A mortgage is a security. It confirms the mortgagee's right to receive performance on cash payments secured by the mortgage loan. The mortgage can be sold. It also gives the right to attract additional funds when applying for a mortgage.

Often, banks use securities or mortgages issued with them to obtain a loan from other financial institutions. Along with the transfer of the mortgage by the bank to another financial organization, its right to the collateral property is lost. Also, the lender will not be able to demand the funds necessary to repay the loan. But he can put this money into circulation, making a profit from it.

What it is?

A residential mortgage note is a security backed by a mortgage. It serves to confirm the transfer of the purchased property as collateral. This means that under some circumstances the bank can use the mortgage and receive a share of the profit.

This document can be issued for the following types of objects:

- An apartment in a multi-storey building on the secondary or primary market.

- Private house, townhouse, cottage;

- Suburban area;

- A plot of land with or without buildings;

- Commercial real estate;

- Other types of real estate.

Recovery

What to do if the mortgage is lost?

The mortgagor himself can draw up a duplicate of the mortgage and formalize it, or he can shift this task to the shoulders of the bank. In this case, the borrower will only have to sign the necessary papers, and the mortgage will be restored. But such a situation carries certain risks. Of course, according to the law, it is impossible to make changes to the terms of the mortgage after the conclusion of the contract, and no one with a mortgage will most likely even try to do this. But the loss of the document makes it possible for dishonest financial organizations to “unnoticeably” make changes to the duplicate mortgage note, pretending that this is how everything happened. Therefore, when restoring a mortgage after its loss, it would be a good idea to seek the help of a lawyer before signing a duplicate document.

If you require free legal advice, you can order it directly on our website in a special form.

We are waiting for your questions. Subscribe to updates and support our project on social networks.

Why do you need a mortgage on an apartment?

Both the borrower and the bank need a mortgage on real estate. For the first category of persons, it serves as an opportunity to obtain favorable lending conditions. It does not provide any other benefits for the borrower.

A mortgage is much more important for banking institutions. For them, this document is a guarantee of the return of funds or the recovery of personal property of clients if they cannot fulfill the conditions specified in the contract. A credit institution has the right to sell or transfer a mortgage without asking the borrower’s permission, but simply notifying him about it. The security also serves to attract investment from outside - if the bank has the opportunity to make money on the transaction, then it can give the borrower more favorable lending conditions. Mortgages for banks are a significant financial portfolio, which they wisely use for their own purposes.

Procedure for removing encumbrances from property

When the borrower repays the mortgage in full, the bank loses its claim on the mortgage. The credit institution is obliged to promptly make an entry in the document confirming that the borrower has fulfilled its obligations to the bank. In addition to the recording, the document is sealed and signed by an authorized person. When the encumbrance is lifted, the former client of the bank will receive the mortgage in hand. Today in Russia, an experimental project has launched on the lending market - reverse mortgage. This loan is mainly for the elderly population. The client pledges his living space to the bank and receives a certain amount from the financial institution every month.

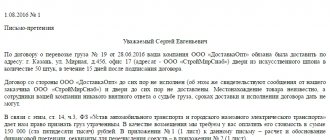

What does a mortgage look like?

In different banks, the type of mortgage may differ in color, size, and fonts. Only the information indicated on the form is uniform - they are approved by Federal Law No. 102 “On Mortgage”.

Example of a mortgage for an apartment

According to the rules, the document contains the following information:

- The name of the document and its identification number - the place where the mortgage note number is written can vary, but in most cases it is located in the header.

- Information about the banking institution - legal data, including checkpoint, tax identification number and other data.

- Information about the borrower - full name, date of birth, information from the passport.

- Number, date of registration and other information about the loan agreement.

- Credit data: term, monthly payment amount, interest rate, etc.

- Requirements from the bank for debt repayment.

- The collateral object and information about it: exact address, cadastral passport number, etc.

- The cost of the collateral (estimated by experts).

- Information about the rights of the mortgagor to the object.

- Signatures of all parties to the agreement, date of execution of the mortgage and loan agreement.

Before final signing, you should always check the data and compare it with the information specified in the loan agreement. If there are different data on loan repayment in the mortgage and loan agreement, priority is given to the information from the first document.

How to apply for a mortgage

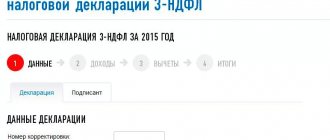

This article describes the standard registration procedure. Please note that as of July 1, 2021, an electronic mortgage has been introduced. To complete it, you must fill out a special form on the Rosreestr website and certify the mortgage with the electronic signatures of the mortgagor, mortgagee and state registrar.

Step #1. Contacting the bank

The signing of a mortgage usually occurs immediately upon execution of a loan agreement. Formally, both parties are involved in its preparation, but in reality everything is filled out by a bank employee, and the client is only required to sign. To conclude an agreement, you should find out what documents need to be provided to the bank - the list of documents differs in different institutions. In general, the documents for creating a mortgage are the same as for registering a mortgage:

- Russian citizen passport . You need a passport of the person in whose name the mortgage is issued. Some banks require that the borrower have a permanent residence permit. You can do it immediately in the purchased apartment.

- Certificate of ownership or extract from the Unified State Register of Real Estate . This is necessary to prove ownership of the property being purchased.

- Property foundation documents. An example of such a document is an apartment purchase and sale agreement.

- Report on the assessment of the market value of real estate . In some banks, employees do this themselves, and in some they ask to contact independent appraisers. The report is required to confirm the market value of the home. The cost of such a procedure is from 2,500 to 6,000 rubles.

- Insurance of an apartment mortgaged in favor of a banking organization . This is a guarantee for the bank to receive the balance of the debt for housing if the collateral is lost, for example, in the event of a fire. If the borrower loses the property for reasons beyond his control, the insurance company will pay the required amount of money to the bank.

The combination of these documents is prescribed in the mortgage. The entire process of completing them does not take more than 30 minutes. Typically, the bank prepares the security in advance along with the loan agreement, and the client only has to sign and register.

The list of documents for registration of a mortgage and loan agreement differs depending on the specific situation, requirements from the bank, and laws in your region. There is no single standard list of documents suitable for every situation. Therefore, you should consult with a realtor or bank about the required list of documents before concluding a transaction.

Step #2. Payment of state duty

The mortgage must be registered simultaneously with the ownership of the property desired to be purchased with a mortgage. Registration of property rights is a paid procedure. Because of this, it is better to pay before registering the mortgage, so as not to visit Rosreestr once again.

Registration of property rights is subject to a fee in accordance with the Tax Code of the Russian Federation. The amount of the duty depends on the form of the person receiving the ownership right:

- For individuals (citizens) – 2,000 rubles .

- For legal entities (organizations) – 220,000 rubles .

Payment of the state fee is made at the Rosreestr cash desk, special terminals or at any banks. Be sure to save and take the receipts with you - if you do not have them, you will not be able to submit documents for subsequent registration.

In fact, you only need to pay for registering ownership. If you make a mortgage without purchasing real estate, that is, for an existing home, you do not need to pay any mortgage costs. The mortgage note is worth nothing. For example, you take out a mortgage for a new home and use your old property as collateral, that is, you make a mortgage on it. In this case, registering a mortgage will cost you free of charge.

Step #3. Registration

Depending on the type of real estate and the purpose of the site, the list of documents for registering a mortgage and ownership rights differs. In most cases, Rosreestr requires the following documents:

- Owner's passport. If the property has several owners (for example, in the case of an apartment being purchased by spouses), then passports of all persons are required. When purchasing real estate on the primary market, you must submit the developer’s documents - their representative will bring them. When buying an apartment on the secondary market, a seller is needed. If one of the future owners is a minor, then you should take his birth certificate and permission from the guardianship authorities.

- Documents confirming ownership. This includes a purchase and sale agreement with signatures, a mortgage issued by the bank, and an act of acceptance and transfer of housing.

- Proof of payment. You must bring the original payment receipt.

The completed package of documents should be submitted to Rosreestr; this can be done at any of its branches. If you are forced to go to the branch at the location of the collateral object, this is an illegal requirement. The department can refuse you only if not all documents have been collected or they are in an unsuitable form (dented or have corrections).

You can submit documents for registration of a mortgage and ownership rights using the MFC. MFC employees themselves send documents to Rosreestr, but the duration of the procedure will increase by several days.

- After accepting all the documents, the Rosreestr employee must issue you a receipt - one copy each for you and the bank.

- The receipt indicates a list of accepted documents, the date of issue of the certificate, as well as contact information. You can use them to find out how long it takes to issue an extract confirming ownership.

- Typically, these documents are processed within 5 business days.

Step #4. Obtaining a certificate

To complete this step, you must come to the Registry at the designated time. Next, provide the employee with a receipt, after which he will issue:

- For the borrower - an extract from the Unified State Register of Real Estate with confirmation of the encumbrance.

- The bank that issued a mortgage on real estate - a mortgage on an apartment (original).

Step #5. Getting a duplicate

You should ask the bank to give you a duplicate of the mortgage note. This is necessary to have confirmation of the terms of the collateral - some banks lose mortgages in the process of work. Registration of a duplicate is a free procedure. The corresponding mark is placed on the duplicate document. You should also ask bank employees to check the information when issuing a duplicate - sometimes there are errors that can play an important role in the future.

Remote services and services

1 The program is being implemented in accordance with Decree of the Government of the Russian Federation dated December 30, 2017 No. 1711 “On approval of the Rules for the provision of subsidies from the federal budget to Russian credit organizations and the joint-stock company “Housing Mortgage Lending Agency” for compensation of lost income on issued (purchased) housing (mortgage) credits (loans) provided to citizens of the Russian Federation with children.”

The subject of the letter must be indicated in the following format: city of loan issuance_full name of the borrower_date of birth. Scans of documents must be sent in good quality only in .pdf format. If it is not possible to send all the documents in one letter, you can send several letters; in the subject line of the letter you must indicate: city of loan issuance_full name of the borrower_date of birth_letter number. You will be notified of the receipt of documents via email.

You may be interested in:: Is there a benefit in Bryansk in connection with the growth of the standard of living for large families

What happens after the mortgage is paid off?

Once the mortgage is paid off, the mortgage is canceled and the encumbrance on the property is removed. This means that after paying off the debt, the banking organization cannot use your property. Repayment of the mortgage occurs within a few days after the mortgage is paid. According to the law, the permissible repayment period is a calendar month, unless other terms are specified in the loan agreement. Some banks offer a paid service for an accelerated mortgage issuance procedure.

To completely remove the encumbrance from real estate, you must complete the following steps:

- Pay off the mortgage in full and obtain a certificate of repayment of obligations.

- Make a request for the issuance of a mortgage and receive it within a calendar month or other period specified in the agreement.

- Come to Rosreestr or MFC and submit a mortgage, a certificate from the bank and an application for removal of the encumbrance.

- Receive an extract from the Unified State Register of Property Rights without encumbrances and a canceled mortgage, which is better to keep.

When can a mortgage be collected?

After the mortgagor has fulfilled his debt obligations, VTB Bank is obliged to return the mortgage to him. The client applies to Rosreestr, where the encumbrance is removed from the mortgaged apartment. The mortgagor, who has fulfilled all the terms of the agreement, thus returns all rights to the apartment in respect of which the mortgage was drawn up.

Look at the same topic: Which banks issue mortgages against maternity capital in [y] year?

From the above it follows that the debtor can pick up the mortgage in two cases:

- If he repaid the loan in full and on time;

- If the full payment of the loan was made by him ahead of schedule.

Useful mortgage tips

Registration of a mortgage and the entire mortgage repayment procedure is a long and complex process, in which there are many nuances. Some of them are worth considering separately.

What to do if the bank does not issue a mortgage after paying off the mortgage

The first thing you need to do is write an application for a mortgage - without it, no one will issue this document. If the application has been written and you have not received the mortgage within the prescribed period, then you should write a complaint to the banking institution or seek help from the judicial authorities.

Is it possible to make changes to the mortgage?

According to the law, the number of amendments to securities is not limited. Therefore, you can change the information in the mortgage in any case, for example, a change of owners or changes in the loan agreement. To do this, you need to contact the bank and inform about the need to make changes, and then go to Rosreestr with a signed agreement and other documents.

How to find out whether a mortgage has been issued

If there is information about the presence of an encumbrance on the property, this does not mean that there is a mortgage. Before buying an apartment, you need to remind the seller that he is obliged to remove the encumbrance from the property. If there was a mortgage, then the period for removing the encumbrance will increase (you need to get permission from the bank), but if there was no mortgage, the procedure will go quickly. You can check the availability of a mortgage directly with the seller or by making a request to the bank that owns the mortgage.

Is it possible to get a mortgage without a mortgage?

Registration of a mortgage is not a prerequisite for purchasing real estate with a mortgage. However, as practice shows, most banking organizations require this security.

What is it like when buying a property under construction?

When purchasing housing that is under construction, the collateral is the rights of claim against the developer. In this case, the mortgagee’s guarantees are the possibility of requiring the developer to fulfill obligations for the construction of real estate.

Cancellation

Until the borrower repays his mortgage debt, the mortgage is kept by the owner - that is, by the bank that issued the loan, or by another organization to which the bank managed to sell this mortgage. The right to own the mortgage is canceled as soon as the borrower pays off the loan. After this, the bank is obliged to return the mortgage to the apartment owner, having previously noted on it the full repayment of the mortgage obligations. You should immediately check that the document bears the bank’s seal and the signature of an authorized representative.

But simply picking up a mortgage from a bank branch is not enough to completely get rid of mortgage obligations. Then the received and signed mortgage must be taken to the executive body, where the registration of rights to real estate is carried out. There, the former borrower must have records about the availability of a loan removed from the database. Only then can the bank’s right to the mortgage be considered completely revoked.