Rights of minor children to an apartment

The rights of minor children to residential premises are protected by Russian legislation.

This leads to restrictions on the opportunities provided by mortgage lending. Mortgage banks do not take property owned by minors as collateral. This means that in order to take out a mortgage loan secured by an existing residential property, its owner must not be a minor. You cannot use an existing residential property as a down payment if the owner is a child or even if he is simply registered in this premises.

To ensure that the child does not lose his property irretrievably, the guardianship and trusteeship authorities exercise control. It is these bodies that give permission to conduct transactions with real estate (if its owner is a minor).

If a child only has a registration in the residential premises being sold, then there is an option to re-register him with someone close to him - until the moment of resale.

If the child is the owner of the residential premises being sold, then the guardianship authorities may issue permission to allocate the minor’s share of the property in the new residential premises (after the mortgage loan is repaid. You can find out whether it is worth paying off the mortgage early here).

There is another, more complicated way - exchanging shares of property with a relative. Thus, the child will have a share of ownership in the apartment of his grandfather, grandmother, and so on (in this case, only adults will be the owners of the apartment being sold). In this case, it is worth considering that this option is only possible if the new share is no smaller in size.

There is another way - if there are no accommodating relatives: this is the sale of existing housing, the purchase of something small. In this case, a mortgage loan is not taken out (the child is provided with the necessary own space). The remaining difference from the sale is used as a down payment to obtain a mortgage.

All these nuances do not in any way relate to the issue of child registration in residential premises (if it was purchased with a mortgage loan). Registration of a child in such an area is allowed without problems.

There are also positive factors in the “mortgage – children” connection. When the second and subsequent children are born, the parents become the owners of maternity capital. It can be used to pay off a mortgage loan (or as a down payment to obtain one). And Sberbank’s “Young Family” program says that upon the birth of a child, the borrower can be given a deferment in repaying the main debt or the loan term can be extended (until the child is three years old).

Conditions for respecting children's rights when purchasing an apartment

The conditions specified in the permission of the Guardianship and Trusteeship Authorities must be complied with without fail (!). This is, first of all, in our (the Buyer's) interests. Therefore, it will be we who will have to monitor their implementation by the other party to the transaction.

In practice, to take into account the rights of the child, as a rule, an alternative apartment is purchased, in which the child is allocated a share (no less than the one he had in the sold apartment). Or a bank account , and part of the money from the sold apartment (the amount is established by “Guardianship”) is transferred by the Buyer to this account. The second option is possible if the child has somewhere to live other than the apartment for sale.

In general, to understand the principle, the rights of minors are considered infringed (violated) if as a result of the transaction there is a decrease in the value of the child’s property (his share in the apartment) and/or a deterioration in his living conditions. “Guardianship” is designed to ensure that this does not happen.

But God protects those who are protected, so it won’t hurt us to keep an eye . After all, if something happens, problems may arise not for Opeka, but for us. How to trace? Well, for example, make sure that the Seller actually buys another apartment to replace his own and allocates shares of ownership there to the child.

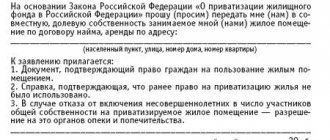

♦ Example of requirements of the Guardianship and Trusteeship Authorities ♦ (Click! And a pop-up window with an example will open)

And even in the case when a minor child only registered (registered) in the apartment and does not have ownership rights in it (i.e. when formal permission from the Guardianship and Trusteeship Authorities is NOT required), it is still better for us as the Buyer to find out where the child is before the transaction will be registered subsequently, and whether his living conditions there will worsen. Or, discharge such a child BEFORE the transaction (for example, to relatives), and make sure that he will live there in decent conditions and legally.

A good option would also be the case when such a child (not the owner), as a result of an alternative transaction, would acquire a share in the ownership of another apartment. Then he obviously receives more than he had before, and it will not be possible to present a claim of infringement of the child’s rights here.

How do alternative transactions with apartments take place? What is the procedure there? – see the link.

Child and mortgage

The child itself will not change anything - the bank, when making a decision on issuing a mortgage loan, does not divide clients into “children” and “childless”. The bank only tracks the borrower's income level. It’s a different matter if the family already owns an apartment, upon the sale of which it will be possible to make a down payment.

If a minor lives in this residential premises as a member of the owner’s family (that is, has a regular residence permit), then you can buy, sell and pledge the acquired property as usual. It’s another matter if the child is the owner of the apartment or a share in it. Then the real difficulties begin.

Protecting the child as an owner

A transaction involving a minor is complex, as there is a conflict between banking interests and the guardianship authorities. To sell an apartment, the share of which belongs to a child in accordance with an article of the Civil Code of the Russian Federation, it is necessary to obtain permission from the guardianship authorities. Basically, the rights of minors are protected by departments of the district administration or other divisions of local self-government bodies.

To obtain their consent, it is necessary to collect certain documents:

- Parental passports

- Marriage certificates

- Birth certificates of children

- Title documents for both apartments being sold and purchased

- Certificates of estimated value and cadastral passports

If the child is already 14 years old, his consent to conduct this transaction is also required. This package of documents is sometimes much larger than the package required to complete the purchase and sale transaction itself.

But even after this, the guardianship authorities may refuse to carry out the transaction. After all, according to common sense, if an unencumbered one-room apartment is exchanged for a more spacious one, but mortgaged to the bank, this can also be regarded as a deterioration in the child’s living conditions. A default can always happen, and the child will remain on the street, and the guardianship authorities have no right to allow this. Municipal employees, as a rule, are sensible people and should understand that a small risk in this case is justified - otherwise the family is unlikely to ever be able to move into a normal apartment. Therefore, most often consent is still given.

“A lot depends on the type of permission issued by the guardianship authorities. The result is also influenced by the quality of preparation for the meeting with municipal authorities, as well as the specific district, specialist and even the application form,” says the general director

"First Mortgage Agency", Maxim Eltsov. Permissions vary. The first provides the option of allocating a new share of the property to the child after the mortgage is paid off. The second permit requires this to be done immediately, at the moment when the purchase and sale agreement is concluded. The first method is more convenient, as the bank will issue a mortgage loan sooner. But the second method, according to Maxim Eltsov, is used much more often.

Banks are against this development of events

Because of the second option, problems arise with banks. Many people refuse to accept residential premises as collateral if one of the owners is a child. “We do not allocate the share due to minor children. This is only because it is impossible to be responsible and allocate a share to a minor in the event that his parents, bank borrowers, suddenly do not service their mortgage loan (and the apartment is sold),” this was the answer given by the head of the mortgage center of the St. Petersburg branch "Promsvyazbank", Alexander Zhestkov. Credit organizations behave cautiously, because, as current Russian legislation states, if the borrower defaults, selling an apartment with a child’s share will be a very difficult process.

The problem is solved by excluding from the pledge scheme real estate owned by a minor. For example, other real estate can become collateral if the family has one. There is an option with a consumer loan for additional payment when exchanging housing. But such a loan is smaller than a mortgage. And it is more expensive - approximately 18-22% per annum versus 12-14% for a housing loan.

There is also this option: if the size and price of the premises allow, then you can sell it and buy a small house in the name of the child. The difference in this case is the down payment. At the same time, the child’s share should not decrease. The purchased property can be rented out - rental payments will cover some of the costs of servicing the mortgage loan.

Finally, the child can receive his own share in other real estate. This could be an apartment or a grandparent's house. The guardianship authorities will give consent to the sale of housing if relatives give the child a share in their apartment. In such a situation, it is possible to obtain a mortgage loan secured by a new home, in which the child will no longer be the owner.

Real estate transactions and minors

We have a one-room apartment. Owners - 12/100 me, 88/100 ex-husband. I and my small child, who I share with my ex-husband, are registered and live in the apartment. I have no other property. My husband offers me to buy his share at the market price (there is a notarized offer). Naturally, I don’t have this money. According to the Civil Code, if I refuse, he can sell his share to third parties. Question: 1) Should the rights of a minor be taken into account (if strangers move in, they are infringed). Is it possible to prohibit a transaction, taking into account the rights of a minor? 2) Only isolated premises can be sold in a residential complex. Why then do such transactions take place?

1) The rights of your child in the pre-emptive right of purchase are not taken into account; this right belongs only to the owners, regardless of their legal capacity. Therefore, the deal cannot be prohibited. 2) The Housing Code of the Russian Federation does not contain a norm allowing the sale of only isolated residential premises. In addition, the regulation of transactions is within the competence of civil, not housing legislation. And the Civil Code of the Russian Federation allows you to sell a share in an apartment, even if an isolated room is not assigned to it. That's why deals like this happen. Another thing is that the new owner will be forced to somehow agree with you on the procedure for using the apartment, and if agreement is not reached, this issue will be resolved by the court. So, there are not many people willing to buy such a product, and they give the price for it much less than the market price.

Is it possible to challenge the fact of privatization if at the time of the procedure one of the family members was under 18 years old and on this basis was not included in the list of owners? If only in court, then what documents do you need to have to file a claim in court? How long can this process take?

This is a violation of the law, and such a privatization agreement is void. But only the court can apply the consequences of a void transaction. Documents: privatization agreement, registration certificate, and certificate of registration on the day of privatization, the claim itself and a receipt for payment of the state duty. The duration of the process depends on the workload of the court and the individual judge. Don't count on less than six months.

Two years ago, a room was purchased in a communal apartment, the owner of the room was a minor girl. Rono allowed the deal to be carried out on the condition that the girl’s mother would give her daughter a share in the apartment purchased in another city. The girl was not given a share. Now I'm buying this room. The notary refused to carry out the purchase and sale transaction. The agent offers to complete the transaction through donation. Tell me, how dangerous is this option and why?

The option proposed by the agent is very dangerous. You are already at risk due to a violation of the child’s rights in a previous transaction (the child’s parents, guardianship and trusteeship authorities, or the prosecutor’s office can go to court at any time, and the room can be confiscated from you by court decision). And the gift transaction adds even more risks: it covers the purchase and sale, and therefore is an insignificant transaction; In addition, when making a gift, the rights of a bona fide purchaser do not apply. So, the notary rightfully refused to certify such a transaction. And we advise you to look for another room.

We are selling an apartment and at the same time buying a larger one. A minor child is registered in our apartment (the child is not the owner). Explain the discharge and registration process for the child and parents.

After the transaction, the parents discharge the child from the sold apartment and register them in the purchased one. The process is standard. In addition to the parents’ passports, documents for the child are provided (up to 14 years of age - a birth certificate, from 14 years of age and older - a passport), originals and copies of documents for the purchased apartment.

We sold the apartment in which the minor child had a share, fulfilled the conditions of the guardianship department - we transferred the appropriate part of the amount from the cost of the apartment to the child’s bank account. The apartment in which the child currently lives was purchased with a mortgage and the child has no share in it. The guardianship department told us that we could, in this case, use the child’s money to purchase the child’s property. What property can we purchase? Can the child's father sell him a car? ?

You can only buy housing for your child; a car will not do. Subsequently, when you pay off the mortgage, you can sell the child a share of the purchased apartment for his money. This can be done immediately - if the bank gives its consent.

Can I sell an apartment and give a minor child money (to his bank account) or a room in a communal apartment? My child and I are registered. The apartment is privately owned (obtained before the birth of the child). The child’s mother is registered at a different address, but does not want to live there and register the child with her. There is a notarized Agreement (which is not being implemented) that the child will live with the mother at her address.

You can, and for this you do not need to obtain permission from the guardianship and trusteeship authorities. But if the mother does not want to register the child, then a bank account will not work, you need to buy a room (for you) and register the child there. You can start with something else - if the mother does not fulfill the agreement and does not register the child with her, you have the right to go to court with a claim for the obligation to fulfill the agreement, i.e. about the eviction of a child at the mother’s place of residence.

A husband, wife, their daughter, son and granddaughter (son's child) are registered in a room in a communal apartment. The social tenancy agreement is issued to the wife. We are going to privatize the room. If, before the start of privatization, the granddaughter is transferred to her mother’s living space (without allocating property), is it possible to privatize the room without the participation of the granddaughter (in this case, the child’s living conditions improve, he is discharged from the room in the communal apartment to a separate apartment)?

It is mandatory to allocate a share for the granddaughter. Being discharged to another apartment will not help - the loss of ownership of the room, subject to the acquisition of only the right to live in the apartment, is a violation of the child’s rights. Such privatization will not be allowed.

Two minors are the owners of the apartment. Under the new legislation, do parents need to obtain permission from the guardianship and trusteeship authorities to sell an apartment in order to buy housing in another city? The children and mother live in this very different city (the mother works there, and the children study there).

Yes, it is necessary - at the place of permanent registration (registration) of the children.

I am selling a room in a communal apartment and buying a 2-room apartment. apartment with a mortgage. However, the agent leading the deal said that the guardianship authorities may not allow the sale of the room: the daughter is 15 years old and she has 14 shares. It is impossible to register your daughter in a mortgaged apartment. The daughter's father (we are divorced) agrees to register the child and transfer his shares in the 2-room apartment. the apartment where he lives with his mother - there are 12 of them, that is, less. But the child will live with me in a separate room, and will have an inheritance in his father’s apartment. Is this option possible?

This option is possible. I think that the guardianship and trusteeship authorities will give such permission, since 12 shares in the ownership of a separate apartment are better than ownership of 14 shares in a communal apartment. But the rights of inheritance and the place of registration of the child do not matter. For a more accurate answer, you need to know the full size of the shares (14/?, 12/?) and the living area of the room and apartment.

My mother-in-law is privatizing the apartment for herself, and demands that my husband and I write a refusal to privatize on behalf of our children. The husband has already agreed, since she assured him that the children will have the same rights to housing as they do now. Is it so? And will the guardianship and trusteeship authorities give permission for such privatization without the participation of children?

This is not so; if privatization is refused, the lifelong right to use the apartment is retained, but still this is not the right of ownership. And the guardianship authorities will not simply give consent to refuse privatization on behalf of the children (to obtain such consent, the children must be allocated shares in the ownership of another apartment, similar in size or area to those that the children refuse to acquire).

1) Is there a law on mandatory privatization of housing, and if there is no such thing, then what could be the risk of refusing privatization: the inability to subsequently sell or exchange the apartment, or something else?

2) If five people are registered in an apartment - four adults and one three-year-old child, is there a law on the mandatory inclusion of this child among the owners during privatization? Or can shared ownership be divided between any residents at will - for example, between two adults?

3) If a child is required to participate in privatization, what is the minimum share he is entitled to by law? And in this case, is it possible to divide the remaining area between the others into unequal shares?

4) Can a minor child participate in privatization as an equal partner, are his parents required to participate as well?

1. It is impossible to oblige privatization. Participation in privatization or refusal from it is the right of a citizen. If you refuse to participate in privatization, you do not become a co-owner of the apartment, and those who entered into the privatization agreement will formally sell or change it.

2. Yes, the child must participate in privatization. A child’s refusal to privatize is possible with the permission of the guardianship authorities, provided that the child is given a share in the ownership of another apartment of equal value.

3. The minimum share of a child is determined based on the equality of shares of participants; if five people participate in privatization, the child’s share will be 1/5 (four - 1/4, three - 1/3, two - ½). Adult participants may, by their agreement, deviate from the equality of their shares, each within the limits of their share.

4. The child is required by law to participate in privatization as an equal partner, while parents may not participate in privatization.

Author of the answers: Alexander PETRENKO Lawyer, Deputy Head of the Law Firm "YURINFORM - CENTER"

VAT – 2022

The best speaker on tax topics, , will prepare you for filing your return on January 14 . There are 10 out of 40 places left for the online workshop . The flow is limited, as there will be live communication with the teacher live. Hurry up to get into the group. Sign up>>>