Methods and options

Exchange (in the literal sense) is now extremely rare, so such transactions are carried out through purchase and sale . It all depends on the initial parameters of the property that needs to be exchanged, and the financial capabilities of the initiators of the exchange transaction.

Obviously, you can’t get two from one living space without an additional payment (read about drawing up an exchange agreement with an additional payment). In addition, you need to take into account the number of people who need to be accommodated. Even people far from the real estate industry know that are in greatest demand .

But apartments with three or more rooms are quite difficult to sell. Therefore, you need to be prepared for the fact that the exchange process may take a long time.

The difficulty also lies in the fact that you need to try to make an exchange operation at the same time , that is, find a buyer for your living space and the real estate options that you plan to purchase.

Having available funds will be a good help . For example, real estate options that are suitable for purchase and further residence have been found, but their owners ask for an advance or a deposit.

And for the property being sold, which is planned to be exchanged, a buyer has not yet been found so that the advance accepted from him can be paid for the options he likes.

The operation of exchanging housing with parents is complex, and you need to prepare for the fact that one of the participants in the chain may change his mind at the last moment .

Therefore, until the very last day you need to leave questions related to the transfer of funds and deregistration.

The exchange operation is also called a counter purchase .

Before you begin to implement it, you need to think through everything carefully.

When exchanging a two-room apartment, it is possible to get two small rooms with an additional payment or a one-room apartment and additional money.

When exchanging a three-room apartment , you can get two one-room apartments, but in remote areas, and one of them may not be comfortable.

There is the option of moving from a big city to the region, then the quality of the purchased housing will be significantly better (read about intercity housing exchange). For example, this option may be suitable for elderly parents.

In any case, when making an exchange, additional costs will be required.

Required documents

When the entire transaction chain is built, you need to prepare a number of documents (it would be better if you do this in advance):

- title documents for the real estate being sold, which indicate on the basis of what event the ownership right arose (sale and purchase agreement, deed of gift, inheritance certificate, etc.), as well as a certificate of ownership (if available);

- technical and cadastral passport - which indicate the parameters of the property being sold;

- a certificate from the Unified State Register - the owners are listed there;

- an extract from the house register (not always required);

- permission for the transaction from the guardianship and trusteeship authorities (if among the owners there are minor children and incapacitated parents);

- a certificate from the Federal Migration Service stating that all residents of the premises were previously deregistered;

- consent to the transaction of the spouse (if the property is jointly acquired), certified by a notary;

- consent to the transaction of other co-owners of the property, in the case of shared ownership, also certified by a notary;

- the purchase and sale agreement itself;

- passports of all participants in the transaction;

- receipt of payment of state duty;

- receipts confirming the absence of debt on utility bills;

- other documents (at the discretion of the registration authorities).

from the sellers from whom real estate is purchased for resettlement.

Documents for the transaction can be submitted:

- to a notary - this guarantees the correct execution of documents and calculations, reduces the time required for registering the transfer of ownership, but requires additional costs. The notary will send documents to Rosreestr through a special program;

- to the Rosreestr office;

- to the office of the multifunctional center, this will save you from wasting time in line, but will increase the registration period;

- in electronic form through the Rosreestr website, but an electronic signature will be required;

- send by mail, only possible in case of a notarized transaction;

- call a Rosreestr employee to your home.

How are real estate transactions involving minors carried out?

It is important to know that children's rights are protected by law, so they must be controlled by parents or other legal representatives. In turn, the actions of parents, guardians or trustees in managing the property of children fall under the jurisdiction of the guardianship and trusteeship authorities. Moreover, the age of the minor affects the scope of powers in transactions. What categories of minors exist? When making a transaction with real estate owned by a child, you need to know that the scope of the rights of a minor owner differs significantly from the scope of the rights of an adult. It is necessary to take these features into account when making a real estate transaction, otherwise it may lead to the invalidity of the transaction. Minors, that is, persons under 18 years of age (the age of majority), are divided into two categories (Articles 26, 28 of the Civil Code of the Russian Federation): - persons aged 14 to 18 years; - persons under 14 years of age. The first category of persons, unlike the second, is endowed with greater rights when concluding real estate transactions. Children aged 14 to 18 years can make real estate transactions, but only with the written consent of their legal representatives - parents, adoptive parents or trustees. If the transaction was made without the consent of the child’s legal representatives, it may be declared invalid by the court (Clause 1, Article 26, Article 175 of the Civil Code of the Russian Federation). Persons under 14 years of age (minors) do not participate in transactions; their interests are represented by parents, adoptive parents or guardians (Clause 1 of Article 28, Article 172 of the Civil Code of the Russian Federation). Moreover, in both the first and second cases, legal representatives must first obtain permission from the guardianship and trusteeship authority (clause 2 of article 37 of the Civil Code of the Russian Federation; clause 3 of article 60 of the RF IC; part 1 of article 21 of the Law of April 24. 2008 N 48-FZ). Obtaining preliminary permission from the guardianship and trusteeship authority. Real estate owned by a child is exclusively his property. Parents, adoptive parents and guardians cannot of their own free will sell, exchange, donate, lease, divide or allocate shares from the child’s property without the prior permission of the guardianship and trusteeship authorities (clause 1, article 28 of the Civil Code of the Russian Federation; clause 3, article 60 RF IC). In this case, the preliminary permission issued by the guardianship and trusteeship authority, as a rule, contains a certain condition. For example, the acquisition of other real estate into the child’s ownership to replace the alienated property. This condition must be met before documents on the alienation of the child’s property are submitted to the registration authorities. It will not be possible to circumvent this condition, otherwise registration of the transaction will be refused. Without the prior permission of the guardianship authorities, the guardian does not have the right to make, and the trustee does not have the right to give consent to, transactions for the alienation of the ward’s property, including: - exchange or donation; — leasing (rent); — renting out for free use or as collateral; - entailing the renunciation of the rights belonging to the ward, the division of his property or the allocation of shares from it; - any other actions leading to a decrease in the value of the ward’s property.

Please pay attention! Preliminary permission or refusal to issue it must be provided to the child's legal representatives in writing no later than 15 days from the date of filing the relevant application with the guardianship and trusteeship authority. Refusal to issue a preliminary permit may be challenged in court (Part 3 of Article 21 of Law No. 48-FZ). Notarization of the transaction. The final requirement is mandatory notarization of the purchase and sale agreement, if the owner or participant in the common ownership of the real estate being sold is a minor. Failure to comply with the notarial form of the transaction entails its nullity (i.e. invalidity). Submission of documents for registration. Since the purchase and sale agreement for an apartment, the seller (one of the sellers) of which is a minor, by virtue of Part 2 of Article 54 of the Federal Law of July 13, 2015 N 218-FZ “On State Registration of Real Estate” is subject to notarization, state registration of rights on the basis of such agreement can be applied by the notary who certified this agreement, or any of its parties. You can submit a package of documents for registration of a transaction involving minors in several ways: - in person at multifunctional state and municipal centers; — in person as part of a field service; — remotely using a single portal of state and municipal services or the official website of Rosreestr. A prerequisite for submitting documents electronically is the presence of an enhanced qualified electronic signature; — in person at the offices of the Federal Cadastral Chamber of Rosreestr (according to the extraterritorial principle); — by mail with a list of the contents and a notification of delivery to the territorial body or Rosreestr office at the location of the property.

The article material is taken from open sources

Do you have any questions for your lawyer on this topic?

Ask them right now here, or call us by phone in Moscow +7 (499) 288-34-32 or in Samara +7 (846) 212-99-71 (24 hours a day), or come to our office for a consultation (by pre-registration)!

Children's rights

Difficulties in sharing living space with children are associated with the state protection program. Minors are not independent and depend on adults. By law, children have the same property and housing rights as adults. They can:

- inherit an apartment;

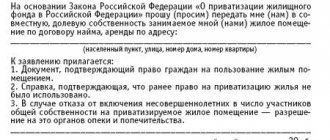

- take part in privatization;

- receive real estate as a gift.

It should be noted that a minor can own a home regardless of age. Registration of real estate provides a guarantee that by the age of 18 a citizen will have his own living space.

Important! Parents or representatives cannot dispose of children's property without obtaining prior consent from the relevant authorities.

Accordingly, in order to sell an apartment or exchange real estate in which a minor owns a share, a guardian or parent must obtain permission from the guardianship authorities.

Exchange of an apartment with a minor owner

If a minor owns the property, in order to exchange privatized housing , you need to submit a request to the nearest department of the guardianship and trusteeship authorities, whose employees are obliged to ensure that the living conditions of the minor do not worsen:

- in the new housing the square footage should be no less than in the previous one;

- moving from comfortable housing to a house without amenities is impossible;

- the location of the new living space is taken into account; consent to exchange from the city to the suburbs will not be given;

- the cost of apartments should be approximately the same.

Children cannot dispose of property themselves until they reach adulthood. Persons under 14 years of age do not participate in transactions. Official representatives speak on their behalf. Citizens aged 14-18 years have the right to engage in real estate transactions, but must provide written parental permission.

Procedures with living space registered in the name of a person who has not reached the age of majority can only be carried out with the permission of the guardianship and trusteeship authorities. If the court recognizes the legal capacity of a 16-year-old person, he receives the right to manage housing independently. You can get a decree if a person started working before reaching adulthood, started a family, lives separately, and does not depend on his parents.

The rules for exchanging an apartment with a minor owner apply not only to real estate where the minor is the owner, but also to the living space where he is registered.

If children do not own housing or a share in it, but only have registration, there is no need to coordinate the operation with any authorities. It is necessary to deregister them in advance with the Office of the Federal Migration Service and, by agreement, register them with relatives.

Important! One of the parents must go through the registration procedure together with the minor, since the child cannot live separately.

Processing times and costs

The processing time and cost will depend on where you are submitting the documents:

- Through a notary – 3 working days; the cost of services consists of a fixed part, the cost of technical work and a percentage of the transaction price (varies from 0.3% to 1%). The fixed part and technical services may be different for each notary.

- Through the office and website of Rosreestr - 10 working days; the amount of state duty will be 2000 rubles; The cost of calling a Rosreestr employee to your home is different in all regions.

- Through the MFC - on average 13-15 working days; You only need to pay the state fee (2000 rubles).

- Delivery times are quite difficult to determine; this method of registering the transfer of property can hardly be called reliable; the cost of Russian Post services depends on the weight of the envelope with documents (300-1000 rubles).

obtain a certificate of ownership at the Rosreestr office or at home by calling an employee of this institution for an additional fee.

Buying an apartment with registered children - risks for the buyer

It is especially worth weighing the pros and cons if you are purchasing an apartment in which the entire family of the sellers is registered and they have nowhere to leave before purchasing a new home. In this case, the buyer’s risk lies in the lack of guarantees that the parents-sellers will turn out to be conscientious people, will subsequently buy an apartment for themselves that will not worsen the living conditions of their children and move there.

Judicial practice knows many cases when new apartment owners had to go to court with a claim to recognize the former owners as having lost the right to use the apartment and being deregistered. Particularly problematic are situations when new housing is purchased using maternity capital funds. The risk of getting bogged down in lengthy legal proceedings in such cases is especially great.

In addition, in situations where children are the owners of an apartment or a share in it, in accordance with Part 4 of Art. 292 of the Civil Code of the Russian Federation, the transaction must be executed with the consent of the guardianship and trusteeship authority (local administration).

One of the most effective ways to insure yourself against risks when purchasing an apartment with registered non-owner children is title insurance of the purchased property . In this case, the buyer can count on the insurance company to pay the entire cost of the apartment if in the future, for one reason or another, the right to it is lost. The obvious disadvantage of this option is the high cost of insurance.