Restriction of freedom of contract by the Family Code

The agreement may include any terms. For example, a marriage contract when purchasing an apartment may provide for the sole ownership of the spouse in whose name it is registered. The transfer of rights from one of them to another upon the occurrence of a certain event may be stipulated: the birth of a child, the acquisition of another home, divorce.

As a general rule, “an agreement is more valuable than money,” but this does not always apply to a marriage contract. According to Article 44 of the RF IC, it can be declared invalid (in a separate part or in its entirety) if the transaction meets the general criteria of invalidity established by the Civil Code (coercion, incapacity of persons, other violations).

Second: at the request of one of the spouses, the court may recognize the marriage contract for an apartment or other property as invalid if its terms “put the other spouse in an extremely unfavorable position” (Clause 2, Article 44 of the Family Code). Thus, freedom of choice can be “crossed out” at the discretion of the court.

About common property

Most of the changes concern the Family Code. First of all, the content of the concept of “common property of spouses” is clarified. The bill plans to exclude from Art. 34 of the Family Code linking common property to assets acquired from the common income of the husband and wife, in order to eliminate the interpretation of this phrase found in judicial practice as allowing the possibility of acquiring property during the marriage from so-called personal funds, which does not belong to the common property of the married couple . The general provisions of this article include property rights and general obligations of the married couple.

Prenuptial agreement for an apartment purchased before marriage

Almost everyone knows that property acquired before the wedding, gifted to one of the spouses, or received by inheritance is not subject to the common property regime. Therefore, they consider it not necessary to mention in the marriage contract an apartment purchased before marriage. Problems arise when it is sold and other housing is purchased with the money received, sometimes with the addition of borrowed funds.

During a divorce, the spouse claims half of the property. In this case, you can defend your rights only if you prove the personal ownership of the funds. These could be documents of donation, certificates for an old apartment and a contract for its sale with the subsequent execution of a purchase and sale transaction for shared housing.

Example. Determination of the Supreme Court No. 4-КГ16-37 (from Review of Practice No. 2, approved 04/26/2017).

The spouses did not draw up a prenuptial agreement for the apartment purchased during marriage. Meanwhile, it was purchased with the wife’s own money, proceeds from the sale of another one, previously given to her by her mother (the documents were drawn up correctly). The amount of investment corresponded to 14/15 of the cost of the premises. After the divorce, the husband filed a claim for the allocation of ½ of the apartment. Let us note that the courts of the first and appellate instances satisfied the requirement, based on the fact that the spouse voluntarily invested money in common housing and did not object to its registration as common shared property. The Supreme Court put an end to the dispute by ruling that contributing funds to purchase a shared apartment does not change the essence of their origin. They were received as a result of a gratuitous transaction and belong to the personal property of the spouse.

Thus, a prenuptial agreement for an apartment purchased before marriage relieves the owner of many problems in the event of a divorce. In the example above, the litigation lasted more than 3 years. Previously, practice was in favor of dividing the disputed premises in equal shares. Especially if documents confirming the origin of the money have been lost. After all, quite often parents give them to their children without filling out anything, not even a receipt in case of a loan.

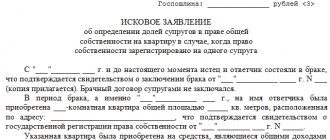

Drawing up an agreement on the division of common property.

Spouses can enter into an agreement on the division of common property. In order to get it properly executed, it is recommended to visit a notary.

Spouses should prepare the following documents:

- passports;

- real estate ownership documents;

- technical certificates, cadastral passport, etc.

Download the sample here:

Agreement on the division of common property.

Marriage agreement for an apartment purchased during marriage

As already noted, spouses can draw up an agreement at any time. And a prenuptial agreement when buying an apartment will not be superfluous if they want to avoid a subsequent “division” through the court. Thus, it often provides for the following conditions:

- registration of the purchased apartment as the sole property of one of the spouses, when personal funds are spent on this;

- transfer of rights to the spouse if, by the time of divorce, the family has common children;

- transfer of the right of existing housing to one of the family members if another apartment (house) is purchased.

The choice of options is unlimited, but, as practice shows, spouses often lack forethought and life experience. Thus, in our practice, there was a case when a husband persuaded his wife, under the pretext of buying a new home, to enter into an agreement, under the terms of which all the real estate was re-registered to him. After which he filed for divorce, and all her attempts to challenge the deal were unsuccessful.

If the contract is developed properly, neither spouse will be interested in creating a divorce situation. Lawyers and advocates of our company will help you competently draw up a prenuptial agreement for an apartment purchased during marriage, taking into account all possible consequences, including the possibility of challenging it in court. And this is especially necessary when housing is purchased with a mortgage and third parties are involved in the dispute (bank, AHML and others).

Joint property

The norms of civil and family law apply to property relations between family members. According to , all property acquired during marriage is considered joint, regardless of which family member it was registered in the name of.

and art. define 2 options for owning and disposing of common material goods:

- Legal regime. It assumes that all property is the joint property of the spouses without determining shares. The right of ownership belongs to both, even if one of the couple had no income due to running a household, caring for children or for other reasons.

- Marriage contract. Establishes the ownership and disposal of property by agreement. The document stipulates the most convenient method of ownership for both parties, for example, the official allocation of shares or registration of housing in the name of one of the life partners.

The common shared property of the spouses is divided into 2 equal parts. Since shares in kind are not allocated, it is considered that the husband and wife own the apartment completely and can only manage the housing jointly.

If an agreement regarding the ownership of the object is not reached, the legislation allows you to establish the procedure for using the residential premises or allocate equal shares for each owner. To do this, housing must meet the following requirements:

- established area per person;

- technical possibility of equal division.

speaks of the possibility of changing the size of shares in court. If technically the premises are indivisible, but are jointly owned, upon division one partner has the right to claim monetary compensation, and the other to full ownership of the property.

Although joint and shared ownership have some common features, the rights to dispose of property are not the same.

This issue is covered in more detail in the article “Difference between shared ownership and joint ownership.”

Marriage agreement when buying an apartment with a mortgage

This is the best way to settle debts in case of divorce. Because a loan is sometimes issued for 10–30 years, and no one can be sure in advance that the marriage will not break up during this time. Let's consider two general cases.

- The apartment was purchased with a mortgage before marriage. In this case, it is not considered common property. However, the debt at this point can reach from 10 to 90% of its value. In the event of a divorce, the second spouse may claim a share of housing corresponding to half of the payments made during the period of marriage. This, of course, may not suit the person who actually paid the debt and interest.

- Housing was purchased during marriage, but a marriage contract was not drawn up when purchasing an apartment with a mortgage. Until the end of the loan agreement, the spouses remain equal owners, and it is almost impossible to obtain the bank’s consent to divide the property. The Family Code establishes that debts are divided in proportion to the share of property received after a divorce. As a result, one of the spouses often has to pay the rent. Debts can only be collected from the second person in court, and then only on the condition that the payer will note in the bank the fact that he is solely responsible for paying off the debts.

Given the severity and length of litigation when dividing property, lawyers advise families to settle issues related to real estate in advance and always draw up a prenuptial agreement before receiving a loan.

The document usually stipulates the following conditions:

- the contribution of each spouse in the down payment;

- share of payment in monthly contributions (during marriage and after divorce);

- change in conditions after the birth of the child (children);

- compensation for payments for an apartment in case of divorce;

- determination of the final owner of the property.

At the same time, a marriage contract when purchasing an apartment with a mortgage may contain conditions only in relation to this specific property, without affecting anything else.

Note that banks welcome this practice, and some of them insist on concluding a prenuptial agreement for a mortgage. Even when one of the spouses is the acquirer, they include the other as a co-borrower. This reduces their risk if one of them becomes insolvent.

A prenuptial agreement for a mortgage apartment must be drawn up very carefully, with the participation of an experienced lawyer. Courts often take different positions in disputes involving such real estate, as the examples below show. In this case, two different decisions were made on the same issue: can a marriage contract for a mortgage be declared invalid if its conclusion was a necessary condition for obtaining a loan?

Example 1. Decision of the city court of the Novosibirsk region in case No. 2-17/13 (dated 01/16/2013).

The prenuptial agreement was drawn up before receiving the loan according to the model proposed by the bank. It included a link to a specific loan agreement and the condition that the apartment would belong to the sole owner - the husband. And also that registering it as common property is impossible under any circumstances. In court, the parties explained that the conclusion of the marriage contract for a mortgaged apartment was not caused by their desire and financial problems. It’s just that otherwise they wouldn’t be able to buy a home. The court assessed the bank’s actions as aimed at solving its commercial interests and coercion into an agreement, which is not allowed under Art. 421 Civil Code of the Russian Federation. The document was declared invalid.

Example 2. Decision of the district court of Samara in case No. 2-4809/2013~M-4395/2013 (10/11/2013).

The claim was filed by the husband after the divorce, since according to the terms of the marriage contract for the mortgaged apartment, it was registered as the sole property of the wife. He asked to recognize the transaction as enslaving on the basis of Art. 179 of the Civil Code of the Russian Federation. The plaintiff argued that this condition was imposed by the bank because he had a bad credit history. However, there was no evidence of this fact. This condition of the bank did not appear in the document, the plaintiff did not apply to other credit institutions, and the urgent need to purchase an apartment using borrowed funds was not proven. The court pointed out that even if all the circumstances it indicated had taken place, when signing the marriage contract for the mortgage, he could not help but understand that he did not have any rights to this apartment. Consequently, his actions cannot be considered forced. Refusal would not entail any property losses for him. The claim was denied.

What is required to re-register an apartment for my wife?

In order to re-register an apartment in the name of your spouse, you will need to prepare the following papers:

- passports of both parties;

- technical and cadastral documents for living space;

- certificate of family composition;

- certificate confirming ownership.

Sometimes additional documents may be required depending on the specifics of the transaction. The donation agreement must indicate the technical parameters of the property, its address, and total area.

If the apartment was purchased with a mortgage by both spouses after registering the relationship, then in order to re-register it in the wife’s name, you will need to obtain permission from the financial institution where the loan was issued.

If a woman’s income is too small, the bank may refuse the procedure.

If the financial institution has given permission to re-register the apartment, then changes are made to the loan repayment agreement.

The agreement states that the husband is released from financial obligations, but also does not claim ownership of the property.

Spouses can also enter into an agreement on the division of property.

In this case, each of them has a share in the apartment determined, and the amount they must pay on the mortgage is also indicated.

Maternity capital and marriage contract for a mortgage

More than 90% of families who have received the right to maternal (family) capital invest it in purchasing housing, and most often using borrowed funds. How is the issue resolved if maternity capital and a marriage contract are used for a mortgage?

On the one hand, according to Law No. 256-FZ, an apartment purchased with state money is registered as the common shared property of the mother, father and all children, with shares determined by agreement. And if this is a mortgaged apartment, the shares must be registered in the name of the children 6 months after the encumbrance is removed.

When maternity capital is involved in the purchase, a prenuptial agreement for a mortgage eliminates many problems. In it you can:

- indicate the shares of the children - they can be anything, but it is more reasonable to allocate them in an amount proportional to the amount of maternal capital divided among all family members;

- provide for the possibility of appropriate compensation for the share of family capital to a spouse who, during a divorce, loses the right to the purchased apartment.

In the absence of a marriage contract before receiving a loan, this issue has practically no solution. Attempts to go to court to allocate shares to children in a mortgaged apartment lead to refusal, since the bank intervenes, which almost never gives permission for such an allocation, as well as for the sale of an apartment or the division of debt between co-borrowers. In rare cases, courts still consider such cases, but the decision made does not suit everyone. There are two positions.

First approach. Judges divide the apartment in equal shares, for example, ¼ for each of the parents and two children, without taking into account that only part of it was paid for with maternal capital. Reason: Art. 245 of the Civil Code of the Russian Federation, which states that if the shares are not determined by agreement, the property belongs to all applicants in equal shares. The children's shares will belong to the parent with whom they live.

Example. Decision of the Vologda City Court of the Vologda Region in case No. 2-427/2014 (2-12521/2013)~M-11327/2013 dated 01/23/2014.

If the parents are divorced and the mortgage loan will be paid off after dividing the apartment, the children should be allocated shares in the common property acquired using maternity capital funds. Since there is no agreement on the size of shares, and they cannot be determined by law, the shares of the plaintiff, defendant and children are recognized as equal for each.

Second approach. Some judges divide the amount of family capital equally between family members, and if there are supporting documents, they take into account the actual contribution of each spouse. In the Review of the Supreme Court dated June 22, 2016, this position was confirmed. According to the Family Code, parents do not have the right to their children’s property, and the latter to their parents’ property. Therefore, it is fair to divide maternity capital proportionally between all family members, and this equality does not apply to other funds with which the apartment was purchased. Therefore, when drawing up a marriage contract for a mortgaged apartment, it is recommended to adhere to this position.

Distribution of tax benefits and deductions for personal income tax

As a rule, spouses who bought an apartment apply for a tax deduction on income for personal property. You can only receive it for the amount of your own money spent, without taking into account maternity capital. If there are two parties to the purchase and sale agreement, the deduction is provided to each of them in proportion to the share in the property.

How is the issue resolved if a marriage contract is concluded when purchasing an apartment, or subsequently, after the deduction has been processed? The fact is that the federal tax service refused to revise the amount of the deduction after a change in the composition of the owners. The answer is given in the cassation Ruling of the Supreme Court No. 5-KG17-53 (06.06.2017).

So, for example, according to the marriage contract for a mortgaged apartment, it became the sole property of the wife, whereas before its conclusion it was registered in equal shares, and accordingly, each spouse received 50% of the required deduction. The Supreme Court ruled that in this case, along with the apartment and the obligation to repay the loan on it, the right to receive the full amount of the deduction, including interest, passes to the spouse.

The second question arises regarding the determination of the 3-year period of ownership of the apartment, after which the seller is exempt from paying income tax. According to the definition of the Constitutional Court No. 444-O (02.11.2006), the transfer of rights to one of the participants in common property does not entail a change in the period of ownership of the property. Therefore, if, after concluding a marriage contract, the mortgaged apartment passes to one of the spouses, and he intends to sell it, such a transaction will not be subject to personal income tax.

Conclusions. The wider spread of marriage contracts is hampered by stereotypes of a predominantly psychological nature. With its help, you can avoid many problems and conflicts that arise during the division of property, including those encumbered by a mortgage, and resolve issues of repaying a loan after a divorce.