Inheritance by will has not yet become an everyday reality in Russia. If the inheritance is “ordinary” - an apartment, a dacha, a car, and so on, people usually “don’t bother” to distribute it all among the heirs. They say they will figure it out themselves.

Whether this is good or bad is not the point. “Fights at the coffin” happen regardless of whether property is distributed by will or law. It all depends on family relationships. The fact is that inheritance by law is the most common method in our country. Let's discuss it.

So, the basic principles of legal inheritance are as follows:

- Marital and family relationships are a priority

- The law defines an exhaustive circle of heirs - 7 lines

- Norms and rules determine the conditions for the transfer of inheritance rights sequentially from one queue to another

- Representatives of one line divide the inherited property equally among themselves (there are exceptions in cases of application of the right of representation)

Let's find out how these principles are implemented in practice.

Order of heirs

Stage II siblings of the deceased (full and half-blood), parents of parents (grandparents)

| Stage I | parents, spouses, children (adopted and foster children are treated as blood) |

| Stage III | siblings of the deceased's parents (aunts and uncles) |

| Queue IV | great-grandparents (third degree of relationship) |

| Queue V | siblings of grandparents (older cousins), children of nephews and nieces, they are also cousins (fourth degree of kinship) |

| Queue VI | fifth degree of kinship, cousins: uncles, aunts, nephews, nieces, great-grandchildren, great-granddaughters, their descendants (by nomination). This is the last line of blood relatives. |

| Queue VII | stepfather, stepmother, unadopted children of spouses from other marriages (stepsons and stepdaughters) |

There is another special category of heirs, prescribed in Article 1148 of the Civil Code of the Russian Federation.

We are talking about disabled dependents who lived at the expense of the testator until his death and at least a year before that. If there are no successive heirs, they are considered the 8th line receiving inheritance rights. If there are heirs of previous queues, the category of disabled dependents inherits on an equal basis with the queue called for inheritance.

Seventh line of succession

The heirs according to the law of the 7th stage include:

- stepsons and stepdaughters of the testator - children of his spouse not adopted by the testator;

- the stepfather and stepmother of the deceased are the non-adopting spouse of his parent.

In 2012, the Supreme Court of the Russian Federation, in Resolution No. 9 of May 29, 2012, clarified that the calling of the persons listed above to inheritance depends on two circumstances. Firstly, on the status of marriage with the parent of the stepson and stepdaughter. If it is not terminated, stepsons and stepdaughters are called upon to inherit after the death of their stepfather and stepmother, and stepfather and stepmother - after the death of their stepchildren.

Secondly, the basis for the termination of the marriage matters. If it was terminated during the life of the testator due to the death of the spouse or the declaration of his death, the listed persons receive the inheritance in the 7th line of heirs. At the same time, if the marriage is terminated by dissolution and also declared invalid, they do not have the right to inherit.

Transfer of inheritance rights from one queue to another

The transition through queues is regulated by Articles 1113 and 1114 of the Civil Code of the Russian Federation. The queues of heirs successively replace each other if:

- It is notarized that there are no priority heirs. For example, if the parents and spouse have already died and there were no children

- Representatives of the previous line do not have the right of inheritance. In particular, parents who have been deprived of parental rights. Or representatives of the current queue are recognized as “unworthy heirs” through the court. This can happen if they are proven to have maliciously evaded the maintenance of a disabled testator, caused physical or moral harm to him, etc.

- All representatives of the previous line signed a waiver of inheritance

- No one from the previous line reported their readiness to enter into inheritance rights within the period established by law

If at least one of the circumstances is present, the right of inheritance goes down the line” - passes to representatives of the next category.

Apartment without a will

Disputes over inheritance, according to lawyers, are one of the most complex, lengthy, and, to hide it, expensive in the truest sense of the word. From year to year, the number of civil inheritance cases in our courts is steadily growing. Therefore, the explanations given by the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation may be useful to many citizens who are faced with the problem of dividing an inheritance.

According to the explanation of the Supreme Court, none of the heirs in the dispute has a decisive advantage

Our story is a dispute about the division of a Moscow apartment, which was left to adult sisters from their brother. Only the deceased brother did not leave a will. One sister lived in her brother’s apartment and after his death remained to live there. In legal terms, the sister, who lived with her brother, actually accepted the inheritance from him - the apartment. This term - “actual acceptance” - is understood as a situation where a citizen remained to live in the testator’s home and pay all expenses related to the property.

According to some citizens, such heirs living together with the testator have an advantage over those heirs who were far away at the time of the inheritance. Such “distant” relatives, simply learning that an inheritance has opened, go to a notary to have it accepted.

According to the explanation of the Supreme Court of the Russian Federation and its Judicial Collegium for Civil Disputes, none of the heirs has a decisive advantage in such a dispute.

The situation that became the subject of consideration was absolutely vital. A citizen filed a lawsuit with the district court. She named her sister as a defendant in her lawsuit. This sister, living with her unhealthy brother, cared for the sick man, managed his money by proxy, and repaired her brother’s home at her own expense. Well, after his death, she continued to live in the apartment and did not go to the notary to register housing rights.

But her sister went to the notary as soon as she learned about her brother’s death and the apartment he left behind in the capital. But when the citizen came to the notary to accept the inheritance, she was refused. The notary explained to the visitor that the six months allotted for accepting the inheritance had already expired, and by that time her sister had already registered ownership of the entire apartment, including the second sister’s share.

The offended citizen went to court, because she did not give up her share in the apartment. And her sister, it turns out, actually accepted the inheritance, although she did not contact the notary. The relatives failed to come to an agreement peacefully.

The district court, which received a claim from one of the sisters, the one who lived with her brother, satisfied her demands.

The district court in its decision explained that the younger sister lived with her brother for many years and after his death continued to use the property and maintain it, and did not refuse the inheritance, that is, she actually accepted it. The losing side challenged this verdict in the city court. They decided that living in an apartment that belonged to the testator does not indicate acceptance of the inheritance.

As a result, the case reached the Supreme Court of the Russian Federation, they requested the materials of the dispute, studied and explained this.

According to the Judicial Collegium for Civil Cases of the Supreme Court, the district court resolved the dispute correctly. The high court recalled that property is inherited by will or by law, and in order to acquire an inheritance, the heir must accept it within six months from the date of opening. This can be done in two ways: submit an application for acceptance of the inheritance to a notary or “carry out actions that will indicate its actual acceptance.” The list of these actions is in Article 1153 of the Civil Code of the Russian Federation. There, in particular, it is written - entry into the management of property, measures for its preservation and protection, expenses for the maintenance of property, payment of debts of the testator, etc.

That is, we are talking about those actions in which “the heir’s attitude towards the inheritance as his own property is manifested,” as the Plenum of the Supreme Court of the Russian Federation specified (No. 9 “On judicial practice in inheritance cases”). Such an action could be the heir moving into the testator’s apartment or living in it on the day the inheritance is opened, the Supreme Court emphasized.

“Our heroine used her brother’s apartment, and the court found that by her actions she expressed her will to accept the inheritance, having actually accepted it,” emphasized the Judicial Collegium for Civil Cases of the Supreme Court. Having chosen a place of residence in the disputed apartment and bearing the burden of maintaining the disputed property, she, who did not refuse to accept the inheritance, is considered to have accepted the inheritance, the panel said.

And here is the main idea of the high court - obtaining a certificate of the right to inheritance upon its actual acceptance is a right, not an obligation of the heir.

As a result, the Supreme Court upheld the decision of the trial court.

Who inherits first?

Closest people: children, parents, husband or wife. The property of the deceased is divided equally between them.

ATTENTION! One clarification should be made regarding the rights of spouses. There is a legal concept of joint property of spouses. That is, not all of the testator’s property is considered his personal property. Half belongs to the husband or wife. Therefore, first, half of the marital share is allocated, and the rest is divided among all first-degree heirs, including the spouse. That is, in practice, the husband or wife receives a larger share of the inheritance than children and parents.

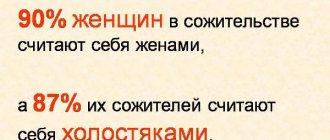

However, in order to inherit from each other, spouses must have a legally registered relationship.

If at the time of the death of one of them, the marriage is legally dissolved, the second spouse is deprived of the right to inherit, even in the case of actually living together and running a joint household.

The only exceptions are cases where the undocumented spouse can be considered a disabled dependent. But the “married half” is not allocated, and the share will be lower.

Parents inherit if they are not deprived of parental rights (an exception, again, may be if the disabled parent is dependent on the deceased). Adoptive parents are equal in law to natural parents.

Children have equal rights to the parent's inheritance. It doesn’t matter if they were born in a current marriage, in a previous marriage, or out of wedlock.

Even if at one time the testator was deprived of parental rights to one of the children, the latter still has the right to inherit, along with the others.

If the testator's children died before him, the right of inheritance passes to their children (grandchildren of the deceased) through the right of representation.

After the funeral: how heirs can deal with deposits and loans, real estate and shares in business

Together with the legal adviser of the Perm Chamber of Commerce and Industry, Vladimir Khaldeev, we are analyzing what to do if the deceased was the founder of an LLC or was registered as an individual entrepreneur.

— Do I need to submit an application to cancel the IP?

— No, the deceased is automatically excluded from the state register of individual entrepreneurs. No additional certificates or applications are required.

— Does the IP pass to the heirs?

— IP status is inextricably linked to a person’s personality and is not inherited. And all property is owned by an individual and is inherited in the usual manner. For example, if an entrepreneur had his own kiosk, it will be passed on to his heirs.

As for individual entrepreneur contracts, it all depends on the nature of the contracts - whether obligations under them can be transferred to other persons. For example, if an entrepreneur has entered into a loan agreement with a bank, then the debts under it will be transferred to the heirs. If, under a contract, the individual entrepreneur promised to paint a picture for someone, then the rights and obligations under such a document (closely related to the person) do not pass to another person. Another clarification: even if the agreement is not related to the personality of the individual entrepreneur, the rights and obligations under it will be transferred to the heirs only if the other party agrees to this.

If any licenses were issued for an individual entrepreneur (specifically for an individual entrepreneur, not an individual), then with the death of the person their validity will cease. You'll have to register it again for someone else.

— What is inherited in LLC and JSC?

— Shares in the authorized capital of legal entities are inherited property. Moreover, the size of the share does not matter. As in the case of inheriting an apartment or car, the notary will establish this property by making inquiries to the tax office. In turn, the tax office will provide information about the shares (in an LLC) or the volume of shares (in a JSC) of the deceased, as well as the heirs who may lay claim to them. The usual period for entering into inheritance is after 6 months.

Difficulties may arise with a legal entity if everything was tied to one person - the manager-owner, and he died. This often happens in small and medium-sized businesses. Then, for some period of time, the enterprise will have to do without a manager; contracts and their implementation may freeze. A good option is when there is not only a founder (deceased), but also a hired manager with the right to make all necessary payments (including loans) and sign documents. Then the enterprise will calmly continue to operate until the new owners take over.

Another possible problem is if the heirs cannot agree and begin to dispute each other’s property. Six months before inheritance, even a successful business can be ruined.

Previously, we told you step by step what needs to be done when a person dies, and how the funerals of those infected with coronavirus differ.

Second stage

Next come the grandparents and siblings of the testator.

Siblings are all children of the same parents. The right of inheritance is enjoyed by both full-born (siblings) and half-born (half- or uterine) siblings who have a different father or mother.

ATTENTION! The main basis for second-order inheritance is family ties. Half-brothers and sisters (if the parents marry having children from previous marriages) are legal heirs only if adopted by the parent for whom they were not relatives. In this case, the family relationship is replaced by a legal one. Officially, non-adopted half-siblings do not have the right to inherit from each other.

The same goes for grandparents. If they were not the blood parents of the testator’s father or mother, they will be second-order heirs only if they are officially adopted.

If the brothers and sisters have already died, the inheritance passes to their children by right of representation.

Heirs of the first stage

After the death of a relative, in the absence of a will, according to the law, the heirs of the first priority will receive the inheritance: spouse, children, parents. Both children born (adopted) by a deceased person during his lifetime and those born after his death are taken into account, since the determining factor is conception by a specific person.

If children do not have to prove anything in relation to the deceased mother, then complications often arise in the event of the death of the father. The fact of the birth of a child from the testator in a legal marriage or without its registration does not play a role. If the father is not recorded on the birth certificate, genetic testing is often used to prove paternity and other possible evidence - this issue is resolved in court.

Heirs of the same line receive property equally, with the exception of successors by right of representation, replacing parents. If one of the heirs has refused his share (or is unworthy), then the part of the inheritance due to him passes into the general hereditary property and is proportionally divided between the heirs of the called line.

It must be remembered that if the testator was legally married, the surviving spouse has the right to allocate his marital share (50%) from the jointly acquired property. Thus, only half of the common property will be included in the inheritance. In addition, the surviving spouse retains the right to inherit from the deceased marital partner under the law.

Example

. The testator's wife and son act as heirs. The mother allocated ½ share of the property in her favor, after which the remaining half was divided between her and her son. Her total share was ¾ of the inheritance.

Divorced spouses are deprived of the right to inherit if they dissolved the marriage during the life of the testator, or if it was declared invalid.

Conditions for inheritance by dependents

The very fact that the dependent was supported by the testator must be proven. The following documents are required:

- Documentary evidence of incapacity for work (pension certificate, disability certificate)

- Documentary proof of residence with the testator (if the dependent is not a relative or a relative so distant that he is not included in any line, it is also necessary to prove that he lived with the testator for a year or more, until the day of his death)

But according to the law, how should the inheritance be distributed among relatives?

The Civil Code of the Russian Federation quite clearly formulates all the rules for the division of property between relatives, if a testamentary document has not been drawn up. This can be found out in more detail in articles of the code No. 1141-1145 and 1148 .

The Code determines the order of inheritance and division of property depending on family ties with the testator. It also defines what jointly acquired property is and what property can be divided.

Right of representation

When people first read the list of inheritance queues, they are often perplexed: “How can this be, where are the grandchildren? And why are there aunts and uncles, but no cousins in any of the queues?

This is due to the concept of the right of representation. In essence and logic, grandchildren are heirs “directly,” that is, in the first place. But only after the inheritance passes successively to the children and then to the grandchildren. Grandchildren can inherit directly from their grandparents only if their parent-heir died before receiving the inheritance from their parents.

The same applies to the children of the testator's siblings. Nieces and nephews become second-degree heirs if the siblings predecease the testator. This is the right of representation.

The inheritance share by right of representation corresponds to the share that the original heir would have received. That is, two grandchildren will share the share of their father or mother, and three nephews will share the share of the testator’s sibling. However, the only heir by right of representation receives exactly the same share as the share of the other heirs of the given order.

This procedure for the right of representation applies to all related queues. In the 6th line, this could be the grandson of a cousin's grandson or the great-granddaughter of a great-aunt.

Nephews are the heirs of what order according to the law?

The Civil Code provides for eight lines of heirs, which are divided among themselves according to the degree of relationship with the deceased testator. The first priority includes official spouses, parents, and children.

Native nephews

Natural nephews are the children of the deceased testator's uncle/aunt. They can only claim the property by right of representation if their parents die prematurely. Nephews belong to the second line of heirs.

Case study:

Citizen Kutuzov left a car to his heirs after his death. The man had no heirs of the first stage, so the property passed to representatives of the second category of applicants. Kutuzov only has an adult brother left. There was also a sister who died in a car accident before the testator. The sister has one minor child who lives with her father.

Based on the documents presented, the notary decided to divide the property between representatives of the second stage, the list of which includes the adult brother of the deceased citizen Kutuzov. Since the sister died earlier, her share of the property goes to the niece of the testator, that is, the daughter of the deceased sister.

Thus, the daughter receives the share of property that would have been transferred to her mother, that is, half of the property. The notary prepared a notarial certificate confirming that the adult brother and minor niece each receive ½ share of the property.

Cousins

The children of the testator's first cousins will be considered first cousins. They are considered the main contenders for the sixth line of heirs. As practice shows, property rights reach this queue extremely rarely, but this also happens.

The right to inheritance can be transferred to representatives of the sixth stage only under the following circumstances:

- lack of candidates in earlier queues;

- refusal of previous relatives from property;

- recognition of all early heirs as unworthy;

- exclusion of relatives from the list of heirs by a person’s will.

Is inheritance possible by law in the presence of a will?

Yes, this is not excluded even if there is a will. The order of inheritance by will can be changed to inheritance by law in the following cases:

- The court declared the will invalid

- The heir or heirs under the will did not show interest in the inheritance within the period allotted for this by law (6 months)

- The court found the heirs under the will unworthy

- The testator, voluntarily or unwittingly, infringed on the rights of the obligatory heirs and did not allocate the obligatory part to them, which is illegal

Rights of the testator's dependents

Legal heirs are considered disabled persons included in one of the 7 lines of inheritance, who were fully dependent (supported) of the deceased for at least a year before his death. If there are heirs of previous orders, such dependents are called up along with them. For example, such persons include the testator’s sister (2nd stage), a disabled person of group 1, whom he supported at his own expense. She will receive property on an equal basis with the heirs of the first stage, while the inheritance is divided between them in equal shares.

Dependents who are not included in the list of heirs (distant relatives, strangers) have similar rights, but a condition must be met for them: they must live with the deceased citizen at the time of his death. If there are no heirs of stages 1–7, then these persons form an independent 8th stage of inheritance.

Right to mandatory part

Representatives of socially unprotected categories of citizens have the right to an obligatory part of the inheritance. These include minors and disabled persons.

In other words, the father has every right to “disinherit his son”, provided that the son is an adult and not disabled. The same applies to all first-line heirs. The size of the obligatory share is half of the “legal” share to which the heirs would be entitled in the absence of a will.

For example, a woman bequeathed everything to her common-law husband, without allocating anything to her elderly father. In the absence of a will, the father would be the only heir, and the common-law husband, on the contrary, would not be entitled to anything. But since the will has been drawn up, the father receives his obligatory share of 50% of the inheritance. The rest will go to the husband.

The obligatory share of the inheritance cannot be lower than the established limit. No one has the right to deprive an heir of his obligatory share. It also cannot be transferred to other applicants.

What has been gained in marriage and how to share it

Joint property is discussed in detail in the Family Code, in Article 34 .

This is property that was purchased during marriage from the moment of its registration. And it doesn’t matter who is indicated as the owner and whose material assets were used during the purchase.

Real estate is divided - apartments, dachas, land plots, garages, outbuildings, and so on, movable - cars, motorcycles, as well as securities, shares, precious jewelry, pensions, benefits, income from business.

If one of the spouses received an inheritance or received something as a gift for free, then these things will not be considered jointly acquired property, even if these facts occurred during the years of marriage.

Also, personal items for personal use are not divided between spouses: clothing, shoes, personal hygiene items. But the jewelry, even if it was purchased and was the wife’s jewelry, will be divided among the heirs, with the obligatory marital share being allocated.

While both spouses are alive, they have equal rights to all their property. For example, during marriage, a family purchased housing - an apartment, and registered it in the name of the wife, however, after her death, marital shares are determined.

That is, this living space will be divided as follows: ½ share is part of the spouse’s apartment , since it was purchased during the period of legal marriage, and ½ is the wife’s share , which will already be divided between the relatives of the first line of heirs.

The first priority includes the spouse, children or their legal successors.

And accordingly, the living space will have to be divided as follows:

- 1/2 - part of the spouse , as joint property, it is indivisible among the heirs.

- 1/2 is the second part of the deceased , it will be divided between the husband and all children.

- If there are two children 1/3 from this half ,

- Each child will also receive 1/3 .

- In the end, the husband's property will be 4/6 of the total area of the apartment, and each child will have 1/6, respectively

Everything acquired during a joint marriage will be shared in the same way. And even if the husband and wife have not lived with each other for a long time and do not communicate, but the marriage is not dissolved, then one of the spouses still has the full right to the marital share of property after the death of one of them.

By the way, if the marriage was not officially registered with the registry office, the spouses lived in a so-called civil marriage, then anything acquired during this marriage will not be considered jointly acquired. Since a common-law marriage is not legal, cohabitants have no rights to inherit property after the death of their partner.