Investor's Dictionary

IIS

— individual investment account. A type of brokerage account for long-term investments with tax benefits. The main limitation is that money cannot be withdrawn from the account for three years. If you withdraw money during this period, the account will be closed, and there will be no tax deductions (and those previously received will have to be returned).

Tax deduction type A

— annual benefit on contributions. This is a deduction from the amount contributed to the IIS for the calendar year. This form of deduction has limitations: it is not carried over to other years, and the investor must pay personal income tax. The maximum amount that will be returned in one year is 52 thousand rubles.

Tax deduction type B

- This is a deduction on income. The investor is exempt from paying personal income tax on profits on an individual investment account. Can be obtained upon closing an IIS, but not earlier than three years after its opening.

EP

- electronic signature, formerly called EDS - electronic digital signature. This is a full-fledged replacement for a handwritten signature in electronic form, replacing it in electronic document management.

2-NDFL

— a certificate indicating the amount and source of income, information about taxes withheld.

3-NDFL

— tax return or reporting form. An individual fills out 3-NDFL in order to report to the state or receive a tax deduction. For example, about winning the lottery or renting out real estate.

On what grounds can you obtain a simplified tax deduction?

In general cases, personal income tax taxpayers have the right to receive the deduction due to them either from the employer or through the tax office.

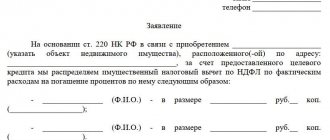

In the first case, you must write an application and attach supporting documents to it.

All the advantages and disadvantages of receiving a deduction at the place of work were discussed by the experts of the reference and legal system “ConsultantPlus” in a special material. To view it, please sign up for trial access to the system. It's free.

In another case, you need to submit to the tax office a correctly completed 3-NDFL declaration, to which supporting documents must also be attached. In this case, the declaration is submitted at the end of the year in which the right to the deduction arose.

From May 21, 2021, a simplified procedure for obtaining personal income tax deductions came into effect. But it will affect only two types of deductions:

- investment, provided under sub. 2 p. 1 art. 219.1 of the Tax Code of the Russian Federation and associated with depositing funds into an individual investment account;

- property, provided in the amount of expenses actually incurred for the acquisition of land, housing and for the payment of mortgage interest under sub. 3 and 4 clauses 1 art. 220 Tax Code of the Russian Federation.

For other types of deductions, the procedure for applying and receiving them remains the same.

Let us note that the simplified procedure for obtaining tax deductions is regulated by Article 221.1 of the Tax Code of the Russian Federation. It was introduced into the code by federal law dated April 20, 2021 No. 100-FZ.

What determines the period of a desk audit of 3-NDFL?

Each declaration received by the tax authorities is subject to a desk audit - one of the forms of tax control. Declaration 3-NDFL is no exception. The information reflected in it and attached documents are subject to verification taking into account the following terms and conditions:

- control procedures can last any amount of time (for example, 1 day or 3 weeks), but cannot extend beyond 3 months (clause 2 of Article 88 of the Tax Code of the Russian Federation);

- the starting date of the 3-NDFL inspection coincides with the moment it was received by the inspector.

In what ways can 3-NDFL get to the inspection, see the materials:

- “How to submit a 3-NDFL declaration through government services?”;

- “Electronic reporting via the Internet - which is better?”.

The period for checking a 3-NDFL tax return within a 3-month period may depend on several factors:

- the volume of data reflected in the report;

- number of supporting documents;

- the presence of contradictions in the submitted data, inconsistencies with the data available to the inspector and (or) errors;

- workload of the tax inspector, etc.

How long does it take to conduct a desk audit of 3-NDFL filed by an individual entrepreneur? Does the verification period change if a clarification is submitted? How can an individual entrepreneur fill out and submit a 3-NDFL declaration? Answers to these and other questions can be found in the Ready-made solution from ConsultantPlus. Get a free trial with expert advice.

How does the simplified procedure for obtaining personal income tax deductions work?

The main advantage of the new procedure is that now for the types of deductions indicated in section 1 of the article, it is not necessary to submit a 3-NDFL declaration with supporting documents. Now tax authorities will receive confirmation of the right to deduction from other sources, and not from the taxpayers themselves. A desk audit of the received information will now take no more than one month, and the return of funds to the taxpayer’s current (or personal) account will take no more than 15 days.

Let us remind you that a desk audit of the 3-NDFL declaration in standard situations takes three months, and the tax authorities transfer the money up to 30 days. That is, the procedural time frame under the simplified system for obtaining a tax deduction is significantly reduced.

You can learn about the intricacies of a desk audit from the article “How is a desk audit of a 3-NDFL tax return carried out?” Get free demo access and read all the most useful information regarding income tax.

What is important to know about the simplified deduction procedure

- The new design procedure does look simpler. You don't need to fill out anything or collect documents. The Federal Tax Service will do everything for you. It will also process your application faster.

- This is convenient if you had no idea that you were entitled to a deduction. It's nice to go to the Federal Tax Service website and see that you are owed some money. If you don’t need tax help, it will probably be faster to file a return or apply for a deduction through your employer.

- According to the law, you can receive property and investment deductions for 2021 in a simplified manner. In fact, so far this only works for the latter, data for which is provided by VTB. In other cases, there is no point in waiting for a notification from the tax office. It's better to file a declaration.

Who will act as a source of information for the tax authorities?

For simplified tax deductions, starting from 2021, all information for tax authorities will be prepared by tax agents, banks, and executive authorities. All these entities will interact within the framework of a special program. The rules for its functioning have already been prepared; participation in it is carried out exclusively on a voluntary basis. That is, no one will be forced to participate, but if a subject has a desire to join the information interaction, then he must meet certain criteria, namely:

- the bank must have a license from the Central Bank of the Russian Federation to carry out banking operations;

- a professional participant in the securities market must have a license from the Central Bank of the Russian Federation to carry out brokerage activities or to manage securities.

Personal income tax taxpayers can always contact the bank where the agreement for the purchase of property was signed, or a professional broker with whom an agreement was concluded to maintain an individual investment account, to clarify information about whether a simplified receipt of a tax deduction is available to them.

Taxpayer actions for a simplified tax deduction option

The fact that the tax deduction has been simplified does not mean that an individual should not take any action. On the contrary, it must monitor the situation constantly.

Firstly, the taxpayer is required to register an account on the State Services or on the Federal Tax Service website. Otherwise, the simplified method will not be available. You will have to fill out a paper declaration (or pay for filling it out), photocopy supporting documents and take the entire package to the tax office.

Secondly, it is necessary to monitor all information messages from the tax authority received by LKN. The message should arrive immediately after the tax authorities receive information from sources of information interaction - banks, tax agents, etc. If the right to deduction is confirmed, the message will contain a pre-filled application. The taxpayer will only need to enter the details of his current or personal account and approve it.

There are special deadlines for generating and sending an application to LKN:

- if all the necessary information was received by the tax authority before March 1, then the application must be generated by it and sent to the taxpayer before March 20;

- if the information reaches the tax authorities after March 1, then they are required to submit an application within 20 days from the date of receipt.

If it turns out that it is impossible to obtain a tax deduction in a simplified manner, then the tax authorities will refuse this method with the help of an information message, but be sure to indicate the reasons. The deadlines for refusal are the same as for filing an application.

How to submit a declaration and apply for a deduction on the Federal Tax Service website

Log in to your personal account

There are three ways to log in to the tax office website:

- Using your login and password from your personal account. To receive them, you need to personally contact the tax office with your passport.

- Using a qualified electronic signature (ES), if you already have one. If not, this is the most difficult and unreasonable option for the average taxpayer. It is issued by a certification center accredited by the Ministry of Telecom and Mass Communications of Russia, and it is stored on a hard drive, USB key or smart card.

- Using your login and password from Gosuslug. The easiest way. If you don’t have an account, it’s best to gain access to it rather than to your personal account on the Federal Tax Service website, since the login and password from “Gosuslug” will be useful in many situations.

Create an enhanced non-qualified electronic signature if you don’t have one

Click on your last name, first name and patronymic to go to your profile page.

Scroll to “Get EP”.

Choose where you will store the electronic signature key: on your computer or in the protected system of the Federal Tax Service of Russia. In the second case, you will be able to use the digital signature on any device, including a mobile one.

Check that your details are correct, create a password and submit your application. Registration of the electronic signature usually takes several days. Here you can register a qualified electronic signature if you have one. Then you do not need to issue another signature.

When the electronic signature is issued, the following field will appear on the same page:

Please note: the signature has an expiration date. Then the procedure will have to be repeated.

Select the items “Life situations” → “Submit 3‑NDFL declaration” → “Fill out online”

Enter personal information

Determine which tax authority you are sending your return to. If the column is not filled in automatically, you can check this on the Federal Tax Service website.

Select which year you would like to file a return for. Available ones are indicated in the drop-down list.

Please indicate whether this is your first time filing a return for this year. If not, write which version of the invoice document this is.

Please indicate whether you are a tax resident. To do this, you need the Tax Code of the Russian Federation, Article 207 “Taxpayers” to be in Russia 183 days in the year for which you are filing a declaration. If you are a non-resident, you are not entitled to a deduction.

Report your income

Employers are required to send tax information about your income to the tax office by April 1. If your employer has already done this, the corresponding fields will be filled in automatically.

If not, click on the “Add Income Source” button and enter the required information manually. The data is on the 2‑NDFL certificate, which you will have to take if your employer has not yet managed to report your income (more on this below).

Select deduction

Lifehacker wrote in detail about the types of deductions in a separate article. In short:

- Property - when buying a home, building a house, paying off interest on a mortgage loan, buying property from you for municipal and state needs.

- Standard - for parents and adoptive parents, disabled people, Heroes of Russia, liquidators of the Chernobyl nuclear power plant accident.

- Social - for training, treatment, charity, insurance, including non-state pension.

- Investment - if you transferred money to an individual investment account.

- When carrying forward losses from transactions with securities, derivative financial instruments, and from participation in an investment partnership.

You can select multiple categories at the same time. But remember that you still won’t get back more than you paid in personal income tax.

Add details about what qualifies you for a tax refund.

For example, if you are registering a property deduction, enter data about the purchased property and the purchase and sale agreement.

If it’s standard, it’s about yourself and/or your children.

If social, enter the amount spent in the required column (it must be confirmed with documents).

Indicate the details by which you will receive your money back

You can enter your account details at this stage or skip the step and then submit a separate application. You need to know the account number, BIC and full name of the bank. All this can be easily found out in the bank’s personal account or in the mobile application. If you do not have access to one or the other, you will have to look for an agreement to open an account or visit a bank branch.

Prepare the declaration for sending

At the last stage, you will see how much money they are willing to return to you. Here it is 6.5 thousand, since, according to legend, a deduction for education in the amount of 50 thousand rubles was declared. In addition, you can download the declaration already on the form to check it again for errors.

Add documents justifying your right to deduction. Make sure that the papers are in JPG, JPEG, TIF, TIFF, PNG, PDF format and weigh no more than 10 MB each. The maximum size of all attached files should not exceed 20 MB.

Now the Federal Tax Service portal itself offers a list of documents that the department would like to receive. Previously, you had to figure out the list yourself.

If your 2‑NDFL certificates are already in the tax database (and you found this out when filling out information on income), you do not need to attach them separately. If the data is not yet available, attach 2‑NDFL in the “Additional Documents” section - the requirements are the same as for other papers.

All that remains is to enter the password for the electronic signature and send the documents for verification.

Follow messages from the tax office

You will be kept updated on the status of your return.

If everything is in order with her, then within a month you will receive a deduction. But the tax office also has the right to conduct a desk audit, and then the process will take three months from the moment the documents are received. The countdown is not from the day the declaration was sent, but rather from the moment it was accepted. The status can also be viewed by selecting the menu items “Life situations” → “Submit 3‑NDFL declaration” → “Fill out online”.

If something goes wrong, you will be sent a message or an inspector will call you. In some cases, it will be enough to send the missing documents to the department. If there were inaccuracies in the declaration, you will have to submit it again.

Submit a refund if you haven't done so before

A point for those who missed the eighth step.

If the tax office has reported the completion of an audit, including a desk audit, it’s time to fill out an application for a refund. To do this, select “My taxes” → “Overpayment”. The overpayment line will indicate the amount you can return.

You will be asked to offset the overpayment against your back taxes, if you have any.

za‑vychetom.ru

If not, proceed to the next step and fill out a return application. You need to indicate the details of the account to which the money will be sent.

white-com.ru

za-vychetom.ru

All you have to do is confirm the data and wait. The money will arrive within a month.

Actions of the tax authority after receiving an application from the taxpayer

Having received an application from the taxpayer, tax officials will conduct an audit. As we have already clarified, 30 calendar days are allotted for it from the date of receipt. In situations where controllers find signs of a possible violation of the law, the deadlines are extended to a maximum of three months.

The inspection ends with the inspectors making a decision to grant or deny a deduction.

If the right to deduction is confirmed, then the next step of the tax authorities will be to check the taxpayer’s debt to the budget for taxes, fines and penalties. If such is detected, the tax authority will offset the amount of the deduction to pay off the debt.

The money must be transferred to the individual’s account within 15 working days from the date of the decision. If the deadline is violated, then the person has the right to claim interest calculated based on the refinancing rate of the Central Bank.

Violation of deadlines for desk audit of 3-NDFL

The duration of a desk audit of 3-NDFL is strictly regulated by the tax legislation of the Russian Federation and is 3 months from the date of submission of the declaration. The inspector can extend the desk inspection only if you submit an updated declaration. Then the desk verification of the primary declaration stops and new control procedures begin to verify the clarification.

If the tax office violates the deadlines for the desk audit of 3-NDFL, we recommend contacting the Federal Tax Service. The tax inspector will quickly check the database to determine what is causing the delay.

In addition to in-person appeal, you have the right to file a complaint about the inaction of tax officials through the taxpayer’s personal account. To do this, go to the “Life Situations” section, then “Other Situations” and select “Complaint about acts, actions (inaction) of officials.” The complaint must be described, referring to the norms of the Tax Code of the Russian Federation.

Results

So, this year legislators have made it easier to obtain a tax deduction. The new procedure is designed to make life easier for taxpayers in that now they will not have to fill out a 3-NDFL declaration and collect supporting documents. But it will not affect every personal income tax deduction. Starting from 2021, it is possible to take advantage of a simplified tax deduction only when purchasing an apartment, including with a mortgage, and when working with an individual investment account.

Under the simplified procedure, an individual needs to wait for a pre-filled application from the tax authorities, enter information about his current account into it and send it back to the tax authorities. The entire procedure will be carried out through the taxpayer’s personal account. In this regard, we recommend that you register in a timely manner on the State Services website or on the Federal Tax Service website in order to be guaranteed to take advantage of the simplified procedure for receiving a tax deduction in 2021 and in subsequent periods.

Sources:

- Tax Code of the Russian Federation

- Federal Law of April 20, 2021 No. 100-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Registration of a non-qualified electronic signature

When filing a return, the taxpayer puts his signature on the documents. In the case of electronic registration of deductions using IIS, an electronic signature (ES) is required. This is an encrypted key that is stored on the user’s computer or other media - for example, on a flash drive. This electronic signature can only be used to send documents to the tax authorities.

To create an electronic signature you need:

- Click on your name at the top of the page and go to your personal profile.

2. Scroll to the right in the top menu, select the “Receive electronic signature” item, and then select the option for storing an electronic signature.

The electronic signature can be stored on the tax server or on your device: for example, a computer or flash drive. Choose the option that seems most convenient and safe.

3. Fill out the form data and send a request.

4. The electronic signature will be officially registered in a few days. After this, you can proceed to filling out form 3-NDFL. The signature is valid for more than a year, so you won’t have to repeat this step next time.