Article updated: December 24, 2021

Marina AfanasyevaTax consultant with 5 years of experience

Hello. This article is written about a tax deduction for spouses who bought an apartment only on the secondary market and only with their own money (without a mortgage, financial capital, etc.).

If an apartment was purchased by spouses with a mortgage, they are entitled to two types of deductions - a deduction for acquisition costs and a deduction for expenses for paying interest on the mortgage. I wrote a separate article about this at this link.

Article 220 of the Tax Code of the Russian Federation. Property tax deductions.

A small digression - if you need a free consultation, write to the consultant on the right or call (24 hours a day, seven days a week for all regions of the Russian Federation) Moscow and the region; 8 (812) 425-62-89 — St. Petersburg and region; all regions of the Russian Federation.

What is a property tax deduction when buying an apartment?

Property deduction is determined according to the costs incurred:

- for the purchase of an apartment or its share;

- payment of interest on targeted loans;

- payment of interest on those loans and borrowings with the help of which the refinancing of previously received loan funds was carried out.

At the same time, the maximum cost of purchasing an apartment is limited to 2,000,000 rubles. The property deduction when purchasing an apartment with a mortgage is limited to the maximum cost of purchasing the apartment and the maximum cost of paying interest. The limit on interest costs is RUB 3,000,000.

You cannot receive a deduction if:

- the object was purchased with the participation of budget funds and maternal capital;

- the actual payment was made by the employer;

- the transaction was made with a person who is interdependent for the taxpayer;

- there was no income taxed at 13%.

Property deduction in 2021: changes when purchasing an apartment

Until 2014, the owner could receive a deduction in accordance with the purchased property. After this, a different order was established. Now the owner has the opportunity to use a deduction for his actual costs. If spouses purchase an apartment as joint property, they both have the right to a deduction in the amount of 2 million rubles. for everyone.

Also, from the same time, the taxpayer had the right to “additionally use” the remainder of the deduction amount. Let's look at how this happens using an example.

Example 1

In 2014, Tatyana Timofeevna Polyakova purchased an apartment worth 1,700,000 rubles as an individual property. In 2015, she purchased a second apartment at a price of 3,000,000 rubles, also in individual ownership. Tatyana Timofeevna wishes to take advantage of the property deduction for 2 real estate properties. It is necessary to determine the amount of property deduction for real estate objects.

Solution:

The maximum deduction amount is 2 million rubles. Therefore, a deduction for expenses of RUB 1,700,000. Polyakova T.T. will be able to take full advantage. The amount of personal income tax that Polyakova T.T. will be able to return from the budget will be 1,700,000 × 0.13 (13%) = 221,000 rubles.

According to sub. 1 clause 3 art. 220 of the Tax Code of the Russian Federation, part of the unused property deduction in the amount of 300,000 rubles. can be moved to a second apartment. That is, from the second apartment Tatyana Timofeevna will be able to return 300,000 × 0.13 (13%) = 39,000 rubles from the budget.

Property deduction in 2021 - no changes when purchasing an apartment

Since 2021, changes have been made to the procedure for providing property deductions when selling real estate. Until 2021, it was established that if a taxpayer sold real estate owned for less than 3 years, then he must remit a tax of 13% on sales income. Now this period has been increased to 5 years. For this purpose, Art. 217.1. However, the new rule does not apply to those objects that were received:

- within the framework of inheritance and under a gift agreement;

- as a result of privatization;

- under a contract for lifelong maintenance of a dependent (annuity).

For the above objects the period is still 3 years.

Parents can also distribute the deduction for their children

Both parents or one of them can receive a deduction for children, but only for minors - clause 6 of Art. 220 Tax Code of the Russian Federation. Parents must decide among themselves in what proportion they can increase their deduction due to the deduction of a minor child - more details. Naturally, this can be done if the parents have not received a deduction before - clause 11 of Art. 220 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of the Russian Federation dated March 16, 2015 N 03-04-05/13747.

When distributed, children do not lose their right to subsequently receive a deduction when purchasing other real estate - letters of the Ministry of Finance dated 09/03/2015 N 03-04-05/50743 and dated 08/29/2014 N 03-04-05/43425. When they become adults and personal income tax is withheld from their income, when purchasing other real estate they can return their personal income tax in the form of a deduction.

Here we also do not forget about the maximum 260 thousand rubles per person. It's easier to understand with examples.

Show examples ↓ Example No. 1: In 2021, spouses Alexey and Svetlana, together with their minor daughter Oksana, bought an apartment for 5 million rubles. They registered it as shared ownership for three people, each with 1/3. Both spouses work and pay personal income tax. Each family member will have a deduction of 13% * (5 million / 3) = 216.6 thousand rubles.

Since the daughter cannot receive a deduction, the parents decided to receive a deduction for her share. They submitted an application stating that each parent would receive a deduction for half the cost of the entire apartment. In the statement, they indicated that the expenses of each of the parents were 2 million rubles. Therefore, they each received the maximum 260 thousand rubles.

At the same time, their daughter does not lose the right to receive a deduction in the future - when buying another property or from the same apartment, but only after she starts working and paying personal income tax.

Example No. 2. In 2021, spouses Dmitry and Marina bought an apartment for 4 million rubles. We registered the apartment as shared ownership for four people, i.e. each spouse gets 1/4, and also 1/4 for their two minor children. Both spouses receive an official salary, from which personal income tax is withheld.

Each family member is entitled to a deduction of 13% (4 million / 4) = 130 thousand rubles. Both parents decided to receive a deduction from the shares of their 2 minor children. They submitted an application that each spouse would receive a deduction for half the cost of the entire apartment, i.e. deduction for your share plus for the share of one of the children (1/4 + 1/4 = 1/2 of the apartment). It turns out that each spouse will receive 130 thousand (for his share) + 130 thousand (for the child’s share) = 260 thousand rubles.

Their children do not lose the right to receive a deduction in the future when purchasing other real estate.

Example No. 3. In 2021, a family of three bought an apartment for 7 million rubles. They registered it as shared ownership - 1/3 for each spouse, and the same share for their minor son. Although each family member gets 13% * (7 million / 3) = 303.3 thousand rubles, they can only receive 260 thousand rubles, because according to the law this is the maximum calculated amount per person.

Parents cannot receive a deduction for the child’s share, because they will also receive a maximum amount of 260 thousand rubles for their shares. (13% of 2 million).

Example No. 4. In 2021, spouses Andrei and Olga bought an apartment for 3 million rubles. The apartment was registered as shared ownership only for Olga and their minor son Alexander, 1/2 each. Both spouses officially work and pay personal income tax.

Let me remind you that any real estate purchased during marriage is joint property of both spouses. Therefore, Olga’s 1/2 share is jointly acquired property together with Andrey. Therefore, Andrey has the right to a deduction for half of his wife’s share, i.e. each spouse will receive 13% * (3 million / 4) = 97.5 thousand rubles. deduction. By law, they can distribute the deduction in any ratio, even 100% to one of the spouses.

The deduction amount for their child is 13% * (3 million / 2) = 195 thousand rubles. Because Olga is one of the owners of the apartment, only she can receive a deduction for the share of the child owner. To get the maximum amount of the deduction, they distributed the deduction as follows: 100% of the deduction for the wife’s share was distributed to Andrey (after all, the share is jointly acquired property), and Olga was allocated 100% of the deduction for the child’s share. They simply submitted an application indicating that each spouse would receive a deduction for half the cost of the apartment. It turns out that Andrey will receive a deduction of 97.5 thousand (for his half of the joint share) + 97.5 thousand (for the remaining half of his wife’s share) = 195 thousand rubles. Olga will also receive 195 thousand rubles, i.e. 100% deduction for the child's share.

Example No. 5. In 2013, spouses Sergei and Marina bought an apartment for 4 million rubles. They registered 1/4 as shared ownership for four, i.e. each spouse and their two minor children. We only found out about the deduction in 2021. Because the deduction has no expiration date, they can get it.

Let me remind you that if the apartment was purchased before January 2014, the maximum amount is 260 thousand rubles. designed for the WHOLE apartment, and not for each owner. Therefore, even though each family member will get 13% * (4 million / 4) = 130 thousand rubles, each person will have a deduction of 65 thousand rubles.

In the application for distribution, the spouses indicated that their expenses for purchasing an apartment amounted to 1 million rubles each. Therefore, each of them will receive 13% * 1 million = 130 thousand rubles, i.e. for the maximum amount.

Example No. 6. In 2021, spouses Vladimir and Oksana bought an apartment for 4.5 million rubles. They registered shared ownership for three people - 1/3 for each spouse, and 1/3 for their minor daughter. The deduction for each will be 13% * (4.5 million /2) = 195 thousand rubles.

Vladimir had previously received a deduction for other real estate, so he had already exhausted his right. Those. He can no longer return the deduction for his share, or for the share of his wife or child. Therefore, Oksana indicated in the application for distribution that her purchase costs amount to 2 million rubles. Therefore, she will receive 13% * 2 million - 260 thousand rubles, i.e. the maximum amount. In this case, the child can receive a deduction for his share when he begins to officially work and pay personal income tax.

How to calculate the amount of property tax deduction when buying an apartment

In order to understand the mechanism for calculating the property tax deduction, let's consider a practical example.

Example 2

In 2012, Tatyana Olegovna Kazakova purchased an apartment worth 1,100,000 rubles. The property is individually owned by T. O. Kazakova. The total earnings of T. O. Kazakova for 2012 amounted to 364,038.25 rubles, for 2013 - 351,791.16 rubles, for 2014 - 384,045.62 rubles; for 2015 - RUB 375,212.04. The tax agent (employer) transferred the entire amount of accrued personal income tax to the budget. She does not take advantage of standard tax deductions. It is necessary to determine the amount of personal income tax to be returned from the budget for all years. Kazakova submitted an application for a refund to the tax authority annually after the end of the tax period.

Solution:

The cost of the apartment is less than 2,000,000 rubles, therefore, Kazakova T.O. will be able to return the personal income tax paid on the entire amount of the purchase of real estate. The deduction can be used for actual expenses incurred in the amount of RUB 1,100,000. The total amount of tax that the tax office will pay her for all years of using the property deduction will be 1,100,000 × 0.13 (13%) = 143,000 rubles.

Let's calculate the amount of personal income tax withheld and transferred to the tax office by year:

- 2012: 364,038.25 × 0.13 (13%) = 47,325 rubles.

- 2013: 351,791.16 × 0.13 (13%) = 45,733 rubles.

- 2014: 384,045.62 × 0.13 (13%) = 49,926 rubles.

- 2015: 375,212.04 × 0.13 (13%) = 48,778 rubles.

In 2012, the amount of property deduction will be 364,038.25 rubles. Since it does not exceed 1,100,000 rubles, Tatyana Olegovna will be able to return from the budget the entire amount of personal income tax paid - 47,325 rubles. The balance of the property deduction for the next years will be 735,961.75 rubles.

In 2013, the amount of property deduction will be 351,791.16 rubles. For this year, Tatyana Olegovna will also return the entire amount of personal income tax - 45,733 rubles. The property deduction for 2 years will be 715,829.41 rubles. The balance of the deduction for the next years is RUB 384,170.59.

In 2014, the amount of property deduction will be 384,045.62 rubles. The property deduction for all 3 years is equal to RUB 1,099,875.03. Therefore, Tatyana Olegovna will be refunded all personal income tax for 2014 - 49,926 rubles. The balance of the property deduction for 2015 is 124.97 rubles.

For 2015, the amount of tax to be refunded from the budget will be 124.97 × 0.13 (13%) = 16 rubles.

Examination:

- Amount of property deduction for 2012–2015 = 364,038.25 + 351,791.16 + 384,045.62 + 124.97 = 1,100,000 rub.

- Amount of personal income tax refund from the budget for 4 years = 47,325 + 45,733 + 49,926 + 16 = 143,000 rubles.

The procedure for obtaining a property deduction from the tax office

To receive a property deduction when purchasing an apartment, a taxpayer must:

- Obtain a certificate in form 2-NDFL from the accounting department of your enterprise.

Find out why it is not necessary to put a company seal on 2-NDFL from our material “Stamp is not required on 2-NDFL” .

- Prepare the 3-NDFL declaration.

- Prepare documents and their personally certified copies for the apartment:

- certificate of registration of ownership of the object;

- an agreement on the purchase of a real estate property or its share (or a share participation agreement), an act of acceptance and transfer of the property;

- a lending agreement with a credit or other organization, which is also necessary when repaying interest on the loan.

- Prepare certified copies of payment documents that prove the fact of purchase of real estate and payment of interest on the loan.

- Make a copy of your passport, marriage certificate (if spouses purchase an apartment as joint property).

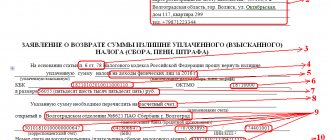

- Provide a declaration, prepared documents and an application for a personal income tax refund indicating the details for the refund to the tax office.

Documents for property deduction when purchasing an apartment are established subclause. 6 clause 3 art. 220 Tax Code of the Russian Federation. When submitting copies of documents to the tax authority in person, you must have their originals with you.

How the tax office returns personal income tax

How much personal income tax was withheld from salary/income during the year will be returned as a deduction next year after contacting the tax office. The money is returned once a year, transferring the remainder of the deduction to the next year. And so on for several years until the entire due amount is returned.

For example, when buying an apartment in 2021, the entire personal income tax for 2021 can be returned in 2021, i.e. next year after purchase. And so on every year until the entire due amount is paid.

If the apartment was purchased a long time ago, but the owner did not apply for a deduction, you can return personal income tax immediately for the previous 3 years, starting from the year the apartment was purchased - clause 7 of Art. 78 Tax Code of the Russian Federation. And if during these 3 years you have not reached the required deduction amount, the remaining amount will be paid in subsequent years.

For example, an apartment was purchased in 2015, but we only found out about the deduction in 2019. This means that when submitting documents in 2021, you can return personal income tax for 2021, 2021 and 2021. If the apartment was purchased in 2021, then in 2021 you can only return it for 2021 and 2021. You cannot return personal income tax a year before purchasing an apartment.

I highly recommend reading each example below to better understand how to contact the tax office and how it pays deductions (personal income tax refund).

Show example No. 1 ↓ Spouses Oleg and Svetlana bought an apartment for 5 million rubles in September 2019. for cash. Registered as joint property. Both officially work and personal income tax is withheld from their salaries.

Although everyone will get 13% * (5 million / 2) = 325 thousand, they will receive only 260 thousand rubles after the deduction. each, because according to the law this is the maximum amount per person.

In 2021, they received 2-NDFL certificates from the accounting department of their employers for the WHOLE 2021. According to this certificate, throughout 2019, 80 thousand rubles were withheld from Oleg’s salaries as personal income tax, and 70 thousand rubles from Svetlana’s salaries. Based on their certificates, they filled out 3-NDFL declarations for 2021, each their own. Plus they wrote applications for a deduction. Each person submitted a declaration, application and documents for the apartment to their district tax office at their place of registration. A desk audit was carried out within three months. After checking, a month later they were transferred to deduct their own withheld personal income tax for 2021, i.e. Oleg – 80 thousand rubles, and Svetlana – 70 thousand rubles. Oleg’s deduction balance will be 260 thousand – 80 thousand = 180 thousand rubles, Svetlana’s will be 260 thousand – 70 thousand = 190 thousand rubles.

In 2021, they again turned to their employers for 2-NDFL certificates, but for 2021. For the entire 2021, 90 thousand were withheld from Oleg’s salaries as personal income tax, and 110 thousand from Svetlana’s salaries. They filled out their 3-NDFL declarations for 2021 and submitted them with documents each to their district tax office. Within 4 months, they were also paid their withheld personal income taxes, only now for 2020. Those. Oleg 90 thousand rubles, Svetlana – 110 thousand rubles. Oleg’s deduction balance is 180 thousand – 90 thousand = 90 thousand rubles, Svetlana’s balance will be 190 thousand – 110 thousand = 80 thousand rubles.

In 2022, they received 2-NDFL certificates for 2021. In 2021, personal income tax of 95 thousand rubles was withheld from Oleg’s salaries, and 90 thousand rubles from Svetlana’s salaries. They filled out their 3-NDFL returns for 2021 and each submitted the documents to their district tax office. Within 4 months, they were returned not their withheld personal income tax for 2021 (95 thousand and 90 thousand), but their deduction balances. That is, Oleg was returned 80 thousand rubles, Svetlana – 70 thousand rubles.

It turns out that in three years after the purchase (2020, 2021 and 2022), the spouses returned their due 260 thousand rubles.

Show example No. 2 ↓ In June 2021, the spouses Vasily and Marina bought an apartment for 3 million rubles. Only Vasily was registered as the property. Both officially work and personal income tax is withheld from their salaries. Both are eligible to receive a deduction.

Since the apartment was purchased during marriage, it is the joint property of both spouses, although it is registered only as the property of Vasily. Therefore, the spouse has the right to a deduction from half the cost of the apartment. Each spouse will have a deduction of 13% * (3 million / 2) = 195 thousand rubles.

In 2021, the spouses turned to the accountants of their employers and received a 2-NDFL certificate for the WHOLE 2021. According to these certificates, in 2019, his employer withheld personal income tax in the amount of 60 thousand rubles from Vasily’s salaries, and 50 thousand rubles from Marina’s salaries.

Based on these certificates, Vasily and Marina filled out 3-NDFL declarations for 2021, each their own. Additionally, everyone wrote an application to receive a deduction and an application to distribute the deduction 50/50. They submitted declarations, applications and documents for the apartment to the district inspectorate at the place of their registration (registration). Within three months, the inspectorate checked the documents, then another month later they were transferred money for the deduction. As a deduction, they were returned their withheld personal income tax for 2021. Those. Vasily – 60 thousand rubles, and Marina – 50 thousand rubles. Vasily’s balance will be 195 thousand – 60 thousand = 135 thousand rubles. Marina’s balance will be 195 thousand – 50 thousand = 145 thousand rubles.

In 2021, the spouses again received 2-NDFL certificates from their employers, only for 2021. His employer withheld 75 thousand rubles from Vasily’s salaries in 2021, and 60 thousand rubles from Marina’s salaries. Each spouse completed their 3-NDFL declaration for 2021 and new applications for deductions. There is no need to submit an application for distribution of the deduction a second time. Submitted all documents to the tax office. After 4 months, their withheld personal income tax for 2021 was returned to them as a deduction. Vasily - 75 thousand rubles, Marina - 60 thousand rubles. Vasily’s balance will be 135 thousand – 75 thousand = 60 thousand rubles. Marina has a balance of 145 thousand - 60 thousand = 85 thousand rubles.

In 2022, the spouses received a 2-NDFL certificate for 2021 from their employers. In 2021, personal income tax was withheld from Vasily’s salaries in the amount of 70 thousand rubles, from Marina’s salaries – 90 thousand rubles. Each spouse completed their 3-NDFL declaration for 2021 and new applications for deductions. After submitting documents 4 months later, they were returned not all of their personal income tax for 2021 (70 thousand and 90 thousand), but the rest of the deductions. Vasily was returned 60 thousand rubles, and Marina 85 thousand rubles.

Over the three years after the purchase (2020, 2021 and 2022), the spouses returned their due 195 thousand rubles. as a deduction.

Show example No. 3 ↓ (with distribution of deductions) In May 2021, spouses Dmitry and Olga bought an apartment for 2.5 million rubles. Registered as joint property. Both officially work and personal income tax is withheld from their salaries. Everyone’s deduction will be 13% * (2.5 million / 2) = 162.5 thousand rubles.

Olga had previously received a deduction for other real estate, so she is no longer entitled to a deduction. Dmitry never received it. Therefore, they decided to distribute the deduction entirely to Dmitry, i.e. he will receive 100% of the deduction, the spouse - 0%. But Dmitry will not receive all 13% * 2.5 million = 325 thousand rubles, but only 260 thousand rubles, because this is the maximum amount allowed per person. More than 260 thousand rubles. no one can get it. Of these, 162.5 thousand rubles. he will receive for his half the cost of the apartment, and 97.5 thousand rubles. for the remainder of Elena's deduction.

In 2021, Dmitry contacted his employer’s accounting department and received a 2-NDFL certificate for the entire year 2021. According to this certificate, in 2019, his employer withheld personal income tax in the amount of 60 thousand rubles from Dmitry’s salaries.

Based on this certificate, Dmitry filled out the 3-NDFL declaration for 2021 and an application for a deduction. The couple also wrote a statement about the distribution of the deduction in proportion - 100% to Dmitry, 0% to Olga. Dmitry submitted declarations, applications and documents for the apartment to the district inspectorate at his place of residence (registration). Within three months, the inspectorate checked the documents, then another month later they transferred the money to him for the deduction. As a deduction, he was returned his own personal income tax withheld for 2021, i.e. 70 thousand rubles The remainder of his deduction will be 260 thousand - 60 thousand = 200 thousand rubles.

In 2021, he again received a 2-NDFL certificate from his employer, only for 2021. His employer withheld 80 thousand rubles from Dmitry’s salary in 2021. He filled out the 3-NDFL declaration for 2020 and a new application for a deduction. There is no need to fill out a new application for the distribution of deductions; it is submitted only once. He filed again with his tax office. After 4 months, his withheld personal income tax for 2021 was returned to him as a deduction, i.e. 75 thousand rubles His balance will be 200 thousand - 80 thousand = 120 thousand rubles.

In 2022, he received a 2-NDFL certificate for 2021. Personal income tax in the amount of 85 thousand rubles was withheld from Dmitry’s salaries in 2021. He filled out the 3-NDFL declaration for 2021 and a new application for a deduction. I submitted documents to my tax office again. After 4 months, the same 85 thousand rubles were returned to him. for deduction. The balance will be 120 thousand - 85 thousand = 35 thousand rubles.

In 2023, Dmitry received a 2-NDFL certificate for 2022. Personal income tax in the amount of 87 thousand rubles was withheld from his salaries in 2022. 4 months after submitting the documents and declaration, he was returned not 87 thousand rubles for the deduction, but the balance of 35 thousand rubles.

In four years after the purchase (2020, 2021, 2022 and 2023), Dmitry returned 260 thousand rubles. as a deduction, i.e. 162.5 thousand rubles. for yourself and 97.5 thousand rubles. for my wife.

Show example No. 4 ↓ In September 2013, spouses Alexander and Daria bought an apartment for 4.5 million rubles. They registered it as joint ownership for two. Only in 2021 did they learn about the deduction and decided to immediately start receiving it. All these years they officially worked. Although everyone will get 13% * (4.5 million / 2) = 292.5 thousand rubles, they can only receive 130 thousand rubles. Since the apartment was purchased before January 2014, 260 thousand rubles are issued for the entire apartment. and the owners divide it among themselves.

Let me remind you that by law they can only return deductions for the last three years after the purchase - for 2021, 2021 and 2021.

In 2021, Alexander contacted his employer’s accounting department and received three 2-NDFL certificates - for 2021, 2021 and 2016. According to these certificates, in 2021, the employer withheld personal income tax from his salaries in the amount of 57 thousand rubles, in 2021 - 55 thousand rubles, in 2016 - 53 thousand rubles. Daria also received three 2-NDFL certificates from her employer over the same three years. According to her certificates, in 2021, the employer withheld personal income tax of 50 thousand rubles from her salaries, in 2021 - 47 thousand rubles, in 2021 - 45 thousand rubles.

Based on their certificates, each spouse filled out three 3-NDFL declarations - for 2021, 2021 and 2021. And everyone wrote one application for a deduction for these three years. They do not need to fill out an application for distribution. They submitted declarations, applications and documents for the apartment to the district inspectorate at the place of their registration (registration). Within three months, the inspectorate checked the documents, then after another month, money was transferred to each spouse for the deduction. BUT Alexander was not returned all of his withheld personal income tax for the last three years, i.e. 50 thousand + 55 thousand + 57 thousand = 162 thousand rubles, and only 130 thousand rubles due to him. You cannot receive more deduction amounts. Same thing for Daria - she was not returned the entire amount of personal income tax withheld for three years, i.e. 45 thousand + 47 thousand + 50 thousand = 142 thousand rubles, and only 130 thousand rubles due to her.

It turns out that the spouses got back the amount of the deduction in one go. That is, in 2021 they returned their personal income tax for 2021, 2021 and 2021.

Property deduction from the employer

The property deduction can be used not only in the form of a refund from the tax authority to the current account of the amount of personal income tax paid. Another option is possible.

To do this, the employee must contact the tax office and perform the following steps:

- fill out an application for a deduction;

- submit copies of the necessary documents certified by the taxpayer to confirm the right to deduction;

- at the end of 30 days, receive a special notification;

- hand it over to your employer.

When calculating wages, such a notification will be the basis for not withholding personal income tax from the employee’s wages.

How is a property tax deduction provided to pensioners when purchasing an apartment?

If the pensioner is a working person with a “white” salary, then there will be no problems with tax refunds. Like other citizens of our country, he will be able to return from the budget the personal income tax paid on wages. But what should non-working pensioners do in such a situation?

The pension is not subject to personal income tax, therefore, it will be impossible to return it from the budget. The opportunity to apply a deduction appears from the year in which ownership of the apartment/share in it arose.

However, if a pensioner does not have income taxed at 13%, then he can transfer the balance of the property deduction to previous tax periods, but no more than 3 (letter of the Federal Tax Service of Russia dated July 19, 2013 No. ED-4-3 / [email protected] ). Moreover, this transfer rule also applies to working pensioners.

Example 3

Alexander Vitalievich Steklov retired in mid-2014. Before this, he worked and received wages taxed at a rate of 13%. After his retirement, he did not work. In 2021 I purchased an apartment. In the same year, I submitted an application to the Federal Tax Service for the return of the property deduction.

Solution:

Alexander Vitalievich can transfer the balance of the deduction to the previous year of purchase of the apartment for a 3-year period, namely to 2013–2015 (letter of the Ministry of Finance of the Russian Federation dated February 12, 2015 No. 03-04-05/6179, Federal Tax Service of the Russian Federation dated August 29, 2012 No. ED-4 -3/ [email protected] ). However, he does not have to submit a zero declaration for 2015 (when there was no income taxed at 13%).

Also learn about innovations that affect working pensioners from our material “New in the legislation on pensions for working pensioners” .

Spouses have the right to distribute the deduction among themselves

Although it is written above that only those who pay personal income tax on wages/income are entitled to a personal income tax refund (deduction), spouses are an exception. Spouses have the right to distribute the deduction in any situation - more details. By default, everyone is entitled to a 50/50 deduction, but it can be distributed in ANY proportion by agreement - paragraphs. 3 p. 2 art. 220 Tax Code of the Russian Federation. For example, 60 to 40, 65 to 35. Up to 100% for the first spouse and 0% for the second. Except when the apartment was purchased before marriage or in a civil marriage.

You can distribute the entire deduction to the first spouse even when - 1) the second spouse does not work, is on maternity leave or works unofficially, i.e. does not pay personal income tax - letter of the Ministry of Finance dated March 29, 2021 N 03-04-05/18320. Moreover, in this situation, the second spouse does not lose his right to a deduction when purchasing other real estate, if he did not previously receive it - letter of the Ministry of Finance dated March 10, 2015 N 03-04-05/12335; 2) the second spouse has previously received a deduction for other real estate, i.e. spent his right - letter of the Federal Tax Service dated April 4, 2013 No. ED-3-3 / [email protected] ; 3) the apartment is fully registered in the name of the second spouse - clause 1 of Art. 256 Civil Code of the Russian Federation, Art. 34 RF IC, letter of the Ministry of Finance dated March 18, 2015 No. 03-04-05/14480. The main thing is that the first spouse, to whom the entire deduction will be distributed, has not previously received it himself for other real estate.

An application for distribution of deductions between spouses can be submitted only once . In the future, spouses do not have the right to change the ratio. Follow the link and completed sample.

We remind you that each citizen can only receive a maximum of 260 thousand rubles. You cannot receive more than this amount - neither for yourself nor for your spouse. Therefore, there is no point in distribution if the apartment was purchased by the spouses for 4 million rubles. and higher. It's easier to understand with the examples below.

Show examples ↓ Example No. 1: In 2021, spouses Alexey and Svetlana bought an apartment for 5 million rubles. They registered it as joint ownership for two. Although everyone will have 13% * (5 million / 2) = 325 thousand rubles, they have the right to receive only 260 thousand rubles. each, because this is the maximum amount issued per person.

Svetlana has a completely “gray” salary, i.e. She doesn’t pay personal income tax, which means she has nothing to return. It makes no sense for the spouses to distribute the deduction entirely to Alexey, because he will already receive the maximum 260 thousand rubles. for your half the cost of the apartment.

When Svetlana starts receiving an official salary with personal income tax withheld, she can get it back in the form of a deduction.

Example No. 2. In 2021, spouses Andrei and Olga bought an apartment for 3 million rubles. It was issued only to Olga. Andrey also has the right to a deduction of half the cost of the apartment, because it was purchased during marriage (jointly acquired property). The deduction for each is 13% * (3 million / 2) = 195 thousand rubles.

Andrey had previously received a deduction for other real estate, so the couple decided to distribute the deduction entirely to Olga, i.e. for her - 100% deduction, for him - 0%. But Olga will not receive 390 thousand rubles. (195 thousand + 195 thousand), but only 260 thousand rubles, the maximum amount by law. Of these, 195 thousand rubles. (its deduction amount) plus 65 thousand rubles. (spouse deduction amount).

Example No. 3. In 2021, spouses Alexander and Natalya bought an apartment as joint property for 3 million rubles. Deduction for each spouse 13% * (3 million / 2) = 195 thousand rubles. That is, 390 thousand rubles. for the whole apartment. Both spouses work and receive an official salary.

Alexander's salary is higher than Natalia's. That is, a larger personal income tax is withheld from him. This means he will return his deduction amount faster. They learned that a person can receive a maximum of 260 thousand rubles. Therefore, they calculated everything and distributed the deduction according to the ratio of 65% for him, 35% for her. Alexander will receive 65% of 390 thousand = 253.5 thousand rubles, and Natalya 35% of 390 thousand = 136.5 thousand rubles.

Example No. 4. In 2013, spouses Sergei and Marina bought an apartment for 4.5 million rubles. They registered it as joint ownership for two. We only found out about the deduction in 2021. Since the deduction has no expiration date, they can receive it. Although everyone gets 13% * (4.5 million / 2) = 292.5 thousand rubles, they can only receive 130 thousand rubles. After all, for apartments purchased before January 2014, they give out a maximum of 260 thousand rubles. for the entire apartment, and not for each owner.

Previously, Marina had already received a deduction for another property, so they decided to distribute the deduction entirely to Sergei, i.e. for him – 100%, for her – 0%. After distribution, Sergey will receive 260 thousand rubles. as a deduction, i.e. 130 thousand rubles. for yourself and the same for your wife.

Example No. 5. In 2012, spouses Vladimir and Oksana bought an apartment for 1.5 million rubles. Registered as joint property. The deduction for each will be 13% * (1.5 million /2) = 97.5 thousand rubles.

Since Vladimir has a much larger official salary than Oksana, they decided that they would distribute the deduction entirely to him. He gets 100% deduction, she gets 0%. Vladimir will receive 97.5 thousand for himself and the same amount for his wife, i.e. only 195 thousand rubles.

Other articles

Who is entitled to a personal income tax deduction and how many times can it be received?

Results

A property tax deduction when purchasing an apartment gives the right to a government refund of personal income tax paid or the right to non-withholding of tax by the employer. Property deduction is provided in accordance with the costs incurred. Since 2014, taxpayers have had the opportunity to “additionally use” the remainder of the property deduction when purchasing other objects.

To receive a property deduction, you must submit to the tax authority specialists a complete package of documents certifying your right to the deduction.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Let's understand the theory

A tax deduction is a refund of the 13% personal income tax paid on salary/income. How much personal income tax has been and will be withheld, the tax office will return as a deduction.

An apartment purchased entirely with your own money is entitled to only one property tax deduction - this is a deduction for the costs of its acquisition . Later in the article I will call it simply - a deduction for a purchase.

The right to deduction arises from the registration of ownership (if the apartment was purchased on the secondary market) or after signing the transfer and acceptance certificate (if purchased in a new building) - more details. The deduction can be received at least 10 years after purchasing the apartment, because it does not expire. And even when the apartment has already been sold.