Article updated: December 24, 2021

Mitrofanova SvetlanaLawyer. Work experience - 15 years

Hello. Since 2014, I have helped 29 clients conduct transactions to donate their apartments. Now the law has changed, so the instructions for drawing up a deed of gift have also changed.

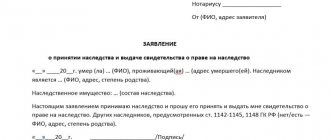

To formalize the donation of an apartment you need to: 1) draw up a donation agreement; 2) donors and recipients must sign it; 3) submit the agreement along with other documents to the MFC or the Registration Chamber (UFRS) so that the transaction is registered there.

The instructions on this page are suitable for most cases. I have also published separate instructions depending on the situation, you can choose:

- Donating an apartment to a close relative. For example, to your adult child/children or minor child/children;

- How can a husband give his wife an apartment that was purchased during marriage?

A small digression - if you need a free consultation, write online to the lawyer on the right or call (24 hours a day, seven days a week for all regions of the Russian Federation) Moscow and the region; 8 (812) 425-62-89 — St. Petersburg and region; all regions of the Russian Federation.

What is donation?

A donation is a transaction according to which the owner transfers property to the donee free of charge.

The procedure is characterized by several signs:

- Gratuitous. Transfer of a gift under conditions is prohibited. The donor has no right to demand money or valuables from the recipient - in such cases a purchase and sale agreement is concluded. If instead a gift agreement (hereinafter referred to as DD) is drawn up, but in fact the owner receives money for the property, the transaction is considered sham and invalid (Article 170 of the Civil Code of the Russian Federation).

- Mutual agreement. The owner is obliged to transfer the gift after execution of the document, or after some time. The second person will need to agree to accept the gift. He has the right to refuse at any time before receipt (Article 573 of the Civil Code of the Russian Federation). In the case of an oral DD, the refusal is made orally; in the case of a written DD, the refusal is made in a similar form.

- Objectivity. In a written deed of gift, reference to the item - a gift - is required. If the procedure is performed by a representative, you will need to indicate the subject and personal data of the recipient. The absence of an object is the basis for declaring the procedure void.

- Reduction of the donor's property. He has the right to donate valuables that belong to him as property. Alienation of other people's belongings is prohibited.

- Increase in the donee's property. Due to gratuitousness, he receives valuables completely free of charge. The only cost is registration of ownership, if real estate is donated: a state duty is paid for this.

The donation is made orally or in writing. Oral delivery is sufficient if movable property is alienated. To transfer a gift worth over 3,000 rubles. from a legal entity, as well as real estate or when promising a donation in the future, a written form is required (Article 574 of the Civil Code of the Russian Federation).

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Deed of Donation of a Residential House”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Gift agreement: one-sided or two-sided transaction?

Now let's figure out what kind of deal this is - unilateral or bilateral. In legal practice there are several interpretations. While some adhere to the first option, others reasonably consider this a two-way procedure.

Let's turn to Art. 154 Civil Code of the Russian Federation:

- A document is considered unilateral, according to which the will of the property owner is sufficient;

- a bilateral transaction is a transaction that requires the consent of the will of both parties;

- a multilateral procedure requires agreement between three or more citizens.

According to the Civil Code of the Russian Federation, DD is considered one-sided, because places obligations on only one person – the donor. However, without the consent of the recipient to accept the gift, the transaction is not possible. Another argument in favor of two-sidedness is the possibility of refusal by the recipient.

How to draw up a debt gift agreement?

Is a gift agreement valid after the death of the donor?

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

Types of unilateral gift agreement

If we consider a document from a generally accepted point of view as one-sided, then it comes in two types:

- real;

- consensual.

Let's look at everything in detail with examples.

Real

A real contract is considered to be concluded from the moment of actual transfer, i.e. fulfillment of obligations by the owner.

The recipient's right to the thing arises immediately after delivery. The exception is real estate: it becomes property from the moment of state registration.

Important! Until the transfer of the gift, the real DD is considered unconcluded. There is no civil liability for the owner in case of refusal of obligations. Even if there are signs of insignificance, imaginary or pretense, such a transaction cannot be considered invalid.

Case study:

The woman gave her daughter a car orally - written form is not necessary here. The moment of conclusion is the handover of keys and title documents.

Consensual

A document concluded after the terms have been agreed upon by citizens is considered consensual.

Unlike the real one, it can be canceled at any time before the delivery of the valuables. It is considered concluded from the moment the document is signed by the owner and the donee, and is two-sided.

Case study:

The man issued a deed of gift for his son, donating an apartment. Written form is required, as is notarization. The document is considered concluded on the day of signing. However, the recipient will have ownership rights only after contacting Rosreestr to re-register the documents.

When is a deed of gift recognized as unilateral?

The procedure is one-sided when drawing up a consensual DD, because Obligations arise only for the donor.

A citizen has the right to accept the thing or refuse it before receiving it. In reality, people have rights and responsibilities at the moment of transfer.

Taxation of donations

Tax benefits for donors

Donor is an individual, in accordance with paragraphs. 1 clause 1 art. 219 of the Tax Code of the Russian Federation, has the right to receive a social tax deduction in the amount of the donation made by him. The amount of such a deduction is limited - it can be no more than 25% of the taxable income received for the tax period in which the donation was made.

Example:

In 2021, Victor donated 500,000 rubles to the orphanage. During this year, he earned 1,200,000 rubles, from which his employer withheld personal income tax in the amount of 1,200,000 x 13% = 156,000 rubles.

Victor decided to receive a tax deduction for the amount of the donation, but the tax office refused him - the maximum amount of the deduction due to him was 1,200,000 x 25% = 300,000 rubles.

Victor drew up a declaration taking into account the maximum allowable amount and received 300,000 x 13% = 39,000 rubles in excess tax paid in 2018.

A donor-organization cannot reduce its income by the amount of property alienated by way of donation (clause 16, clause 34 of Article 270 of the Tax Code of the Russian Federation).

Income tax for the recipient of the donation

In accordance with the provisions of Art. 247 of the Tax Code of the Russian Federation, the object of taxation for an organization is the profit it receives. When determining the amount of profit, in accordance with clause 2 of Art. 251 of the Tax Code of the Russian Federation, targeted revenues aimed at maintaining organizations are not taken into account, provided that the transferred assets were used by the organization for the purpose specified in the agreement.

In order to correctly determine the size of the tax base, the recipient of the donation must keep separate records of all income received by him. Income from one’s own activities must be recorded separately from income received as a donation (clause 3 of Article 582 of the Civil Code of the Russian Federation).

What can be given as a gift under a unilateral agreement?

You can give any valuables that belong to the donor by right of ownership:

- real estate: apartment, house, land, buildings, structures;

- movable property: car, money, shares, jewelry, etc.;

- right to claim debt;

- debt obligations of the recipient (notification of the creditor will be required).

Alienation of a share in the authorized capital is also allowed, but the consent of the remaining owners will be required if this is provided for in the organization’s charter.

Features of donating real estate

Real estate is any property that cannot be actually transferred “into hands” without destruction: houses, apartments, etc.

If a private house is donated, the land plot on which it is located is also transferred to the recipient: separate alienation is not allowed.

There are other points:

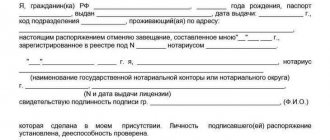

- If the property was purchased during marriage, you will need the notarized consent of the spouse. The exception is the presence of a marriage contract, according to which everything belongs to the donor.

- The transfer of ownership is subject to state registration. The procedure must be in writing.

- You cannot give housing to children under 18 years of age.

- To alienate a share, the consent of the remaining owners is not required; notarization is required.

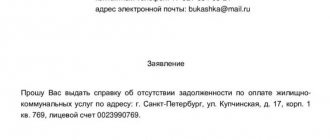

Lawyer's advice: to donate real estate, pay off all debts for housing and communal services in advance and write out all the people. Otherwise, the donee may have problems when he becomes the owner.

Features of a deed of gift for movable property

Any property that is not related to real estate is considered movable: a car, bank deposits, securities, etc. To transfer such valuables, a written form is not required.

An exception is the presentation by a legal entity of a gift worth more than 3,000 rubles: everything must be documented in writing.

Oral DD is considered real, because lies at the moment of receiving the gift. Written – consensual: it is considered concluded on the day of signing.

Who can I give a gift to?

If you are the owner of a gift, you have the right to dispose of it as you wish and give it to anyone. However, each case has its own characteristics.

To a close relative

Close relatives are considered to be children, parents, spouses, grandparents. Oral or written donations are made with their consent.

Unlike other categories of citizens, they will not have to pay tax when donating real estate - they are exempt from payment.

For a minor child

If the child is yours and the gifted property was purchased during marriage, the consent of the spouse will be required. In other cases it is not needed. For children under 14 years of age, parent-donors have the right to sign independently, therefore, despite the indication of two parties to the transaction in the contract, it is actually carried out by one person - the parent-donor.

If you want to give a valuable item to someone else's child, you can only act with the permission of the parents.

Sample gift agreement for a minor:

Son or daughter

Adult children of donors participate in the transaction independently. If they are married, the donated property becomes their sole property, and in the event of a divorce it will not be divided (Article 36 of the RF IC).

Sample agreement for donating an apartment to a son or daughter:

Legal advice: if you want to donate real estate on a specific date (for example, a wedding), draw up a promise of gift agreement. It will come into force from the moment of marriage.

Sample contract of promise to donate an apartment in the future:

Gift between spouses

One spouse has the right to donate to the other property purchased before marriage or acquired as a gift.

If the gift was purchased during marriage, the consent of the second person does not need to be formalized - he will already confirm it by signing the deed of gift.

To a third party

A third party is a person who is not the donor's spouse or relative.

You have the right to give him a movable or immovable thing, keeping in mind the specifics of the transaction in the case of acquiring property during marriage, as well as a child having ownership rights. This is described earlier.

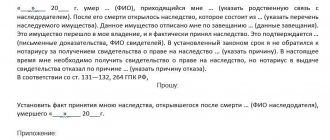

How to issue a deed of gift: step-by-step instructions

Let's consider a step-by-step algorithm of actions when drawing up a contract using the example of real estate alienation:

- A written document is drawn up where the owner promises to make a gift in the future.

- If necessary, everything is certified by a notary.

- Before the date of transfer of property, the donee has the right to refuse. The refusal must be made in writing.

- From this date, the recipient applies to Rosreestr to register ownership rights.

- After 10 days, an extract from the Unified State Register is issued.

An example of concluding a real bilateral agreement:

- A citizen gives a car to a person, handing over the keys, changes are made to the title. From this moment on, another person is considered the new owner.

- The owner buys compulsory motor liability insurance and registers the vehicle with the traffic police.

Note! A real two-sided document is also relevant for small gifts that are usually given on holidays: jewelry, tool sets, cosmetics, etc. The recipient can refuse them at the time of transfer, so his consent is required.

Contents of the agreement

The document must contain complete information:

- Full name, passport details, dates of birth of citizens;

- information about the subject;

- effective date;

- signatures of the parties.

Sample apartment donation agreement:

Documentation

When registering, you will need the following documents:

- passports of citizens;

- notarized power of attorney, if the interests of the owner or recipient are represented by another person;

- real estate documents: extract from the Unified State Register of Real Estate, cadastral passport, technical documentation;

- when alienating a car - PTS, STS, as well as documents confirming the grounds for the emergence of ownership rights (inheritance certificate, DCT, etc.).

The complete list of documents depends on the type of gift.

How to challenge a deed of gift?

Cancellation by peaceful means is possible only with mutual consent of the parties. The procedure is supported by the execution of a termination agreement.

In other cases, you will have to go to court to cancel if there are grounds:

- commission by the donee of a crime against the life and health of the donor or his relatives;

- death of the donor due to the fault of the other party;

- death of the recipient before the former owner, if this is provided for in the deed of gift;

- invalidity: signing under the influence of delusion, threats, violence, blackmail;

- imaginary or pretense.

Third parties also have the right to go to court:

for example, heirs, if the donee intentionally killed the donor, and the court verdict entered into legal force. Creditors of the former owner of the property can also demand cancellation if less than six months before the start of the bankruptcy procedure he registered everything in the name of another person.

Arbitrage practice

Challenging is carried out through the court, because The consent of the other party is not required in this case. Challenging a deed of gift is a complex process that requires good legal preparation and complete evidence confirming the grounds for canceling the transaction.

But there is an opportunity to challenge everything in court, this is confirmed by several decisions:

- Decision No. 2-55/2019 2-55/2019(2-775/2018;)~M-675/2018 2-775/2018 M-675/2018 dated June 17, 2021 in case No. 2-55/2019 ;

- Decision No. 2-597/2019 2-597/2019~M-515/2019 M-515/2019 dated June 13, 2021 in case No. 2-597/2019;

- Decision No. 2-3414/13 2-3414/2013 dated November 11, 2013

![Bank Zenit mortgage and refinancing [credit][sale]](https://bgrielt.ru/wp-content/uploads/bank-zenit-ipoteka-i-refinansirovanie-credit-sale4-330x140.jpg)