As a rule, acquiring rights to real estate is a conscious decision and allows you to improve your living conditions or invest money in a reliable property. However, under various circumstances, it is possible to waive the registered right to an apartment at the will of the owner.

In the material presented, you can find out who has the right to renounce ownership of real estate, and how the renunciation of ownership of an apartment is formalized.

Important! If you are dealing with your own case related to the relinquishment of ownership of an apartment, then you should remember that:

|

Ways to refuse real estate

The manner in which property rights are relinquished depends directly on how those rights were acquired.

The main refusal options are:

- Giving.

- Deprivatization of real estate.

- Refusal of inheritance.

The design of each of them has its own characteristics.

Registration of a gift agreement

This form of waiver is best suited if the purpose is to transfer property to a close relative.

It is important to understand that a gift is a gratuitous transaction that should not have additional conditions for the transfer of ownership rights. In addition, if a deed of gift is concluded by close relatives, they are exempt from paying income tax on this transaction. Otherwise, the tax is:

- 13% of the inventory value of property (for citizens of the Russian Federation).

- 30% – for foreigners.

Article 574 of the Civil Code of the Russian Federation determines that a gift agreement can be drawn up in free form and without having it certified by a notary.

But, as with any transaction, in order to renounce ownership of real estate through a gift, you need to collect a list of documents:

- Registration certificate of the apartment from the BTI.

- Documents establishing the right of ownership of this apartment.

- Passports of the parties to the transaction.

- Documents about the relationship between them (if the deed of gift is drawn up by relatives).

- Certificate from the Unified State Register of Real Estate.

All these documents, together with the deed of gift, must be submitted to Rosreestr (directly or through the MFC office) to register the property rights of the new owner. This procedure is subject to a state fee. The amount of the fee depends on the type of property transferred to another person. Also, the cost of this service is different for individuals and legal entities. To register the rights to an apartment, an individual needs to pay 2,000 rubles.

Sometimes additional documents may be required. For example, when transferring a share of property acquired jointly during marriage, the consent of the spouse will be required.

After re-registration with Rosreestr, the process of transfer of ownership will be completely completed.

Refusal of inheritance

The reason for renouncing the right of ownership of an inheritance is most often the presence of debts of a deceased person in the inheritance mass. The heir has the right to refuse to accept the property bequeathed or assigned to him by law without giving reasons.

There are two possible options for refusal: in favor of another heir or absolute refusal, without transferring ownership rights to a specific person.

In the first case, it is necessary to contact the notary in charge of the inheritance case with an application to renounce the inheritance. This application must be submitted within six months from the date of death of the testator.

In case of an absolute refusal, it is also advisable to draw up a written document about this with a notary. This will make it easier for the remaining applicants to receive the inheritance, as it will eliminate the ambiguity of the refuser’s inaction. That is, if a statement of refusal is not drawn up, then until the expiration of the period for entering into the inheritance it will not be clear whether the person refused to accept the property or for other reasons does not enter into rights. This creates for other heirs the risk of revision of shares in the future, if a “late” applicant suddenly wants to restore his right to inheritance.

However, many people do not want to waste time visiting a notary and simply do not take any action to accept the inheritance.

What does Sberbank say about the refusal of a mortgage after registration?

Every second mortgage in the country is issued by Sberbank, so let’s look at what it says about refusing a mortgage loan after it has been issued. In general, other banks operate similarly; Sber’s scheme can be called a standard.

As mentioned above, refusal to apply for a mortgage can be announced at any stage of the process. But if it has already come to an end, contracts have been concluded, registration has been completed, the actions will not be so simple.

How to refuse a Sberbank mortgage:

- Refuse to go further at any time without any statements if the agreement has not yet been signed.

- If the agreement is signed, but the deal is not concluded in Rosreestr. The client writes a mortgage waiver application to the bank office. If the documents have already been submitted for registration, you need to promptly contact Rosreestr and stop the process.

- If the transaction has been registered, but the bank has not yet transferred the money to the seller. Contact the bank and write an application, terminate the purchase and sale agreement with the buyer, register the termination with Rosreestr and provide Sberbank with a document confirming this.

These are ideal solutions to the situation. The case is resolved without trial, fines, or additional fees. It's just important to make a decision in a timely manner. If the seller has already received the money, then that’s it, there will be no easy way out of the situation.

Deprivatization of real estate

Deprivatization is the relinquishment of ownership rights to previously privatized real estate. As a result of such refusal, it becomes the property of the state.

It is important that in this case you can only refuse your share of the real estate. If part of the apartment belongs to the child, then a waiver can be signed for him only with the consent of the guardianship authorities, which in this case will be very difficult to obtain.

The deprivatization process itself involves collecting the following documents:

- Owner's passport.

- A copy of his personal account.

- Notarized declaration of abandonment of property.

- Legal documents.

- Extract from the house register.

- Real estate registration certificate, cadastral passport, certificate from the BTI.

- Extract from the Unified State Register of Real Estate.

- Certificate of no debt.

The documents are submitted to local authorities along with the agreement on the transfer of property into state ownership.

The deprivatization process takes about 2 months, during which the initiator can stop it, retaining his property rights. Upon completion of the deprivatization procedure, he loses his rights. In some cases, a social tenancy agreement may be concluded with him, which will still allow him to live in this apartment.

Features of deprivatization

The process of renouncing ownership of real estate in favor of the state has some difficulties in the following cases:

- Shared ownership. If one of the co-owners decides to transfer his share to the state, then this is possible only with the consent of the other owners.

- The owner is incapacitated or a minor. In this case, to carry out deprivatization, it is necessary to obtain permission from the guardianship and trusteeship authorities.

In addition, it is possible to achieve the abolition of privatization through the courts. But it makes sense to file such a claim only if there are compelling reasons supported by documents.

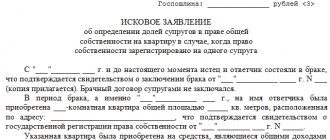

Relinquishment of ownership rights to a share in an apartment

In the case of shared ownership of housing, the owner of the share has the right to make any transactions with it. The only special feature is the pre-emptive right to purchase by other co-owners. That is, before selling such a share on the real estate market, the owner must notify the remaining shareholders about this and wait for their response within a month. If one of them wants to buy this share, the owner will have to sell it to him. Only if all co-owners refuse to purchase can a market share be sold.

The donation procedure is simpler - the owner of the share can give it to any person.

The transfer of ownership rights itself takes place in Rosreestr, where the former owner renounces his rights, and the new owner accepts them. It is important that the basis for the transfer of rights is correctly drawn up (for example, a deed of gift).

If one of the residents of the apartment decides to renounce his share in the process of privatization of housing, then he must notarize his consent to its privatization by the remaining residents.

All these nuances sometimes require the participation of a qualified lawyer in the process, which allows you to avoid mistakes and subsequent problems.

Advantages and disadvantages

What to choose if you already have a share in the apartment and need to give it up?

| Advantages | Flaws | |

| Gift deed | It is not taxable to the donor. The recipient is not subject to personal income tax if the share is received from a close relative. Co-owners do not have a preemptive right. Cheaper than PrEP. | You cannot apply for a tax deduction when purchasing a home. If the gift was not received from a close relative, you need to pay 13% of the price of the property to the budget. |

| PrEP | A universal form of transfer of rights to housing. It is possible to obtain a tax deduction when purchasing a home. | It is necessary to respect the pre-emptive right to purchase from co-owners. The seller must pay personal income tax on the sale amount. |

The choice between these methods of transferring a share to another person is made depending on specific conditions.

Procedure

Relinquishment of property rights begins with the announcement of your decision. If we are talking about rights to real estate, then it is important to draw up a written refusal and notify the registration authorities about it. There the data will be entered into the real estate register. The application itself must be submitted to the municipality. From this moment on, the property will be considered unmanaged.

But at the same time, the owner can still:

- Submit an application to suspend the refusal procedure.

- Take back ownership of this property within a year from the date of refusal.

- Confirm your intention to renounce your property rights by finally losing your rights to it.

After the property is declared unmanaged, the former owner receives a certificate to this effect. After a year, it can be transferred to a new owner. After this, the former owner is no longer obliged to maintain the property.

Until the new owner acquires ownership of the property, the previous owner retains all of his rights.

Is it possible to simply close the mortgage early?

The first thing that comes to mind is exactly this option - simply close the mortgage loan early, and that’s it, the obligations will be fulfilled. Early repayment of loans, according to the law, takes place without fines, commissions or obstacles on the part of the bank.

Only in the case of a mortgage there is one big “but” - where to get the money for this early repayment? In the case of a conventional cash loan, funds are issued in person and may simply not be spent by the borrower. Then he will simply make an early repayment with them and close the loan.

If it is a mortgage, then there is no money in hand; it has been transferred to the seller. There is only a purchased apartment that you want to return to the bank. Of course, if the buyer has available funds, early repayment is simply an ideal option. But usually the situation is completely opposite: there is no money, there is a desire to give up the mortgage and apartment.

In this case, early repayment is possible only with money received from the sale of the mortgaged apartment. You will have to negotiate this with the bank.

Consequences of termination of ownership

The mere fact of renunciation of property rights does not mean release from responsibilities for maintaining the property. Until it gets a new owner, all maintenance costs will be borne by the previous one.

In the case of owning a land plot, even after refusal, you will have to pay land tax for it until the moment when the plot is transferred to the new owner.

If the owner does not appear after a year after the refusal, municipal authorities may claim rights to the land. However, judicial practice shows that more often the decision is made in favor of returning the land to the former owner, if he agrees to this.

If you refuse to own any thing that poses a danger to others, the former owner is obliged to monitor its safety and ensure the safety of people.