What is assignment of rights under a mortgage?

Events may occur in the life of any borrower that make it impossible to fulfill their mortgage obligations as before. The causes of financial difficulties are often associated with divorce of spouses, unexpected loss of ability to work, dismissal, or salary reduction.

In such a situation, the mortgage borrower has the right to transfer his rights and obligations to repay the debt to the lender to a third party. This is an assignment of rights under a mortgage. Naturally, you will need to obtain official consent from the bank. To do this, you need to contact the bank’s authorized mortgage center and submit an application with a pre-prepared package of papers. If the credit institution, in the process of analysis, reveals that the assignment of rights is advisable and will not lead to an increase in risks, then the parties will enter into an assignment agreement (the new borrower will buy an apartment from the existing one).

After sealing the assignment contract (assignment of claims under the mortgage) with signatures, the buyer will become the new owner/owner of the living space and the borrower, and the bank will remain the existing lender, taking into account the unchanged key terms of the agreement.

IMPORTANT! A new borrower is subject to standard bank requirements in accordance with the current credit policy regarding age, solvency, quality of credit history and other factors.

The procedure for assigning rights during divorce

The assignment of rights may become necessary in the event of a divorce of spouses, when one wants to withdraw from the agreement and transfer part of the property due to him to the second.

After a divorce, the spouses enter into an agreement on the division of jointly acquired property and the rights to it, which spells out in as much detail as possible all the parameters, actions, as well as rights and obligations in relation to the real estate pledged under the mortgage.

The important nuances of such a transaction are:

- It does not matter who the title borrower is under the agreement.

- An apartment purchased with the help of a mortgage during marriage is jointly acquired property and is divided equally between spouses (unless there is a prenuptial agreement providing for other conditions).

- Assignment of rights under a mortgage is possible only with the consent of both parties.

- The spouse who remains the primary borrower after assignment must have sufficient income to repay the remaining debt.

NOTE! If the solvency of the new title borrower is insufficient, the bank has the right to refuse to conclude such a transaction. We discussed mortgages during divorce in more detail earlier.

How to re-register a contract for a spouse

If a transaction occurs between spouses, then the procedure for conducting it is somewhat different than with strangers. Assignment in this case is impossible, because By law, they are both full owners of the apartment, regardless of who the contract is for.

The reason for re-registering a DDU under these circumstances is very often the tax deduction provided by law to every working citizen who pays a 13% income tax. For example, if the contract was originally concluded with a non-working spouse, he will not be able to receive a deduction. If the contract is reissued to another one that works, a deduction will be made.

In this case, the following scheme is used:

- by agreement with the developer, the contract is terminated;

- after its registration, the developer returns the money paid under the contract;

- a new contract is concluded with the other spouse, who pays its cost on his own behalf.

Whether or not the developer will agree to these conditions is unknown. It is quite possible that for a certain fee he will agree to renew the contract. But in any case, this is his right, but not his obligation, so you will have to negotiate with him.

Transfer of rights to a third party with or without a mortgage

In accordance with 102-FZ, Russian banks have the right to transfer rights to mortgages under existing mortgage loans to other persons. Obtaining consent from the borrower is not required. In the best case, the client will receive notification of the fact of the sale of the mortgage and, accordingly, details for payment.

In general, banks transferring ownership rights to housing or an apartment with a mortgage to third parties is an effective way to attract capital for further lending. It is essentially an asset that its holder (the bank) can sell to a third party. Using the funds received, the lender will continue to issue new mortgage loans to the public.

Small banks often assign mortgage rights to larger market participants. In addition, such transactions are the direct responsibility of DOM.RF partner banks, to which mortgages begin to be transferred several months after the conclusion of the loan agreement.

If the mortgage has not been formalized, then the mortgage debt is assigned to a third party under a standard assignment agreement, under which the new lender will have the right to satisfy its claims at the expense of the collateral value of the real estate. The mortgagee, to whom the rights under the mortgage are transferred, is required by law to comply with all principles of maintaining the borrower’s personal data and trade secrets.

Buyer's risks

Assignment always carries risks. For example, no one is immune from delays in the delivery of a building. In addition, if the initial shareholder is declared bankrupt within 1 year after the transaction, it may be cancelled. The initial shareholder may not notify the developer of the change in the shareholder of the DDU and may not pay him a commission - these problems will also fall on the shoulders of the new owner.

But in general, if this is the purchase of an apartment through the assignment of a mortgage, then the bank undertakes to check the legal risks. He knows all the nuances, all the pitfalls. If the deal is risky, he will notify the potential borrower and invite him to choose another property.

If you want to buy an apartment under a transfer agreement yourself, be sure to assess all the risks. The ideal option is to hire a real estate lawyer to conduct the necessary inspections.

Give your rating

Assignment of a mortgage to a new borrower

Replacing one borrower with another under a mortgage agreement is an extremely undesirable option for a bank. The creditor agrees to it, as a rule, only as a last resort, when there is a risk of long delays or a complete refusal of its obligations by the current debtor. First of all, the bank will offer the client to refinance or restructure the loan, give a deferment on the payment of the principal debt, but once convinced of the distress, there is a chance to replace the payer.

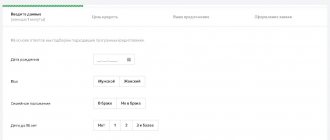

The new debtor must have a stable source of income, sufficient creditworthiness, meet the requirements for age, citizenship, credit reputation and other criteria.

The procedure for assigning a mortgage to a new borrower is carried out by concluding a new loan agreement with the new borrower (under a purchase and sale agreement between the old and new debtor). The bank will have to again accept a package of documents for the new borrower, analyze its financial situation and enter into a transaction with registration in Rosreestr. All this is fraught with additional money and time costs. Therefore, most Russian banks do not want to deal with replacing mortgage payers.

Assignment of rights of claim under a mortgage with DDU

The process of purchasing an apartment in a new building is confirmed by signing an equity participation agreement (DPA). This document also involves the assignment of rights of claim to another person subject to mandatory registration with the MFC or the Registration Chamber.

ATTENTION! The assignment agreement under the DDU can be signed only before the delivery of the object and before the signing of the transfer deed of the premises. After this, it is no longer possible to assign rights.

The assignment of rights of claim under a mortgage with a DDU is a fairly common option and is most often associated with delays in the construction and delivery of the project. However, this is the riskiest way to purchase an apartment in a building under construction.

Possible risks include:

- the likelihood of bankruptcy of the development company (if after the conclusion of the assignment agreement the company goes bankrupt, then the new owner of the property will face long and grueling court hearings with the developer);

- invalidity of the assignment agreement (for example, if official consent is not received from the developer or the cost of the apartment is not paid in full, the assignment of rights may be considered illegal);

- challenging the contract (if the housing was purchased less than a year before the developer was declared bankrupt or was purchased at a reduced price, then there is a high chance of challenging the concluded contract);

- multiple assignment of rights under the DDU (when using so-called “investment memorandums” that are not subject to registration in Rosreestr, an unscrupulous shareholder can repeatedly assign his rights of claim).

Registration procedure

You can start taking out a mortgage by assignment when the property has already been found, or if you are looking for it - it doesn’t really matter. For example, consider a situation where the borrower has not yet decided on the subject of purchase:

- Selecting a bank and submitting an application for a mortgage based on the assignment of the DDU. Usually it is issued under the program of new buildings, but not all banks are ready to finance the assignment. Sberbank and VTB have such offers.

- Collection of documents for consideration of the application, the package includes certificates. The bank decides whether to issue a loan or not. If yes, then based on an assessment of the borrower’s level of solvency, it determines the possible loan amount.

- Having received information about the amount, the borrower begins searching for the object and collecting documents for it. Typically banks give 90 days for this. The package includes documents on DDU, as well as DUPT.

- The bank checks the legal side of the transaction and makes a decision within a few days. Upon approval, a loan agreement is concluded and the DUPT is registered in Rosreestr.

- The seller receives money from the bank, the buyer becomes a participant in shared construction.

Each bank takes an individual approach to issuing mortgages upon assignment of rights. Therefore, look at the requirements and conditions of a particular bank. It can indicate criteria not only for the object, but also for the seller and the developer.

After the developer completes construction and puts the house into operation, the borrower will have to order a real estate appraisal at his own expense from a company accredited by the bank. Afterwards, collect documents to register the apartment as collateral.

In addition, after receiving ownership of the apartment, there is a need to insure it. By law, when taking out any mortgage, the borrower must insure the mortgaged property. Insurance is issued for 1 year and is regularly renewed. If you do not buy a policy, sanctions will not keep you waiting: up to the termination of the loan agreement.

Conditions for the transaction for the assignment of the DDU

The seller or assignor is required by law to notify the developer of the assignment of its rights in writing. To do this, an application or notification is drawn up in a free format, containing information about the seller and buyer of the residential property, and a copy of the assignment agreement and a set of required papers are attached. Among them:

A new buyer is strongly advised to carefully study the developer's business reputation and history of activities. Only if you are completely confident should you enter into a deal.

The procedure for purchasing an apartment through assignment of the right of claim includes the following steps:

- Informing the construction company and obtaining permission for the assignment.

- Preparation of the required package of documents.

- Concluding an assignment (assignment) agreement and registering it with Rosreestr.

- Concluding a mortgage agreement with a bank.

notifications can be found here. You can download the agreement on the assignment of rights under the DDU using this link.

The procedure for conducting an assignment transaction in Sberbank

Sberbank is usually very reluctant to agree to the assignment of rights under a mortgage. He can enter into such a deal only as a last resort, when the current borrower proves the objective facts of his financial insolvency and the advisability of transferring obligations.

The process of conducting a transaction for the assignment of rights under a mortgage agreement looks like this:

- The existing debtor is looking for a new buyer/mortgage borrower.

- The parties contact the financial institution to obtain permission to assign rights.

- The bank accepts documents from a potential borrower and makes a decision on it.

- The buyer and the bank enter into a loan and mortgage agreement, then register it.

- Payment is made between the buyer and seller.

- The new debtor begins to repay the loan in accordance with the signed agreement.

In general, there is a high probability that the client will be denied a mortgage assignment from Sberbank.

FAQ

Is it possible to obtain a mortgage for assignment from an individual?

The seller can be either a company or a citizen. But if it is an individual, pay more attention to the legal risks. For example, are there any children among the owners of the future apartment? If there is a spouse, you need to obtain his consent to the transaction, etc.

Which banks issue mortgages for the assignment of claims?

More and more banks are introducing such mortgage options into their product lines. Most often, citizens turn to Sberbank and VTB. In addition, if you buy claims from a company that is actively involved in this business, it will itself provide a list of banks and help you obtain a mortgage.

When will I have ownership rights?

After accepting the apartment, you go to the MFC and register the property, which immediately becomes collateral for the loan.

Is it profitable to buy a new building on transfer?

Yes, such deals often promise benefits. Sometimes even greater than the offer of the developer himself. Therefore, if you are planning to buy a new building, consider this transaction option.

Is it possible to arrange a transfer if the original owner also took out a mortgage?

It is possible, but only if he has paid off the mortgage.

Sources:

- ConsultantPlus: Federal Law-214 on shared-equity construction.

- DomClick: How to buy an apartment with a mortgage by assignment.

- RBC: Second-hand: how to buy a new building by assigning rights.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

The procedure for conducting a transaction for the assignment of a mortgage at VTB

VTB Bank has a reputation as a lender that does not seek to approve the assignment of a mortgage. As an exception, it may be allowed to formalize a transaction of assignment of rights of claim under a mortgage in the event of a divorce of spouses, as well as in a number of tragic cases when the immediate relatives want to assume the obligation to repay the debt.

In all other situations, the bank will offer restructuring or sale of the apartment to further repay the loan debt.

If the transfer of an apartment is approved, then you need to be prepared for the fact that the new borrower will be subjected to a thorough check. It's unlikely that you can cheat here. The transaction scheme will be similar to that of Sberbank.

A significant feature of VTB is the organization of work on the assignment of military mortgages and loans through the official website of Rosvoenipoteka, where current advertisements for the sale of such apartments are posted.