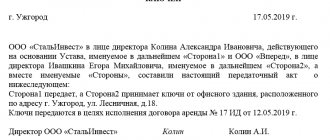

The act of acceptance and transfer of an apartment is not an independent document. It is formed as an annex to the contract of sale or lease of an apartment. By themselves, both documents - the deed and the agreement - do not have legal force. The act records the fact of transfer of an object from the seller to the buyer or from the lessor to the lessee. The parties to the transaction can be both individuals and legal entities. Let's consider how to correctly draw up an act of acceptance and transfer of an apartment to legal entities.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Bank requirements for collateral

A mortgage loan is issued to the applicant only if there is collateral real estate (house, apartment, land). The bank has the following requirements for a mortgaged apartment:

- Stone or brick foundations and reinforced concrete floors (wooden houses and living quarters in old panel houses are not accepted as collateral);

- The wear and tear of an apartment building cannot exceed 70%;

- The building does not belong to the dilapidated and emergency housing stock and is not subject to demolition;

- The apartment has no encumbrances (rent, lease, arrest, etc.);

- No unauthorized persons are registered in the premises;

- The residential building is connected to public utilities (there is a heating radiator in each room);

- There are no illegal alterations in the rooms;

- The premises have a kitchen, bathroom and toilet;

- The building has no obvious structural defects;

- The apartment is in satisfactory sanitary and technical condition;

- The housing is located in the region where the credit institution operates.

Title borrowers who are married are required to register the collateral living space as shared ownership. A regime of separate ownership of living space can be established if there is a notarized marriage contract. If children are registered in the apartment, then the living space can be mortgaged only with the written consent of the guardianship and trusteeship authorities.

Collateral must have known liquidity. The credit committee rarely accepts elite cottages located on the shores of picturesque lakes as collateral. Objects of this class are quite difficult to implement in a short time. Bankers are willing to take land plots belonging to the middle price category as collateral. Loan officers pay great attention to the area in which the building is located.

Objects located in places with poorly developed infrastructure and poor environmental conditions are not accepted as collateral. Housing on the first and last floor of an apartment building is also not considered as collateral.

Why is an act of transfer of material assets required?

It is proof of the fact of a change in the user of the property. Its error-free execution implies that the responsibility for the safety of the asset will be borne by the recipient, who will have to pay compensation in the event of loss or damage. With his name on hand, you can safely go to court with a statement of claim to recover the appropriate amount from the guilty party.

The one who gives something for a while is considered a depositor, the one who receives is considered a custodian. Information about these legal entities is necessarily written down in the business paper, along with the period and terms of the agreement. Immediately after the expiration of the agreed period, another document is created - indicating the return of the property.

When performing external operations, it is drawn up as an annex to the concluded business agreement. It also helps to record the fact of the direction of an asset from one structural division of the company to another, as a result of which the control of transferred objects is simplified (especially when branches are geographically remote from the head office and administrations). This approach allows you not to travel for business papers and not to carry them with you, but to use those that are locally available.

Purchasing housing from accredited developers

Before purchasing his own square meters in a new building, the borrower is obliged to check the availability of a license and statutory documents from the construction organization. You should also go online and study customer reviews about the developer. The acquisition of real estate is fixed in an equity participation agreement (DPA).

If a construction organization offers to sign an “investment agreement,” the borrower will not be able to defend its rights in court. “Investment agreements” are not subject to mandatory state registration. The only legal document that confirms the purchase of housing under construction is the DDU.

Sberbank cooperates with a large number of reliable construction companies. All of them undergo a mandatory accreditation procedure. A company wishing to become a partner of the bank must provide:

- Statement of the established form;

- Financial reporting;

- Documents confirming the fact of construction work (permission to commission residential buildings or a contract);

- Land lease agreement or certificate of land ownership;

- Project declaration and construction permit issued by local authorities;

- Sample DDU;

- Legal opinion on the compliance of the company’s activities with the requirements of Federal Law-214;

- Photos of houses and videos of construction work.

The submitted package of documents is examined by bank experts within a week. After verification, the developer is assigned a certain category, on the basis of which the bank determines the tactics for further interaction with the counterparty. A bank client who has purchased a home from an accredited developer will be able to obtain a mortgage at a reduced interest rate.

Signing an agreement with a trusted construction company will reduce the time spent on completing the transaction. The buyer of a residential property will not have to look for clear examples of paperwork. The developer's lawyers will provide ready-made documentation, which is drawn up in accordance with the requirements of current legislation.

Application of the act of acceptance and transfer of inventory items

Here are the most common cases of relevance of its design:

- During the inspection, a discrepancy in the quality/quantity of available goods was recorded;

- products are sent for storage;

- products arrive without accompanying documents;

- property is transported from one structural unit to another or redistributed between authorized persons;

- assets are alienated for someone else's benefit by decision of the commission;

- a contract is concluded for short-term use, for a period of several days or even hours.

In all of the above situations, it is permissible to fill out the business paper in question arbitrarily (by entering the necessary details).

Pre-purchase inspection procedure

Before purchasing real estate, you should inspect all rooms and utility rooms. Particular attention must be paid to various elements that change the geometry of the rooms (arches, additional walls, etc.). You should also carefully inspect the rooms for cracks and other obvious structural defects. After this, you need to check the serviceability of engineering systems and electrical outlets.

Check the condition of the wiring. Poor insulation of wires can lead to a short circuit and fire. Make sure all latches, latches and locks are in good condition. The home inspection must be carried out using a measuring tool. The actual dimensions of the rooms must correspond to the data specified in the technical plan of the residential building. Examine the first floor of the building. If there are alcohol stores and dubious “spa salons” there, then you will have to periodically deal with a criminal element. There should be a well-equipped children's playground in the yard.

It is best to carry out the inspection during the daytime. During the day, you can easily determine the nature of the natural light in the room. You can also easily notice traces of floods and insect activity. Examine the technical and sanitary condition of the entrance. A non-working elevator, broken windows and broken handrails should alert a potential buyer.

Uneven floors, walls and ceilings can significantly reduce the market value of real estate. Evaluate the quality of repairs and finishing. Unevenly glued tiles, falling off wallpaper and peeling paint reduce the price. Inspect the bathroom and toilet. All plumbing fixtures must be in good condition. There should be no traces of fungus or mold on the bathroom walls.

Pay attention to the level of noise pollution. If your family has small children, then it is better to purchase living space in a quiet area. Go to the windows and study the opening panorama. If you see a cemetery, landfill, wasteland or industrial area, then it is better to find another premises. Get to know your neighbors in the stairwell and the local police officer. You should not buy an apartment next to a brothel frequented by dubious citizens.

If your neighbor keeps a fighting dog, then your life and health are in serious danger. Residents who are registered with a narcologist and psychiatrist also cause a lot of problems. Deficiencies identified during the inspection may complicate the preparation of the necessary papers.

Features of the MOL change

The order of action comes to the fore - the following steps must be taken:

- Issue an appropriate order, certified by the manager.

- Check the availability and completeness of assets through inventory.

- Establish the real number of items or the fact of their absence, damage, shortage.

- Let the “old” and “new” responsible employee sign.

We remind you that the act of acceptance and transfer of goods and materials (inventory) to an employee, a sample of which we have already given, can be drawn up directly, between subordinates, or with the participation of an intermediary - the company itself. But in both cases, it is more practical to draw it up in 3 copies: one will be received by the parties, and the third by the accounting department. The main thing is that the document will confirm: the asset is in storage and is in proper condition, and there are no claims against its previous holder - transferring to another position, going on vacation or resigning.

Contents of the document

The acceptance certificate is a mandatory addition to the purchase and sale agreement for living space. The act specifies the following points:

- Technical characteristics (number of floors, usable area, ceiling height, etc.) and the actual address of the object;

- List of existing defects (if any);

- Building inspection protocol;

- Cadastral documentation;

- Details and signatures of the parties to the transaction.

The counterparties officially confirm the absence of mutual material claims. If the buyer is not satisfied with the appearance of the premises, then he is obliged to fill out the so-called “defect sheet”. This document contains a list of design defects, as well as deadlines for their elimination.

The act is drawn up in two copies having equal legal force. Attached to the document is a certificate confirming that there is no debt for utility bills. From the moment the documents are signed, the buyer is responsible for loss and damage to the collateral property. After signing the documents, the seller is obliged to hand over the keys to the apartment to the buyer.

If there is valuable property in the apartment, then it is necessary to make an inventory of it. This procedure will help to avoid conflict situations related to the purchase of interior items. The lack of an inventory may result in an unscrupulous homeowner filing a statement with law enforcement agencies and trying to accuse you of stealing personal belongings.

What is contained in the act

First of all, the mandatory details that have already been repeatedly mentioned, and secondly, important details that are relevant for a particular case, for example, about existing defects or the rental period. It is simply necessary to provide a place (point) for indicating claims - so that later there will be somewhere to enter your demands for compensation for damage suffered. If the subject of the transaction is not one object, but a whole group of them, different in type, value, character, this fact also needs to be reflected.

It should be filled out in at least 2 copies - for each party, so that there is an opportunity to subsequently go to court and resolve the controversial issue in their favor.

Common Misconceptions

Some buyers believe that signing an agreement with a bank or seller automatically secures ownership. But in order to manage real estate, register on square meters, you must go through the registration procedure in the Unified State Register of Real Estate.

Another number of bank borrowers believe that they will have ownership rights after the lender receives the last penny under the agreement. Before that, the apartment belonged to the bank. The opinion is erroneous and contradicts regulations. It is better not to deal with banks that claim otherwise. You can pay off millions in debt and find out that the home belongs to a completely different person.

You can contact the Registration Chamber as soon as the developer issues the documents required by law. Only the mortgage note is signed by the bank. The buyer, until the debt to the creditor is repaid, cannot dispose of the property without his knowledge.

The registration process is regulated, described in legislative acts and regulations. The buyer is required to follow a certain procedure and obtain timely certificates and confirmations.

Savings and mortgage system (NIS) for housing provision for military personnel

Since January 1, 2005, a savings-mortgage system (NIS) to provide housing for persons in military service. The essence of this program is to develop a set of measures aimed at providing their own real estate to representatives of law enforcement agencies.

The main purposes of a military mortgage are as follows:

- Increasing the interest of young people in contract service .

- An incentive for long- serving to stick to their chosen profession.

- There are no restrictions in choosing a place of residence (the use of mortgage funds is possible in any region of Russia).

- Reducing the period for providing military personnel with housing . Previously, in order to receive your own property, you had to wait in line for a long period of time to provide housing; now a military man receives the right to receive cash payments after 3 years of service.

- State support in cash. A military mortgage is a certain amount that guarantees the ability to choose a property: area, floor, infrastructure, location of housing.

Who cooks it

Typically, the preparation is carried out by the transferring entity: seller, lessor, employer, etc. It must be signed by both parties: both the transferor and the recipient. Commission transfer and acceptance are acceptable - with the participation of several representatives.

Participants of the act:

- seller and buyer;

- donee and donor;

- exchangers;

- landlord and tenant;

- employee and responsible person of the company;

- service provider and customer.

How to sell an apartment correctly?

A property owner who wants to quickly and profitably sell his property is faced with the question of how to do this most correctly.

There are several basic steps without which a transaction cannot be completed:

- The seller must prepare a package of documentation necessary for the sale.

- If you want to sell an apartment at the best price, you should take care of its condition (cosmetic repairs, proper functioning of the plumbing, electricity, heating system, proper type of plumbing equipment).

- It wouldn’t hurt to tidy up the entrance to the house and the courtyard area - these are important nuances that potential buyers pay attention to.

- It is necessary to determine the cost of housing; this can be done independently or by contacting professional appraisers. The price of housing should not be several times higher than the average cost of real estate of the same type, otherwise the sale can be extremely difficult.

- Active object for sale. It is necessary to take high-quality photographs, think over the text of the ad, which indicates the location, square footage, layout of the housing, the main emphasis should be on the positive aspects, for example, transport accessibility, developed infrastructure, decent residents.

An advertisement for the sale of an apartment can be submitted to newspapers, using Internet resources, or calling real estate agencies.

There are two main ways to sell a home:

- on one's own;

- through a realtor.

The latter option will require additional financial costs, but can speed up the process of selling real estate.

- Highly qualified real estate firms are professionals in their field; they are aware of the possible pitfalls and legal risks associated with such transactions.

- Experienced agencies know how to present the property for sale in the most favorable light, how to negotiate, and how to properly formalize the deal.

When is it necessary to complete this type of form?

Registration of the APK is optional. The party transferring the item to the other party to the agreement draws up this document on its own initiative in order to guarantee itself compensation for material damage in the event of damage to property.

So, APK can be issued when:

- the car is transferred as a result of a purchase and sale agreement, exchange, donation, inheritance, rental, repair;

- housing is transferred as a result of a purchase and sale agreement (including under a trust agreement), exchange, lease, gift;

- objects that cannot be fully exploited without the use of keys (safes, commercial, garage and warehouse premises) are transferred under agreements of purchase and sale, exchange, lease;

- job obligations under employment contracts are transferred if these obligations involve access to the employer’s property or documents.

It is also useful to read:

Storage of primary documentation

According to Article 29 of Federal Law No. 402, it is carried out for 5 years - to meet the needs of accounting. The tax requirements are somewhat more modest - 4 years (based on paragraph 1 of Article 23 of the Tax Code of the Russian Federation), but only in the general case. If you receive losses, evidence of expenses cannot be archived for at least 10 years.

If you need an electronic version of the acceptance certificate for goods and materials (material assets), you can download a sample form from here:

- for goods;

- for property;

- for storage (xls format).

Number of impressions: 64637

Conditions

When submitting an application, you should take into account the terms of a mortgage with maternity capital from Sberbank (download the housing loan agreement in pdf):

- the residential premises must be registered as property (common and shared is allowed) of the future borrower;

- the minimum amount you can count on is 300,000 rubles for a period of up to 30 years;

- the minimum interest rate starts from 7.3% (if you receive your salary on the card of this bank, you can count on a lower rate);

- wages are credited to the account or card of another financial organization - proof of income and work activity will be required.

Also, the terms of the mortgage plus maternity capital at Sberbank provide for the procedure for using state support funds. An application to the Pension Fund for the transfer of funds to repay a loan debt is given no more than six months from the date of receipt of loan funds. But today the bank does it.

To make a down payment, it is allowed to use part of the funds. capital, and the second part of own savings. Keep in mind that the Pension Fund does not immediately transfer money (256-FZ dated December 29, 2006, Article 8 (download)), and the first month or two payments will be larger.

You can use the DomClick calculator to calculate the minimum down payment amount. We wrote in detail about how to calculate a mortgage with maternity capital in Sberbank using an online calculator in a separate article.

Sberbank issues mortgages against maternity capital with an initial payment of 15%. And the borrower will be required to take out an insurance policy for the property (102-FZ On Mortgage, Article 31 (download)). Bank clients have their own requirements.