6

After a person dies, his property goes to his heirs. If the testator managed to leave a will, the inheritance of assets occurs on the basis of his last will. The absence of an administrative act triggers inheritance of property by law. The issues of opening an inheritance are dealt with by an authorized person - a notary. He is entrusted with the functions of distributing property between applicants.

The question arises, how to find out about the opening of an inheritance and contact a notary? Indeed, situations can be different: distance from the place where the inheritance was opened, several objects of inheritance, ignorance about the opening of the case, employment and other factors. Let's try to figure out how and where an inheritance is opened, who manages it, and what the heirs need to do.

Is it possible to apply for an inheritance at any notary office?

The testator died, but he was left with property: a house, a garage, land, a car, a deposit, jewelry, shares and other assets. What should the heirs do?

First of all, you need to submit an application to a notary office. Typically, a probate case is opened at the residence address of the deceased (less often, at the place of residence).

If the address is unknown or is located outside the state, then you can contact a notary at the location of the testator’s property (see “Place and time of opening of inheritance”). If assets are located in different cities, the application is submitted to the one where the most valuable property is located.

For example, the apartment of a deceased citizen is located in Budennovsk, and the car is in an impound lot in Pyatigorsk. Therefore, the heirs need to submit documents to a notary from Budennovsk.

In a word, any notary office will not work - otherwise there would be confusion. If the testator has not reached the age of 14, the application to the notary is submitted at the place of residence of the child’s legal representatives (parents, guardians, trustees).

Procedure for entering into an inheritance when contacting a notary

In order to enter into an inheritance according to all the rules and avoid possible problems with other successors in the future, it is better for the heir to carry out this procedure according to the law, through a notary. The following actions should be taken:

- Obtain a certificate of death or death of the testator.

- Submit an application to the notary to accept the inheritance.

- Check for a will.

- Collect a package of documents for re-registration of property.

- Appraise the property.

- Provide the collected papers to the notary.

- Pay the state fee.

- Acceptance of the inheritance is evidenced by receipt of a document from a notary.

Registration of the property of the deceased, if the deadlines established by law are missed, will require going to court and providing valid evidence of delay in this matter.

How to find out if an inheritance case has been opened?

| No. | Options | Comments |

| 1 | The notary will independently notify applicants about the opening of an inheritance case | The notification is sent to persons about whom the notary has reliable data - residential address, place of work (Article 61 of the Federal Law “Fundamentals ... on notaries”). Additionally, the notary can make a publication in the media. However, this method is ineffective - not every person follows newspaper news. |

| 2 | Visit a notary at the place of residence of the deceased citizen | Here you can find out whether an inheritance case has been opened. If not, then you can apply for inheritance rights. Based on this, the notary will open a case. If the applicant lives in another city, the application can be sent by mail. The only condition is that the applicant’s signature must be notarized. Therefore, you need to separately contact a notary at your place of residence. |

| 3 | Obtain the necessary information through close relatives of the deceased citizen | The third option is associated with objective complexity - reluctance to help other claimants to the property of the deceased. Many relatives believe that the inheritance should go to them. It wouldn't be surprising if they didn't tell other relatives about him. It happens that the information is inaccurate or late - when the assets have already been divided, ownership has been registered, and the property has been sold/donated/mortgaged/bequeathed. |

| 4 | Find out information about opening an inheritance case through the Federal Tax Service website | There is an electronic register on the website of the Federal Notary Chamber, which contains information about all open inheritance cases |

Prices for notary services

Notaries charge a certain fee for their services within the limits of the law. Contacting specialists entails material costs, which are regulated by state regulations.

The payment amount includes not only the preparation and certification of documents, but also the technical and legal aspects accompanying the paperwork.

The cost of a notary's work when registering an inheritance consists of the following points:

- registration of a will – from 1900 rubles;

- cancellation of the previous version of the will – 500 rubles;

- certification of will – from 100 rubles;

- certification of the successor’s assumption of authority certificate – from 100 rubles;

- issuance of a certificate of inheritance – from 100 rubles.

In addition, when entering into inheritance, the applicant pays a state duty in the amount of 0.3 or 0.6% of the assessed value of the property. The higher the value of the inherited property, the greater the amount that will have to be transferred.

You can first consult with a specialist as part of free legal assistance on any of the Internet sites or look for an office that provides free advice in your city.

How to recognize a notary by inheritance?

Typically, this question arises if there are several notary offices operating in the area where the testator lives. You can determine which of them you need to submit documents to by calling a notary.

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

But it is better to use the official website of the Notary Chamber. The resource contains an up-to-date database of all notaries in Russia. By requesting the necessary information, you can find out: the notary’s full name, service region, office address, telephone, email and other data.

The Unified Information System (UIS) is now in effect - notaries have access to its information. The heirs can contact the nearest notary office, pay to find the right notary and determine which specialist is handling the case? It is advisable to apply as a group of relatives - this way you can quickly find out about the inheritance, and then notify the other applicants.

Read our instructions on how to recognize a notary in order to enter into an inheritance?

Can I contact any notary?

In contrast to the system that distributes notaries according to districts and according to the alphabetical principle, a project called “Inheritance Without Borders” (NBG) began its activities in the Russian Federation.

The essence of the idea is that successors can use the services of the selected specialist, regardless of territorial and alphabetical distribution. However, this rule applies to cases in which the death of the testator occurred after the entry into force of the new rules. For applicants whose relatives died before the introduction of the NBG, it is expected to contact legal experts according to the old principle.

The program was first tested on August 1, 2005. Thus, inheritance cases opened after this date fall under its scope. Heirs have expanded rights and independently determine how to choose a notary to register an inheritance in any area of their locality.

The sphere of influence of the NBG extends to Moscow and its region (since 2014), St. Petersburg and regional entities (since 2014). In addition, residents of the Chelyabinsk (2014), Novosibirsk (2015) and Irkutsk (2016) regions, Altai (2014) and Perm (2015) territories have such powers. In these constituent entities of the Russian Federation, citizens have the opportunity to choose a notary in any district, regardless of its territorial distribution.

How to open an inheritance case with a notary

There are two options for opening an inheritance: if there is a will and if the property is inherited by law (lack of a will). It must be taken into account that the procedure for opening an inheritance in these cases differs (see “Differences between inheritance by law and by will”). But in general, the steps are the same.

By will

The disposition gives certain privileges to the heirs. In fact, they have priority in inheritance, regardless of other claimants, including close relatives of the deceased citizen.

However, in order to take over the rights, the heir must contact a notary in a timely manner. If he is part of the circle of close relatives, he can accept the property on a general basis.

Algorithm of actions

- Find out if there is a testamentary disposition.

- Contact the notary's office at the location of the will - usually its address coincides with the address of the deceased's last place of residence.

- Make an application for inheritance.

- Submit the initial package of documents.

- Collect and deliver missing documents.

- Pay the tax fee - state duty.

- Obtain a certificate of inheritance.

- Register ownership with the Rosreestr or the State Traffic Safety Inspectorate.

Example:

During his lifetime, the testator left a will in favor of his sister. He gave her shares in an oil company. The rest of the property (the house and the land attached to it) was inherited by the relatives in order of priority. After the death of a citizen, his relatives turned to a notary. The sister of the deceased citizen was abroad at that time. She actually could not return to her homeland and inherit. The deadline for submitting an application has been missed. The wife and son of the deceased person accepted the inheritance in full. Each received a corresponding portion of the property, including shares.

After 8 months, the testator’s sister returned from a business trip. She turned to a notary, where she was refused to issue documents for the property of her deceased brother. The woman met with relatives, but they refused to explain anything. The heiress went to court. She asked to restore the terms and recognize ownership of the securities. The woman managed to prove the validity of the reason for missing the deadline for acquiring her license (the basis is a certificate from the consulate, a boarding pass for an airplane, a certificate from her place of work, an order from her superiors). The court satisfied the plaintiff’s demands on the basis of paragraph 1 of Article 1155 of the Civil Code of the Russian Federation. The inheritance certificate was declared invalid. The ownership of the shares is recognized by the heiress. All applicants received new documents and registered their rights.

Without a will

Acceptance of the property of a deceased person by law is practically no different from inheritance under a will. The main difference lies in the composition of the heirs and the size of the shares they are entitled to.

Algorithm of actions of the heir

- Preparation of documents for inheritance.

- Visiting a notary's office - at the address of the last place of residence of the deceased or at the location of valuable property (real estate).

- Submitting an application for acceptance of assets.

- Transfer of documents, including relationships.

- Order a property valuation - from the BTI or Rosreestr.

- Repeated visit to the notary.

- Obtaining a certificate of inheritance.

- Registration of property rights in Rosreestr or the State Traffic Safety Inspectorate.

The most important thing is not to violate the order of inheritance. Opening an inheritance is just the beginning, followed by legal actions on the part of the heirs. They will also have to collect a package of documents.

Required documents

The list of papers depends on the method of inheritance and the type of inherited property.

When contacting a notary office you will need:

- heir’s passport (copy + original);

- documents confirming the death of the testator - a certificate from the registry office or an extract from a court decision declaring a person dead;

- evidence of the relationship between the applicant for property and the deceased person - birth certificate, marriage certificate, etc.;

- extract from the house register - issued to the housing office at the request of the heir;

- certificate from the local police department at the Ministry of Internal Affairs regarding deregistration (if necessary);

- papers for the property of a deceased person;

- a document confirming that the deceased person has no debt - certificates from the housing office, tax office;

- proof of payment of the state duty - receipt (original).

Read more about documents in our article “What documents are needed to open an inheritance case with a notary?”

If inheritance is by will, you must attach the original order. If documents are submitted on behalf of a minor child under 14 years of age, a passport of the legal representative (parent, guardian) will also be required.

A report on the value of the property is required when you contact the notary again. You can set the price of an inheritance in Rosreestr or in a private appraisal firm. All expenses are borne by the heirs.

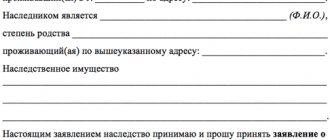

Application for inheritance (sample)

An applicant for the property of a deceased person needs to submit an application according to the sample.

The document contains the following information:

- details of the notary's office;

- information about the heir (registration address, full name, contacts);

- the essence of the application is to accept the assets of the testator or testator;

- degree of relationship with the deceased citizen;

- date, signature of the applicant.

The application must be accompanied by a package of papers and a receipt for payment of the state duty. The notary establishes the identity of the applicant, checks his legal capacity, completeness of documents and opens an inheritance case. The citizen is explained his rights/responsibilities.

The certificate is issued after the deadline for accepting the inheritance has expired. Before receiving the document, the heir needs to evaluate the property. An assessment report will be required to calculate the amount of tax withheld upon issuance of the certificate.

Deadline for opening an inheritance

You should contact a notary within 6 months . The deadline for filing an application does not depend on the method of accepting the inheritance: by law or by will. The countdown of time begins from the moment of the citizen’s death (Article 1114 of the Civil Code of the Russian Federation).

What to do if a person is declared dead by a court decision? The calculation of deadlines begins from the moment the judicial act enters into legal force. For example, if Ivanov A. was absent from his place of residence since August 20, 2021, and the court decision entered into legal force only on September 30, 2021, the date of opening of the inheritance will be September. The six-month period for entering into inheritance begins on September 30.

Price

What costs does an applicant bear when submitting an application? The state duty is 100 rubles . After opening an inheritance case, the applicant needs to conduct an assessment of the property and pay a state fee for obtaining a certificate of inheritance. The cost of the appraisal depends on the type of property and the city in which the heir lives.

To evaluate an apartment, on average you need about 3,000 rubles. You will have to pay from 2,000 to 3,000 rubles to evaluate the car. Valuation of freight transport will cost 1,000 - 1,500 rubles more.

How much do heirs pay when receiving a certificate? The state duty rate depends on two factors - the degree of relationship and the value of the inheritance.

Basic rates:

- 0.3% - this is what close relatives of the deceased citizen pay . This includes siblings, parents/children and living spouse. The maximum tax amount should not exceed 100,000 rubles;

- 0.6% - this is what other applicants pay . For them, the tax limit has been increased to 1,000,000 rubles.

Notary services are paid separately. On average, applicants for an inheritance pay from 1,000 to 5,000 rubles. The rate may increase if a notary is called to your home. If you travel outside the office, the cost of services increases 1.5 times (Clause 2, Article 22.1 “Fundamentals...”).

Can the heir take advantage of the benefits? Yes. Certain categories of citizens are exempted completely or partially from paying the fee. For example, disabled people of groups I-II are entitled to a 50% discount.

The amount of state duty is calculated based on the base tax rate. Benefits can only be provided if supporting documents are available. If the heir cannot provide them, the tax is paid on a general basis.

Subsequent registration of ownership is accompanied by additional costs. For example, to register an inherited apartment, the heir will need to pay another 2,000 rubles , and the land will cost 350 rubles. Documents are submitted to any “My Documents” (MFC) branch or Rosreestr on a territorial basis.

Documents for contacting a notary when registering an inheritance

The procedure for registering an inheritance takes place in accordance with legislative acts on the distribution of shares or based on the orders left in the will. A document drawn up by the copyright holder with a complete list of inherited property will require the applicant to provide a passport. Acceptance of ownership after entering into legal title will occur automatically; you only need to write a corresponding application.

The list of additional documents required for inheritance will be indicated by the notary in certain situations. The basic agreements required to formalize an inheritance include:

- statement of the successor's intention to assume office;

- certificate of the death of the testator or a court ruling on his death;

- identification document of the deceased;

- passport of a successor or several;

- certificate of registration of the last place of residence of the testator;

- when transferring an apartment or other real estate by inheritance, proof of the presence or absence of citizens registered in the living space is provided;

- documents on relationship with the deceased;

- involvement of a third party to whom the rights and obligations to conduct the business are transferred (will require the conclusion of a trust agreement).

The notary is provided with the originals of all papers, on the basis of which the successor receives a certificate of inheritance.