An easement is the right to limited use of someone else's land. Encumbrances are established for various purposes, for example, when there is an uneven distribution of natural goods between the owners of two plots. One owner may require the other to establish an easement for free passage to his land plot, reservoir or other public facility. Constraint can be positive or negative. A positive easement establishes the right to perform actions that do not cause damage to someone else’s land plot. Negative - imposes a ban on certain types of use of the neighboring plot.

In an easement agreement, the parties have the right to provide for the obligation of the person in whose favor the encumbrance is established to make a proportionate payment for losses caused to the owner by the restriction of rights. The amount of compensation and its type (one-time or periodic) is also fixed in the contract. provides services for assessing the easement of a land plot in order to comply with the interests and legal requirements of the parties to the agreement. Activities are carried out in accordance with the Law of the Russian Federation of July 29, 1998 No. 135-FZ.

Objects of assessment

Object of assessment: the right to limited use of someone else’s land plot or part thereof.

When is an easement assessed?

- Resolution of property disputes in court.

- Confiscation of a land plot from the owner for municipal or state needs.

- Determining the market value of an object for the purpose of making management decisions.

If the easement is established for a limited period, then the owner of the land plot has the right to set the amount of payment for limited use according to the principle of independent reasonable determination. If an oral agreement is reached between the parties, you can do without calculations and documentation.

Calculation example

Let's consider an example where the easement is a land plot and an asphalt covering on it. Vehicles must pass through this plot of land; this plot of land will be used intensively, at any time of the day.

- First you need to determine the boundaries of the easement.

- Routes are established along which vehicles can travel. It is important that the routes meet the requirements of SNiP 2.05.02 85.

- The area of the entire easement is 1320 square meters.

In order to calculate the cost, you need to find out the main coefficients:

- The cadastral value for the property was 594 rubles.

- This amount must be multiplied by the category of the tenant.

- Multiply by the land plot coefficient.

- Multiply by the coefficient of proximity to the administrative center.

- Multiply by the year's inflation rate.

Substituting all these indicators into the formula, we get 12.50 rubles per square meter per year.

It should be taken into account that the owner became the owner of this land plot as a result of privatization.

It is worth understanding that he made investments in land, which are also worth considering:

- Therefore, 0.05 must be multiplied by the specific indicator of the cadastral value of 594. It turns out 29.7 rubles. per square meter.

- This amount must be divided by 50. It turns out 0.594. This is the rate of return on capital.

- 12.50 must be multiplied by the number of square meters that the owner has (which is 1320).

- It turns out that the owner will receive 16,500 monthly for using the easement.

However, given that the easement is private, the parties can agree on other additional contributions, since there is no state control in this area.

Stages of assessing the easement of a land plot

To conduct an assessment, it is necessary to establish the qualitative and quantitative characteristics of the object burdened with the easement.

They take into account data on real estate located within the boundaries of the land plot. Assessment steps:

- processing of title documents for land and real estate;

- obtaining cadastral registration data;

- studying information about operational and technical characteristics;

- analysis of the market to which the land plot encumbered with easement belongs;

- calculation of actual losses, lost profits and damages;

- performing calculations of proportionate fees taking into account the received data;

- the final expression of the assessment of the easement in the units established by the agreement.

The customer receives a conclusion indicating the exact figure. The assessment of the easement of a land plot, carried out in accordance with the requirements of the law, is recognized as reliable and recommended for payment to the owners of the encumbered object.

What is included in the subject of proof in claims for the establishment of an easement?

Or does the plaintiff have to prove to the court that he is being prevented from using the neighboring plot?

The Presidium of the Supreme Arbitration Court of the Russian Federation spoke unequivocally on this matter, noting that one should not confuse the requirements to stop violations of property rights not related to deprivation of possession (Article 304 of the Civil Code of the Russian Federation) with the requirements to establish an easement (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 28, 2012 N 11248 /11 in case No. A45-12892/2010). These are different claims and their subjects of proof are, accordingly, different. As a conclusion, I note that more complete legislative regulation could remove some of the identified problems, but for now the courts have to do this. VAT – 2022

The best speaker on tax topics, , will prepare you for filing your return on January 14 . There are 10 out of 40 places left for the online workshop . The flow is limited, as there will be live communication with the teacher live. Hurry up to get into the group. Sign up>>>

What factors influence the assessment?

To determine the amount of the proportionate fee for the easement, actual losses are taken into account:

- real damage - the difference between the market price of a land plot with and without a restriction;

- lost profit - the difference between the profit that the owner could have received from using the allotment before the establishment of the easement and after it;

- losses caused as a result of early termination of obligations to third parties.

The assessment results are influenced by the current situation on the real estate market in the region, the condition and purpose of the site, its location, transport accessibility, area, type and scope of restrictions imposed. The characteristics of the property matter. For example, if there is a shopping center or large warehouse complex on the site, the establishment of an easement may entail more serious losses for the owner than in the case of an empty territory.

Methodology for determining cost

There are several methods that allow you to calculate the fee for using an easement.

Each approach is applied in a clearly defined situation.

Approaches to assessment

When using the approaches described below, the concept of “market value” is used. It is decisive for establishing the value of the easement.

We talked in more detail about how easements are assessed here.

Comparative

The comparative approach is a set of methods that are used to estimate value. Basically, similar assessment objects (analogues) that are located in a given region are compared.

To implement this approach, it is important to meet several conditions:

- The property does not have to be unique.

- Information about the easement had to be comprehensive.

- Factors that in one way or another should influence pricing must be comparable.

- The analogue must be similar to the object of evaluation.

In order to determine the cost using a comparative approach, you need to conduct a logical analysis , taking into account the consideration of each individual indicator.

The advantage of this approach is that the sale price will be reflected in changes in financial position and inflation. And also, this method is statistically justified.

The disadvantage of the comparative approach is its dependence on market activity.

Profitable

The income approach is based on the fact that the cost of a land plot must correspond to an assessment of the quality and quantity of income that the land should bring.

The calculation uses the process of capitalization of income, which will determine the relationship between cost and future profit.

The capitalization ratio is used, which reflects the relationship between the cost of the object and profit. Attention is paid to expected income.

Based on the application of these concepts, the “discount rate” is determined. The discount rate is a compound interest that is applied when recalculating funds received during the use of property.

With the income approach, the emphasis and focus is on the profit that the owner of the land plot receives if he allows the use of the easement.

Reference. It often happens that the owner of a plot of land sees the inappropriateness of using the plot. This means that during the use of the allotment it will suffer more damage than if it remains untouched.

In this case, the owner of the allotment has the right to refuse use.

What should the initiator of the agreement do in this case?

If a person assumes that he can lay claim to the use of a land plot, then he can file a claim in court.

However, this is not the most necessary measure, which may ultimately result in costs for participation in court, but without any visible result.

Costly way

The cost approach includes methods that determine the main costs used to restore or improve real estate.

The owner of the easement must not pay more for the property than for its repairs.

To apply the cost approach, you need to focus on the following indicators:

- Usage fee level.

- Costs of purchased equipment.

- Approximate rate of return, which is typical for the region of residence.

The cost approach has its advantages. It is perfect for evaluating new objects.

However, there are also disadvantages, because the costs will not always be equivalent to the market value.

Evaluation result

The customer receives the report in writing.

The conclusion on the valuation of the easement is certified by the signature of the appraiser and the seal of a specialized organization. The document has legal force and can be used as evidence in court. The report has 5 main sections:

- general characteristics of the conclusion with information about the customer, land plot and appraisal organization;

- list of standards used in calculations;

- description of methods for assessing the value of an established easement;

- indication of the object of assessment and the period of encumbrance;

- the text of the appraiser's conclusion with a detailed description of the easement being established, the characteristics of the land plot and other data.

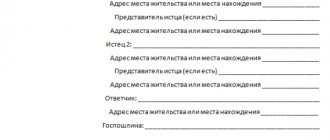

Where to record?

An agreement is concluded between the parties, which includes a number of key crisis points in the relationship. The amount of payment, period of possession and other important points are discussed here.

If the agreement from the moment the decision to establish the easement was not signed by the owner within 24 hours, then this indicates a refusal to use the easement for a fee, which means that the agreement does not enter into legal force.

If the terms of cooperation change mutually by decision of the two parties, an additional agreement is drawn up and attached to the original document.

We talked in more detail about how an easement agreement is concluded here.

List of documents

- A document confirming the right to dispose of a land plot.

- A cadastral passport of an object or an extract from the Unified State Register of Real Estate indicating the main technical characteristics of the object and the buildings, structures and structures located on it.

- A document indicating the encumbrance (if any).

- Data on the amount of taxes, on the book value of the land plot.

Easement assessment is a complex undertaking that requires highly qualified specialists.

It is impossible to carry out calculations independently in accordance with the regulations. Only a specialized organization licensed to carry out professional activities can carry out an assessment of the easement of a land plot. The appraisal department has many years of experience working with objects of various types and purposes. Deep professional knowledge and experience allow us to guarantee quality workmanship. The company's liability is insured. To order an assessment service, call us or leave a request on the website.