Who inherits without a will after the death of her husband: wife or children

As a general rule, after the death of a man, his children, spouse and parents inherit first - clause 1 of Art. 1142 of the Civil Code of the Russian Federation. And only under certain circumstances are grandchildren called upon to inherit - clause 2 of Art. 1142 of the Civil Code of the Russian Federation.

This means that if the testator has all the listed heirs on the day the inheritance is opened, the inherited property is divided equally between them.

Grandchildren enter into inheritance rights only in the event of the death of their parent, that is, one of the children of the deceased, before the testator or at the same time as him. They will only inherit their parent's share.

Who inherits property after the death of a spouse?

As already stated above, after the death of a citizen, the following are called upon by law as heirs of the first priority:

- Children of the testator (natural and adopted). And if they pass away before the testator - grandchildren.

- The official spouse with whom a marital relationship existed at the time of death.

- Parents of the deceased.

Attention! If there is a will, those persons who are mentioned as heirs inherit the property (all or directly specified in the will).

Important! Children for whom paternity has not been established, common-law spouses and ex-wives do not inherit after the death of a citizen, unless there is a corresponding will and they are not recognized as disabled dependents. Unadopted stepsons and stepdaughters are also not included in the circle of inheritors in the first place according to the law - clause 3 of Art. 1145 of the Civil Code of the Russian Federation.

If there is a will, the following may claim an obligatory share in the inheritance:

- Children under 18 years of age, as well as adults if they are disabled.

- Other disabled persons (including illegitimate children, stepchildren), if they were dependents of the deceased.

See also:

How is the inheritance divided between heirs according to the law this year?

Does a common-law wife inherit?

By law, a common-law spouse is not included in the number of heirs in any line. She acquires inheritance rights only in the following cases:

- In the will she is expressly named as an heir.

- She is disabled and was dependent on him for at least 1 year before the death of her partner. At the same time, she lived with him.

Who can be excluded from inheritance

The following have no right of inheritance either by will or by law:

- Persons who committed intentional unlawful acts against the life, health of the testator, co-heirs, against the implementation of the will of the testator, who tried to increase their own or someone else’s inheritance share - clause 1 of Art. 1117 of the Civil Code of the Russian Federation.

- Those excluded from inheritance by a court decision due to malicious evasion of fulfillment of assigned alimony obligations in relation to the testator - clause 2 of Art. 1117 of the Civil Code of the Russian Federation.

Attention! The listed persons are called “unworthy heirs.” Such citizens not only themselves are deprived of inheritance rights, but also automatically cancel similar rights from their descendants. We are talking about inheritance by way of presentation, when the heir dies before the opening of the inheritance.

What shares are due to the wife and children when inheriting without a will?

If there is no will and the testator’s parents have died before him and there are no grandchildren, then only the legal spouse and his officially recognized children are called upon to inherit. In this case, the total inheritance mass is divided among all heirs in equal shares.

So, if the deceased has a wife and two children, then the inheritance mass is divided into three equal parts. And then each of them will receive ⅓ of the inheritance. Accordingly, the share ratio changes depending on the number of children.

Attention! The inheritance does not include the marital share, which is due to the spouse in accordance with the norms of the RF IC.

Establishment of paternity posthumously is allowed. The legal representative of a son or daughter who was not recognized during the life of the testator goes to court. If the court establishes the fact of paternity, then after the judicial act comes into force, this child inherits along with the other children of the deceased.

And if certificates of inheritance have already been issued, then they are subject to invalidation. Since new certificates are issued taking into account the inherited share of another co-heir and the redistribution of previously determined shares.

Options for the actual distribution of shared ownership of a house

Co-owners of the house can do the following:

- agree on the simultaneous sale of their shares to one buyer with the subsequent distribution of the proceeds in accordance with the size of the share due to each heir;

- If a joint agreement on the sale of the entire house is not possible, the co-owner who wishes to sell his share must offer it first of all to the owner of the second share. If he agrees to purchase it, then the entire house will become his property after the share is bought out. If the second owner refuses to buy out the share offered by the co-owner, then he must demand from him an official refusal to buy out. After receiving it, he can offer it to other buyers. To do this, it will be necessary to carry out a real allocation of shares of co-owners;

- having allocated everyone's shares in the form of a separate room or several rooms, with a separate entrance and a personal plot, they can live in that part of the house that will become the personal property of each co-owner.

Important! If both co-owners want to buy out a share from each other, and a conflict arises between them, then it is resolved in court. The heir who lived in this house together with its previous owner has the advantage, and has no other property besides this place.

How can a wife enter into an inheritance after the death of her husband?

Let us consider in more detail the procedures for registering inheritance rights using the example of the testator’s wife.

What is the procedure for entering into inheritance after the death of a husband - instructions

What needs to be done by the wife of the deceased:

- Collect the required documentation.

- Contact a notary within 6 months from the date of death of the testator with an application for acceptance of the inherited property and relevant documents.

- Submit an application for a certificate of inheritance.

- After the specified 6-month period, receive a certificate of inheritance.

- Register rights to real estate and vehicles with Rosreestr and the State Traffic Safety Inspectorate, respectively. Self-propelled vehicles are registered with Gostekhnadzor.

How to register inheritance rights after the death of a husband

First of all, you need to collect a package of documents. Next, fill out an application for acceptance of inherited property and/or issuance of a certificate of inheritance. You can do this yourself or with the assistance of a notary. The filing deadline is six months from the date of death of the testator.

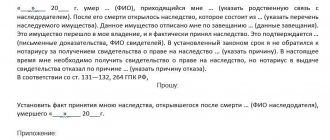

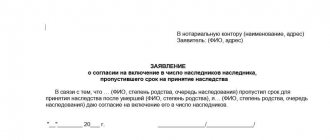

Sample application (DOC, 12 KB)

Important! The main one is the application for the issuance of a certificate. In the absence of an application for acceptance of the inheritance, the inherited property will still be recognized as accepted. But without an application for a certificate, it will not be possible to formalize inheritance rights. It is allowed to include two requirements in one act.

After the 6-month period, the notary will issue a certificate of inheritance. This document should be submitted to Rosreestr and the State Traffic Safety Inspectorate if you have real estate and a vehicle.

If a woman missed the specified deadline, then she will be able to formalize inheritance rights only in court:

- If there are good reasons for missing, restore it.

- Having established the fact of acceptance of the inheritance.

What are the rules for registering with a notary?

The basic rule comes down to the timely submission of applications with accompanying documents to a notary in the locality of the last place of residence of the deceased:

- On the acceptance of the inheritance mass.

- On the issuance of a certificate.

The notary, having checked all the documentation provided, will open the inheritance case in the book of inheritance affairs. Enter data into the UIS (unified information system) of the notary. This guarantees the absence of duplication of inheritance proceedings.

If the applicant is not the first to apply, his application is added to those submitted earlier in the same case.

Then, within six months from the date of opening of the inheritance, the notary accepts applications and other documents from co-heirs. And after the specified period, it issues certificates of the right of inheritance to all of them, if there are no obstacles to this. In particular, if the heirs are not or are not recognized as unworthy.

To determine her marital share in the inheritance, the wife brings documents confirming the acquisition of property during her marriage. In this case, the wife’s share is first deducted from the jointly acquired property in accordance with the norms of the RF IC.

The remaining part will be considered hereditary and subject to division among all those called to inherit. Provided that they have submitted the relevant application in a timely manner.

What documents are needed to register rights after the death of a husband?

Documentation package in the absence of a will:

- Application for acceptance of inherited property by law.

- Application for issuance of a certificate of inheritance. These two statements may be combined into one.

- Applicant's identity card.

- Documents confirming the relationship with the testator (marriage certificate).

- Title documents for real estate and vehicles (sale and purchase agreements, donations, etc.).

- Registration acts for property (from Rosreestr, traffic police).

- Documents confirming the residence of the testator in the territory of a particular municipality in the last days of his life.

If there is a will, the first thing you need to do is find its original. Then contact the notary who issued it. He must put a mark indicating that the will has not been changed or revoked. The application to the notary in charge of the inheritance case is accompanied by an original copy of the will with such a mark.

If there is a will, the list of documents to be submitted is identical to the above. It is supplemented only by a copy of the will with the appropriate mark.

If a copy of the will is not found among the testator’s papers, then first you should get a duplicate. It will be issued by the notary who executed the will or who keeps the archives of such a notary. You can find out who exactly executed the will by contacting the nearest notary office.

The electronic register of wills helps notaries find all the necessary and most up-to-date information about wills in a matter of minutes. This does not depend on which locality, which notary and when they were compiled.

You can find an inheritance case in the same way or independently on the FNP portal notariat.ru in the “search for inheritance cases” section.

The search for an inheritance case is carried out by identifying the full name. If you mistakenly enter the testator's personal information incorrectly, the site's search engine will not be able to detect the case. Dates of birth/death are not required to be entered in full unless you know them for sure.

Do I need to pay for notarial services after the death of my husband?

For issuing a certificate of inheritance rights, you must pay a state fee in the amount of 0.3% of the value of the inherited property, but not more than 100 thousand rubles:

- To my wife.

- Children, including adopted children.

- To the testator's parents.

The following are exempt from paying state fees at notary offices:

- Heroes of the USSR, Russian Federation, full holders of the Order of Glory - in full, according to Art. 333.35 Tax Code of the Russian Federation.

- Disabled people of groups 1-2 by 50% for all types of notarial acts - clause 2 of Art. 333.38 Tax Code of the Russian Federation.

- Citizens - for issuing certificates when inheriting: a house, other residential premises when living together with the testator, 100% - clause 5 of Art. 333.38 Tax Code of the Russian Federation.

- Individual - in case of similar events when inheriting a land plot with such a house, 100% - clause 5 of Art. 333. 38 Tax Code of the Russian Federation.

The value of the estate is assessed based on the price of this property on the day of death of the testator.

The value of real estate is determined both by the BTI authorities at the location of the property and by organizations that have received the appropriate license for valuation activities. Land plots are assessed by the branch of the Federal Cadastral Chamber in the municipality, as well as by independent appraisers.

How to share what you inherited

Carrying out the division of land adjacent to the house

A private house is inherited along with the land plot on which it is located and adjacent directly to the house. If the land on which the house is located belongs to agricultural land or the plot with the house is located in a horticultural society, then when inheriting it, the new owners must take into account the procedure for using the land established for their state status. The division of a plot of land adjacent to the house should be carried out after determining the possibility of allocating real shares in the house.

When dividing a land plot, separate plots must be formed that meet the following requirements:

- new areas should not change their purpose;

- the plot that is allocated to each owner after division must be adjacent to the part of the house inherited by him;

- Each allocated land plot cannot have a size less than the norm established by law for a given type of target land.

If, after the allocation of shares in the form of the actual allocated area of the house, the division of the plot and the adjacent land is impossible, because If this leads to violations of the listed requirements during its implementation, then the entire plot will remain in the common shared ownership of the owners of the house.

How is property divided between a wife and two children?

In the absence of parents and grandchildren, the inherited property is divided equally between the spouse and children: in equal parts to each inheritor.

In what shares is the inheritance divided between the wife and children?

The shares of the heirs of the first stage, including the wife and children, are recognized as equal. This means that if the deceased had 2 children and had a legal spouse, then the inherited property is divided into three parts. That is, in such a situation, everyone is entitled to ⅓ share.

The main condition is the absence of the testator’s parents and grandchildren.

Attention! The wife's marital share in jointly acquired property is not subject to division. This means that if real estate, vehicles or things were acquired by spouses during marriage, then half of this property initially belongs to the wife according to Art. 34 RF IC. Accordingly, only ½ of the spouses’ common property will be considered inheritable, which is divided between the wife and children.

Thus, most often only ½ of the deceased’s total property is inherited. Exceptions:

- Property acquired before marriage - clause 1 of Art. 36 IC RF.

- Personal property of a spouse received by him during marriage as a gift, by inheritance or through other gratuitous transactions - clause 1 of Art. 36 IC RF.

- Personal items (clothing, shoes, etc., except for excessively expensive items and jewelry) - clause 2 of Art. 36 IC RF.

- Exclusive right to the result of intellectual activity - clause 3 of Art. 36 IC RF.

The following cannot be considered personal property and are subject to division, and therefore inheritance:

- Jewelry.

- Luxury items (furs, antiques, expensive designer items, signature items, significant pieces of art, etc.).

In addition, the personal property of each spouse can be recognized in court as the joint property of the husband and wife. This means that it is subject to division and inheritance by relatives on both sides - Art. 37 RF IC.

To do this, it is necessary to establish through the court that during the marriage the market price of such property has increased significantly. Due to major repairs, reconstruction, redevelopment, re-equipment, etc. due to:

- Common property of spouses.

- Personal property, labor or other contribution of the husband or wife.

Under these circumstances, the property is first recognized as joint property, then the testator's share is allocated. And only after that it is divided equally among all co-heirs. Moreover, the spouse participates in the division of property twice: first within the framework of family legal relations, then on the basis of hereditary claims.

Important! Personal property is not automatically recognized as joint property of spouses. For these purposes, interested parties should go to court. Otherwise, it will not be included in the estate.

If there is a marriage contract, the spouse receives as her share in the jointly acquired property only what is expressly stated in such an act - Art. 40 IC RF. Or you get nothing at all. The procedure for determining the inheritance mass in this situation will be similar.

How is the inheritance divided between the wife and children from the first marriage?

It does not matter at all from which marriage the testator’s children are from. The main thing is that they are officially recognized or adopted. Then they inherit the property of the deceased in equal shares with his last official wife.

Unadopted stepsons and stepdaughters are not considered first-priority heirs and have the right to claim an inheritance only under certain conditions:

- They are disabled (under 18 years of age or disabled, age pensioners).

- For at least 1 year before the death of the testator they were dependent on him. It does not take into account whether they lived together with the deceased or not.

Children of a common-law wife will also be able to receive an inheritance under the combination of the following conditions:

- They are disabled.

- For at least 1 year before the death of the testator, they were dependent on him.

- Lived together with the deceased.

These citizens inherit together and on an equal basis with those persons who are actually called to inherit by law.

How to disinherit children from your first marriage

All methods of challenging the inheritance rights of children come down to the courts. It is possible for the wife to file a claim in court to have the property recognized as her personal property and to exclude the property from the jointly acquired property. After the entry into force of such a court decision, this property is automatically excluded from the estate.

The judicial act must be submitted to a notary to correctly determine the composition of the inherited property. If certificates have already been issued, then measures are taken to cancel them.

There is positive judicial practice on such disputes. In particular, civil case No. 2-1091/2015.

Time frame for the procedure

Registration of inheritance occurs six months after the death of the owner of the property. There are 3 situations in which the specified time period can be changed:

- the period is counted not from the date of death, but from the moment the testator receives the status of deceased or missing by a court decision;

- the heir has a reasoned basis to explain the missed deadline for entering into inheritance established by law. In such a situation, he can restore his own rights in one of two ways - by applying to the judicial authorities or through an out-of-court procedure. The second option requires the consent of all other heirs;

- the heir is an unborn child who can inherit after birth.

In the absence of heirs of the 1st stage, the rights listed above pass to the representatives of the 2nd stage. In this case, the period allotted for entering into inheritance, which is equal to 6 months, begins anew.

How does real estate inheritance occur?

Inheritance of real estate has some practical nuances. Let's take a closer look at them.

How does a house inherit after the death of a husband?

The rules for registering an inherited residential building are identical to registering other property. An exception is the list of documentation attached to the application.

The application for acceptance of inherited property shall be accompanied by title and registration documents for the residential building included in the inheritance estate. Namely:

- Contract of purchase and sale, donation of a residential building.

- Certificate of state registration of ownership.

- Extract from the Unified Register of Real Estate Rights (USRN).

- Privatization acts.

There is also a certain aspect after receiving a certificate of inheritance rights: ownership of the house should be registered with Rosreestr.

In practice, co-heirs often encounter certain difficulties. In particular, by determining the procedure for using common shared property.

After all, the certificate of inheritance does not indicate which rooms, other living quarters or parts thereof become the property of each co-heir. In view of this, disputes inevitably arise on this matter.

If the co-owners have not found a common language and have not resolved the dispute peacefully, each of them has the right to go to court to allocate his share in kind. As well as establishing the procedure for using common shared property - clause 1 of Art. 247 Civil Code of the Russian Federation.

But most often, construction and technical expertise establishes that allocating a share in kind without causing significant damage to the house is not possible. Then all that remains is to determine descriptively, graphically, which part of the home ownership goes to the plaintiff, and which part to the defendant(s).

At the same time, the procedure for using common areas is determined: kitchen, corridor, bathroom, toilet, attic, basement, as well as outbuildings.

The claim proposes a description of the boundaries of the part of the house that is coming into the possession and use of the plaintiff according to existing landmarks: walls, fences.

If the difference in the square footage of the housing after determining the procedure for using the common shared property is significant, then the party with the smaller housing area has the right to demand monetary compensation - clause 2 of Art. 247 Civil Code of the Russian Federation.

How is the inherited apartment divided between the spouse and children?

In the absence of the testator's parents, the apartment is divided into equal shares between the children and the spouse - in the case of inheritance by law.

A will can change the distribution of inherited shares, including completely depriving one or all heirs of the rights to the apartment. But there are exceptions to this rule.

Some people have a mandatory share in inherited property. This implies that they participate in the inheritance regardless of the contents of the will. The obligatory share is assigned to the following citizens:

- Minor or disabled children of the testator.

- Disabled parents and spouse.

- Disabled dependents of the testator.

If there is a will, they claim half the share due to each of them upon inheritance by law. This is provided for in Art. 1149 of the Civil Code of the Russian Federation.

The procedure for allocating shares in a private house

- If it is necessary to allocate shares in kind, before deciding to do so, you need to make sure that from a technical point of view the division is possible. For this purpose, it will be necessary to conduct a technical examination to determine the compliance of the house structure with the established technical requirements. In the technical report, the expert can also indicate the real market value of the house, as well as offer redevelopment options in connection with the allocation of individual premises and the costs of its implementation.

- After receiving an expert opinion on the possibility of real division of a residential building, the owners need to obtain permission to carry out redevelopment from local authorities.

- Having drawn up the documents and legitimized the new internal layout of the house and the separate exits of the premises, the co-owners can begin to actually divide the premises in the house.

- After the actual division of the common house, the owners must again go through the process of registering allocated shares in their property. If the house is located within a geographic locality, then each owner of the share must legalize it in the same way as a separate home by assigning an official address and receiving individual documents in the cadastre and a BTI plan.

Crib

- Collect a package of required documentation confirming the opening of an inheritance, the applicant’s inheritance rights and the ownership of the deceased.

- Find out if there is a will. If there is one, find a copy of it or issue a duplicate and mark that it has not been canceled or changed.

- Draw up an application for acceptance of the inheritance and issuance of a certificate of inheritance.

- Within six months from the date of death of the testator, submit an application along with the attached documents to the notary at the last place of residence of the deceased.

- Wait until 6 months have passed since the death of a relative and obtain a certificate of inheritance. If there is a will and dependents, the timing changes.

- If there is real estate in the inheritance estate, register the rights to it with Rosreestr, the vehicle - with the State Traffic Safety Inspectorate.

Basic rules (order) of inheritance by law

According to the law, heirs of each subsequent line receive the right to inherit in the event of the absence of heirs of the previous line, their removal from the inheritance, their non-acceptance of the inheritance or refusal of it.

The rules on the order in which heirs are called by law to inherit and on the size of their shares in the inheritance can be changed by a notarized agreement of the interested heirs, concluded after the opening of the inheritance. Such an agreement should not affect the rights of heirs not participating in it, as well as heirs entitled to an obligatory share.