Do they have the right?

Options for dividing property in such a situation may be different, and each of them must be considered separately.

In the simplest case, the parts will indeed be equal - if inheritance occurs by law, and no complicating factors are observed.

But it can also happen that the shares will differ significantly; such situations also occur.

If there is a will

If you have this paper, registering an inheritance after death is quite easy, and this situation should not raise any unnecessary questions. The will is intended to announce the will of the testator after his death, and by contacting a notary, the heirs will be able to find out what property belongs to each of them. With this document in place, disputes can be avoided, and therefore its preparation becomes the best option for almost all situations where there is more than one legitimate claimant. According to the will, the brother and sister are allowed:

- completely identical parts;

- different parts in any ratio;

- one of them may be disinherited altogether.

However, in the absence of a will, the situation may be radically different, since inheritance will occur according to law. The same applies to options when relatives manage to challenge the will in court - if it is canceled, inheritance also occurs by law. According to the law, property that is not included in this document is also inherited.

Important ! Sometimes one of the children of the deceased naturally receives the majority of the property even if there is a will. This applies to the situation with the provision of a mandatory share, which minors and disabled people can apply for.

If there is no will

When there is no will, inheritance occurs according to the law in accordance with all the rules that exist for such situations .

Being close relatives, the children of the deceased have the right to sign an agreement regarding the division of the inheritance; in addition, one of them has the right to cede all property to another.

If a situation arises when dividing an item is impossible - for example, if it is necessary to share a car or a room, one of the relatives has the right to refuse his share in favor of compensating its value with money.

Who can become the owner after the death of the maker of the last will?

After the death of the maker of the last will, among the participants in the division in the first and second line, who can receive the property, are both immediate relatives in the form of children, spouses and parents, and brothers and sisters. In this situation, it is necessary to understand whether a will has been made or not. Read about who has the right to inheritance if there is a will in favor of specific persons.

If there are no applicants in the first line, and also, a will has not been drawn up, siblings can become the full owners of the property of the deceased. Remember this.

Who can swear property?

Their close relatives have the opportunity to claim the property of a brother or sister, in accordance with the order of the lines of kinship. You can familiarize yourself with the lines in detail in Article 1141 of the Civil Legislation. Anyone can be a claimant if they are mentioned in the will.

How to become eligible?

In order to receive property, you need to perform some actions:

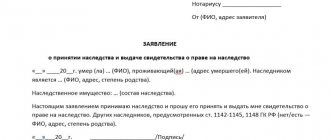

- First of all, you need to inform the notary about your rights in the form of an application.

- Attach the documents that will be required in order to take steps to accept the inheritance.

- Wait for the notary to review the papers.

- Obtain a notary agreement to register the inheritance of the property.

- Appear at Rosreestr, where you will take steps to accept the inheritance mass.

Formal method of acceptance

The formal method of accepting an inheritance assumes that a written application for acceptance of the inheritance is submitted and all documents are drawn up first, and only then you can begin to use the property.

This method is necessary if, in addition to brothers and sisters, there are other heirs with whom it is necessary to settle the dispute. The formal method of acceptance is the most common.

Actual design method

The actual method of accepting an inheritance assumes that the heir will continue to use the property of the brother or sister, without drawing up documents for ownership. This can only be done if there are no other claimants to the property.

Of course, many would be happy to use only the actual method. However, it is not always good and may not meet your requirements. One way or another, the actual method of accepting an inheritance is only good if the heir is too lazy to document ownership rights.

Section of the deceased's belongings

After death, the property is divided among those persons who were mentioned in the will in the shares that were announced. Or distributed along the line of kinship closest to the deceased.

If the testator does not have representatives of the first line, the inheritance will go to a sibling , or will be divided among several relatives according to a will or law.

Inheritance from cousins or second cousins

Second cousins do not have the right to inherit after the death of the owner; in the absence of closer relatives, the property is considered escheat.

Cousins usually claim by right of representation.

The exception for both options is the presence of a will, which can be legally written to any individual or legal entity; family ties are not considered in this case.

How to refuse in favor of someone?

Situations often occur when one of the heirs refuses property. However, it is possible to refuse inheritance. This means that the received share will be proportionally divided among other claimants to the property.

Along with the above options, there is the possibility of dividing property by agreement. Read about it on our portal. In addition, we recommend that you familiarize yourself with the materials on inheritance taxation and the rules for dividing property between third-line applicants, as well as the grandchildren of the deceased.

If in the near future you intend to enter into legal rights to the right to own real estate, then you should carefully consider a number of nuances. It depends only on you how the procedure for acquiring rights will work out.

It is quite possible that prudence will be an excellent help in ensuring that you become the owner of real estate both by law and by the will of your second-degree relatives. We wish you success in your further actions aimed at legitimizing your property rights in relation to the testator's property.

How to avoid a quarrel

There are many options to resolve any conflicts related to property and choose the best option for dividing property that will please everyone.

In order to avoid troubles and quarrels, it is worth agreeing on the division of property peacefully, concluding an agreement that secures the right to one or another inherited property for each of the relatives. The ability to reach an agreement and good relations between relatives will eliminate the need to go to court, proceedings that can last for a long time.

The procedure for dividing property between heirs

Inherited property is divided equally between recipients of the 3rd stage. If the object of inheritance is not subject to division, then the property is registered as shared ownership.

The right to a preferential share in the inheritance is vested in the citizen who used the property during the life of the deceased owner. For example, the inheritance includes the apartment in which the uncle lived. Or the car that my aunt used for work.

They may ask other recipients to give them a larger share. If other heirs do not mind, then they must enter into a written agreement.

In case of disputes regarding the division of property, the issue will be resolved in court.

How to get a larger share?

A larger share can be obtained if a mandatory share is provided.

A similar measure is practiced if one of the heirs is an incapacitated person due to age or disability. The obligatory share is provided by reducing the shares of other heirs.

Also, a difference in shares arises in the presence of a will, if the testator did not consider it necessary to make the shares equal. A difference in shares may arise by mutual agreement when signing an inheritance agreement. Also, one of the heirs can completely abandon the inheritance in favor of another.

Commentary to Art. 1142 Civil Code of the Russian Federation

1. Heirs of the first priority are the spouse, children and parents of the testator, adoptive parents and adopted children equated to blood relatives (about the peculiarities of inheritance of the latter, see the commentary to Article 1147 of the Civil Code), as well as grandchildren and their descendants who inherit by right of representation (about the peculiarities of inheritance on the right of representation, see commentary to Article 1146 of the Civil Code).

2. The surviving spouse who has the right to inherit is recognized as the person who was legally married, i.e. registered in the civil registry office (clause 1 of article 10 of the IC) or in diplomatic missions and consular offices (art. 157 of the IC), marriage with the testator on the day of opening of the inheritance. The duration of the marriage until the death of the testator has no legal significance. The main thing is that on the date of opening of the inheritance, state registration of the marriage is carried out, with which the rights and obligations of the spouses arise (clause 2 of article 10, clause 2 of article 11 of the IC).

Relationships that are not properly registered - de facto cohabitation - do not give rise to inheritance rights, unless otherwise directly established by law, for example, in relation to de facto marital relations that existed before the issuance of the Decree of the Presidium of the Supreme Soviet of the USSR of July 8, 1944 (Vedomosti VS USSR. 1944. No. 37), in the event of death or disappearance at the front of one of the persons who were in such a relationship (see Decree of the Presidium of the Supreme Soviet of the USSR of November 10, 1944 “On the procedure for recognizing de facto marital relations in the event of death or disappearance at front of one of the spouses" // Vedomosti USSR. 1944. N 60). In addition, the rule on recognizing legal force only for a legal marriage does not apply to marriages of citizens of the Russian Federation performed according to religious rites in the occupied territories that were part of the USSR during the Great Patriotic War, until the restoration of civil registry offices in these territories (p. 7 Article 169 SK). Subsequent state registration of such marriages is not required (Clause 3, Article 3 of the AGS Law).

3. The termination of a marriage due to the death or declaration of death of one of the spouses does not affect the right of inheritance of the surviving spouse, since it is a legal fact that determines the opening of an inheritance. The conclusion of a new marriage by the surviving spouse after the death of the other spouse does not affect his inheritance rights in relation to the deceased spouse, which is explained by the absence of a legal connection between these events.

Since the condition for calling a spouse to inherit is precisely the marriage relationship, the termination of the marriage deprives the surviving spouse of inheritance rights if the marriage was dissolved (by the registry office or in court) before the date of opening of the inheritance or declared invalid both before and after the opening of the inheritance (clause 2 Article 16 SK).

4. The inheritance rights of children are based on their origin, certified legally (Article 47 of the Family Code). In other words, a child is an heir if the testator is related to him by motherhood or fatherhood. Therefore, the mere birth of children within or outside of marriage, as well as the termination of a marriage or its recognition as invalid, do not affect inheritance rights. Another thing is that in some cases a special procedure is required to establish the origin of a child from a particular person.

5. The only condition for calling the testator’s parents to inherit, apart from the general requirement that the heir be alive on the date of opening of the inheritance, is the established fact of consanguinity. The absence or presence of cohabitation, age and ability to work (disability) have no legal significance. However, parents do not inherit by law as unworthy heirs after children in respect of whom they were deprived of parental rights in court and were not restored to them by the day the inheritance was opened, or were removed from inheritance at the request of an interested person in the event of malicious evasion from fulfilling their duties. according to the contents of the testator (paragraph 1, clause 1, clause 2, article 1117 of the Civil Code).

What to do if a will is written on the property of the deceased?

There are situations when, when opening an inheritance case, it turns out that a will has been written for property or part of the inherited property and one of the parties does not agree or does not recognize such a will and believes that it has full right to the property.

In this case, do not be upset, since you have 2 options:

- invalidate the will;

- receive an obligatory share in the inheritance.

In the first case, it is extremely difficult to invalidate a will, but it is possible, and it is better to do this with an experienced specialist. And the reasons must be very significant.

In the second case, you will still receive the inheritance, but not in full, as if the will had not been drawn up.