It's sad to know, but quarrels over inheritance are a fairly common occurrence. Moreover, regardless of whether there is a will or inheritance by law. Sometimes even the closest people come into conflict because they feel deprived or deceived.

The law cannot prohibit relatives from quarreling. But it can establish a fair order that reduces the likelihood of conflicts with an adequate attitude to the issue.

In Russia, there is a procedure for distributing inheritance according to queues.

In this article we will look at how the inheritance is divided between the primary heirs who make up the closest family circle of the deceased person.

Inheritance by law. Order of heirs

Ancient wisdom says that in a good way, an inheritance should be shared with “warm hands.” That is, it is better to divide the future inheritance while the person is still alive and can come to an agreement with his relatives about what will go to whom after his death. The family finds compromises together, after which a will is written that suits everyone.

Unfortunately, this does not happen often, largely because it is not customary in our culture to talk openly about impending death. And after the death of the testator, the family begins to sort things out on their own.

If a will is not drawn up, the inheritance is distributed according to the law. 7 lines of inheritance have been defined in descending order of degree of kinship (and a special category: disabled citizens who lived as dependents of the testator). The principle is this: the entire inheritance goes to the first priority heirs.

If there are none (for example, they died earlier), the right of inheritance passes to the second. If there are also no heirs of the second stage, or they do not declare their rights to the inheritance, the right passes to the third stage, and so on.

In this article we consider the situation when there are heirs of the first priority and are ready to enter into inheritance rights. We will discuss all aspects of this process.

What documents should be prepared for the heirs of the 1st stage?

Be prepared to prove to the notary the fact of a family or marriage relationship.

In order to claim an inheritance, each potential heir or his official representative must provide the notary with evidence confirming the fact:

- Kinship or marriage relationships.

- Dependency.

Prepare originals of the following documents:

- Heir's identity card (passport).

- Certificate from the last place of registration of the deceased.

- Certificate of death of the testator, of the death of his son/daughter.

- Birth/marriage/divorce certificates.

- Certificate of change of surname.

- Certificate of adoption.

- Court decision to establish legal facts, incl. on recognition of paternity, on family ties.

If there is no evidence of a family relationship, the notary may include you in the certificate of inheritance.

To do this, you must obtain the written consent of all legal successors who have submitted documents confirming the relationship and have submitted an application for acceptance in a timely manner.

On a note. If the documents contain discrepancies in last names, first names, patronymics, the notary decides on their significance individually and, if necessary, independently makes a request to the civil registry office.

To confirm the fact of being supported and living with the testator, you will need:

- Certificates from housing authorities or local authorities.

- Income certificates for all family members.

- Documents confirming the regular transfer of money from the testator.

- A court decision establishing the fact of dependency.

Heirs of the first stage. Division of inheritance

The first line of heirs are the people closest to the testator. Natural children and parents (consanguinity), plus spouses, adopted children and parents (the role of consanguinity in this case is played by legal, social and emotional ties).

So, the list of heirs of the first stage:

- Surviving spouse

- Children (blood, adopted/unborn)

- Parents (natural or adoptive parents)

The inheritance is divided equally among all claimants.

Husband wife

Only spouses officially registered in the registry office have the right to inherit from each other. A “civil” or church marriage, no matter how many years it lasts, does not serve as a basis for inheritance. Joint farming as well. Even if a divorce after a long marriage took place the day before the death of the testator, the husband/wife is excluded from the list of heirs.

ATTENTION! The widespread belief that the testator's spouse receives a larger share of the inheritance than other family members (more than half of the total property) is erroneous. This impression is created because people overlook one legal aspect of marriage - joint ownership of property.

The common property of the spouses is the so-called “jointly acquired property”, everything that they acquired while married. Before proceeding with the division of the inheritance, the share that legally belongs to the second spouse is allocated from the entire property. This happens according to the same principle by which property is divided during a divorce.

And after this initial division, that part of the property that is recognized as the share of the deceased is divided equally between all representatives of the first priority. The spouse participates in this division on an equal basis and receives the same amount as the others.

In other words, the spouse first receives 50% of the common property, and then an equal share of the testator’s personal property.

Difficulties (from the point of view of other heirs) may arise with different methods of registering property rights to objects that both spouses used.

For example, if the apartment in which the family lived was registered as the personal property of a living spouse, it is considered personal property and will not be divided among the heirs.

If the car was purchased in the name of the wife, then, despite the fact that the husband used it, after his death the car will not be considered an object of inheritance. It is the personal property of the deceased's wife.

An example of dividing an inheritance in the presence of common property

At one time, a husband and wife purchased a house that was jointly owned by them. The man has three children. After the death of the husband, the wife receives 1/2 share of the house. The remainder will be divided into 4 equal shares: one for each child and wife. Thus, the wife owns 5/8 of the share of the house, and the children own 1/8 each. All other property will be divided in the same way.

Children

All children of the testator enjoy equal rights when dividing the inheritance:

- Children born in an official, valid marriage

- Children born in previous marriages

- Illegitimate children of any age, provided that paternity is recognized or established

- Born after the death of the testator (within ten months)

Parents

Citizens who survive their children have the right to inherit after them as part of the first line.

Adoptive parents who have officially adopted the testator have the same rights as blood parents. Parents who are unmarried or divorced have equal rights, regardless of whether they lived with the testator or not.

A parent who has been deprived of parental rights to a given child by a court at one time is deprived of the right to inherit. If parental rights have not been restored during the life of the testator, his father or mother does not have the right to inherit from his child.

Other heirs of the first stage. Right of representation

The list of first-priority heirs does not include one category of close relatives – grandchildren. Since she is not in other queues, this often raises puzzling questions: “Can’t grandchildren inherit from their grandparents at all? After all, these older relatives inherit from their grandchildren in third place.”

In fact, grandchildren can directly inherit from their grandparents only by will. According to the law, they receive the inheritance of their grandparents after their parents. When, for example, father and mother received shares of their parents' inheritance. And then, in turn, they inherited the combined property of generations to their children.

But there are cases when the grandchildren of the testator are included in the first priority of inheritance. True, with certain reservations. This occurs if their parents (children of the testator) died before him, and is defined as “inheritance by right of representation.”

Grandchildren can inherit from their grandparents only by right of representation (excluding cases where they were adopted last after the death of their parents or deprivation of their parental rights).

Inheritance through the right of representation has one peculiarity: the heirs do not always receive an equal share with other heirs of the first priority. Their share is the share to which the person they represent was entitled.

That is, if there are more heirs by nomination than there were direct heirs of the first stage, then the share of each will be proportional to their number.

Example of inheritance by view

The deceased man has a living father and mother, a wife and three children together. But two children died in a car accident shortly before the death of the testator himself. Both left children: one has two, the other has one.

The inheritance (after allocating the marital share) is divided into six equal parts: father, mother, wife, and each of the three children. The shares of the deceased children of the testator pass to their children. One grandchild receives the full share of his parent, which is 1/6 of the inheritance. The two grandchildren receive their parent's share (1/6) and divide it in half. Everyone gets 1/12.

Inheritance by right of representation is a legal norm. An heir by nomination cannot be deprived of his share, except by the will of the testator, or in cases provided for by law (for example, declaring the heir unworthy).

Dependents

This is a special category of heirs, inheriting simultaneously with representatives of the current (called for inheritance) line. Family or legal connection in this case is an optional condition. “Common-law” husbands and wives who do not have the right to inherit can inherit if they are also dependents of the testator.

A citizen is recognized as a dependent if the following conditions are met:

- He must be disabled (for example, disabled)

- Have no other sources of income other than financial assistance from the testator

- Live with the testator until his death

- Live with the testator for a year or more before his death (this condition is not mandatory if the dependent was a blood relative of the testator)

Even if there is no first-priority heir, a disabled dependent cannot receive more than 1/4 of the first-priority share of the inheritance. The rest will “go down” in queues.

Remember

- The first priority heirs are parents, children and spouse.

- All children of the testator, incl. illegitimate and adopted children have equal rights to inheritance.

- If the testator's child dies earlier, his right to inheritance passes to his grandchildren.

- The property is divided equally between all candidates. Grandchildren who inherit the share of their deceased parent divide this share among themselves.

- The surviving spouse should contact a notary and allocate a spousal share in the amount of 50% of the property acquired during the marriage before dividing the inheritance.

- Cohabitants and former spouses can only claim a share of the inheritance as a dependent.

- Disabled dependents of the testator will inherit first if they confirm this status.

Distribution of inheritance among first-degree heirs. Shares

We have already touched on this issue in previous sections. Now let’s summarize all the information about legislative norms and summarize:

- The inheritance is divided equally among all representatives of the first stage

- If the testator’s spouse is among the first-priority heirs, first the “marital half” is allocated from the entire property (relatively speaking, the part that the spouse would receive in the event of a divorce). After this, the spouse participates in dividing the remaining part of the inheritance on an equal basis with the rest of the heirs

- If there is only one heir of the first stage, he inherits solely, completely

- If there are no first-line heirs, a disabled dependent may claim 1/4 of the inheritance

- Heirs by right of representation receive the share of the direct heir of the first stage who died before the testator. The only heir by right of representation has the right to a share the same as that of all heirs of the first priority. If there are several of them, they divide the share of the direct heir equally.

ATTENTION! Despite legal requirements, heirs of the first stage are not obliged to equally divide each object included in the inheritance. They can draw up an agreement on the basis of which, for example, one takes the car, the second garage, the third and fourth own the dacha in half, and so on. If an agreement cannot be reached, the division of property can be carried out through court proceedings.

Features and rules of refusal of inheritance

The right of inheritance is voluntary. To refuse to participate in the division of property, it is enough to use one of two methods. The first provides for inaction in matters of registration of inheritance for six months. As a result, the testator's property will be divided without the participation of the heir.

The second option is to issue a written refusal. To do this, the easiest way is to contact a notary handling the inheritance case. The heir must submit a corresponding application and have the document certified by a specialist. In this case, it is possible to transfer your share to one of the other heirs.

In legal you can get free legal advice on any issue that interests you.

Inheritance by will. Mandatory share

It is clear that if there is a will, the order of inheritance changes. A citizen has the right to bequeath his own property to whomever he finds necessary, even to a complete stranger or legal entity. In common parlance this is called “disinheritance,” and everyone has the right to do this to their relatives.

However, some categories of priority heirs do not lose the right to receive a certain share of the inheritance even in such a situation. The obligatory share of the inheritance is legally assigned to:

- Disabled husband or wife (pensioners and disabled people)

- Disabled parents (retired and disabled)

- Disabled children (pensioners and disabled people)

- Minor children (under 18 years of age at the time of death of the testator)

The obligatory share is half of the share to which the first priority heirs would be entitled in the absence of a will.

An example of obtaining a mandatory share

The woman bequeathed all her property to a charitable foundation. However, she has an elderly mother and a disabled husband. Without a will, the husband would have received the “marital half” and would have shared the other half with his mother. Since there is a will, the spouse’s share of the property acquired during the marriage is allocated (to which he is entitled regardless of the will), and then the mother and husband divide 1/2 of the remaining inheritance in half. The rest goes to the heir named in the will.

FAQ

Q : Who inherits after the death of the father?

A : All his children (including adopted and unborn at the time of opening of the inheritance), legal spouse, his parents and disabled dependents can claim their rights to the inheritance. In the event of the death of the testator's child before the opening of the inheritance, his grandchildren will inherit the share due to him.

Q : How is the inheritance divided between the brothers after the death of their mother?

A : Being the sons of the deceased, the brothers have the right to an equal share in the inheritance.

Q : Who are the first priority heirs if the husband, wife or children die?

A : The wife and children are the heirs of the first turn and they inherit at the same time. The wife's marital share (half of the property acquired during the marriage) must initially be allocated from the inheritance mass. The notary will divide the remaining half between his wife and children in equal shares.

Q : Is the brother of the deceased the first-degree heir?

A : No, brothers and sisters belong to the second priority. After the death of a brother, his children inherit (if one of them died earlier, then his share goes to his grandchildren), wife and parents. Another brother can accept the inheritance along with the first line by proving the fact of his incapacity for work and being dependent on the testator for the last year.

Q : Who inherits property after the death of an unmarried son?

A : If the testator was not married, had no children and did not provide systematic assistance to any of the disabled dependents, his only heirs will be his parents. The mother and father will receive equal shares of the inheritance.

Q : Can a common-law wife receive an inheritance if she has a group 3 disability?

A : Maybe as a dependent. But only if she manages to prove a combination of factors: 1) cohabitation with the testator for 1 year; 2) the amount of one’s own income is insufficient to meet the needs of life.

Q : What will happen to the property if the heir of the first priority does not contact the notary in time and does not declare his rights?

A : Accepting an inheritance is a right, not an obligation. The share of such an heir will be divided equally among other first-line applicants. If there are no such successors, the right to inheritance will pass to the second-order heirs.

Q : Is the wife entitled to a share of the inheritance if the spouse dies during the divorce process?

A : If the decision has not been made or has been made, but has not entered into legal force at the time of death, the wife is considered the official spouse and is the heir of the first priority.

Q : Can a retired cohabitant aged 65 years receive an inheritance after the death of his common-law spouse?

A : Only if he lived with her during the last year of her life, they ran a joint household, and her income significantly exceeded his pension.

Q : Will the only son, after the death of his father, have to share an apartment with his stepmother and her children from another man?

A : Yes, if the stepmother was officially married to her father at the time of death, and her children are minors, and your father supported them.

Inheritance terms for the first stage

The generally accepted period for entering into inheritance rights is 6 months. The countdown begins from the day of death of the testator, or from the date of the court decision declaring the citizen dead. There are a number of exceptions to this rule:

- The six-month period may be extended for valid reasons.

- An unborn heir of the first priority (a child of the testator who was not born at the time of his death) enters into the inheritance after his birth, even if 6 months have already expired.

- If there are no heirs of the first stage, the right to inherit passes to the second stage, and so on. After each transition, the six-month period starts anew.

You will find more detailed information about this in the article “The order of inheritance by law” posted on our website.

What property is not subject to inheritance

Any property that remains after the death of the testator passes by inheritance to close relatives. Relatives of the 1st stage can be the first to count on the inheritance mass.

The following property is an exception:

- which the citizen included in the will;

- accounts for which a testamentary disposition has been made;

- written down for inclusion in the inheritance fund.

Example. After the man's death, he was left with an apartment, a plot of land and a car. The apartment and car were bought in 2 marriages. He received the land allotment under a gift agreement before its conclusion. Whereas the man still has a daughter from his first marriage. The deceased also left behind an elderly mother. However, she does not lay claim to her son's property. The wife is entitled to ½ share of the apartment and car as a marital share. The remaining property is divided into 1/3 share to each recipient. Since the wife receives 4/6 shares of the apartment, the daughter of the deceased offers to exchange her 1/6 share of the apartment for 1/3 share of the land plot. With her stepbrother she changes to 1/6th share of the car. As a result, the girl receives the entire plot of land. The boy receives 1/6 share of the apartment and 1/3 share of the car. The wife of the deceased receives 5/6 shares of the apartment and 2/3 shares of the car.

How can a wife enter into an inheritance after the death of her husband?

Let us consider in more detail the procedures for registering inheritance rights using the example of the testator’s wife.

What is the procedure for entering into inheritance after the death of a husband - instructions

What needs to be done by the wife of the deceased:

- Collect the required documentation.

- Contact a notary within 6 months from the date of death of the testator with an application for acceptance of the inherited property and relevant documents.

- Submit an application for a certificate of inheritance.

- After the specified 6-month period, receive a certificate of inheritance.

- Register rights to real estate and vehicles with Rosreestr and the State Traffic Safety Inspectorate, respectively. Self-propelled vehicles are registered with Gostekhnadzor.

How to register inheritance rights after the death of a husband

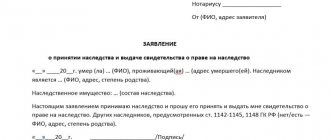

First of all, you need to collect a package of documents. Next, fill out an application for acceptance of inherited property and/or issuance of a certificate of inheritance. You can do this yourself or with the assistance of a notary. The filing deadline is six months from the date of death of the testator.

Sample application (DOC, 12 KB)

Important! The main one is the application for the issuance of a certificate. In the absence of an application for acceptance of the inheritance, the inherited property will still be recognized as accepted. But without an application for a certificate, it will not be possible to formalize inheritance rights. It is allowed to include two requirements in one act.

After the 6-month period, the notary will issue a certificate of inheritance. This document should be submitted to Rosreestr and the State Traffic Safety Inspectorate if you have real estate and a vehicle.

If a woman missed the specified deadline, then she will be able to formalize inheritance rights only in court:

- If there are good reasons for missing, restore it.

- Having established the fact of acceptance of the inheritance.

What are the rules for registering with a notary?

The basic rule comes down to the timely submission of applications with accompanying documents to a notary in the locality of the last place of residence of the deceased:

- On the acceptance of the inheritance mass.

- On the issuance of a certificate.

The notary, having checked all the documentation provided, will open the inheritance case in the book of inheritance affairs. Enter data into the UIS (unified information system) of the notary. This guarantees the absence of duplication of inheritance proceedings.

If the applicant is not the first to apply, his application is added to those submitted earlier in the same case.

Then, within six months from the date of opening of the inheritance, the notary accepts applications and other documents from co-heirs. And after the specified period, it issues certificates of the right of inheritance to all of them, if there are no obstacles to this. In particular, if the heirs are not or are not recognized as unworthy.

To determine her marital share in the inheritance, the wife brings documents confirming the acquisition of property during her marriage. In this case, the wife’s share is first deducted from the jointly acquired property in accordance with the norms of the RF IC.

The remaining part will be considered hereditary and subject to division among all those called to inherit. Provided that they have submitted the relevant application in a timely manner.

What documents are needed to register rights after the death of a husband?

Documentation package in the absence of a will:

- Application for acceptance of inherited property by law.

- Application for issuance of a certificate of inheritance. These two statements may be combined into one.

- Applicant's identity card.

- Documents confirming the relationship with the testator (marriage certificate).

- Title documents for real estate and vehicles (sale and purchase agreements, donations, etc.).

- Registration acts for property (from Rosreestr, traffic police).

- Documents confirming the residence of the testator in the territory of a particular municipality in the last days of his life.

If there is a will, the first thing you need to do is find its original. Then contact the notary who issued it. He must put a mark indicating that the will has not been changed or revoked. The application to the notary in charge of the inheritance case is accompanied by an original copy of the will with such a mark.

If there is a will, the list of documents to be submitted is identical to the above. It is supplemented only by a copy of the will with the appropriate mark.

If a copy of the will is not found among the testator’s papers, then first you should get a duplicate. It will be issued by the notary who executed the will or who keeps the archives of such a notary. You can find out who exactly executed the will by contacting the nearest notary office.

The electronic register of wills helps notaries find all the necessary and most up-to-date information about wills in a matter of minutes. This does not depend on which locality, which notary and when they were compiled.

You can find an inheritance case in the same way or independently on the FNP portal notariat.ru in the “search for inheritance cases” section.

The search for an inheritance case is carried out by identifying the full name. If you mistakenly enter the testator's personal information incorrectly, the site's search engine will not be able to detect the case. Dates of birth/death are not required to be entered in full unless you know them for sure.

Do I need to pay for notarial services after the death of my husband?

For issuing a certificate of inheritance rights, you must pay a state fee in the amount of 0.3% of the value of the inherited property, but not more than 100 thousand rubles:

- To my wife.

- Children, including adopted children.

- To the testator's parents.

The following are exempt from paying state fees at notary offices:

- Heroes of the USSR, Russian Federation, full holders of the Order of Glory - in full, according to Art. 333.35 Tax Code of the Russian Federation.

- Disabled people of groups 1-2 by 50% for all types of notarial acts - clause 2 of Art. 333.38 Tax Code of the Russian Federation.

- Citizens - for issuing certificates when inheriting: a house, other residential premises when living together with the testator, 100% - clause 5 of Art. 333.38 Tax Code of the Russian Federation.

- Individual - in case of similar events when inheriting a land plot with such a house, 100% - clause 5 of Art. 333. 38 Tax Code of the Russian Federation.

The value of the estate is assessed based on the price of this property on the day of death of the testator.

The value of real estate is determined both by the BTI authorities at the location of the property and by organizations that have received the appropriate license for valuation activities. Land plots are assessed by the branch of the Federal Cadastral Chamber in the municipality, as well as by independent appraisers.

How to share what you inherited

How does real estate inheritance occur?

Inheritance of real estate has some practical nuances. Let's take a closer look at them.

How does a house inherit after the death of a husband?

The rules for registering an inherited residential building are identical to registering other property. An exception is the list of documentation attached to the application.

The application for acceptance of inherited property shall be accompanied by title and registration documents for the residential building included in the inheritance estate. Namely:

- Contract of purchase and sale, donation of a residential building.

- Certificate of state registration of ownership.

- Extract from the Unified Register of Real Estate Rights (USRN).

- Privatization acts.

There is also a certain aspect after receiving a certificate of inheritance rights: ownership of the house should be registered with Rosreestr.

In practice, co-heirs often encounter certain difficulties. In particular, by determining the procedure for using common shared property.

After all, the certificate of inheritance does not indicate which rooms, other living quarters or parts thereof become the property of each co-heir. In view of this, disputes inevitably arise on this matter.

If the co-owners have not found a common language and have not resolved the dispute peacefully, each of them has the right to go to court to allocate his share in kind. As well as establishing the procedure for using common shared property - clause 1 of Art. 247 Civil Code of the Russian Federation.

But most often, construction and technical expertise establishes that allocating a share in kind without causing significant damage to the house is not possible. Then all that remains is to determine descriptively, graphically, which part of the home ownership goes to the plaintiff, and which part to the defendant(s).

At the same time, the procedure for using common areas is determined: kitchen, corridor, bathroom, toilet, attic, basement, as well as outbuildings.

The claim proposes a description of the boundaries of the part of the house that is coming into the possession and use of the plaintiff according to existing landmarks: walls, fences.

If the difference in the square footage of the housing after determining the procedure for using the common shared property is significant, then the party with the smaller housing area has the right to demand monetary compensation - clause 2 of Art. 247 Civil Code of the Russian Federation.

How is the inherited apartment divided between the spouse and children?

In the absence of the testator's parents, the apartment is divided into equal shares between the children and the spouse - in the case of inheritance by law.

A will can change the distribution of inherited shares, including completely depriving one or all heirs of the rights to the apartment. But there are exceptions to this rule.

Some people have a mandatory share in inherited property. This implies that they participate in the inheritance regardless of the contents of the will. The obligatory share is assigned to the following citizens:

- Minor or disabled children of the testator.

- Disabled parents and spouse.

- Disabled dependents of the testator.

If there is a will, they claim half the share due to each of them upon inheritance by law. This is provided for in Art. 1149 of the Civil Code of the Russian Federation.

Exclusion of the spousal share from the inheritance estate

The notary who is in charge of the inheritance case can separate the surviving spouse's spousal share from the inherited property and exclude it from the inheritance mass.

The marital share of the surviving spouse is subject to allocation even in the presence of a will. For example, it may happen that all the property acquired during the marriage and registered in the name of the testator was bequeathed to him.

In this case, of course, the spousal share of the surviving spouse is also subject to separation from the estate, since it cannot be bequeathed.

As a general rule, when dividing the jointly acquired property of spouses, their shares in this property are recognized as equal (Article 39 of the Family Code of the Russian Federation), accordingly, the spousal share of the surviving spouse is at least half of the total property.

The notary acts in accordance with the norms of the Fundamentals of Legislation “On Notaries”, according to which, in order to allocate the marital share, the surviving spouse must submit to the notary a corresponding application for the allocation of the marital share from the inheritance.

Accordingly, the heirs of the first stage will divide the remaining part of the property among themselves.

In some cases, other heirs may not agree with the allocation of the marital share to the surviving spouse of the testator.

The classic situation is when during his lifetime the testator was in a registered marriage, but for a long time he did not actually maintain marital relations with his wife, they lived separately, did not have a single budget, and the testator acquired part of the property, including real estate, during this period . Under such circumstances, the heirs of the deceased may challenge the surviving spouse's right to half of the testator's property, which was acquired during the period when the marital relationship between him and his wife was actually terminated.

Consequently, the dispute in this case is subject to resolution by the court, and of course, the heirs will have to present indisputable evidence of their position in court.

The division of the inherited property will be made based on the evidence presented by the parties.

Lawyer (advocate) for inheritance disputes. Tel.+7 (812) 989-47-47 Telephone consultation