Before we look at the Sberbank mortgage agreement sample 2021 (identical to 2020), I would like to explain what the mortgage agreement consists of and how to draw it up.

Because in this concept the emphasis is on the word “mortgage”, the whole essence of such an agreement depends on it.

Mortgage is a special type of lending in which real estate serves as collateral for the fulfillment of the payer’s obligations. When applying for this loan, a special document is drawn up, which specifies all the conditions for its provision .

In the event of a violation of the terms of the loan agreement by the payer, Sberbank has every right to terminate it unilaterally and begin selling the collateral, thereby ensuring repayment of the debt on the loan body and the interest accrued on it.

Clauses of Appendix No. 7 to the “General Conditions for the Provision, Servicing and Repayment of Housing Loans” that you need to pay attention to.

General information about the mortgage lending service at Sberbank

Before concluding a mortgage agreement with Sberbank, you should be sure to familiarize yourself with the intricacies of providing a credit loan.

5 main mortgage programs in SB

| Loan program | Annual % | % of the down payment | Credit term |

| Secondary market deal | 10.75 | 20 | Up to 30 years old |

| Loan for the purchase of an apartment in new buildings | 10.9 | 15 | Up to 30 years old |

| Mortgage loan for individual construction | 12.25 | 25 | Up to 30 years old |

| Lending for the purchase of country real estate | 11.75 | 25 | Up to 30 years old |

| Mortgage for military personnel | 11.25 | — | Up to 20 years |

The procedure for preparing for a loan transaction takes up to four months, according to various estimates.

During this period, the borrower determines the mortgage program according to which the loan will be issued and selects a suitable property. On the part of the lender (in our case, Sberbank), the selected object is assessed - for this purpose a special commission . Based on its results, the bank issues a verdict on the possibility of obtaining a mortgage loan for the subject.

An example of steps to take out a mortgage loan from a bank.

After approval of the loan, the lender draws up a contract for the purchase and sale of an apartment or house under a mortgage, issued at Sberbank between individuals or an individual and a legal entity.

The purchase and sale agreement from Sberbank can be found in the attachment.

Item

Subject information is a fundamental component of any document. The subject of the apartment mortgage agreement is the funds with which the Buyer purchases the property. In the text of the document, information about the subject is written as follows:

The buyer, using funds provided by the Public Joint Stock Company PJSC "Bank Yabloko", located at the address: Kurgan region, Kurgan city, Burova-Petrova street, building 30, INN 000000000, which is a credit institution with a banking license number 000, acquires ownership of an apartment located at the address: Kurgan region, Kurgan city, Blyukhera, building 30, apartment 233. In accordance with this agreement, the Lender in favor of the Buyer provides a sum of money in the amount of 5,567,000 (Five million five hundred sixty-seven thousand) rubles 00 kopecks The Buyer pays interest to the Lender according to the annual rate of 7 (Seven) percent per annum. According to Article 77 of Federal Law N 102-FZ “On Mortgage”, the right to participate of the Lender as a Mortgagee is certified by the mortgage. The apartment indicated in the text of the document is owned by the Seller according to an extract from the Office of the Federal Service for State Registration of Cadastre and Cartography for the Kurgan Region. The price of the apartment is 5,567,000 (Five million five hundred sixty-seven thousand) rubles 00 kopecks. The apartment is not in dispute, under arrest or pledge, is not a gift, and is not encumbered with the rights of third parties.

General conditions for mortgages

Any mortgage lending agreement must take into account the following important components :

- The cash component is the loan amount .

- For what period is the loan issued?

- Payment system (number and size of payments, their terms).

- Interest rate on the loan.

- Purpose of lending.

- Payment Methods.

- Determination of various late fees .

- Possibility of changing conditions upon early or partial repayment of the loan.

- Description of additional services.

- Methods of communication between the lender and the borrower.

- Mandatory familiarization of the borrower with the terms of the agreement .

- Information about the co-borrower.

- Conditions and procedure of the credit process.

Information in the loan agreement on early repayment.

Mandatory conditions also include confirmation of the intended use of loan funds, representations and warranties, the presence of an application for collateral (mortgage), designation of the actual addresses of the parties.

Rights and obligations of the parties

The section on rights and obligations specifies the provisions on the obligations of the parties under this agreement. Since the mortgage agreement is provided by the bank itself, the wording of the obligations is drawn up by the organization’s employees. Below we will try to present typical wording that may appear in the text of the document:

The mortgagor has the right to: • Own and use the property in accordance with its purpose, provided that ownership and use do not entail loss, destruction, damage or reduction in the value of the apartment. The mortgagor undertakes: • To pay for the purchased object in accordance with this agreement using funds issued by the bank. The mortgagee has the right to: • Demand timely payments on the loan, taking into account interest charges. The pledge holder undertakes: • To provide funds in the amount stated in the paragraphs of this agreement for the purchase by the mortgagor of the property.

Special attention

In anticipation of receiving a new living space, many people, without hesitation, sign a loan agreement without really going into details. As a result, after some time, due to misunderstanding of certain points, borrowers have some questions. Now we will discuss what things are worth focusing on.

Conditions for imposing penalties and fines in the General Credit Conditions.

Sometimes the borrower has the opportunity to close the contract early. To do this, it is necessary that there is no moratorium on this in the conditions.

Be sure to familiarize yourself with the conditions for imposing penalties and fines. In the interests of the client, it should be stated that if the delay did not arise through the fault of the borrower, then no penalty will be charged.

Insurance also plays an important role. The mortgage agreement must stipulate the borrower's right to refuse to purchase insurance.

Pay attention to borrower insurance under home loan programs.

If you pay attention to these things in time (when reading the contract, at the signing stage), in the future you won’t have to worry about excess costs.

general information

When applying for a mortgage at Sberbank, each borrower must study all the accompanying documents in detail and in as much detail as possible before signing them. It is the loan agreement and the mortgage agreement that are the key documents when purchasing real estate using borrowed funds. Read more about the main terms of the mortgage agreement and what features you should pay attention to.

A mortgage agreement is a fundamental document regulating the relationship between the parties involved when purchasing real estate with the help of a loan - Sberbank of Russia, the borrower and the seller.

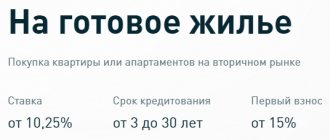

The main conditions for mortgage lending at Sberbank are as follows:

- age limit for clients is from 21 to 75 years;

- The minimum acceptable work experience at the current place is at least six months;

- the object of the mortgage can be houses, apartments, land plots, apartments intended exclusively for consumer/personal use;

- the loan amount is transferred to the seller after registration of the transaction in Rosreestr (imposition of an encumbrance in favor of the bank);

- the client will be required to make his own funds as a down payment (from 15% of the market value of the property);

- the interest rate, the maximum loan amount and the loan term depend on many factors, including the client’s creditworthiness, classification into a certain category of borrowers and the quality of the credit history;

- The residential property pledged to the bank must meet established requirements regarding the year of construction, distance from the city, presence and condition of communications, etc.

The agreement specifies in detail all the parameters of the loan being issued: the size of the annual rate, the name of the mortgage program, the method of calculating interest and the value of the effective interest rate, as well as the rights and obligations of the parties, penalties.

The mortgage agreement has a standard structure, but in individual cases the bank can prescribe specific features or nuances of the transaction at the request of the borrower. Let us consider further the terms of such an agreement.

Forms of mortgage payment

At any Sberbank branch, by contacting the manager, the client can find out his payment for the current period .

If for some reason he is not able to visit a banking institution, then the official website of Sberbank contains an online calculator that will help calculate the monthly loan payment.

An example of an annuity payment on a mortgage loan.

two payment generation systems for the consumer to choose from :

- Annuity.

- Regular ( differentiated ).

The first is designed for the category of borrowers who plan to make payments in equal parts each reporting period. The second is characterized by a gradual reduction in the size of the payment.

We offer a video for your reference:

Individual conditions

This section specifies provisions on individual conditions under the loan agreement between the Bank and the Pledgor. Such conditions may look like this:

• The loan amount is 5,567,000 (Five million five hundred sixty-seven thousand) rubles 00 kopecks. • The currency in which the loan was issued is the Russian Ruble. • The interest rate at the time of conclusion of the agreement is 7 (Seven) percent per annum. • The interest rate is set in accordance with the base interest rate. • Number of Borrower payments – 359 (Three hundred fifty-nine). • Payment frequency: monthly during the payment period. • Payment period: 10th day of each calendar month no later than 18:00. • The interest period begins on the next day. After the actual issuance of the loan. • The amount of the monthly payment, except for the first and last, is XX XXX XX rubles XX kopecks, taking into account the interest rate in effect at the time of conclusion of the agreement. The first payment includes interest. • In everything. What is not provided for in the section on individual conditions, the parties are guided by the current legislation of the Russian Federation.

What is needed to apply for a mortgage?

In order for Sberbank to enter into a mortgage lending agreement with a client, certain points must be observed, namely:

- All information provided must be current and reliable .

- All documents are collected strictly according to the procedure provided for by current laws.

- The main document (agreement) is drawn up only within the banking institution without the intervention of third-party organizations and individuals.

- The date from which the agreement begins is the date when all parties to the agreement sign the document, as well as its proper registration in the bank’s database.

Consent to the processing of personal data for site visitors

By continuing to work on the site, I express my consent to JSC NPF Sberbank (address: 115162, Moscow, metro station Shabolovskaya, Shabolovka St., 31G, 4th entrance, 3rd floor) to the automated processing of my personal data ( cookies, information about user actions on the site, information about the user’s equipment, session date and time), incl.

using metric programs Yandex.Metrica, Google Analytics with the following actions: collection, recording, systematization, accumulation, storage, clarification (updating, changing), extraction, use, depersonalization, blocking, deletion, destruction, transfer (provision, access), including cross-border, to partners of Sberbank PJSC providing services under the specified metric programs. The processing of personal data is carried out in order to improve the operation of the site, improve products and, determine user preferences, provide targeted information on products and its partners. This consent is valid from the moment it is provided and during the entire period of use of the site.

If I refuse to process personal data by metric programs, I am informed of the need to stop using the site or disable cookies in my browser settings.

The contract process

To draw up and conclude such agreements, Sberbank has a special staff of lawyers who have developed a standard mortgage agreement operating on the basis of existing laws.

Registration of the agreement in the Unified State Register is a mandatory stage of registration of a mortgage.

In order for the agreement to come into force, it is not enough for both parties to sign it - it is necessary to register it in the Unified State Register of Rights (USRE) . Without this action, the agreement will not be valid.

Apartment mortgage agreement

Kurgan

November 11, 2023

We are PJSC "Bank Yabloko", represented by the head of the mortgage lending center, Alexander Alexandrovich Alexandrov, acting on the basis of the Charter, hereinafter referred to as the Mortgagee, on the one hand, and Sergey Mikhailovich Loginovskikh, born on 04/07/1983, residing at the address Kurgan region, Kurgan city, Maxim Gorky Street, building 901, apartment 902, passport series XXXX number XXXXXX, issued by the department of the Federal Migration Service of Russia for the Kurgan region in the city of Kurgan on 04/07/2003, hereinafter referred to as the Pledgor, on the other hand, we have entered into this agreement as follows:

The preamble to an apartment mortgage agreement traditionally contains the following information:

- type of agreement;

- place and date of the transaction;

- names and roles of subjects under the contract;

- passport details of an individual acting as a Pledgor.

Also in the text of the document it is necessary to specify the conditions, without which the agreement will not enter into legal force. The essential conditions, according to Article 9 of Federal Law N 102-FZ “On Mortgage” are:

- subject of mortgage;

- assessment, essence and size of the subject of the mortgage;

- term for fulfillment of obligations secured by a mortgage.

Loan repayment procedure

After transferring the borrowed funds, the client is obliged to begin repaying the loan from the next month. The payment date is determined by the day the borrowed funds are issued.

If desired, the borrower can make payments with partial or full early repayment. To do this, you will first need to fill out a corresponding application at one of the bank branches. It must be issued no later than one day before the planned date of payment. In this case, you will need to indicate from which account the debit will be made, and also ensure that the required amount is on it.

Important! To partially or fully repay the debt early, the borrower can use maternity capital or other types of government support.

What is a preliminary agreement, what does it consist of and why is it needed?

Before concluding an agreement, the lender usually requires the client to submit a preliminary purchase and sale agreement, which is concluded between the future buyer and the seller of the living space directly. You cannot do without a document in cases where a secondary home is purchased with a mortgage. It includes four blocks:

- Credit conditions, description of the subject of the transaction, a note that the parties plan to enter into the main agreement in the future;

- Key conditions (description of the process of concluding a purchase and sale transaction and transfer of funds, indicating the value of the object, a note on how the object will be transferred to the creditor bank as collateral).

- Intentions of the parties and warranties. This section specifies when and how the main contract will be concluded;

- Final points. Who takes part in the transaction and the number of copies of the document.

To conclude a preliminary agreement, it is not necessary to involve a Sberbank employee; only 2 parties take part in the transaction: the buyer and the seller. Next, you need to bring the document to the bank in order to draw up the main mortgage agreement on the basis of it, when a third party joins the transaction - Sberbank itself. The purpose of this document is simple: it is needed to agree on preconditions and provide the bank with the finished text of the document. This allows the lender to understand that the parties have reached an agreement, decided on the price and method of transferring money from the buyer to the seller.

Thanks to the preliminary agreement, the time required to prepare and reflect all the important aspects of the main document of the mortgage transaction is significantly reduced.

mortgage agreement with Sberbank in 2022 can be found here or you can pick up a form at any lender’s office, then fill it out yourself or involve a lawyer in the process.