Many newlyweds who want to buy their own home, regardless of whether it is a house or an apartment, use the service of the most popular bank, Sberbank Mortgage for a Young Family. And if the family has received a Certificate for a subsidy from the state, its full name: “On the right to receive social benefits for the purchase of residential premises or the creation of an individual housing construction project” in accordance with the Subprogram “Providing housing for young families” of the federal target program of the Russian Federation “Providing affordable and comfortable housing and utilities for citizens of the Russian Federation” (hereinafter referred to as Certificate of Social Payment or Certificate of Subsidy), then the double benefit is quite obvious.

Let's not confuse the two concepts:

There is a Sberbank “Young Family” promotion, when one of the spouses is under 35 years old;

And there is a state subsidy provided to young families based on the issued Certificate. How to get it is described below.

In our article we will tell you in detail and step by step about applying for a Sberbank mortgage for a young family with a Certificate of Social Payment for the purchase of a secondary home.

Terms of the Sberbank “Young Family” mortgage program

Sberbank’s “Young Family” promotion, which takes into account the most important aspects in the life of a young couple, namely the birth of a child and assistance to parents. According to the terms of the promotion, it is the parents who are legally co-borrowers.

A mortgage for a young family with a child, according to Sberbank’s terms, is the most convenient and perhaps the only one in Russia that has paid attention to this important and costly aspect. The main advantage of this mortgage promotion is the low mortgage rate. The rate is calculated depending on the down payment, which is at least fifteen percent, which is significantly lower than the rates in other banks.

There is also the possibility of receiving interest rate discounts:

- 0.5 p.p. when one of the spouses is under 35 years old;

- by 0.3 percentage points - if you buy an apartment on the Domklik website;

- 0.3 p.p. — if a participant in the Sberbank salary project;

- 1 p.p. — if you insure the life and health of the title borrower;

- 0.1 p.p. — upon electronic registration of a transaction.

After conducting a small analysis of current mortgage schemes, it becomes obvious that mortgage terms in Sberbank are more favorable for young families than in other banking organizations.

To make an independent loan calculation, you need to go to the Sberbank website and use the online calculator. It is he who will help to correctly calculate the exact amount of payments on a Sberbank mortgage loan provided to young families. If the decision on lending and purchasing real estate is positive, Sberbank issues a mortgage amount. After this, housing must be subject to compulsory insurance.

The program does not exclude the use of maternity capital.

Similar products from other banks

A mortgage under the “Young Family” program at Sberbank is considered the most profitable due to the low interest rate (from 0.1%). Many other banks offer alternative lending programs. You can see them in the table:

| Bank | Loan amount, up to | Bid | Mortgage term |

| up to 30,000 rub. | from 9.8% | up to 30 years old | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

Benefits under the terms of the Sberbank “Young Family” promotion

Based on the numerous benefits of a Sberbank mortgage, young spouses can also take advantage of additional benefits:

- At the time of the birth of the child, you can submit a written request to consider a temporary deferment of payments on the principal amount of the debt; this condition can be used until the child is three years old;

- No additional payment required for early repayment;

- The penalty interest is also relatively minimal and will be no more than zero point five percent of the daily overdue amount.

It is also worth considering that if one of the pair of spouses is a participant in the salary project from Sberbank, then you can make a request to reduce the interest paid on the loan.

Mortgage calculator

The bank's official website provides a very convenient online calculator. With its help, borrowers can calculate the expected financial burden based on their own calculations. After filling out all the parameters, the calculator will instantly give the user an estimated monthly payment amount. Borrowers can receive a more accurate calculation before submitting an application, and the monthly payment, accurate to the ruble, will be provided by the bank’s experts before applying for a mortgage loan.

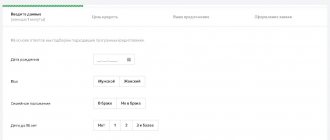

If the user has entered all the data correctly, then the online calculator will give the calculated amount (+/- 5%). What parameters are entered in the service:

- the full cost of the property, or you will need to enter the amount for which the borrower is going to purchase the property;

- it is necessary to indicate the amount of equity capital in the appropriate window - down payment;

- The service will calculate the loan amount automatically;

- the period during which the client plans to use the credit funds;

- you need to check all the boxes, since the bank has a lot of benefits, thanks to which lending conditions can become significantly more profitable;

- All that remains is to indicate the official income - one that the borrower can document.

Online calculator

Which category of citizens can receive a mortgage subsidy?

To receive a subsidy you must:

- The spouses had citizenship of the Russian Federation;

- The age of the spouse (maybe even one) does not exceed thirty-five years, but has already reached twenty-one years;

- Incomplete family, where the parent also has the right to take out a mortgage if his age is not more than thirty-five;

- A down payment is not required, because... the subsidy amount can be used as a down payment on a mortgage, but if the amount of social benefits is not enough to cover 15% of the price of the apartment, then you need to add your own money;

- A married couple is registered in the housing register as in need of improved conditions, namely to increase or purchase housing.

- The family must have an income sufficient to obtain a mortgage amount that can fully cover the average price of real estate in the region.

Recommended article: Otkritie Bank mortgage terms

It is important to take into account that the social program “Providing housing for young families” with the support of the Russian Federation is designed for the purchase of both primary and secondary housing.

Requirements for borrowers

Sberbank imposes requirements on the age, work experience and citizenship of clients intending to take out a mortgage, and for their co-borrowers:

- The lower age limit is 21 years at the time of loan provision.

- The upper age limit is 75 years at the time of loan repayment. This limit is reduced to 65 years if the borrower does not provide documents confirming work experience and income level.

- Minimum work experience is at least 6 months at the current place of work. If the borrower does not receive a salary on a savings account or card in Sberbank, he is subject to an additional requirement - at least 1 year of total work experience over the last 5 years.

- The borrower must be a citizen of the Russian Federation.

The client can attract no more than three co-borrowers to mortgage lending. When the maximum mortgage amount is calculated, their income is taken into account.

Important! If the title co-borrower is married, his wife or husband must be included in the number of co-borrowers (in the absence of a marriage contract).

Electronic transaction registration

The transaction can be registered remotely; the client does not have to personally visit the MFC and other institutions. The procedure takes place in several stages:

- the Sberbank manager sends the necessary certificates to the email address of Rosreestr;

- after receiving the documents, the specialist begins the registration process;

- certificates and statements confirming registration are sent to the client’s email.

The service is provided for a fee. Its cost varies between 8,000-11,000 rubles. much depends on the region where the purchased apartment is located and on the type of real estate.

What is included in the service?

The service includes:

- personal support of the transaction by a specialist;

- remote registration;

- direct interaction with Rosreestr;

- sending completed documents to the client directly;

- issuance of an electronic signature for all persons participating in the transaction.

All government fees are paid from the amount that the client paid once for electronic registration.

What documents should be sent by email?

Rosreestr specialists send the purchase and sale agreement and all necessary extracts (including a certificate from their Unified State Register) to the client’s email address. The new owner of the property can only print out the documents. In this case, they do not lose their legal force.

To make it easier to track the mortgage loan repayment schedule, the client can create a Domklik personal account. Using the service, you can choose the most suitable options for your family.

Loan application procedure

The first step is to collect a standard package of documents that will facilitate the application for a loan. If the client doubts whether he has collected the required papers correctly, then he can call the hotline, where the borrower will be advised and given a complete list of current documents for filing an application. The procedure for applying for a mortgage is as follows:

- Collecting papers to submit your initial loan application.

- Financial company experts respond within 3 business days. After 3 days, a message with the bank’s decision will be sent to your phone.

- The client needs to come to the bank and clarify the amount of approved funds, since the credit institution cannot always give the borrower exactly as much as requested.

- If the amount is satisfactory, then both spouses prepare all the necessary documents at the second stage of applying for a mortgage loan and take them to the bank’s credit department.

- Loan specialists accept documents for review and send them to the head office (usually this procedure takes 5–7 business days).

- After final approval of the property, you can sign a loan agreement. At the same time, employees open a cell or account for transferring funds.

- Immediately after completing the mortgage loan and signing the loan agreement, the borrower should contact the MFC or Rosreestr to register the property. Sberbank also carries out an electronic registration procedure, but it does not apply to all categories of housing.

- After signing the loan agreement, it is necessary to insure the life of the main borrower and the property, as well as transfer the housing to the bank as collateral.

List of documents for participation in the state program

The list of documents is more than standard, there are only a few differences in the number of documents that are easy to provide. When applying for a loan, there are some restrictions, and you also need to prepare a small package of documents:

- Questioning. The application form can be downloaded from the bank’s official portal, or printed out at any nearest branch of the credit institution. Specialists will help with the registration, and if the borrower does not want to ask for help, then he can use a correctly completed example, which is also available on the website.

- A photocopy of the passports of all borrowers and guarantors; husband and wife must be co-borrowers of each other.

- Documentary proof of income. What applies to income: wages, pension, monthly government payments, conducting business or legal activities, etc. The main condition of the bank is that income must be documented.

- Marriage certificate.

- Birth certificates of children.

Here is the entire list of documents that will be needed to approve the required amount of money under the terms of the “Young Family” state program.

If the spouse went on maternity leave

Over the 10 to 20 years that the loan is being repaid, both partners will definitely decide to take full maternity leave. But many citizens do not even know what to do in such a situation, since the spouse’s salary was also included in the family budget.

Here is a standard list of documents that must be submitted to bank experts if the borrower’s spouse has gone on maternity leave:

- A document confirming the birth of a child.

- State certificate of maternity capital (at the birth of a second child). Since the state increases the certificate every year, and some mothers do not use it until the baby is 3 years old, Sberbank will definitely clarify whether the borrower will repay the mortgage loan using maternity capital in advance, or whether both spouses plan to wait until the 3-year period.

- Extract from the Pension Fund of the Russian Federation on the balance of funds on the certificate.

After submitting a package of documents, the family can count on the bank to provide the borrower with a deferment for a period of 1 to 3 years. This condition is legally confirmed and is widely used in practice.

What documents will be required?

The package of documents is standard, except for a few items. The borrower must provide the bank with:

- loan application form. You can visit the bank’s official website or contact the nearest branch of a financial institution;

- copies of passports of spouses, as well as guarantors, if any. The husband (wife) always acts as a co-borrower - this is a mandatory condition;

- documentary evidence of the level of official income. This can be not only wages, but also government payments, interest on deposits, as well as business profits;

- marriage and birth certificates.

In the process of concluding an agreement, you will need to provide an agreement for equity participation or purchase and sale of real estate.

Additional support measures

In addition to preferential mortgages and a subsidy program, young families receive the following government support measures:

- Maternal capital.

- 450 thousand to pay off the mortgage upon the birth of 3 children.

State support measures at the federal level are listed above. Many constituent entities of the Russian Federation have separate regional programs to support young and large families. You can find out about the availability of programs in your city or town from the social welfare authorities.