Author of the article: Anastasia Ivanova Last modified: January 2021 43070

A share in an apartment by inheritance after the death of its owner can pass into the possession of the heirs both in accordance with the will and on a legislative basis. In order to formalize property rights, the successors are given a period of six months; if this is missed, then the issue of inheritance will have to be resolved through the court, therefore, in order to avoid this problem, you should promptly collect the necessary package of documents for entering into the inheritance and registering your part of the inherited residential real estate .

Inheritance by will

In order to dispose of property at will and select specific heirs, the testator must draw up a testamentary act. With its help, he will be able to transfer any property to his successors, including a share of residential real estate. If the testator did not distribute the shares of the apartment independently, then according to the law they will be distributed equally among all successors. Inheritance of property by will is the simplest option for inheritance relations for both heirs and the testator. Typically, a testamentary act is drawn up between close relatives.

Expert commentary

Shadrin Alexey

Lawyer

For example, after the death of a mother or father, who drew up a will during their lifetime, all their property is usually bequeathed to their children. However, the law still imposes several restrictions on the will of the testator.

One of these restrictions is the mandatory property share of residential real estate, which is due to socially vulnerable heirs. This category of citizens includes:

- minor children of the testator;

- disabled spouse;

- parents and dependents for whom the deceased was responsible during his lifetime.

The persons listed above receive half of the share that is legally due to heirs.

Legal inheritance

According to the Civil Code of the Russian Federation, there are eight hereditary orders. Taking them into account, the principle of succession of each subsequent round of the queue occurs only if there are no applicants from the previous one or they refused the inheritance or were found to be dishonest. According to the transfer of part of the apartment without a will, the property will be distributed among the successors in equal shares.

The order will depend on the degree of closeness of family relationships. The first circle of succession includes the spouse, children and parents of the testator. However, for the other half of the deceased to be included in this category, their marriage must be registered and valid until the death of the testator. Otherwise, the former spouse will not be included in the first circle of inheritance, since the division of property has already occurred during the divorce process.

Next in line will be grandparents and sisters/brothers. The further queue is formed according to the degree of remoteness of family ties. The seventh level of priority is occupied by citizens who are not related by blood to the testator.

Expert commentary

Kolesnikova Anna

Lawyer

Legal inheritance of part of residential property is carried out according to general rules, that is, in equal shares.

Procedure for registering a share of inherited residential real estate

In order to receive your part of the apartment, you must follow the inheritance procedure, which consists of:

- Obtaining a certificate of inherited property. To obtain this document, you must contact a notary with a statement confirming your consent to accept your share of the housing. The application can be submitted personally or sent by your representative, having previously drawn up a power of attorney for him.

- Registration of property and payment of state fees. The registration procedure for rights to a share of real estate is carried out in Rosreestr upon presentation of the required package of documents. The state duty is paid in the amount of 0.3% of the total cost of the apartment for close relatives and in the amount of 0.6% for successors who are not closely related to the testator.

To register inheritance rights to a share of residential real estate, the notary must submit the following documents:

- death certificate of the testator;

- documents confirming relationship with the deceased donor;

- an extract about real estate from Rosreestr;

- papers from utility organizations confirming the absence of debts on housing and utility payments.

- technical documentation with BTI;

- the heir's passport;

- certificate of inheritance.

Expert commentary

Leonov Victor

Lawyer

The notary must check and confirm the family ties of the heirs with the testator who claim shares of the housing left by the deceased. Evidentiary documents include marriage and birth certificates, as well as other papers that can confirm relationship. In addition to the above documents, the notary may request others that he deems necessary. The heirs must provide them.

Taxes

When inheriting an apartment under a will, you need to pay a certain amount. There used to be a tax, but it was abolished not long ago. Now there remains a state duty, which is 1% of the cost of housing. Depending on the degree of relationship, the size may be reduced. Moreover, some citizens are generally exempt from state duty. These include:

- Knights of the Order of Glory;

- veterans and people with disabilities;

- Heroes of the USSR and Russia;

- tenants who lived in the apartment with the testator during his life and who remain after his death.

To summarize, we note that registering an inheritance is a rather complicated procedure, which often cannot be done without a trial. Rarely can people peacefully resolve the issue of dividing property among themselves. If there is only one heir, then no problems arise in such a situation. In order to successfully register an inheritance, you need to study what this legal phenomenon is, as well as its features and nuances. In this case, you will quickly and successfully register it and become the owner of the property transferred to you.

Attention! As part of our project, you can get advice from an experienced lawyer completely free of charge. All you have to do is leave your question in the form below. Contact us!

Preemptive rights when inheriting a share of residential real estate

According to the law, after the death of the testator, all property belonging to him is divided in equal shares and passes to his successors. The division of property representing shared ownership is carried out no later than three years from the date of opening the inheritance case. With regard to real estate, such actions are carried out only after all heirs receive their certificates confirming their inheritance rights.

If the apartment is not inherited as a whole, but is divided between heirs in parts, then the following categories of heirs have the benefits of receiving a personal share:

- successors who lived with the testator in the same territory, but were not its owners;

- heirs who legally used the apartment before the death of the testator;

- heirs who lived continuously with the testator until his death.

They have preferential rights if they do not own their own apartment or housing that they rented from other people.

Important! The legal successor who received real estate on similar grounds must pay other heirs monetary compensation for their property parts.

The emergence of shared ownership of an apartment or house

The heirs receive the right of common ownership of a residential property after the opening of the inheritance (clause 4 of Article 1152 of the Civil Code of the Russian Federation). They can continue to use it jointly without a legal division of shares, but they may wish to secure in the certificate of inheritance the parts due to each. Shared property will arise from the common property after the allocation of property to each of the heirs.

You can use a shared apartment after inheriting it without distributing shares. Then it will be considered that the living space is in joint ownership .

The allocation of shares from common property occurs by agreement of the parties on the basis of an agreement . If the heirs cannot reach a consensus in terms of the size of each share or the involvement of individual heirs in the process of dividing the apartment, interested parties should go to court .

The size of the shares of each heir is recorded in the certificate of inheritance.

The principle of inheritance of privatized residential property

Inheritance of part of privatized residential real estate must occur in accordance with established rules. The share of the deceased testator is divided in equal parts among his heirs. However, if the deceased is married, then certain difficulties may arise with the inheritance of his property, especially if he privatized the apartment with his other half and it is joint property.

Important! Regardless of the existence of a will, the spouse of the deceased testator will receive his share according to the law. If, during his lifetime, the testator transferred into possession a part of the joint property that belonged to his other half, then this clause in the testamentary act will be declared void.

Expert commentary

Kireev Maxim

Lawyer

If the apartment was privatized before marriage, then the spouse will inherit part of it according to the law, that is, parts of the housing will be divided among all heirs, including him/her in equal shares.

However, one should take into account the fact that the privatization rules have changed several times. One of them was a provision that made it possible to transfer ownership of residential real estate to citizens free of charge, whose area did not exceed established standards, and the area above the limit had to be purchased. If in practice there is a similar situation, then the successor can increase his part of the inheritance upon receipt.

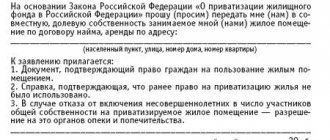

A situation often arises when an heir gets a share in a non-privatized apartment. In this case, everything will depend on whether the testator intended to privatize his living space during his lifetime. It is impossible to inherit a non-privatized apartment, so the notary will not be able to issue a certificate of inheritance rights to legal successors. In order to still receive your legal share of the property, you should go to court with evidence that the testator intended to privatize the housing.

As evidence of such intentions, you will need to submit a statement from the testator and a collected package of documents. If this evidence is considered plausible, then the property will be included in the general inheritance mass, and accordingly it can be inherited. Persons living with the deceased testator will be able to contact the municipality and enter into a social rental agreement, and then privatize the housing.

Concept and features of shared ownership

If indivisible property is taken into possession by several owners without a clear allocation of shares, it is considered common property (Article 1164 of the Civil Code of the Russian Federation). Such property may become shared property after the allocation of the shares of each heir or remain joint if the division does not occur (clause 2 of Article 244 of the Civil Code of the Russian Federation). Both options are legal.

Living space is an indivisible object , since division in kind will make it unsuitable for use. Therefore, it can only be in joint or shared ownership without physical allocation of shares.

The division of an apartment is possible only on paper, after which a regime for the common use of property for the heirs is established.

Regardless of the moment of obtaining the right to dispose of one’s share in the inheritance, the property is considered to belong to each of the heirs from the date of death of the testator (Clause 4 of Article 1152 of the Civil Code of the Russian Federation). This occurs provided that it is accepted by the heirs.

By share we mean the allocation of part of the inheritance in mathematical expression (fractions or percentages).