative in the person of his mother or father should accept the gift for a minor .

Also, often the guardianship and trusteeship authorities are involved in overseeing such a transaction.

For this reason, before gifting real estate to a child, make sure that all encumbrances have been removed from it.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 350-29-87Moscow

Donating a share of land to a relative

To donate a share of land, you must definitely ask permission from other share owners. It is advisable that their consent to the transaction be formalized in writing.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 350-29-87Moscow

Read more about the nuances of drawing up a donation agreement for a share of a land plot in this article.

Main stages of contract execution

In order to formalize a donation agreement, the subject of which is a plot of land, it is necessary to go through several stages:

- Collect the necessary documentation.

- Prepare a draft agreement. If necessary, you can involve a lawyer.

- Introduce the recipient to the project.

- Sign the agreement and attach copies of the necessary documents. If the parties are not relatives, then it must be certified by a notary. He will once again check the correctness of the drafting.

- Submission of the contract for registration to Rosreestr. You can register a deed of gift for a land plot at the MFC, since Rosreestr has not worked directly with citizens for several years.

- Waiting for ready documents. Re-registration of the right occurs within 10 working days.

- Receive an extract from the Unified State Register of Real Estate.

Important! To notarize a deed of gift, you must pay a fee. Its size depends on the cadastral value of the donated item. You will also need to confirm that the donor has no property tax debts. To do this, you will need to take a certificate from the Federal Tax Service at the location of the gift.

Advice from a lawyer on drawing up a deed of gift:

What the donor and recipient need to know - pitfalls

The requirements for making a donation are as follows:

- Buildings on the site are donated along with the land;

- The land plot must have state registration;

- The law prohibits donating lands located in border zones, as well as to stateless persons and foreigners.

If all requirements are met, the procedure will proceed without a hitch. The documents will be accepted by the government agency, and the transfer of ownership will be recorded. The new owner will receive a certificate and deed of gift and will take ownership of the property.

In addition, a number of documents have a short validity period. Thus, a certificate from the Unified State Register is valid for only 5 days. Therefore, you should clearly draw up a plan for obtaining documents.

Taxation of gift deeds

Receiving a plot of land as a gift is the basis for the emergence of taxable income. According to tax law, you need to pay income tax. The donee must do this, since it is he who receives the additional profit.

Personal income tax must be calculated independently. To do this, you need to know whether the recipient of the gift is a resident of the Russian Federation or not. If yes, then 13% of the cadastral value is due for payment (if it is not established, then of the estimated value. But this happens rarely). If the recipient of the gift is not a resident, then 30% of the cadastral value is subject to payment.

The exception is close relatives. If they act as parties to the agreement, then the donee is exempt from paying the mandatory income tax. But when registering a transaction, you will need to confirm the presence of close family ties. Close relatives are:

- parents - children;

- grandparents – grandchildren/granddaughters;

- siblings and half-brothers.

A transaction between a nephew and an aunt no longer falls under close relationship. Therefore, you will have to pay tax.

What is the difference between a deed of gift for a close and distant relative?

The main advantage of giving land to a loved one within the family circle is the absence of income tax obligations. If the recipient is a distant relative or a stranger, then Art. 224 of the Tax Code of the Russian Federation , according to which the object of a gift for a tax resident of Russia is subject to personal income tax in the amount of 13%, and for a non-resident - 30% personal income tax.

The tax is calculated based on the market value of the land. The value calculated by the appraiser must be indicated in the donation agreement.

The text of the gift agreement for a close relative is distinguished by the need to indicate the details of documents confirming the degree of relationship. Otherwise, the design of the deed of gift is no different.

How to donate land to a close relative

A standard agreement is drawn up. If relatives have the same surnames, this benefits them. It is not necessary to confirm your relationship! But there are cases of fraud when a transaction occurs between namesakes and not relatives. Therefore, it is recommended to indicate the fact of relationship in the “body” of the agreement, and attach supporting documents to it.

For example, a father gives his daughter an apartment. Their surnames are different, since the daughter got married and is already in her second official marriage. To confirm your relationship, you must attach copies of the following documents:

- her birth certificate, which shows her previous name;

- marriage registration certificate confirming the transition to the surname of the first husband. An archival certificate from the registry office is also suitable;

- certificate of termination of these ties;

- a new certificate of remarriage, and a transition to the current surname.

Important! Confirmation of relationship is necessary in order to exclude the obligation to pay tax. Otherwise, tax authorities may become interested in the transaction and require confirmation of preferential treatment or payment of personal income tax.

You can get more detailed information regarding the issue of donation between close relatives in our other article.

What are the mistakes when drawing up a gift agreement - TOP 5 popular mistakes

Unfortunately, no one is immune from mistakes, sometimes extremely stupid and offensive. In jurisprudence, the price of such flaws is loss in a case or dispute.

The land donation agreement is no exception. Here are some errors due to which Rosreestr simply will not accept such a document.

Error 1. Inaccurate data about the parties to the transaction

Typos or deliberate changes in the settings of at least one participant in the transaction do not allow such an agreement to be accepted for registration. In the register, all information from the contract is verified with personal documents.

If inconsistencies are found, the documents are returned to the applicant without execution of the public service. Be careful and do not try to deceive the registrar.

Error 2. The presence of corrections in the text

It is strictly forbidden to make amendments to the text of the contract. If a mistake is made, retype the agreement and sign it again. Do not try to submit a document with corrections for registration, as it will definitely be returned.

Error 3. Information is written in pencil.

The gift deed can be typed on a computer or handwritten with a ballpoint pen. Any additions in pencil are unacceptable. This agreement will also be returned. Forget about a pencil when drawing up contracts.

Error 4. The contract does not indicate that a donation is being made

A land donation agreement is not a sale. There should be no obligation to provide material compensation for the gift.

Example

Sergei gave his son Artyom a plot of land, but indicated in the contract that he was obliged to pay his loan in the amount of 100 thousand rubles for this. Such an agreement was returned, as it implied a material reward, albeit in an implicit form.

Error 5. Inaccurate data about the site

When drawing up a deed of gift, you need to write the information about the plot very carefully. Check the cadastral number several times, as there are a lot of numbers and it’s easy to make a mistake. Information such as area and address are also important. An error in the details of the site is the basis for refusal to register the agreement.

Is it possible to revoke a deed of gift?

There are legal grounds for revoking a gift agreement. These include:

- initiative of the guardianship authorities and their reasoned decision if the transaction violates the rights of minor children;

- a committed and proven crime that the donee committed against the life and health of his donor;

- recognition of the donor (he may be an individual or individual entrepreneur) as financially insolvent. To cancel, it is necessary that less than a year has passed since the signing of the agreement;

- initiative of the donee himself, if he refuses to take possession of a plot of land under a gratuitous transaction.

Cancellation of the donation is carried out in court. Except for the last case! It is enough for the recipient of the gift not to sign the contract for the operation to not take place. If he is pressured, threatened or otherwise forced to sign a document, he can challenge the transaction afterwards. But he will have to prove the fact of coercion.

After the court cancels the deal, the gift is returned to its former owner. Based on a judicial act, ownership rights are re-registered.

Concept and purpose of the document

A gift agreement is a document by which the owner donates property belonging to him to a third party. Such property could be, for example:

- real estate (apartment, house, their share, room);

- vehicles (cars, planes, yachts);

- land;

- shares and other securities;

- precious stones and metals.

However, in practice, donation is most often used to transfer land and various real estate.

The parties to this transaction are:

- donor - the owner of the property who transfers it;

- donee - the person who will receive the property.

The main feature of this transaction is that it is completely gratuitous in nature. This means that the donor does not have the right to demand from the recipient any things, services or other benefits in exchange for the transferred property. If such conditions are nevertheless included in the contract, it will be declared invalid.

It is also not allowed to include in the document a condition that the transfer of ownership of the land plot will occur only after the death of the donor - in such a situation it is worth turning to drawing up a will. However, you can postpone the transaction and transfer of property by specifying in the contract a specific period or date when this should happen. An agreement of this kind is called consensual.

When concluding a transaction the object of which is a land plot, the same general rules and requirements apply as in the case of a gift of real estate or other property. However, certain peculiarities also exist, in particular in the provision of certain documents or when filling out certain sections of the contract.

Price and terms

The authorized body is given 7 working days to check the documents submitted by the applicant and make a record of the change of owner of the land plot. When submitting documents through the MFC, the registration period reaches 10 days.

Regarding the deadline for submitting documents to Rosreestr, the law does not limit the participants in the transaction, but it is better to register the land plot during the life of the donor. In this case, this is fundamental, since the donee becomes the full owner of the property not from the moment of signing the agreement, but from the moment of its registration. Accordingly, if the donor dies and the agreement remains unregistered, it will be difficult to prove rights to the plot.

Now about the cost. Here a lot will depend on a number of factors. So, for example, if the donor and the donee are adults, and the subject of the donation is the entire plot of land, and not a share in the right, it is enough to draw up an agreement, then pay a fee and apply for registration.

In cases where the donor intends to transfer a share, the agreement must be certified by a notary. The cost of the transaction certification service is calculated based on the contract amount in the amount of 0.5%. In this case, the minimum duty is 300 rubles, the maximum does not exceed 20,000.

In addition, if the donor has a spouse, a notarized written consent to complete the transaction will be required, the cost of which is 500 rubles.

At the stage of submitting documents to Rosreestr, the person bearing the costs of registering the transaction is required to pay a state fee for registering the right in the amount of 350 rubles. This value is established in relation to lands intended for vegetable gardening, horticulture, private plots, as well as plots provided for individual housing construction and civil construction.

In what cases can a deal be cancelled?

The donation of a land plot can be canceled on the following grounds:

- attempt or deprivation of the life of the donor by the person receiving the gift, as well as similar actions committed against close relatives or family members of the donor (at the request of the donor or his heirs);

- the threat of irretrievable loss of the donated item, if it is of great property value to the donor;

- completion of a transaction by an individual entrepreneur or a legal entity within a six-month period before declaring him bankrupt (at the initiative of creditors);

- the presence in the contract of a provision on the possibility of canceling the gift if the donor survives the donee;

- transfer of a gift under duress;

- the occurrence of unforeseen circumstances associated with the need to incur significant expenses (at the initiative of the donee).

The consequence of canceling the donation transaction in any of the listed cases will be the return of the donated item, and sometimes compensation for damage caused to the donor.

Registration procedure

After drawing up the gift agreement and collecting all the documents, they must be submitted to the Rosreestr office, the MFC department, or registered electronically through a notary.

Most often, people turn to the MFC, and recently all functions of considering donation cases are gradually being transferred to this structure.

All parties to the transaction need to go to an appointment at the MFC. If someone cannot come, then he must send a representative with a notarized power of attorney.

MFC employee:

- Fill out the application and familiarize those who apply with it;

- Let them sign a statement;

- Will generate a registration package of documents for transfer to the Unified State Register of Real Estate.

As a result, the donor will receive a contract, and the recipient will receive a contract, a registration certificate for the house and an extract from the register.

Registration period is from 7 to 14 days. Electronic registration takes place 3 days in advance.

Registration of a deed of gift for a plot by power of attorney - is it possible or not?

Executing a gift agreement through a proxy is not that uncommon today. Quite often, one of the parties is not able to be present when the deed is signed or cannot be present during the re-registration of property rights. In this case, according to the current Russian legislation, the person acting as the donor or donee has the right to issue the appropriate power of attorney in a notary office, transferring his rights to the authorized person.

Lawyer's Note

At the same time, the recipient cannot act as the donor’s proxy! Indeed, in this case, he would be making a gift to himself, which would contradict one of the main conditions of this method of alienation of property - gratuitousness.

Also, it is worth noting that despite the prevalence in legal practice of transactions involving proxies, registering state bodies are wary of such procedures (this is especially true for donations under the so-called general power of attorney, which actually shifts all rights and obligations to carry out the transaction to a third party ). Therefore, when drawing up such a document, we recommend that you choose an experienced specialist with an impeccable reputation, who will act as a guarantor of the purity of the transaction!

How many people can you give a dacha to?

The question is not idle, since often we are talking about donating property from parents to children or grandchildren. The number of recipients can be any. In this case, the deed of gift must describe very precisely:

- To whom exactly the gift is being given, list everyone by name, indicating their passport details.

- Who gets what share of the house and land?

- On what rights will the new owners own real estate in the future - on the right of common (joint) or shared ownership (with or without allocation of shares in kind).

Afterwards, each of the recipients pays or does not pay tax depending on the degree of relationship with the donor. Registration of a deed of gift in Rosreestr is possible only in the personal presence of all participants in the transaction or their representatives by proxy.

There can also be several donors. For example, parents who jointly own a dacha can give it along with the land to their only child.