The primary heirs who have the right to claim the property left by the testator include relatives of the immediate circle : children of any age, spouse (if he is alive) and parents of the deceased. This list is specified in Art. 1142 of the Civil Code of the Russian Federation and is called the first line of inheritance.

The list of priority heirs may change . This is associated with the refusal of one of the successors to enter into the inheritance, recognition of him as unworthy, or inclusion in the circle of the listed persons as a dependent.

In the event of the death of one of the adult children of the testator before the opening of the inheritance, it is understood that instead of the deceased, his descendants (grandchildren of the person who left the inheritance) will inherit.

Primary heirs are deprived of their rights if the court finds them unworthy due to harm to the testator or insufficient care for him during his lifetime, as well as interference with other heirs in receiving their share (Article 1117 of the Civil Code of the Russian Federation). The testator also has the right to deprive any of them of the opportunity to inherit without giving reasons (Article 1119 of the Civil Code of the Russian Federation), with the exception of the right to a compulsory share .

When does inheritance occur by law?

According to Art. 1111 of the Civil Code of the Russian Federation, inheritance by law occurs if the owner did not enter into an inheritance agreement and did not leave a will, as well as in cases where the heirs under the will:

- refused to enter into inheritance;

- missed the deadline established for accepting the inheritance;

- found unworthy;

- have the right only to part of the bequeathed property.

Citizens who are alive and related at the time of the death of the testator, as well as unborn children of the testator, can be heirs by law. All heirs have equal rights regardless of gender, citizenship, or financial status. Heirs by law are called upon to inherit in the order of priority provided for in Articles 1142 - 1145 and 1148 of the Civil Code of the Russian Federation. The closest relatives are classified as first-degree heirs.

Who can be included in a will?

The testator is free to leave his property to any person, not necessarily a relative, as is the case with legal inheritance. Property can be transferred even to a legal entity, not just to a person. Citizenship and legal capacity are not important.

Only holders of compulsory shares should be taken into account (children under 18, disabled mother/father and spouse, dependents). Whoever receives the bequeathed inheritance, the listed persons will receive at least half of the share due to them upon legal inheritance.

The testator can designate not only the share assigned to each successor. Sometimes specific things are conveyed. The size of the parts may not be indicated. Then all the persons mentioned in the will will receive equally.

Who is the first priority heir?

Based on Article 1142 of the Civil Code of the Russian Federation, the heirs of the first priority by law are:

- parents;

- children;

- spouse;

- grandchildren by right of representation.

If the legal heir died before the opening of the inheritance or at the same time as the testator, his share passes to the descendants by right of representation.

Example: After the death of citizen Krivosheeva, the legal heirs are her son and daughter. My husband and parents died long ago. Krivosheeva’s son died as a result of the accident, but he left behind a daughter. Therefore, the legal heirs will be the deceased’s daughter and granddaughter. The granddaughter inherits by right of representation.

Parents of the testator

The law protects the interests of parents. Parents have the right to inheritance. It doesn't matter if they live together or are divorced. Adoptive parents have the same rights as biological parents. It is not necessary to disclose the fact of adoption to a notary. Parents must provide the notary with a passport and birth certificate of the child.

The following cannot claim inheritance:

- persons deprived of parental rights;

- adoptive parents, if the adoption was canceled by a court decision.

Children born and adopted

All children of the deceased have equal rights to inheritance after the death of a parent.

The right to inheritance is vested in:

- blood children;

- adopted;

- illegitimate children, provided there is documentary evidence of the relationship.

If there is an unborn heir, then the property cannot be divided until the moment of his birth (Article 1166 of the Civil Code of the Russian Federation).

The interests of children under 18 years of age are represented by:

- second parent;

- guardian;

- adoptive parent;

- guardianship specialist.

To claim an inheritance, a child must provide a passport and birth certificate.

Non-adopted children (stepsons, stepdaughters) are not first-degree heirs. Paragraph 3 of Article 1145 of the Civil Code of the Russian Federation classifies them as heirs of the seventh order.

Minor heirs of the first stage

Article 1167 of the Civil Code of the Russian Federation protects the legitimate interests of minor citizens during the division of inheritance. Minors inherit equally with other legal successors.

Features of registering an inheritance for a minor citizen depend on his age:

- child from 0 to 13 years old - in this case, the second parent, guardian or legal representative acts on behalf of the child. The presence of the child at the notary is not necessary.

- a child from 14 to 17 years old - in this case, the child comes to the notary, writes the application himself and signs with the consent of his representative.

When drawing up an agreement on the division of the inheritance and on the consideration of the case on the division of the inheritance in court, the guardianship and trusteeship authority must be notified.

A refusal of inheritance can be formalized only with the permission of the guardianship and trusteeship authorities, if it is proven that the debts of the testator exceed the amount of the inherited property.

Surviving spouse of the testator

When inheriting by law, not only kinship, but also marital relations are taken into account. To claim inheritance rights, the spouse must present a passport and marriage certificate to the notary. And it doesn’t matter whether the spouses lived together or the marriage actually broke up.

The spouse has the right to inheritance if the marriage was registered according to the laws of the Russian Federation and was not dissolved at the time of the death of the testator.

In the event of the death of a spouse before the court decision enters into legal force, the marriage is considered not dissolved and the surviving spouse retains the right to inheritance.

If the spouses divorced before the opening of the inheritance, the surviving spouse cannot take part in the division of the deceased’s property. In what cases established by law does an ex-wife have the right to her husband’s inheritance, read the article: Is the ex-wife an heir?

If the marriage took place in another country and Russia does not have an agreement with this country, the spouses do not have the right to each other's inheritance.

Citizens in same-sex marriages are not considered spouses on the territory of the Russian Federation.

Wedding or civil marriage are not grounds for including the surviving spouse among the first-priority heirs.

Disabled dependents of the testator

Disabled dependents of the testator have the right to claim a share in the deceased's property.

The following persons are considered disabled dependents of the testator:

- Citizens who are considered heirs according to the law of all established 7 queues, who were disabled on the day of opening of the inheritance, but are not included in the circle of heirs of the queue that is called to inherit, if at least 1 year before the death of the testator they were his dependents, regardless of whether they lived they are joint with the testator or not;

- Citizens who are not considered heirs by law, but were disabled by the day the inheritance was opened and were dependent on him for at least 1 year before the death of the testator and lived together with him.

Resolution of the Plenum of the Supreme Court of the Russian Federation No. 9 of May 29, 2012 “On judicial practice in inheritance cases” enshrines the concept of disability in relation to inheritance legal relations.

Disabled people include:

- Minor citizens.

- Persons who have reached the age to receive an old-age labor pension.

- Citizens recognized as disabled people of groups I and II.

Persons entitled to early assignment of an old-age pension are not classified as disabled.

The incapacity of a citizen is determined on the day of opening of the inheritance

Example. Elizaveta, a group 2 disabled person, lived with her daughter and son-in-law. After the death of her son-in-law, the daughter decided that she was the only heir by law, since her husband’s parents died a long time ago and there were no children. The daughter wanted to live separately from her mother, the relationship between them was terrible. The mother did not have any other housing and she filed an application to the court to recognize herself as a dependent of her son-in-law. Elizabeth provided the court with a certificate of disability and documents confirming that she was his dependent for three years before the death of the testator and lived with him. The court satisfied her demands and she received a 1/4 share in her son-in-law's apartment.

Grandsons-heirs of the first priority by right of representation

In the event of the death of an heir who did not have time to accept the inheritance, his heirs are called to inherit, who inherit by right of representation. The share of the deceased heir is not divided between relatives of the inherited line, but is divided only between his heirs.

Example: Legal heirs are son and daughter. The son died before receiving the inheritance. The right to inheritance passes to two grandchildren (children of the son). They will receive the parent's share and it will be divided between them in equal shares. The daughter will receive 1/2 share, the grandchildren 1/4 each.

To enter into an inheritance, the grandson must present to the notary:

- passport;

- birth certificates (yours and those of your deceased parent);

- parent's death certificate.

Spouses

A husband or wife has the right to inherit after the death of their spouse, provided that:

- at the time of the death of the testator, an official marriage was registered;

- The court decision on divorce at the time of opening the inheritance did not enter into legal force.

Important! A person who cohabited with the deceased or is married to him in a church marriage does not apply to successors called to inherit.

If the inheritance was acquired during an official marriage, then only the part that belonged to the deceased is subject to division. As a rule, this is half of the joint property with the husband or wife.

How to divide an inheritance between first-line heirs

The distribution of the inheritance among the first-priority heirs takes into account the marital share. The heirs can independently distribute shares of the inheritance and sign a settlement agreement on this. This requires the consent of all heirs of the first priority and notarization of the agreement.

Procedure for dividing inheritance

When dividing an inheritance, it is important to observe the following principles:

- the marital share is removed from the testator's property;

- the remaining inheritance is distributed equally by the heirs of the 1st stage, including the heir who received the spousal share;

- if there is only one heir of the first priority, he receives all the property;

- disabled dependents inherit if they prove and document the circumstances set out in Article 1148 of the Civil Code of the Russian Federation;

- heirs by right of representation receive the share of the deceased heir of the first priority and divide it equally;

- The indivisible property is either sold and then divided among the heirs, or transferred to one of the first-priority heirs with the payment of monetary compensation to the others.

How do heirs of the first stage enter into inheritance?

Any inherited property entitled by law can be acquired:

- on the basis of an application for inheritance and documents confirming relationship with the deceased. Legal successors must contact a notary at the last place of residence of the deceased or the location of his property.

- by actual acceptance. The heirs take actions aimed at accepting the property. They live in the inherited property, pay utility bills, and make repairs.

A citizen who is not one of the heirs by will or law does not have the right to actually accept the inheritance.

Procedure for entering into inheritance from a notary

To transfer the property of the testator to themselves, the heirs need to obtain a certificate of inheritance rights from a notary and register ownership of the objects in their name.

You need to contact a notary at the place of residence of the testator or at the location of his property (which is of the greatest value). The sequence of entering into an inheritance from a notary:

- Obtain a death certificate.

- Prepare:

- passport;

- a certificate from the last place of registration of the deceased;

- documents confirming family ties;

- title documents for property.

- Contact a notary to clarify the presence or absence of a will.

- Make an assessment of the inherited property.

- Submit an application for acceptance of the inheritance and issuance of a certificate of inheritance and a package of documents.

- Pay for legal and technical notary services.

- Pay the state fee.

- Obtain a certificate of inheritance.

- Register property rights.

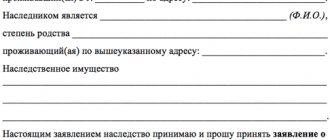

Sample application for acceptance of inheritance and issuance of a certificate of right to inheritance

| Application for acceptance of inheritance and issuance of a certificate of inheritance |

What documents does a notary need to formalize and enter into an inheritance?

State duty for inheritance under the law

For the issuance of a certificate of the right to inheritance, clause 22, clause 1, article 333.24 of the Tax Code of the Russian Federation, payment of a state fee is provided for, which is established depending on the value of the inherited property and amounts to:

- for close relatives 0.3 percent of the value of the inherited property, but not more than one hundred thousand rubles.

- for all other heirs 0.6 percent of the value of the property received, but not more than one million rubles.

State duty is not charged for some inheritance items:

- cash;

- real estate objects in which the heirs lived and continue to live;

- property of those killed in the performance of public duties;

- all objects if the recipient of the inheritance is a minor.

How much does it cost to enter into an inheritance with a notary?

Various life circumstances

Let's consider the situations that occur when first-line heirs enter into an inheritance.

If the heir of the first priority does not accept the inheritance

The heir may not accept the inheritance or refuse the inheritance.

If the heir has not applied to the notary, then his share is divided equally among the other heirs of the first priority. If there are no heirs of the first stage, the right to inheritance passes to the heirs of the second stage.

The heir has the right to renounce the inheritance in favor of other persons or without specifying the persons in whose favor he renounces the inherited property.

How to challenge a first-priority heir

It is possible to challenge the rights to the inheritance of a first-priority heir if he is found unworthy in court. It is necessary to confirm that the heir intentionally committed illegal actions against the testator or other heirs (Article 1117 of the Civil Code of the Russian Federation).

Parents of the testator

The ability of parents to inherit from their children is not limited by age, legal capacity, or the presence of consanguinity between them. The restriction is imposed only by deprivation of parental rights in relation to a particular child, and even then not always.

- The article of the law concerning first-degree heirs does not explicitly refer to blood and adoptive parents. However, in Art. 1147 of the Civil Code of the Russian Federation states that adoption is equivalent to consanguinity .

- Parents cannot inherit from a child if they are deprived of parental rights in relation to him, or he was adopted by other people (Clause 2 of Article 1147 of the Civil Code of the Russian Federation). In such cases, the blood relationship is interrupted . The exception is cases when, by court decision, parents are given the right to communicate with their children by origin.