Conditions of receipt

The conditions for obtaining a deduction are described in Article 220 of the Tax Code

, as well as in

Federal Law No. 202-FZ of July 19, 2009

, which introduced certain amendments to this article.

Main conditions:

- the plot must be purchased after January 1, 2010, if it was purchased earlier, then it will not be possible to issue a deduction;

- the plot must be intended for the construction of a residential building, that is, it will not be possible to receive a deduction for garden or dacha plots, or it will be necessary to prove that the garden house complies with the standards of residential premises enshrined in Article 15 of the Housing Code;

- a residential building must be built on the site that complies with all urban planning standards, and ownership must also be registered.

There are certain requirements for the recipient of the deduction:

- he must be a tax resident of the Russian Federation;

- during the reporting period for which the deduction is requested, they had to pay taxes to the country's budget (that is, the unemployed, pensioners, dependents and other citizens who do not have taxable income will not be able to issue a deduction);

- the purchase and sale transaction should not be concluded between interdependent persons, which, according to Article 105 of the Tax Code,

include close relatives, as well as step-grandparents (that is, the grandparents of the spouse); - the property must be paid for from the buyer’s personal funds, and not at the expense of the employer or the state (that is, a tax deduction is not provided for that part of the property that was paid for with maternity capital, a military certificate or other housing subsidy).

In addition to the deduction for the plot itself, you can apply for a deduction for interest paid on a loan or mortgage.

However, it should be taken into account that in reality this is not always possible, since citizens usually file for tax refunds for the past period in full, and there are simply no “reserves” left to receive other deductions.

For example, in 2014, a citizen paid taxes for 14,000 rubles.

If he returns this entire amount, using his right to receive a deduction for the purchase of a land plot, then he will not be able to formalize deductions for the mortgage due to the fact that all withheld taxes will already be returned to him.

Tax refund deadlines

The tax office will first check all the data. She can request information from Rosreestr or another body. Thanks to amendments made to the Tax Code in April 2021, some tax deductions from 2022 can be obtained without a declaration and filing documents.

The application that a citizen has submitted for a simplified deduction will be checked by the tax office within 30 days from the date of its submission. In some cases, the period can be extended to 3 months. After a positive decision is made, the money is transferred within 15 days.

If a declaration is submitted for a regular tax deduction, then auditors can check it within 3 months. If the deduction is confirmed, the money will be transferred within a month. Thus, the time frame for returning the tax deduction in this case is from 4 months.

Deduction amount

Any citizen has the right to return 13% of his expenses for the purchase of property, but the deduction is provided for an amount not exceeding 2,000,000 rubles.

Thus, the maximum deduction is 260,000 rubles.

This rule is enshrined in Article 220 of the Tax Code

, in paragraph 3, subparagraph 1.

In practice, this means that if the value of the purchased property exceeds 2 million rubles, then a deduction can be issued for only part of its value.

It should be taken into account that a property tax deduction can be issued to oneself only once in a lifetime, so you should carefully consider which property to apply for it for.

However, if the cost of the plot was less than 2 million rubles, the remaining amount can be obtained if another property is purchased.

For example, a plot cost 1 million rubles. The owner filed a deduction and received 130,000 rubles within three years.

Subsequently, he purchased an apartment for 3 million rubles.

The balance of the tax deduction (1 million rubles) is “transferred” to her.

That is, he can issue a refund of another 130,000 rubles, only for the apartment.

Amount of property deduction for house and plot

According to Art. 220 of the Tax Code of the Russian Federation, the amount of property deduction is equal to the amount you spent on the purchase of residential real estate, but is limited to 2 million rubles. This means that in total the tax deduction for the land and the house located on it cannot be more than 2 million rubles or 260 thousand rubles to be returned (13% of 2 million rubles).

Example:

You bought a plot of land for 1.5 million rubles and spent 3 million rubles on building a house. Since the amount of the tax deduction cannot be more than 2 million rubles, you will receive 260 thousand rubles into your account.

Example:

You bought a plot of land and a house for 1.8 million rubles. Since the deduction cannot be more than the expenses incurred, the refund will be 234 thousand rubles (13% x 1.8 million rubles).

Ways to receive a deduction

There are two ways to receive a deduction, and they will suit different categories of citizens depending on the timing of the acquisition of real estate, as well as personal preferences.

Through the tax office

Registration of a deduction by contacting the tax service has special meaning if a citizen purchased a plot several years ago.

By law, the deduction can be obtained for the last three years.

If, for example, a certain owner bought a plot of land with a house in 2011, then in 2015 he will be able to apply for a deduction only for 2014, 2013 and 2012, and then provided that he had taxable income during this period.

To receive a tax deduction, you need to download the “Declaration” program for the corresponding year from the official website of the service and fill it out yourself.

If necessary, you can contact a lawyer.

Previously, the declaration could be filled out with the help of a tax inspector directly in the Federal Tax Service building; now not all branches provide such services.

After filling out the declaration in one way or another, you need to prepare the following documents and take them to the tax service along with copies:

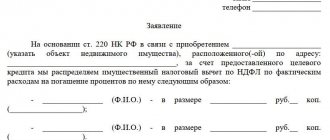

- tax refund application (can be downloaded from the Federal Tax Service website);

- passport or other document allowing identification of the owner;

- TIN;

- a certificate confirming income (in Form 2-NDFL), if during the reporting period the applicant worked in several organizations, certificates are needed from all places of work;

- certificate of ownership of the plot;

- certificate of ownership of a residential building located on the site;

- document of title – in this case, a purchase and sale agreement, as well as a transfer and acceptance certificate;

- documents confirming the expenditure of funds: receipts, checks, receipts;

- bank account number or savings book – for transferring funds.

It is enough to certify copies of documents yourself: in front of the tax inspector, write on paper “Copy is correct” and sign.

In addition, if necessary, documents can be certified by a notary.

If a tax deduction needs to be issued for several years, then for each year you need to prepare your own package of documents.

In each case, you will need to fill out a separate tax return, write various statements and provide certificates of employment for each year.

The deduction is credited to the specified bank account within 2-3 months after submitting the full package of documents.

In some cases, the declaration may be returned to clarify the data.

In this case, you need to make an adjustment and submit a new declaration marked: “Secondary submission.”

Since filing a tax deduction is not an obligation, but a right, the buyer can submit a declaration at any time during the next year (the seller must report income by April 30).

It is advisable to submit documents in February-March, then the tax service is not so busy, and you can get the deduction before the summer.

You will probably be interested in looking at the mental map “How to fill out a declaration on form 3-NDFL”, which explains in detail the procedure for drawing up and submitting documents

Or HERE you will find out how to get a tax deduction when buying an apartment

How is apartment ownership registered:

Through the employer

The second way to apply for a deduction is to contact the accounting department of the enterprise where the owner of the new land plot works.

In this case, you can receive a tax deduction for the current year.

For example, a citizen bought a plot in January, and in July submitted an application for a deduction.

He will receive all tax deductions in his hands starting in January, and subsequently no income tax will be deducted from his salary until the RUB 260,000 limit is exhausted.

The balance of the unpaid amount will be carried forward to the next year.

To receive a tax deduction from the employer, you must receive a notification from the tax office in the form approved by order of the tax service dated December 7, 2004.

The new owner of the site must submit to the inspector the same documents as to receive a tax deduction, only formulate the application differently.

After 30 days have passed while the documents are being verified, the applicant will be given a notification.

It must be submitted along with the application to the accounting department of the enterprise.

There is no need to provide any further documents.

Based on Article 24 of the Tax Code

, the employer does not have the right to refuse to provide a deduction, since this is his responsibility.

You can apply for a deduction at any place of work - main or additional.

The role of the intended purpose of the land plot

Each plot of land has a purpose. Depending on it, you either have the right to a property deduction or not.

A house built on land for individual housing construction (IHC) can be claimed as a tax deduction.

If you bought a dacha plot (dacha plot) and built a house on it that is not recognized as residential, you are not entitled to a deduction. But if you transfer your country house to residential status, you will receive the right to a tax deduction not only for the house, but also for the land acquired for individual housing construction or private plots. This is stated in the Letter of the Federal Tax Service of Russia No. ED-4-3 / [email protected] dated 12/10/12.

From January 1, 2021, summer residents and gardeners are given the right to register and receive a tax deduction when purchasing a summer house for permanent residence. In addition, you can apply for a special reduced electricity tariff. But remember, a condition must be met - the country house must have official residential status.

It is now easy to recognize a garden house as residential - this is done administratively, and not, as before, through the court. The simplified registration procedure is valid until March 1, 2026.

You need to submit an application to the administration of the district where your garden house is located. Please attach to your application a certificate of ownership of the land plot and an extract from the unified register of ownership rights to real estate.

In addition, it is necessary to make a plan of the garden house to confirm that it meets the requirements of a residential building. You must have all communications - sewerage, heating, electricity.

And one more important requirement - the house must be built from capital materials: brick, wood, etc. That is, you should be able to live in the house both in summer and winter. Plywood and other non-permanent buildings cannot be registered as residential.

Common problems and errors

If you submit documents for a tax deduction incorrectly, you can not only get a refusal from inspectors, but also get into serious trouble. Below are details of common errors and problems:

- When submitting documents through their personal account on the website nalog.ru, most applicants do not control the acceptance process. Documents may be sent but not receive the “accepted” status. So the declaration can hang for several months. Therefore, you always need to monitor the entire process of submitting documents to the tax office.

- Some resident applicants do not attach documents confirming their right to the deduction. A declaration without accompanying certificates is a usual statement of intention to receive a deduction.

- Some citizens request deductions in the wrong order. If a person bought real estate, then he has access to a property deduction for the purchase of real estate and for the interest paid on the mortgage. The last deduction is provided only for 1 object. To get two deductions at once, you first request a deduction for the purchase of real estate, the tax office pays it, and then submit a request to deduct interest on the mortgage.

- You cannot request the balance of the social deduction. It is obtained only for the year in which the applicant incurred expenses for it. If a person has not received the full deduction, the remainder will be lost next year.

- To receive a tax deduction, you need to submit documents to the tax office at your registered address, not your actual residence. People often confuse addresses. The tax inspector will not accept documents if the registration address does not match the inspection address. If your place of registration is far from your place of residence, then it is better to submit a declaration through nalog.ru or by regular mail.

- Sometimes citizens expect to receive a refund greater than the amount of taxes paid. The resident must independently calculate how much money he can return so that the inspector does not reject his declaration.

Object of taxation

In order for a land plot to be recognized as an object of taxation, a land tax must be introduced at its location, and the cadastral value for the plot must be determined.

Not subject to land tax (Articles 388, 389 of the Tax Code of the Russian Federation):

- lands that are withdrawn from circulation;

- lands under especially valuable objects of cultural heritage of the peoples of Russia, objects from the World Heritage List, nature reserves, etc.

- forest fund lands;

- lands occupied by water bodies as part of the water fund, which are in state ownership;

- plots as part of the common property of apartment buildings.

There are also benefits that exempt plots from taxation.

How to determine the base for calculating land tax

The tax base is the cadastral value of the land recorded in the Unified State Register at the beginning of the year. It is determined by each region during the state cadastral assessment, which is carried out at least once every five years.

Organizations must find the cadastral value and calculate the base themselves; the tax office only controls the process. But for individuals and individual entrepreneurs, inspectors calculate the tax themselves based on the data they receive from Rosreestr.

You can find out the cadastral value in the taxpayer’s personal account, on the public cadastral map of Rosreestr or in an extract from the Unified State Register of Real Estate.

If you have a standard situation, then to calculate tax and advance payments it is enough to take the cadastral value. But sometimes a special procedure is used, for example, if the cadastral value of a plot has changed during the year, the plot is owned by several persons or is subject to deduction.

Land tax rate

Subjects of the Russian Federation independently set land tax rates. You can find out what rates apply in your region on the Federal Tax Service website.

The maximum bet size is limited and fixed in the Tax Code of the Russian Federation:

- 0.3% - for agricultural land, housing funds, engineering infrastructure, housing construction, personal subsidiary plots and others provided for in paragraphs. 1 clause 1 art. 394 Tax Code of the Russian Federation.

- 1.5% for all other lands.

In regions there may be not two types of rates, but more, since they have the right to come up with separate rates for lands of different categories and types of permitted use.

If tax rates are not established in regional legislation, it must be paid at the maximum rates in accordance with the Tax Code of the Russian Federation.

What types of deductions are covered by the new procedure?

These are several types of personal income tax deductions:

| TYPE OF DEDUCTION | STANDARD of the Tax Code of the Russian Federation |

| Investment deduction in the amount of funds deposited during the tax period into an individual investment account (IIA) | Subp. 2 p. 1 art. 219.1 Tax Code of the Russian Federation |

| Property deduction in the amount of actual expenses for new construction or purchase of residential houses, apartments, rooms or share(s) in them, acquisition of land plots or share(s) in them provided for individual housing construction, and land plots or share(s) in them , on which the purchased residential buildings or share(s) in them are located | Subp. 3 p. 1 art. 220 Tax Code of the Russian Federation |

Property deduction in the amount of actual expenses for interest repayment:

| Subp. 4 paragraphs 1 art. 220 Tax Code of the Russian Federation |

| Social deduction in the amount paid for their education (up to 120,000 rubles, taking into account other social deductions), children under 24 years of age, wards under 18 years of age - full-time, but not more than 50,000 rubles. for each in the total amount for both parents (guardian or trustee) | Subp. 2 p. 1 art. 219 Tax Code of the Russian Federation |

| Social deduction for medical services provided by medical organizations, individual entrepreneurs, individuals, their spouses, parents, children (including adopted children) under 18 years of age, wards under 18 years of age, as well as in the amount of the cost of medications prescribed by the attending physician and purchased using own funds | Subp. 3 p. 1 art. 219 Tax Code of the Russian Federation |