The change of user of the property must be recorded on paper. Sufficient documentary evidence will be the act of acceptance and transfer of material assets, a sample of which we will provide below. We will also consider the cases for which it is relevant, the specifics of its application, the features of its preparation, mandatory details - all the important points so that you know how to fill it out correctly.

general information

Any company has some assets, and it is important not only to reliably protect them, but also to operate them effectively. To do this, they should be clearly controlled, transferred for temporary possession to other legal entities (without changing ownership), if this is economically beneficial, and this fact should be reflected in the accompanying documentation of the enterprise.

Please note that the legislation does not require the use of any one standard form. Any organization has the right to develop its own, convenient for employees and, in principle, simple sample of an acceptance certificate for goods and materials (inventory assets) - the main thing is that the form contains all the required details, a full list of which we will provide below. If you don’t have time for this, you can do it even more logically and fill out the MX-1 form, because it has several advantages:

- traditional for document management practice and therefore familiar to representatives of various authorities;

- unified and therefore understandable;

- convenient for adjustments - it’s not a problem to add the necessary data to it or delete unnecessary ones.

In practice, this is what most companies prefer, so it can be considered a standard. Just remember that it must be certified in any case so that it complies with the accounting policies of the enterprise.

Instructions for writing a Goods Acceptance and Transfer Certificate

We will conditionally divide filling out the document into three stages.

Information about the parties

The first part of the act contains information about which document it is an appendix to (number of appendix, date, contract number). Then enter the full name of the enterprise transferring the goods, indicating the official representative (here usually written either Director, General Director or other authorized employee) and the document on the basis of which he works (“Charter”, Regulations”, “Power of Attorney”, etc. .d.).

Next, the same information about the second side of the acceptance and transfer of goods is entered into the document.

Terms of acceptance and delivery and list of goods

The second part includes the main points for the transfer of goods.

- First, the fact of the transfer itself is recorded, as well as the document on the basis of which it took place (its name, for example, “Agreement”, number and date of its preparation).

- Then you need to include a table in the act, in which you must enter a detailed list of the goods being transferred, indicating the name, quantity, price and total cost.

- Below the table, you should once again indicate the total cost of the goods being transferred (in numbers and in words).

- Next, you need to add a clause about the condition of the transferred products. If it is in excellent condition, then this must be noted; if there are any defects or malfunctions in it, then this should also be recorded (preferably in a separate document).

- Afterwards, you need to certify that the receiving party has no complaints about the quality and quantity of the transferred goods.

- In the next paragraph, you need to note the number of copies of the act, and also note its equivalence before the law.

Why is an act of transfer of material assets required?

It is proof of the fact of a change in the user of the property. Its error-free execution implies that the responsibility for the safety of the asset will be borne by the recipient, who will have to pay compensation in the event of loss or damage. With his name on hand, you can safely go to court with a statement of claim to recover the appropriate amount from the guilty party.

The one who gives something for a while is considered a depositor, the one who receives is considered a custodian. Information about these legal entities is necessarily written down in the business paper, along with the period and terms of the agreement. Immediately after the expiration of the agreed period, another document is created - indicating the return of the property.

When performing external operations, it is drawn up as an annex to the concluded business agreement. It also helps to record the fact of the direction of an asset from one structural division of the company to another, as a result of which the control of transferred objects is simplified (especially when branches are geographically remote from the head office and administrations). This approach allows you not to travel for business papers and not to carry them with you, but to use those that are locally available.

Disputes regarding the transfer of documents

1. Disputes regarding the transfer of documents

1.1. An act of acceptance and transfer of a document, signed by both parties without disagreement, cannot automatically confirm that the transferred document was properly executed.

Determination of the IC ES of the Armed Forces of the Russian Federation dated October 05, 2017 No. 309-ES17-6308:

“The courts erroneously identified the evidence of the transfer of a document called a bill of exchange to the Avers company with evidence of the validity of the bill of exchange (compliance with the requirements for form and details) and evidence of the existence of the rights from the bill of exchange in the COMP company (affixing a continuous series of endorsements on the bill), as well as transfer of these rights to the Avers company in the manner prescribed by law.

The fact of transfer of a document, indeed, can be confirmed by an appropriate act. However, the presence of such an act in itself does not indicate either the absence of a form defect in the transferred bill of exchange, or the presence of a continuous series of endorsements. As a means of proof in this part, a copy of the bill of exchange could be used, reproducing the original with endorsements and other marks contained on the document.”

Determination of the IC ES of the Armed Forces of the Russian Federation dated November 23, 2017 No. 305-ES17-10308:

“In support of the claim, the seller presented only the agreement, the register of transfer of bills of exchange, and also referred to the fact of the further use of the bill of exchange by the debtor in his commercial activities.

At the same time, the above-mentioned evidence could not confirm the fact of proper fulfillment by the seller of his obligation, with the exception of the transfer of possession (delivery) of the paper itself. In particular, based on these documents, it is, in principle, impossible to establish whether the bill complied with the legal requirements for the form and presence of details, who was the legal (according to a continuous and consistent series of endorsements) holder of the bill at the time of conclusion of the agreement, and whether the seller made an endorsement on the bill.” .

1.2. An act of acceptance and transfer of documents, drawn up “as is”, without indicating a detailed list of documents, is not evidence of the transfer of all truly necessary documents - Determination of the Investigative Committee of the Economic System of the Armed Forces of the Russian Federation dated October 17, 2017 No. 302-ES17-9244:

“Without taking into account the existence of enforcement proceedings to seize the debtor’s documentation from Merkulov A.V. and without refuting the conclusion of the court of first instance about the absence of information about the requested documents in the act dated December 16, 2013, and limiting itself only to a reference to the absence of any reservations when accepting documents, the appellate court, however, recognized this act as admissible evidence confirming the transfer the defendant of all documentation of the debtor to the bankruptcy trustee.

According to the panel of judges, the mere absence of reservations does not mean proper fulfillment of this obligation, since when accepting documents, the bankruptcy trustee, as a general rule, should not have information that the transferred documents allow the relevant procedures to be carried out, including information about their completeness and completeness of content. Only after analyzing the received documents, the bankruptcy trustee has the opportunity to determine whether all the necessary documents have been submitted. Moreover, the defendant did not draw up an inventory of the documents, and copies of the primary documents, as the plaintiff points out, were received by him from other persons.”

1.3. To compel the transfer of documents, it is enough to indicate that the documents were not transferred; the burden of proving the transfer of documents rests with the defendant - Determination of the Investigative Committee of the ES Armed Forces of the Russian Federation dated December 19, 2017 No. 305-ES17-13674:

“The basis for refusing to satisfy such a request may be the fact of the transfer of documents and material assets.

Applying to the court with a corresponding petition, the bankruptcy trustee Blinkova O.L. indicated that the former manager of the debtor, Weinberg Allen A.L. the obligation to transfer the debtor’s accounting and other documentation, seals, stamps and other material assets has not been properly fulfilled. At the same time, the defendant did not provide evidence of fulfillment of this obligation.

In violation of the requirements of Part 2 of Article 9 of the Arbitration Procedural Code of the Russian Federation, the courts unlawfully transferred to the bankruptcy trustee the negative consequences of the controlling person’s failure to perform procedural actions to present evidence.”

1.4. When requesting documents, the production of which is within the competence and capabilities of the obligated person, the actual absence of documents does not exempt from the obligation to produce and transfer them - Determination of the Investigative Committee of the Economic System of the Armed Forces of the Russian Federation dated 04/09/2021 in case No. 307-ES20-19764:

“As a general rule, it is the defendant, as the previous management organization, who bears the burden of proving the objective impossibility of fulfilling the legally established obligation to transfer the documents, technical means and equipment requested by the plaintiff, including due to their actual absence.

However, while releasing the Egida-Stroy-Invest company from the statutory obligation, the courts did not take into account the above rules of law, ignoring the plaintiff’s arguments about the obligation of the management organization to bring documentation, technical means and equipment into compliance with the requirements of the current legislation during the period of management of the apartment building.” .

2. Collection of a judicial penalty (asrenta) for failure to fulfill the obligation to provide evidence (transfer documents)

2.1. The right to collect a penalty for failure to hand over documents:

- legal basis - 308.3 Civil Code of the Russian Federation;

- The determination of the Investigative Committee of the Economic System of the Armed Forces of the Russian Federation dated July 11, 2017 No. 307-ES16-21419 applied this general rule in a dispute about the requisition of documents within the framework of bankruptcy proceedings;

- Accordingly, all clarifications regarding the general provisions for the application of this penalty are applicable, incl. and that the court does not have the right to refuse to award a judicial penalty if the claim for compulsion to fulfill an obligation in kind is satisfied (clause 31 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 24, 2016 No. 7), and that as a result of the award of a judicial penalty, the execution of the judicial act must turn out to be clearly more beneficial for the defendant than his failure to comply (clause 32 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 24, 2016 No. 7).

2.2. Judicial practice is guided by the following sizes of astrent:

| No. | Details of the resolution | Amount collected |

| 1 | Resolution of the AS ZSO dated January 28, 2019 in case No. A81-491/2017 | 7.2 thousand rubles. in a day |

| 2 | Resolution of the Arbitration Court of the Moscow Region dated December 19, 2018 in case No. A40-55962/2017 | 10 thousand rubles in a day |

| 3 | Resolution of the Arbitration Court of the Moscow Region dated 09/06/2018 in case No. A40-122605/2017 | 50 thousand rubles. for the first week of non-compliance, 100 thousand rubles for the second week of non-compliance, 150 thousand rubles. for the third week and so on, on the basis that each subsequent week of non-execution is subject to payment of a penalty by increasing the penalty for the previous week of non-execution of the judicial act by 50 thousand rubles. before the date of actual execution of the judicial act |

| 4 | Resolution of the AS PO dated 02/07/2019 in case No. A12-34248/2014 | 5 thousand rubles in a day |

| 5 | Resolution of the AS SKO dated May 24, 2019 in case No. A53-25263/2017 | 500 rub. for the first week of non-compliance, 1 thousand rubles for the second week of non-compliance, 2 thousand rubles for the third week of non-compliance, 3 thousand rubles for the fourth week of non-compliance, 5 thousand rubles, starting from the fifth week of non-performance for a full week of delay in performance |

| 6 | Resolution of the AS UO dated January 15, 2019 in case No. A60-12782/2016 | 5 thousand rubles in a day |

| 7 | Resolution of the AS UO dated December 5, 2018 in case No. A60-27961/2017 | 5 thousand rubles in a day |

| 8 | Resolution of the AS UO dated December 26, 2018 in case No. A76-21123/2017 | 5 thousand rubles for the first week of delay; 8 thousand rubles for the second week of delay; 11 thousand rubles for the third week of delay, etc.; starting from the fourth week of delay in execution of the court decision, for each subsequent week the amount is subject to increase by 3 thousand rubles |

| 9 | Resolution of the AS UO dated May 23, 2017 in case No. A60-5615/2016 | One-time 4.47 million rubles. with the continued accrual of a penalty in the amount of 30 thousand rubles. in a day |

| 10 | Resolution of the AS UO dated July 2, 2018 in case No. A60-49820/2015 | 10 thousand rubles. in a day |

2.3. If the size of the astrent does not sufficiently motivate the obligated person, and the necessary information and documents are not provided, in accordance with Art. 324 of the Arbitration Procedure Code of the Russian Federation, it is possible to change the method of execution of a judicial act - from fulfilling an obligation in kind to collecting a sum of money. The award of these amounts should not affect the amount of subsidiary liability of the perpetrators, since has a different nature.

Arbitrage practice:

Determination of the IC ES of the Armed Forces of the Russian Federation 04/15/2015 No. 304-ES14-6750:

“Since there is no evidence that it is impossible to execute the judicial act due to circumstances beyond the debtor’s control, the court of first instance had grounds to change the method and procedure for executing the court decision: to recover the cost of the quantity of goods that the defendant was obliged to transfer.

In determining the value of the goods, the court of first instance rightly relied on the evidence of its market price presented by the claimant. The debtor did not provide evidence that would refute the evidence presented by the plaintiff and indicate a different price.”

Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 4, 1997 No. 5205/94:

“If the debtor does not have the opportunity to fulfill the obligation to return the property in kind, the claimant has the right to demand recovery of the value of the property, calculated on the basis of the price that is valid at the time of presentation of the demand to replace the method of execution of the decision.”

Resolution of the Arbitration Court of the Ural District dated November 25, 2014 in case No. A76-8675/2009:

“Taking into account the foregoing, and also taking into account that replacing a non-monetary obligation with a monetary one does not change the essence of the claim in this dispute and is aimed at protecting the violated rights of the plaintiff, the courts reasonably satisfied the society’s demand to change the method and procedure for executing a judicial act by collecting the value of the property from the entrepreneur , the return of which in kind is impossible.”

3. Destruction or other disposal of documents before the completion of bankruptcy proceedings is an unlawful action of the arbitration manager

Determination of the IC ES of the Armed Forces of the Russian Federation dated November 25, 2019 No. 305-ES19-15519:

“The duties of the bankruptcy trustee of the debtor include organizing the organization of the latter’s archival documents, independent storage of documentation or transfer to the archive for storage (clause 2 of Article 129 of the Bankruptcy Law, part 3 of Article 6, parts 1, 10 of Article 23 of the Federal Law of October 22, 2004 No. 125 -FZ “On Archiving in the Russian Federation”, paragraph 1 of Article 29 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”).

Judicial practice proceeds from the fact that even in the event of liquidation of a legal entity, including as a result of bankruptcy, its documents are not subject to destruction unconditionally, even due to the expiration of their storage period (determination of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated 02.02.2016 No. 302-ES15-14349).

Such an obligation is indirectly referred to by the provisions of paragraph 5 of Article 61.14 of the Bankruptcy Law, which establish the maximum permissible period for filing an application to court with an application for prosecution on the grounds provided for in Chapter III.2 of the Bankruptcy Law.

Thus, the norms of the current legislation do not contain provisions that the debtor’s documentation, potentially related to evidence in the case, can be destroyed by the bankruptcy trustee at his discretion before the completion of bankruptcy proceedings, even in the absence of objections from the bankruptcy creditors, and even more so if there are court of an unconsidered application to bring the persons controlling the debtor to subsidiary liability for the debtor's obligations, which indicates the prematureness of the courts' conclusions about the unfoundedness of the complaint, and therefore the judicial acts adopted on a separate dispute on the basis of paragraph 1 of Article 291.11 of the Arbitration Procedure Code of the Russian Federation are subject to cancellation with sending a separate dispute to the Moscow Arbitration Court for a new consideration to establish the circumstances that are essential for the correct consideration of the dispute.”

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Application of the act of acceptance and transfer of inventory items

Here are the most common cases of relevance of its design:

- During the inspection, a discrepancy in the quality/quantity of available goods was recorded;

- products are sent for storage;

- products arrive without accompanying documents;

- property is transported from one structural unit to another or redistributed between authorized persons;

- assets are alienated for someone else's benefit by decision of the commission;

- a contract is concluded for short-term use, for a period of several days or even hours.

In all of the above situations, it is permissible to fill out the business paper in question arbitrarily (by entering the necessary details).

What is he like?

The simplest act of acceptance and transfer of goods and materials (inventory), the form of which we will separately provide below, is precisely the primary accounting documentation. Therefore, it must contain a detailed description and key distinctive characteristics of those things that become the objects of the transaction:

- purchase and sale;

- deliveries, one-time or regular;

- registration of a lease agreement (relevant not only for real estate);

- responsible storage.

The property described by this paper includes goods, raw materials for the manufacture of products, auxiliary materials such as additives or dyes, spare parts, semi-finished products, containers, and fuel. The main thing is that the work of the enterprise is simplified.

The Supreme Court pointed out the inadmissibility of the absence of actual transfer of the apartment under the purchase and sale agreement

The Supreme Court published Determination No. 305-ES19-3996 (6) dated August 20, which determined whether the transfer of ownership of an apartment can be carried out under a transfer deed without the actual transfer of property under a sales contract.

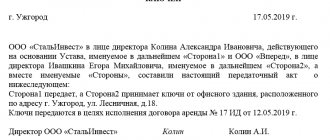

Circumstances of the dispute over ownership

On April 23, 2015, Margarita Dyakonova and Victoria Ingulova entered into an agreement for the purchase and sale of an apartment in the amount of 9.3 million rubles. A record of registration of Ingulova’s ownership of the apartment was entered into the Unified State Register of Real Estate on May 13 of the same year.

On October 24, 2021, the Moscow Arbitration Court declared Dyakonova bankrupt and introduced a procedure for the sale of her property, during which the financial manager applied to the court to declare the apartment purchase and sale agreement invalid.

On April 20, 2021, the financial manager’s application was granted, the contract was declared invalid with the consequences of invalidity applied in the form of recognition of the ownership of this apartment by the seller. At the same time, neither Ingulova nor her representative participated in the court hearings. On May 30, 2021, an entry was made in the Unified State Register of Real Estate to register Dyakonova’s ownership of the apartment.

Subsequently, the apartment was put up for sale by the financial manager as the property of a bankrupt individual, constituting the bankruptcy estate. Dmitry Reshetnikov was recognized as the winner of the auction held on December 19, 2021.

On December 25 of the same year, representatives of the financial manager went to the location of the apartment and drew up an act in which they reflected that Ingulova’s neighbors refused to allow them into the common apartment corridor, fenced off by a metal door, and called the police and Ingulova’s relatives. The latter declared the actions of the manager’s representatives illegal and denied them access to the apartment.

On the same day, the financial manager filed a claim to recognize Ingulova as having lost the right to use the property, indicating that she, not being the owner, actually owns the apartment, stores personal belongings there and refuses to hand over the keys to the manager.

On December 26, 2021, the financial manager and Dmitry Reshetnikov entered into an agreement for the purchase and sale of an apartment at a price of about 7 million rubles. On the same day they drew up an act of acceptance and transfer of housing.

On January 9, 2021, the financial manager’s claim against Ingulova was submitted to the Gagarinsky District Court of Moscow.

Victoria Ingulova, having learned about the claims of third parties to the apartment, filed an appeal on January 18, 2021 against the ruling of the trial court dated April 20, 2021, filing a petition to restore the missed deadline for appeal.

Soon after this, an entry dated February 18, 2019 was made in the Unified State Register of Real Estate registering Reshetnikov’s ownership of the apartment.

The Ninth Arbitration Court of Appeal recognized Ingulova’s reasons for missing the deadline for appeal as valid and on April 4, 2021, refused to satisfy the financial manager’s application to recognize the apartment purchase and sale agreement as invalid and to apply the consequences of invalidity. The court found that Ingulova, when purchasing the apartment, acted in good faith, properly fulfilled her obligation to pay for the property, and the transaction price corresponded to the market price.

On May 16, 2021, Victoria Ingulova applied to the court of first instance to invalidate the auction and the apartment purchase and sale agreement concluded between the financial manager and Dmitry Reshetnikov, as well as to terminate the latter’s ownership of the apartment and recognize the plaintiff’s ownership.

Pending the resolution of the dispute by the arbitration court, the Moscow City Court, by an appeal ruling dated August 22, 2021, refused to satisfy the claim of the financial manager to recognize Ingulova as having lost the right to use the apartment. The court of general jurisdiction proceeded from the fact that Ingulova’s property right arose on the basis of a valid purchase and sale agreement dated April 23, 2015, and she did not lose this right, including the right to use residential premises. In addition, the real estate has not been removed from its actual possession since the moment of acquisition. On September 27 of the same year, within the framework of a separate dispute, the Moscow City Court partially satisfied Ingulova’s application, declaring the trading results invalid.

The appeal, in turn, overturned this determination and declared Ingulova’s statement unfounded. The court considered that the auction could be declared invalid only if the procedure for conducting it was violated. In the case under consideration, no such violations were committed; at the time of sale to Reshetnikov, the apartment was included in Dyakonova’s bankruptcy estate. The cassation supported the conclusion of the appellate court.

The Supreme Court indicated that the legal fate of the disputed property was decided against the will of the owner

Victoria Ingulova appealed to the Supreme Court. Having studied the case materials, the Supreme Court indicated that in accordance with paragraph 1 of Art. 235 of the Civil Code of the Russian Federation, the right of ownership terminates when the owner alienates his property to other persons, the owner renounces the right of ownership, the destruction or destruction of property and when the right of ownership to property is lost in other cases provided for by law.

The highest authority noted that the grounds established by law for the termination of Ingulova’s property rights did not arise. An erroneous court decision that was subsequently overturned is not one of these grounds. Consequently, the entries made in the state register about the termination of Ingulova’s ownership of the apartment and the restoration of Dyakonova’s ownership are unreliable.

The Supreme Court indicated that since the apartment was included in the bankruptcy estate in the absence of legal grounds, the financial manager could not dispose of it (clause 1 of Article 209 of the Civil Code).

In addition, the Court noted that if Dmitry Reshetnikov had exercised the minimum degree of diligence that was required of him in the current situation - inspecting the real estate before concluding the transaction - he would inevitably have learned that ownership is carried out by a person other than the seller , as well as about the defects of the registration record on the restoration of Dyakonova’s ownership of the apartment. In this regard, Reshetnikov cannot be considered a bona fide purchaser. “He, as well as the financial manager, who went to inspect the apartment only after it was sold at auction, does not have the right, by virtue of paragraph two of paragraph 6 of Article 8.1 of the Civil Code of the Russian Federation, to substantiate objections to the claim of V.B. Ingulova. references to the fact that they reasonably relied on the state registry entries about the rights of M.S. Dyakonova, not knowing about their unreliability,” the Supreme Court emphasized.

The Supreme Court explained that the provisions of paragraph 7 of Ch. 30 GK. So, in accordance with paragraph 1 of Art. 549 of the Code, the main obligation of the seller under a purchase and sale agreement is to transfer ownership of the real estate to the buyer. According to paragraph 1 of Art. 551 of the Civil Code, the transfer of ownership of real estate is subject to state registration. At the same time, paragraph 1 of Art. 556 of the Code establishes special rules for the transfer of sold real estate from the seller to the buyer: it must be formalized by a transfer deed or other transfer document signed by the parties to the transaction (paragraph 1); The seller’s obligation to transfer the property to the buyer is considered fulfilled after the delivery of this property to the buyer and the signing of the relevant transfer document by the parties, unless otherwise provided by law or agreement (paragraph 2).

Thus, the Supreme Court emphasized, Art. 551 and 556 of the Civil Code determine the moment of fulfillment of the seller’s obligation to transfer property to the buyer: the transfer must take place before state registration of the transfer of ownership; the condition for the transfer of property after registration of the transfer of rights can be agreed upon by the parties in an agreement or enshrined in law.

The definition notes that the financial manager and Reshetnikov in the agreement dated December 26, 2021 did not deviate from the dispositive provisions of paragraph. 2 p. 1 art. 556 of the Civil Code, namely, did not provide that the transfer of ownership does not depend on the fulfillment of the seller’s obligation to transfer the property. In this regard, they executed an acceptance and transfer act dated December 26, 2021. The court noted that this act, submitted to the registration authority, was obviously unreliable: the financial manager, in principle, could not transfer the apartment to Reshetnikov, and he, in turn, could not accept her, since the property was in Ingulova’s possession all the time.

The highest authority added that the main obligation under the purchase and sale agreement dated December 26, 2021 was not fulfilled by the seller - the transfer of real estate to the buyer did not take place, which in this case is a necessary prerequisite for registering the transfer of ownership. This legal position, the Supreme Court emphasized, corresponds to the meaning of the explanations given in paragraph. 2–4 clause 61 of the Resolution of the plenums of the Supreme Court and the Supreme Arbitration Court of the Russian Federation dated April 29, 2010 No. 10/22 “On some issues arising in judicial practice when resolving disputes related to the protection of property rights and other property rights.”

Thus, the Supreme Court concluded, by drawing up a deliberately unreliable transfer act, the financial manager and Reshetnikov artificially excluded the actual transfer of property under the purchase and sale agreement from the legal composition required for registering the transfer of ownership. Under such circumstances, it should be recognized that Reshetnikov did not acquire ownership of the apartment (clause 2 of Article 218 of the Civil Code).

The judicial panel of the Supreme Court considered that the rights of Victoria Ingulova were violated not by the very facts of the auction and the conclusion of an agreement with Reshetnikov, but by the registration of the latter’s property rights, which was carried out without reason and led to the fact that the legal fate of the disputed real estate was decided against the will of the owner, who remained only actual owner.

In paragraphs 58 and 59 of Resolution No. 10/22, the Supreme Court noted, it is explained that a person who considers himself the owner of real estate in his possession, the right to which is registered for another entity, has the right to apply to the court with a claim for recognition of ownership rights. Unless otherwise provided by law, if the plaintiff presents evidence of the emergence of the corresponding right, the claim is subject to satisfaction.

“The requirement for recognition of ownership of the apartment, along with others, is V.B. Ingulova, who is not in an obligatory legal relationship with D.O. Reshetnikov. and having not lost possession, transferred it to the arbitration court of first instance for resolution. She addressed this demand to the proper defendant - the person listed in the state register as the copyright holder. It was this requirement that was subject to satisfaction by the court, since in this part Ingulova V.B. chose the proper method of defense and her claim was supported by the necessary evidence. The corresponding court decision recognizing the property rights of Ingulova V.B. should have become the basis for adjusting the entries in the state register, bringing them into line with the real state of affairs (paragraph two of paragraph 52 of resolution No. 10/22),” the definition emphasizes.

However, the highest authority noted, at present the judicial panel is deprived of the opportunity to satisfy Ingulova’s demand, since, as her representative, representatives of the financial manager and Reshetnikov explained at the court hearing, after the Supreme Court filed the case, an agreement was signed on the further alienation of the apartment to another person, the transfer of rights property to which is registered in the Unified State Register of Real Estate. The last copyright holder was not involved in the case.

The Supreme Court indicated that Victoria Ingulova, who has not committed any imprudent, much less illegal, actions, has been actively trying to legally protect the rights to the apartment in which she actually lives, acquired in accordance with the law, in three trials since January 2019.

“Based on the circumstances of the case under consideration, which changed after the filing of the cassation appeal, the judicial panel considers it possible to state in the operative part of its ruling the conclusion that the property right of Reshetnikov D.O. for the apartment never arose, and leave in force the ruling of the court of first instance regarding the recognition of the result of the auction (agreement dated December 26, 2018) as invalid, bearing in mind the invalidity of the legal effect generated by this agreement in the form of the transfer of ownership to D.O. Reshetnikov,” – is summarized in the document. The Supreme Court added that a different outcome of the dispute resolution at this stage would not correspond to the principle of the effectiveness of judicial protection.

Thus, the Supreme Court overturned the decisions of the lower courts in this case. At the same time, he canceled the ruling of the first instance regarding the refusal to satisfy Ingulova’s demands and recognized Reshetnikov’s ownership of the apartment as not having arisen. The court recognized the requirement to recognize Ingulova’s ownership of the property as subject to review by the Moscow Court of Justice. The rest of the ruling of the first instance is upheld.

Experts emphasized the practical significance of the Court’s legal position

In a commentary to AG, Mikhail Novoselov, a senior lawyer at the Plotnikov and Partners legal group, called the definition useful for practice, since cases of participation of bona fide buyers in litigation by bankrupt sellers have become more frequent.

He noted that, unlike the six judges in the appeal and cassation, the Supreme Court considered the dispute “fairly.” “It is noteworthy that the courts of general jurisdiction also resolved the dispute fairly and refused to evict the original owner, despite the fact that he was no longer listed in the Unified State Register of Real Estate,” emphasized Mikhail Novoselov.

In addition, the decision, according to the expert, is correct from the point of view of risk distribution. He explained that the winning bidder had to understand that he was buying a bankrupt’s apartment under a contested transaction, the decision on which could be cancelled. At the same time, it was easier for him to restore his right by returning the money paid under the transaction. “With a different decision, it would be unfair for the owner to change the apartment for a monetary claim against the bankrupt,” says Mikhail Novoselov. “If the decisions of appeal and cassation remained in force, this would undermine the stability of turnover and the fundamental principles of property rights.”

In his opinion, the Supreme Court correctly did not discuss the issue of notifying the apartment owner about challenging the transaction, since procedural violations should not lead to deprivation of ownership rights.

Mikhail Novoselov called the conclusion of the Supreme Court important for judicial practice that “another outcome of the resolution of this dispute at this stage would not correspond to the principle of the effectiveness of judicial protection.” “This conclusion should help overcome formal court decisions based on the letter of the law, to the detriment of its spirit and effective judicial protection,” he emphasized.

In addition, in his opinion, from the ruling of the Supreme Court it can be concluded that it is necessary to check the seller before purchasing an apartment using a file of court and arbitration cases for possible bankruptcy, as well as to store payment documents in case the transaction is contested and to inspect the apartment before purchasing.

Olga Trokhacheva, head of judicial practice at Grits and Partners, pointed out that questions about the integrity of real estate purchasers often arise in judicial practice. “There are no uniform criteria by which, as if using a checklist, one can check the actions of the parties and make the right decision in cases of declaring transactions invalid. That is why the courts in each specific case need to delve deeply into the situation, analyze the actions of the parties, their sequence and the content of the documents. In the case under consideration, the judges established the good faith of two buyers, to whom the ownership of the disputed apartment was transferred at different times,” she noted.

The expert drew attention to the fact that the Supreme Court, unlike lower authorities, when considering the case, analyzed in detail the actions of the buyer who purchased the disputed apartment at auction. Thus, he found that, if a minimum of diligence had been applied, it would have become clear to the buyer that the property was actually owned by someone other than the seller. The Court also pointed out the importance of the date of transfer of real estate in purchase and sale transactions.

“If the contract does not stipulate that the real estate is transferred after state registration of the transfer of rights, then, as a general rule, it must be transferred to the buyer before registration. In the case under consideration, the contract did not mention the transfer of the apartment - the transfer and acceptance certificate was signed on the day the contract was signed. But since the apartment was actually occupied, it could not be transferred. Having analyzed these circumstances, the Court came to the conclusion that the act was deliberately unreliable, and the actions of the buyer cannot be considered conscientious,” summarized Olga Trokhacheva.

When is it compiled?

Whatever sample form for the act of acceptance and transfer of material assets you choose, remember that it should be drawn up, checked, and signed directly on the day the user of the property changes. This is usually done by the recipient or his authorized representatives: they indicate a specific date for the actual completion of the transaction.

In practice, control over the correct filling and approval is most often carried out by the head of the enterprise. He also determines which of his subordinates will be responsible for storing and ensuring the safety of the asset, as well as what compensation will have to be compensated in the event of damage, theft, or loss of the agreed items.

How to draw up an act of acceptance and transfer of material assets

Keeping in mind two things: firstly, that there is no single form of registration, which means there is a certain freedom in decision-making, and secondly, that there are still mandatory details, without which the document will not be have legal force.

Taking into account both of these points, we propose to act according to the following algorithm:

- Take MX-1 as a basis - understandable, standard and already containing fields for indicating the necessary information.

- You add data that is relevant specifically to your transaction, for example, evidence of product quality, an addition to the contract, the exact number of pieces in the shipment, existing complaints, etc.

- Remove unnecessary (outdated) information.

With this approach, you get the most concise and easy-to-check primary documentation.

Civil Code on Contracts

Civil contracts are concluded in accordance with the Civil Code of the Russian Federation, which determines the procedure for carrying out settlements, the rights and obligations of the parties, etc.

Schematically, under a contract, one party, who is the customer, instructs the other party - the contractor - to perform certain work. The contractor, having completed the work, is obliged to hand over the result to the customer. The customer must accept and pay for the result of the work.

As a rule, the contractor determines the methods of performing the work independently (unless otherwise provided by the contract). The customer has the right to regularly check the progress and quality of the contractor’s work (Clause 3, Article 715 of the Civil Code of the Russian Federation).

note

Checking the progress of work and recording the results can be useful in cases of legal disputes.

The contract must indicate the start date of the work and the completion date. Work can be submitted in stages. In this case, the contract must stipulate deadlines for completing individual stages of work.

What is contained in the act

First of all, the mandatory details that have already been repeatedly mentioned, and secondly, important details that are relevant for a particular case, for example, about existing defects or the rental period. It is simply necessary to provide a place (point) for indicating claims - so that later there will be somewhere to enter your demands for compensation for damage suffered. If the subject of the transaction is not one object, but a whole group of them, different in type, value, character, this fact also needs to be reflected.

It should be filled out in at least 2 copies - for each party, so that there is an opportunity to subsequently go to court and resolve the controversial issue in their favor.

How is acceptance carried out according to 44-FZ

Acceptance is carried out in several stages:

- compliance of quantity, volume and completeness with the requirements specified in the accompanying documents is checked;

- a visual inspection of the goods or the results of work (provision of services) is carried out in order to identify defects (manufacturing defects, hidden defects);

- identified deficiencies (including those that can be eliminated) are recorded in the acceptance certificate.

If there are no complaints

If the delivered goods, work performed or service provided suits the customer and he does not have any claims regarding the execution of the contract, he must sign the acceptance certificate and accompanying documents (for example, a delivery note). The acceptance certificate will indicate that the customer has received the required product or the result of the work (provision of a service) and he has no complaints. If the customer discovers deficiencies that the contractor must eliminate, this is recorded in the acceptance certificate.

If a dispute arises as a result of the execution of the contract between the customer and the contractor, then an acceptance certificate will be needed when going to court.

The legislation does not provide for any specific form in which the acceptance certificate should be drawn up, therefore it is allowed to draw it up in any form. The act must indicate a list of goods (works, services) with prices for each item, details and signatures of the parties, as well as a clarification that the customer has no claims against the contractor.

Before accepting the goods, an examination is carried out, in which the customer’s commission or third-party specialists are involved. If an examination is carried out by third-party specialists, their conclusion is drawn up in a separate document.

There are removable shortcomings

It happens that a product (work, service) does not fully satisfy the customer because shortcomings have been identified. If these deficiencies are removable, the customer has the right to accept the goods after they have been eliminated. For example, as soon as the product is replaced with one that meets the requirements of the contract.

If removable deficiencies are discovered, a discrepancy report is drawn up, in which the customer must list the detected deficiencies and propose options for eliminating them within a certain period of time.

Refusal to accept

If the customer is not completely satisfied with the product (work, service) and he decides to refuse to accept it, the customer must formalize the refusal in writing and send it to the contractor. In addition, within three days he must place a refusal in the Unified Information System.

If the customer receives a justified and expertly confirmed refusal of acceptance from the supplier, he has 10 days to eliminate the deficiencies, otherwise the contract will be considered terminated. If the customer can correct himself within the established period, the decision to refuse acceptance will be canceled.

If the customer refuses acceptance without any justification, the contractor should request an explanation of the reasons for the refusal. If there is no response to the request, the contractor can file a claim, or go to court if the customer does not respond to it in any way.

To protect your interests in a conflict situation with the customer, use the Astral.Tender range of services. The service will help you prepare for trading, improve your professional skills and thus increase the company’s income.

What form of the act of acceptance and transfer of material assets should be used?

It is not mandatory, but there are standard ones, that is, the most common and universal ones - we will consider them below.

MX-1: features of its filling

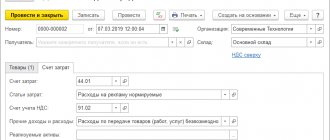

It looks like this:

Pay attention to the number and location of fields - they are designed so that you can clearly present all the important data. And the law does not prohibit removing some of them or adapting them to your needs. Why? Because the document itself is proof of a change in the user of the asset - it confirms an already accomplished fact, and does not give permission to carry out a transaction, so it is not subject to particularly strict requirements.

This form is convenient to use as a basis when concluding agreements, leases or temporary possession agreements. When you own the asset, be sure to leave space to record your complaint so that if you receive an item back that is defective, you can state your dissatisfaction and take the matter to court to resolve the dispute. And so that the chances of winning the case are subsequently as high as possible, it is worth immediately indicating as much information as possible about the parties to the transaction and its object (quality characteristics, consumer properties, etc.).

Attention, the document will not be considered valid if it is signed by persons who do not bear any obligations in the event of theft, damage, or partial damage to property.

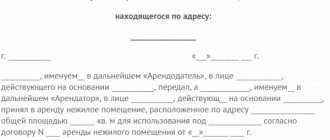

Sample act of acceptance and transfer of goods and materials between financially responsible persons

Again, the legislation does not provide for one form as mandatory. But a certain practice still exists: for example, catering enterprises and related fields most often use the OP-18 form, and other companies can also adopt it. It is convenient enough to become the basis on which you can easily develop your own primary document, including details in it in accordance with paragraph 2, paragraph 9, article of Federal Law No. 402. The main thing is that it has legal force, and for this it should be approved in the accounting policy by order of the manager and make sure that he gives a whole range of information.

The act of transfer of material assets between MOL organizations must contain:

- name, place and date of filling;

- Full name, passport details of persons receiving and donating assets;

- an employment contract, order, other papers explaining the need to change the user of the property;

- a list of objects, which is most conveniently presented in a table - with serial and inventory numbers, name of the item, units of measurement, number of pieces in the batch, cost;

- confirmation of a competent inspection and absence of claims on both sides;

- a note about how many copies have been created; usually there are two of them, but you can make three - for accounting or inspection authorities.

At the end - the signatures of the manager (or his authorized subordinates) and the MOL. In general, the document looks like this:

Form for the act of acceptance and transfer of material assets to the employee (sample)

It is relevant when the asset remains on the balance sheet of the enterprise, but the one who bears the obligation to store it quits or goes on vacation. In such a situation, it is necessary to appoint a new MOL - according to the following scheme:

- An inventory is carried out to find out if there is a shortage, and its results are included in special reports. You can simplify this process using software from Cleverence, for example, Sklad15.

- The first person signs that he is parting with the agreed upon items, the second - that he receives them.

All this can be done not only directly, but also through a third party, which is the company itself. In this option, more bureaucratic work and confirmation will be required: first, that the objects have returned to the balance sheet of the enterprise and there are no claims against the subordinate who held them, then, that their next custodian has been found and appointed.

Developed on the basis of OP-18, the document looks like this:

Payment documents

Confirms payment for goods or services. This can be a payment order, payment request or cashier's check.

A cash receipt is issued using an online cash register. It is required to be used by everyone who accepts payments in cash and by bank cards. Exceptions are listed in paragraph 2 of Article 2 of Law 54-FZ. All checks are submitted to the tax office through the fiscal data operator (FDO). Kontur.OFD instantly sends data to the Federal Tax Service, and all information about receipts and cash registers is available in the service’s personal account.

There are no longer any deferments for the use of online cash registers, but there are exceptions for some types of activities, and only some entrepreneurs should use a patent cash register - see the article for a full list of exceptions.

Article about online cash registers

The payment order remains with the entrepreneur when he transfers money via Internet banking. This document confirms the transfer of funds using certain details.

A sales receipt is an optional document that is issued at the buyer’s request. The buyer needs a document to confirm that he not only spent a certain amount of money, but also bought certain goods - for example, on behalf of his manager. The form of the sales receipt has not been established, so you can develop your own with the required details: name of the document, number, date, name of the LLC or full name of the individual entrepreneur, INN, goods and services, amount of payment and signature with transcript and position.

What papers can be replaced

It is interesting that in itself it is not a complete equivalent to a purchase and sale or lease agreement, but can only act as an annex to it. But the act of moving material assets, an example of which we gave above, is not the only thing that can be used. You have the right to draw up anything that confirms the need for a decision to transfer an asset and contains mandatory information.

This could be a delivery note - with information about the product, parties to the transaction and other relevant data.

But there are also cases in which the alternative is unacceptable. Typically, these are situations where it is necessary to leave the possibility of making claims (or asserting their absence), for example, when concluding a contract for the purchase of large industrial equipment or expensive property.

Results

Often, enterprises ignore the need to draw up an act in the TORG-1 form and accept goods according to TORG-12, issued by the supplier.

But the purpose of the TORG-12 invoice and the TORG-1 Act is different, so failure by a trade organization to draw up a Goods Acceptance Certificate can have very negative consequences for it in the future. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

We accept goods under government contracts

The rules and terms of acceptance are regulated by the Federal Contract System. The state customer has the right to develop and approve its own regulations on the acceptance of goods supplied, work performed, services rendered and forms of official documents. There are customers who form an acceptance committee of at least 5 people.

Using the example of the supply of material assets, we described step by step the procedure for accepting goods and materials under a government contract:

- Choose a room that meets the storage requirements and conditions.

- Check the accessibility of the premises for transport and loading equipment, and the serviceability of the equipment.

- Notify the commission members or representative about the date and time of receipt of goods.

- You will receive the products within the deadline for acceptance of goods in accordance with 44-FZ.

- Check the receipt against the invoice and sign it.

- Ensure the safety of accepted goods.

- Carry out an additional inspection of the delivery with a representative of the contractor, checking for compliance with the specified characteristics and completeness (if necessary).

- Assign an internal or external examination of the acceptance of goods in terms of quantity and quality in accordance with 44-FZ (if necessary).

- Make sure that the supplier has provided warranty coverage (Part 7.1, Article 94 44-FZ).

- Prepare a document of acceptance or a reasoned refusal to accept goods, work or services.

IMPORTANT!

Before signing the acceptance certificate or before returning the goods, organize its safety (clause 1 of Article 514 of the Civil Code).

ConsultantPlus experts examined the features of acceptance of goods, works, and services in 2021. Use these instructions for free.

Features of the MOL change

The order of action comes to the fore - the following steps must be taken:

- Issue an appropriate order, certified by the manager.

- Check the availability and completeness of assets through inventory.

- Establish the real number of items or the fact of their absence, damage, shortage.

- Let the “old” and “new” responsible employee sign.

We remind you that the act of acceptance and transfer of goods and materials (inventory) to an employee, a sample of which we have already given, can be drawn up directly, between subordinates, or with the participation of an intermediary - the company itself. But in both cases, it is more practical to draw it up in 3 copies: one will be received by the parties, and the third by the accounting department. The main thing is that the document will confirm: the asset is in storage and is in proper condition, and there are no claims against its previous holder - transferring to another position, going on vacation or resigning.

Required details

- name – explains what kind of business paper it is;

- place and full date of filling;

- information about the parties to the transaction (names of companies, full names of managers and their passport details, legal addresses, contact numbers);

- reference to important parameters of the contract (subject, date of conclusion, serial number);

- a detailed and detailed description of the product (quantitative and qualitative indicators, key features, and, if any, defects);

- company seals and MOL signatures.

The cost of stocks sent for storage must also be entered. So the act of acceptance and transfer of the warehouse (the sample of which coincides with the forms already given above) will reflect the value of the asset. To complete the picture, you also need to indicate VAT (or a legal reason for non-payment of tax) - this will help avoid disputes and misunderstandings with the other party.

When concluding transactions directly, information about receipt of full or partial prepayment is optional, but highly desirable, as it significantly simplifies further mutual settlements. If third parties are involved, this information must be provided.

Legal nuances

The document should be drawn up in at least 2 copies - so that you receive one of each of the “old” and “new” MOL. Only authorized people have the right to sign; if the buyer is a legal entity and is represented by an individual, this fact must be confirmed by a power of attorney.

The contract should indicate that an act of issuing material assets to the employee has been drawn up: the sample application in this case will have the same legal force as the main contract.

This paper helps to successfully resolve controversial issues in court. Because it confirms both the change of user of the asset and the proper quality of the property. The following information indicates the legality and timeliness of the procedure:

- delivery within the agreed time frame and without any associated violations;

- signature of the MOL confirming the correctness of the inspection;

- coincidence of the number of product units;

- no claims against the counterparty.

Storage of primary documentation

According to Article 29 of Federal Law No. 402, it is carried out for 5 years - to meet the needs of accounting. The tax requirements are somewhat more modest - 4 years (based on paragraph 1 of Article 23 of the Tax Code of the Russian Federation), but only in the general case. If you receive losses, evidence of expenses cannot be archived for at least 10 years.

If you need an electronic version of the acceptance certificate for goods and materials (material assets), you can download a sample form from here:

- for goods;

- for property;

- for storage (xls format).

Number of impressions: 64659

How does electronic acceptance work?

In addition to the procedure for delivery and acceptance of services provided under 44-FZ, legislators have developed a provision on electronic acceptance. The parties have the right to use electronic acceptance until 01/01/2022 (360-FZ dated 07/02/2021). And from 01/01/2022 it becomes mandatory for customers and suppliers.

The new procedure for accepting goods under 44-FZ is enshrined in Parts 13-15 of Art. 94 44-FZ. The changes adopted in 360-FZ have already been introduced into the Federal Contract System. The instructions for electronic acceptance are as follows:

- The contractor generates invoices, acts and other registers through the UIS functionality. It strictly adheres to the requirements that are provided for electronic acceptance documents.

- The customer receives the file in an hour. The date of receipt of the acceptance certificate is the date of its placement in the Unified Information System.

- The customer signs an act or forms a reasoned refusal to accept the delivered products. The signing period is the one specified in the contract, but not more than 20 working days.

- The contractor receives the file in the Unified Information System an hour after the customer has signed it or sent a reasoned refusal.

- The supplier has the right to correct the document regarding any identified deficiencies. The contractor sends the corrected file to the customer according to the same scheme.

IMPORTANT!

If the paper acceptance document differs from the electronic one, then priority is given to the electronic register.

The electronic procedure for delivery and acceptance of services under 44-FZ is described in detail in a special user manual in the Unified Information System.

![Bank Zenit mortgage and refinancing [credit][sale]](https://bgrielt.ru/wp-content/uploads/bank-zenit-ipoteka-i-refinansirovanie-credit-sale4-330x140.jpg)