Why do you need a certificate?

A certificate of birth of a child from the registry office is first of all needed so that parents can subsequently receive a one-time benefit. The right to an additional payment is enshrined in Article 11 of Federal Law No. 81-FZ of May 19, 1995. You should not pay attention to the size defined in Article 12 of the same normative act. The benefit amount changes annually due to indexation.

In 2021 and January 2021, 17,479.73 rubles are transferred to families, as stated in Resolution No. 32, issued by the Government of the Russian Federation on January 24, 2021.

The benefit is issued by the Social Insurance Fund or at the place of work of the mother or father upon presentation of a number of documents. The list of those required, as reported in paragraph 28, part 4 of Order No. 1012n, issued on December 23, 2009 by the Ministry of Health and Social Development of the Russian Federation, also includes the birth certificate issued by the registry office. Without a document, it is impossible to receive payment, so the child’s parents will have to visit the specified department without fail.

New in legislation

Federal Law No. 305-FZ dated August 2, 2019 amended Federal Law No. 418-FZ dated December 28, 2017. In this regard, the conditions for providing support to women with children under 3 years of age have changed. Now those citizens whose average per capita income is below two subsistence minimums are also entitled to receive it. Before this, the limit was considered to be a level of one and a half PM. And the period for providing benefits has been extended from 1.5 to 3 years.

Read more: How to calculate family income to receive payments for a child under 3 years old.

Sample certificate

Until October 23, 2021, to fill out the paper, the form provided by Decree No. 1274, issued on October 31, 1998 by the Government of the Russian Federation, was used. Sample F24 was used in the case of children with both parents, F25 - for fathers and single mothers.

On October 24, the sample changed due to the entry into force of Order No. 200, registered on October 1, 2021 by the Ministry of Justice. The regulatory act obligated the authorities to issue a completed new Form No. 1 when registering a newborn. The document reflects:

- full name of the authority that provides the certificate;

- number assigned to the document;

- child details: full name;

- information about mother and father;

- date of birth;

- Place of Birth;

- details of the birth certificate record: date of compilation, number, department that registered the birth;

- date of receipt of the paper by the child’s representative.

A sample certificate is available.

The document is certified by the signature of the head of the department and a special seal.

How to draw up a document

Despite the presence of a standard unified form, the design of form 182n is left to the compiler. Information can be entered into it by hand (with a ballpoint pen of any dark color, but not in pencil) or filled out on a computer, on letterhead (conveniently, the document contains all the necessary details of the employing company) or on an ordinary A4 piece of paper.

It is not necessary to stamp the certificate using a seal, since from 2021 legal entities, as previously and individual entrepreneurs, are exempt from the requirement of the law to certify their documentation using stamps (unless this norm is specified in the internal local acts of the company).

The only condition that must be strictly observed: the presence of “live” autographs of the head of the enterprise (or a person authorized to act on his behalf), as well as the chief accountant (the use of facsimile signatures, i.e. printed in any way, is excluded).

The certificate is usually made in one copy , but if necessary, the employer can issue certified copies of it in the required quantity.

Obtaining a certificate from the registry office

According to the Administrative Regulations, in force since December 29, 2017 on the basis of Order No. 298 approved by the Ministry of Justice, the issuance of certificates is organized exclusively by the registry office that registers the newborn. The issuance procedure is reflected in paragraphs 77.38 to 77.44 inclusive and consists of the following stages:

- A birth certificate is drawn up in two forms - electronic and paper.

- A certificate is issued.

- The document details are entered into a special accounting journal, which remains with the department and is then transferred to the archive.

- The certificate is stamped.

- The document is given to the parent.

- The applicant checks the information provided by the department employee.

- If the information is correct, the child’s representative signs in the highlighted column of the journal, confirming receipt of the paper.

Particular attention should be paid to paragraph 77.42 of the Regulations. The deadline for processing the requested document is indicated. According to the regulations, the procedure takes 10 minutes.

The certificate has a limited validity period - valid for six months from the date of birth of the child. In the future, the document loses its relevance and is not required to be re-received.

Required documents

You can initiate the procedure for issuing a certificate only if you provide a number of documents. The person authorized for registration will require:

- A medical certificate issued by the maternity hospital. It acts as confirmation of the birth of a living newborn.

- Completed application. A sample is provided when you contact the department, but you can do it in advance.

- Passport. Moreover, both the mother and the second parent, if there is one.

- A certificate issued by the registry office upon registration of marriage.

And the additional execution of a power of attorney certified by a notary allows you to issue a certificate to third parties.

Documents for the Social Insurance Fund from the employer

The employer submits documents (information) to the Social Insurance Fund within five calendar days after the employee’s application. They can be submitted:

- on paper or electronically, if the average number of employees does not exceed 25 people;

- only electronically if the average number of employees is more than 25.

When submitting documents on paper, in addition to the main list of papers, you will need an inventory of them. The inventory form is approved by the Federal Social Insurance Fund of the Russian Federation (clause 3 of the Regulations on the specifics of the appointment and payment of VNiM benefits in 2021).

If you submit documents electronically, you only need to submit a register of information. The register is compiled electronically on the basis of data available to the employer and documents submitted by the employee (clauses 1.2, 1.4 of the Procedure for filling out the register of information). In column 19, mark all information that is not included in the register form, but is important when assigning benefits. For example, the name of the district or locality, if the benefit needs to be increased by the district coefficient.

If the employer does not submit all the documents or makes errors during preparation, the Social Insurance Fund will not award benefits. First, he will send a notice to provide the missing information. In addition, the official may be fined 300-500 rubles.

Algorithm of actions in case of loss of a document

The original certificate must be kept by the parents until the submission of documents on the assignment of state benefits. However, any document is easy to lose. And the Certificate from the Civil Registry Office is no exception.

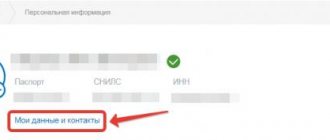

There is no point in refusing due payments if the issued paper was accidentally lost. The legislation does not indicate that the certificate is issued only in a single copy. If lost, you will have to arrange a second visit to the registry office and restore the document. You can make an appointment in advance on the State Services website to see a specialist so as not to stand in line, or order the document right away.

However, despite the absence of a law prohibiting the issuance of duplicates, employees often refuse to issue them. Such actions are absolutely illegal. If the benefit has not been accrued, parents have the right to insist on receiving the document. Issuance is usually organized upon provision of:

- passports of father and mother;

- birth certificate, which was issued simultaneously with receipt of the original of the required certificate;

- certificate of registration of the child at the residence address of one of the parents;

- a certificate proving the registration of marriage between the father and mother;

- confirmation of non-payment of birth benefits. The document is issued at the MFC;

- application for a duplicate.

The documentation included in the list is sufficient to draw up a new certificate. In addition, you will have to pay a state fee for issuing a copy. It is 200 rubles. Payment can be made in cashless form directly on the State Services portal.

Delivery times are more difficult. While the time for filling out the original is clearly reflected in the Administrative Regulations, legislators did not pay similar attention to the duplicate. Therefore, the delivery time varies. Usually, it takes a little time to check the information provided, and the applicant receives the necessary paper on the day of application. But the process can take a week. And if a document is ordered through the State Services portal, delivery may take up to 30 days. Therefore, if you discover that a document has been lost, you should not delay restoring it.

The duplicate is valid and is virtually no different from the original copy. Therefore, the Social Insurance Fund and the employer are obliged to accept the paper provided and, on its basis, assign payment of benefits.

Who pays a lump sum benefit upon the birth of a child?

Since the beginning of 2021, only one benefit payment system has been in effect - direct payments. In this case, the employer accepts a package of documents from the employee and transfers them 5 days in advance to the Social Insurance Fund at the place of registration of the employer. The authority itself will transfer the required amount to the parent within 10 days from the date of receipt of the documents necessary to assign the benefit. Direct payments are a pilot project, which all regions of Russia joined from January 1, 2021.

Previously, along with direct payments, there was an offset system: the employee wrote an application for benefits, the employer paid it from his own funds, and then applied to the Social Insurance Fund to reimburse the expenses incurred. The company had to pay the entire amount within 10 days.

If the parents do not work, then the benefit is paid through the social security authorities.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Deadlines for applying for benefits

Typically, the document is ordered simultaneously with the application for a birth certificate. To receive the latter, a month is allotted after the birth of the child, as reported in paragraph 6 of Article 16 of Federal Law No. 143-FZ, issued on November 15, 1997.

The timing of receiving a duplicate is more difficult. The law does not establish restrictions on the time of application. However, it is worth considering the purpose of completing the edit - the appointment of lump sum payments for the birth. The deadline for applying for such material support is clearly regulated.

In accordance with paragraph 80, found in part 9 of Order No. 1012n, issued by the Ministry of Justice on December 23, 2009, the application is submitted until the newborn is six months old. This means that the certificate must be obtained before this moment. Later, the document is no longer needed.

Maternity calculator

The employer no longer calculates the amount of benefits - this is done by the Social Insurance Fund. The calculator will help you find out in advance the amount of maternity benefits and the monthly child care benefit for up to 1.5 years.

How to use the calculator?

- In the first step, select the benefit type. For maternity benefits, you need to indicate data about the period from the employee’s application (based on a certificate of incapacity for work), and for child care benefits up to 1.5 years, also data about the child. Calculation years will be determined automatically. By default, this is 2 calendar years preceding the vacation. Since 2013, periods of sick leave or parental leave are excluded from them. If there were such periods, indicate them.

- In the second step, the employee’s earnings for 2 accounting years are indicated. These are all payments for the calculation period for which insurance contributions to the Social Insurance Fund are calculated. Indicate the regional coefficient, if provided. Check the box for part-time employment, if any. The insurance period is taken into account if it is less than six months. This is necessary to calculate the average daily earnings and compare them with the calculation of minimum wage benefits.

- In the third step, you will see the final calculation of the benefit amount.

Arbitrage practice

The procedure for obtaining the original certificate and assigning payments based on it does not cause any difficulties. There is no point in going to court for parents. Conflicts arise when a certificate is lost. Refusal by employees to prepare a duplicate or by FSS authorities to accept copies becomes the reason for the filing of claims by the child’s representatives.

Such trials are often covered by the press. The case of 03/01/17 No. A19-10707/2016, considered by the Arbitration Court of the East Siberian District, caused a stir.

The social security authority did not accept a copy of the birth certificate. The employer of the child's mother was denied compensation for the funds used to pay benefits. The organization had to go through three levels to prove the legality of the right to receive payment when providing a duplicate document.

The court ruled: failure to provide the original is not a basis for refusal of compensation, since the fact of the occurrence of an insured event - the birth of a child - is confirmed.

How and where to get child benefit

This also depends on the mother’s employment:

- if she has a job, then she should contact the employer;

- if she is a student, to the university rector’s office;

- if you are unemployed, but are registered with the employment service, go to the social security department;

- if an individual entrepreneur - to the Social Insurance Fund.

Government bodies are gradually transferring the authority to accept documents for social benefits to multifunctional centers, so in the last two cases, it may be wiser to go there straight away. The money will be transferred to the mother's bank account.