Just 10 years ago, promissory notes were almost never found in nature. Our Russian mentality perceives any official pieces of paper as unnecessary bureaucracy, for which a normal person should be ashamed. Or, at least, it’s inconvenient, because “that’s not how decent people do things.” Like, we are related, among ourselves, what should we share...

But debtors begin to sing differently when the date for repayment arrives. The creditor, who was previously ashamed of forcing the person to write a receipt, suddenly realizes that only this document can now help him collect the debt from another person. And he feels like a lucky man who miraculously escaped from great trouble.

What role does a receipt play when repaying a debt?

IOU

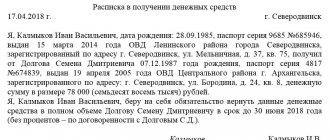

is a document written by hand. The text in the document confirms that one party lent the other a certain amount of money, and that the borrower undertakes to repay the funds within a strictly specified time frame.

The document is direct evidence of the debt. It is a key factor in the legal process. Receipts confirmed by notarization are especially valued, although the law does not force private creditors to contact notaries. But in the legal process, this will help speed things up.

Interestingly, creditors who did not require a receipt also have a chance to return the money. But in this case it will be more difficult to return the money.

The difference in debt collection with and without a receipt is as follows.

| If there is a promissory note | In the absence of a promissory note | |

| Proof | The receipt itself confirms the fact of the debt | Other evidence of debt is needed: recognition by the debtor himself, witnesses, money transfers based on a bank card statement, and so on. |

| Collection process | Through the order | Through enforcement proceedings by bailiffs |

| Deadlines | You can get a court decision in a few days | The process will take a long time, and challenges to higher authorities are possible. |

Without a receipt, collecting a debt is very difficult.

What should the receipt look like?

In order for the receipt to become conclusive evidence of the existence of a debt, you must follow several rules for its execution:

- Place and date of document preparation. We indicate the city and date when it was written.

- Information about the parties. Here you must indicate the full name and passport details of both parties. If an entrepreneur is involved in the relationship, you can additionally indicate his OGRNIP and TIN.

- The amount of monetary debt and currency. Both numbers and the amount in words are indicated.

- Information about the conditions. The justification is indicated - for example, borrowing money, transferring an advance payment, prepayment for some services, and so on. You can also specify obligations - for example, return within 2 months in equal parts. At the same time, return deadlines and other clarifications are established.

If desired, you can specify the purpose of the debt: for example, the purchase of real estate, payment for certain services.Additionally, the creditor has the right to specify a fee for using someone else’s money, as a percentage or a fixed amount. Of course, within reasonable limits, otherwise it will be difficult to recover compensation for use in a lawsuit.

- Return conditions. The creditor may indicate his bank account or set other rules for the return of what was received.

- Signatures of the parties.

The document can be drawn up on a computer and printed on a printer, but it is more correct for the lender if it is drawn up manually - and the borrower must fill out the receipt. If necessary, then, if the debtor refuses to recognize the receipt, a handwriting examination can be carried out, which will confirm that the receipt was written by the person who borrowed the money.

By the way, the latter often then try to disown the debt in court - such nuances as a manually drawn up receipt are very helpful to a conscientious creditor.

Notarization of the receipt will not be superfluous. This service involves additional expenses, but they are fully justified by minimizing risks.

Rules for drawing up a receipt

It is worth noting that this document is considered an analogue of a loan agreement and the terms of the agreement can be specified in it. Namely:

- the amount borrowed;

- time when you need to repay the debt;

- the amount of interest (optional) and the procedure for their payment;

- method of refund (bank transfer, cash);

- other conditions.

What should the receipt look like?

The repayment of a loan on a receipt depends on how well it is drawn up. The document must be in writing. It is signed by the borrower, this confirms that he has received a certain amount. In some cases, the paper is signed by both parties to the agreement. If the procedure takes place in front of witnesses, they must put their signatures and also indicate their passport information in the document.

When do you need a notary?

The participation of a notary in drawing up the receipt is optional. However, this will give an advantage to the one who lends the funds. In particular, when drawing up a document, a notary:

- will confirm the legal capacity of both parties;

- will check the authenticity of passport data;

- make sure that no fraud is committed and no one is threatened;

- will mark the transfer of money.

The disadvantage of notarization is the fact that you have to pay a fee. A percentage of the transaction amount is charged.

5 important points when lending money

Borrowing money is always associated with risks, even when the funds go to relatives or close friends. To minimize risks, it is worth considering the recommendations of lawyers specializing in debt collection by receipt:

- Before drawing up the paper, you need to check the original passport of the person to whom the money is being transferred. This can be done through the online services of the Ministry of Internal Affairs. Also, you should not accept copies or documents of third parties instead of originals.

- It is better to ask for a handwritten receipt. If the document is disputed, it will be possible to resort to a handwriting examination. If the person has already typed the text, you can ask to decipher the full name by hand next to the signature.

- You must provide your passport details accurately. The loan amount must be indicated in both numbers and words.

- The lender must have the original. You can also make two copies.

- It is prohibited to take the debtor's passport as collateral. They may be held accountable for this.

How to transfer money correctly

Typically, if a receipt is issued, the transfer of money occurs in cash. Each party independently recalculates the funds. Then indicate the amount on the paper.

If money is lent by transfer to a bank card, it is advisable to indicate the purpose of the transfer in the purpose of the payment. It is almost impossible to challenge a payment document. This will serve as evidence in court.

Are witnesses needed?

To receive a debt under a receipt, the presence of third parties is not necessary. But if a person wants to attract witnesses, it is important that they see the entire process and confirm the actions with signatures.

For variety, we present below possible methods of collection.

Peaceful solution to the issue

You go to the debtor and try to negotiate a return without going to court.

Let's imagine the situation. You gave a distant relative $20,000 against a receipt for home renovations. The return period is 2 years. Ok, 24 months are up, you wait, but nothing happens. A relative does not answer the phone, although you know where he works and where he lives.

You go to him and appeal to his conscience. He lowers his eyes to the floor and says something like “maybe I’ll give it back later, there’s no money now, his wife is pregnant, the cow is sick, the roof is leaking in the barn,” and so on.

There are two possible options:

- you are trying to get into a position and draw up an additional agreement under which he will return the money to you, say, in a year;

- you understand that no one is going to repay your debt voluntarily, and you are thinking about further actions.

In practice, additional expectations, agreements and attempts to resolve the issue peacefully do not bring results if the debtor a priori does not want to return the money. You will only lose time, your money and faith in people.

Submitting official claims

This is already a more effective method. If your debt is not returned within the stipulated time, you can file a formal claim and send it to the person’s place of residence.

The claim must:

- indicate legal norms for debt claims, referring to them;

- demand a refund;

- indicate further intentions - that you are going to forcibly recover the money through the court.

It is better to draw up a claim with lawyers and send it by registered mail. Be sure to keep the second copy with you and wait for the mail notification - it can be attached to the statement of claim as a supporting document.

If the debtor does not return the money after receiving an official complaint, you can prepare documents for the court.

Appeal to the court of first instance

Proceedings should begin if, within 30 days of receiving the claim, the debtor has not contacted you and has not repaid the debt.

You can contact:

- to the magistrate's court;

- to a court of general jurisdiction.

As a rule, they usually go to the magistrate's court - the case is considered in a shortened time, and the creditor receives a court order. The order has the force of a full court decision. It allows you to start enforcement proceedings and return the money on receipt through bailiffs.

Obtaining a notary's executor's inscription

The return method is used if the debt document was notarized.

All you need to do is contact a notary and submit a package of documents for verification. After a thorough analysis, the notary will issue a writ of execution, with which you can contact the bailiffs at the FSSP.

Contacting third parties to draw up an agreement for the assignment of the right of claim or enforcement

We are talking about collection agencies that professionally collect overdue debts.

Note that this method works 100% only in the bank-collector chain, where the sale of overdue loans is carried out in bulk. Collectors do not like to deal with private creditors.

Typically, cooperation with them is carried out on the following conditions:

- the creditor turns to the magistrate for an order to settle the debt - sometimes collectors make such demands in order to protect themselves;

- the percentage for services will be significantly higher than in the format of cooperation with banks. Collectors may demand at least 40-50% of the money collected from the debtor.

Seeking help from debt collectors will work if the debtor does not pay the money when given the opportunity. Simply put, dynamite in all available ways.

It is possible to collect money through the court using a promissory note

The creditor may initiate foreclosure proceedings based on the promissory note. It is advisable that all the circumstances of the debt registration be indicated there, and that notarization be present.

Contents of the document

When drawing up a document, you must follow the following instructions:

- A prerequisite when drawing up a receipt is to indicate the person’s full name. Otherwise, if a controversial situation arises, such a document will have no force in court.

- A mandatory criterion by which you can recognize which person wrote this receipt is the indication of the borrower’s passport information. Hoping that it is impossible to meet a person with the same name is imprudent. Therefore, the presence of passport data will be indisputable evidence when establishing identity in court.

- If the debtor turns out to be unscrupulous and you still have to look for ways to get him in touch, the receipt must indicate his place of residence, telephone number and other similar information.

- The receipt must detail all the circumstances surrounding the provision of the service. The purpose of its writing should be accessible and understandable. If we are talking about lending a sum of money, then it is necessary to indicate what amount was transferred - in numbers and in words.

- Record the fact of receiving money. Indicating the amount in words is a mandatory criterion that the court pays attention to.

- Indication of the currency in which the money was transferred. If these are not Russian rubles, then it would not be amiss to indicate the rate at which the money should be returned.

- Particular attention should be paid to dates. The full date of preparation of the document and the date of refund or provision of services must be indicated.

- The receipt must be written without crossing out or corrections, so that there are no multiple interpretations.

- You should pay attention to the recipient’s signature in the passport and the one he puts on the document. This will eliminate the slightest doubt of the court about the authenticity of the person.

- The last thing to pay attention to is the pen that will be used to write the document. There are types of ink that lose their brightness over time and smear the text - it is better not to use them. A regular ballpoint pen will do just fine.

If you use the above rules, then if you need to go to court, it will be much easier for the creditor to protect your rights.

The procedure for collecting debt by receipt

The law requires that the claims procedure be followed before going to court. This will prove to the court that at least one of the parties tried to resolve the issue peacefully, and the trial is being used as a last resort.

Classic legal regulation provides for the following stages of communication between creditor and debtor:

- pre-trial procedure;

- judicial procedure for resolving disputes.

To put it in plain language, you need to first warn the person, and then sue the debtor on the receipt. Moreover, many lawyers advise that you MUST comply with the notorious pre-trial order.

But we don't insist. Why? Because the Supreme Court of the Russian Federation, in decision No. 69-KG19-11, directly stated that filing a claim for debt collection by a private creditor automatically constitutes a demand for repayment.

Material on the topic

Sample application for cancellation of a court order You have decided to cancel the court order that the magistrate issued regarding your debt. What should I write in my cancellation application? You don’t have to explain your decision, but simply state that you do not agree with the decisions made in the order. A sample receipt for borrowing money. How to correctly draw up a receipt if you lend money to someone. What needs to be written in it. Does it need to be certified by the signatures of witnesses or by a notary? Without what data the receipt will be invalid and will not be accepted in court.

The Supreme Court came to this conclusion while considering case No. 33-5195/2018, which also involved non-repayment of money on a promissory note. The creditor went to court, simultaneously notifying the debtor about this, but lower courts refused to satisfy the claims. They argued that the woman creditor should have followed the claim procedure before applying for a court order to collect the debt on the note.

The Supreme Court took the side of the creditor. He pointed out to the courts a common mistake: it is important to observe pre-trial procedures in arbitration disputes involving organizations and businessmen. But in civil relations between people, formalities are unnecessary.

What follows from this? It is RECOMMENDED to follow the pre-trial procedure, but it is not mandatory.

Pre-trial settlement

When claiming money against a receipt, there is only one situation where compliance with pre-trial procedure is required without exception: the text of the document states that without claim work, going to court will be considered unlawful.

It is rarely possible to obtain repayment of a debt on a receipt without a trial. In reality, the pre-trial procedure is used only to comply with legal requirements.

How to properly organize a pre-trial claim:

- A claim is drawn up, which indicates the debtor's unfulfilled obligations under the receipt, the amount of claims, references to legislative norms and the requirement to repay the debt.

- Documents for the court are being prepared. If nothing happens within 30 days, the creditor goes to court.

Legal settlement

It involves going to court.

Jurisdiction: the magistrate's court and the court of general jurisdiction.

If the plaintiff chooses the first option, he initiates writ proceedings:

- This will be followed by a simplified consideration of the case within 5 days;

- he will not have to attend meetings;

- the debtor is also not involved in the case;

- consideration is carried out on the basis of the submitted package of documents.

Then a court order is issued and sent to the parties. If no objections are received from the defendant within 10 days, the creditor can contact the FSSP and initiate enforcement proceedings.

A court of general jurisdiction is approached if proceedings are pending, if the debtor has challenged the court order by writing an objection. Such processes differ in duration, the need to attend court and other nuances.

Preparation of procedural documents

In order not to face a refusal to collect a debt on a receipt, you must prepare the documents correctly. You must submit to the court:

- Statement of claim in two copies - the second is sent to the debtor.

- Receipt for payment of state duty.

- Documentary evidence of debt: promissory notes, loan agreements, account statements, a copy of the claim, bank transfers and postal notices.

The key emphasis is on the statement. This is the document that is considered first. How to file a claim?

The statement of claim must include:

- We indicate the full names of the parties, passport details, residential addresses, and contacts.

- We indicate the name of the court to which we are applying.

- In the text of the application we list the violations - delays, lack of payment with references to legislative norms.

- We list the circumstances that arose within the framework of relations with the debtor.

- We provide a detailed calculation of the requirements - the principal amount of debt, accrued interest and remuneration for unauthorized use of loan money.

- We confirm that the claim procedure has been followed.

- We list the contents of the attached package of documents.

You must go to court within the period strictly BEFORE the expiration of three years from the moment the delay arose. This is the statute of limitations for debts. If you miss the deadline, the debtor will be able to send a counter-statement - and it will no longer be possible to receive your money on the receipt; the court will close the case based on the debtor’s appeal.

Cost of debt recovery services

It is recommended to return the money with the help of a law firm. If the debtor does not want to make contact and does not plan to give you the due amount, a lawsuit will most likely be required. Other methods rarely work.

Where and to whom will need to be paid as part of debt collection:

- Collection agency. If you use the services of debt collectors, you will have to share part of the collected debt on a receipt. In reality, such cooperation rarely occurs.

- Your legal representative. If you do not want to personally deal with this matter, you can involve a legal representative in the process - for example, a lawyer, and pay for his services.

- Lawyers. You can use their services one-time - for example, order only consultations or the preparation of an application; Or you can seek comprehensive legal support.

The calculation of the cost of collection is carried out personally, and depends on the amount of debt, the correctness of the debt receipt, the measures taken, the defense strategy and other factors.

In what situations must a receipt be written?

Guided by the provisions of part one of Article 808 of the Civil Code of the Russian Federation, when concluding a loan agreement for individuals, it is necessary to use a written form if its amount exceeds ten times the amount of the minimum wage.

If the lender is a legal entity, then this amount no longer depends on the minimum wage and is equal to 1000 rubles. When collecting a credit debt using a receipt of a generally recognized form, there is no mandatory requirement to enter passport data. At the same time, for better reliability it is still worth indicating them. Filing a statement of claim to the court regarding the collection of credit debt under this document occurs in accordance with the general procedure established by Article One Hundred and Thirty-First of the Civil Procedure Code of the Russian Federation.