The federal program, under which so-called maternity capital is provided to families with children, has won a positive assessment from the population over the years of its existence, representing a truly effective mechanism for supporting citizens. However, it should be remembered that the certificate represents not only financial assistance from the state, but also imposes certain requirements on its owners. First of all, this is the intended use of the money received, and it is used for payment in non-cash form after submitting the appropriate supporting documents.

What documents will be required?

When allocating shares, ownership of the property is transferred, which requires mandatory state registration. Therefore, first a written agreement on the allocation of shares is drawn up, which must be submitted to the Rosreestr body or the MFC.

The transaction will be executed on the basis of the following documents:

- identification documents of all participants in the transaction;

- an application from the owner, if the allocation comes from the common shared property of the spouses, then from each according to an application;

- legal documents for residential premises (sale and purchase agreement, donation agreement, etc.);

- an agreement to determine the shares of each family member in the property (if the case does not require notarization - in simple written form);

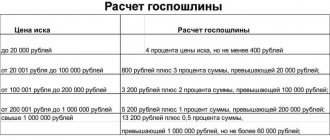

- payment document confirming payment of the state duty (from the allocating owner - 2000 rubles, from others - 350 rubles).

Allocation of share after loan repayment

Within six months after the mortgage is repaid, the legal representatives of minors are required to allocate a share in housing for the children (if necessary). If this condition is not met, the authorized bodies may go to court against the parents, and the maternity capital will need to be returned.

Registration of a share is carried out through the execution of a deed of gift or the signing of an agreement to transfer part of the property to the child. Both methods represent a procedure for the gratuitous transfer of a share in residential real estate.

Both documents contain the following information:

- Information about the participants in the transaction: I.O.F., date of birth, passport details;

- Generic characteristics of the property, its registration number;

- The size of the allocated share;

- If a share is allocated to a minor under 14 years of age, his legal representatives are indicated.

The Law does not stipulate how many square meters should be allocated to a minor; the amount is determined by local authorities. If more children were born in the family during the mortgage payment, then the shares in the apartment are distributed to all children born in a joint marriage between the borrower/co-borrower under the agreement.

What will you need?

The allocation of a share is most often made by a notary. In this case, you will need to pay a state fee depending on the size of the allocated area.

An agreement on registration of shares can be drawn up without the participation of a notary and submitted to Rosreestr independently. But not always. You don’t have to contact a notary if the housing was purchased or built without additional investments of joint funds of the spouses, exclusively with maternity capital funds.

But it is possible to register the share of both spouses as common joint property (spouses - 2/3, child - 1/3), and in this case it is not necessary to contact a notary.

Required documents

The following documents must be submitted to Rosreestr:

- Passports of all parties to the transaction;

- Certificates of marriage, birth of children;

- Documents for the purchased housing: Extract from the Unified State Register of Real Estate, purchase and sale agreement;

- Agreement for the allocation of a share or a gift agreement;

- Receipt for payment of state duty.

It is necessary to write an application for registration of property rights on behalf of all parties to the transaction.

All documents are submitted in original with copies attached.

Agreement on granting minors rights to housing

The agreement is drawn up in the Pension Fund of the Russian Federation before the transfer of maternity capital funds to pay for housing. It contains the obligation of parents to allocate a share to minor children.

The obligation to allocate a share to children lies with the parents with whom there is a proven family connection, i.e. when the child is common in the marriage.

When signing an agreement, the parents of a minor act as his legal representatives if the child is under 14 years old.

The agreement contains the following information:

- FULL NAME. parents, children with passport data, dates of birth;

- Characteristics of the acquired property with generic characteristics;

- Type of ownership, size of shares;

- Documents underlying the transaction;

- Information about MK;

- Condition with redistribution of shares in case of birth of children in the future.

In relation to whom it is not drawn up

In judicial practice, there are often disputes regarding the allocation of a share of residential premises acquired using funds from a family certificate. However, not all of them are subject to satisfaction. Thus, the legislator clearly defined the circle of persons who must be allocated space in such real estate:

- blood relatives or officially adopted children;

- the second spouse, if the home is registered in the name of only one of them.

The following persons are not subject to inclusion in the obligation:

- warded minors;

- registered in the purchased apartment, but not relatives (adopted) in relation to the owner of the MK certificate;

- any other relatives other than spouses (even if they are disabled, incapacitated, etc.);

- children who were not yet born at the time of drawing up the document (not officially adopted);

- ex-spouses.

Example. In 2006, the officially married Kostylevs had a child. In 2008, they divorced, and the child remained to live with his mother; the ex-husband paid alimony for his maintenance. Two years later, Kostyleva remarried and gave birth to a second child, thereby gaining the right to receive maternity capital. She decided to use it to pay off the mortgage on the apartment that she and her second husband acquired during their marriage. After completing the entire procedure, the woman and her husband allocated shares in the apartment to both children in accordance with their obligations. However, Kostylev filed a lawsuit stating that he also has the right to be allocated living space in this apartment, since one of the children is his, he pays alimony. The court rejected these demands from Kostylev, explaining that he is not one of the persons in respect of whom shares in real estate acquired with the help of family capital should be allocated.

How to draw up an agreement?

Depending on the form of common ownership , the process of allocating shares will differ. The property of the spouses acquired during the marriage is their joint property , thus, regardless of which parent became the purchaser of the property, the size of the shares of the spouses is recognized as equal .

However, there are situations when parents own real estate on the basis of shared ownership , for example, there was a division of property or the housing was initially acquired as shared ownership. In this case, in order to be able to allocate the appropriate parts to the children, the law requires that such a transaction be certified by a notary .

To do this, the owners must contact a notary and draw up an appropriate agreement, in which they indicate the share of each family member and its size, for example, 2/6 for each spouse, and 1/6 for children.

Agreement on the allocation of shares in maternity capital without a notary

The participation of a notary in certifying a gift transaction is not necessary in the following cases:

- When alienating shares to children from the sole owner - if the parent is the only one or the housing was purchased before marriage.

- If the property is jointly owned by the parents.

However, on the issue of mandatory certification of transactions under these circumstances, a varied practice . There is an explanation from the Office of Rosreetr dated August 12, 2016, according to which notarization of transactions is necessary only if there is common shared property of the spouses. The position of the Office regarding the alienation of a share in case of sole or joint ownership is that there is no need to certify the transaction by a notary.

This clarification refers to Art. 7 Federal Law No. 172 of 06/02/2016 (the law on amendments), which amended Art. 24 Federal Law No. 122 of July 21, 1997 (registration law), this law establishes the obligation to certify transactions with a notary when alienating shares, but does not clarify whether this needs to be done in cases of joint or sole ownership. Based on the letter from the Department, we can conclude that with this form of ownership, there is no need to notarize the transaction.

The article of the law on registration has lost force since January 1, 2021, however, the circumstances introduced by the law on amendments apply to this day , since they are specified in the current version of paragraph 1 of Art. 42 Federal Law No. 218 dated July 13. 2015 in the same form .

The position of the Office is advisory in nature and in practice Rosreestr may refuse registration in the absence of a notarized agreement. However, in the case of a sole alienation of property , in most cases, the registering authority formalizes the transaction upon submission of a simple written agreement.

The legislation also obliges the allocation of shares to all children, incl. appeared after receiving maternity capital. In this case to formalize the transaction without a notary if, when allocating shares to previously born children, the parents did not change the regime of joint ownership to shared ownership.

The price of drawing up an agreement with a notary

The tariff for a notarial agreement on the allocation of shares in maternity capital is established in accordance with Decree of the Ministry of Finance of the Russian Federation No. 03-05-06-03/59074 dated October 11, 2016 and is 500 rubles , as for certification of transactions the subject of which is not subject to assessment.

However, in practice, notaries do not always take into account the instructions of the Department and set the state duty as for contracts, the subject of which is subject to assessment. According to paragraphs. 5 p. 1 art. 333.24 of the Tax Code of the Russian Federation, the amount of such certification is 0.5% of the value of the property , but not more than 20,000 rubles.

Notarial services of a legal and technical nature are also subject to payment, the cost of which is set by notaries independently, depending on the complexity of drawing up the agreement and the region of location.

Allocation of share before mortgage payment

Before paying off the mortgage, allocating a share may become necessary if the apartment is purchased using family capital. When using family capital, parents agree to allocate a share in housing to their children after repaying the loan, which is certified by a notary.

If we are talking about a facility under construction, it will not be possible to immediately allocate a share. It must be allocated before putting the property into operation or before registering ownership of the housing. When constructing a private household, an additional allocation of a share of the land plot will be required.

The guardianship authorities give consent to the execution of the transaction if the rights of the children are stipulated in the real estate purchase and sale agreement. Therefore, the allocation of shares is required before receiving a loan. Banks, in turn, are reluctant to process transactions with an allocated children's share, since problems may arise with the sale of property that belongs to a minor if the borrowers are unable to repay the mortgage loan.

Conflict resolution is possible in several ways

:

- offer the lender another property as collateral;

- transfer other property to minors;

- turn to loyal lenders working according to AHML standards.

Who should be allocated shares?

When answering this question, one should be guided by clause 4 of Art. 10 of the Federal Law of December 29, 2006 No. 256-FZ. It states that in housing purchased or built using the funds from the MSC certificate, the shares must be allocated:

- the person in whose name the certificate for the MSK is issued;

- spouse of the certificate recipient;

- children, including the first, second, third and subsequent ones.

Accordingly, all family members must become co-owners of the common property.

Liability for failure to fulfill an obligation

In fact, none of the government bodies monitors the fulfillment of the obligation to allocate a share to children after using maternity capital. The guardianship authorities, Rosreestr and the Pension Fund of the Russian Federation require only a nominal obligation. However, in some cases, a judicial procedure for restoring the rights of children may be applied to parents who have not fulfilled the notarial obligation. Typically, the guardianship authorities, the prosecutor's office or pension fund employees, having established the fact of failure to fulfill such an obligation, file a claim with the justice authorities. 100% of such requests are considered not in favor of the parents. Based on a court decision, changes are made to the state register and children are given their own share in housing.

Neither criminal nor administrative liability for an obligation not fulfilled on time is provided for by the legislation of the Russian Federation.

How to allocate shares in a mortgaged apartment?

The allocation of shares in a mortgaged apartment is carried out in accordance with legal requirements.

Step-by-step instruction

- Once the mortgage loan is repaid, the encumbrance must be removed from the collateral. To do this, you should contact Rosreestr with the appropriate application and documents confirming the absence of mortgage debt. After reviewing the documents, the applicant will be presented with a new Extract from the Unified State Register of Real Estate with no encumbrance on housing.

- After this, the apartment owner has the opportunity to allocate a share.

- Drawing up a written agreement with a notary to transfer part of the property to the child or a gift agreement. Documents are prepared for both parents, for the Pension Fund, for Rosreestr. You will need to submit documents confirming the identities of the parties to the transaction, marriage certificates, birth certificates, an extract from the Unified State Register for real estate, and an agreement on granting housing rights to minors.

- Submitting documents to Rosreestr for registration. An application for registration is submitted on behalf of each owner. It is required to provide a complete package of documents as a notary, and a completed agreement or gift deed.

The state duty for the service will be 2 thousand rubles

.

Documents are submitted to the MFC. The registration period for the transaction is 10 days, then the owners receive a new statement containing information about the owners of the apartment (house) where the minors will be present.