The abolition of donation was introduced to protect the civil rights and interests of the donor in the event of malicious ingratitude of the recipient. It allows you to cancel a donation that has already been made. For this reason, the rules regarding the invalidation of a contract or the termination of a contract cannot be applied to the cancellation of a deed of gift . It is easier to cancel a donation concluded under a consensual agreement (agreement of promise) at the obligation stage, when the donated property has not yet been transferred to the donee.

Important

After fulfilling a contractual obligation it is very difficult to cancel a donation , since the donee acquires ownership of the property donated to him. Therefore, in practice, it very often happens that the donor wants to include in the contract a condition under which the donee will not be able to sell the gift to a third party in the future.

In accordance with paragraph 1 of Art. 572 of the Civil Code (Civil Code) of the Russian Federation, it is unacceptable to present counter obligations to the donee , since the whole meaning of the gratuitous nature of the gift agreement is lost, and it can be declared invalid due to its insignificance. Under certain circumstances provided for by the Civil Code, it is still possible to cancel the donation . One of these circumstances is the death of the donee , which occurred after the conclusion of the gift agreement with him and the fulfillment of the obligation under it to transfer the donated property.

Death of the donee as a basis for canceling the donation

The death of the donee as a basis for canceling the deed of gift is reflected in paragraph 4 of Art. 578 Civil Code of the Russian Federation. This is the only one of all the grounds in which the donor has the opportunity to cancel the contract only if it is included in its terms. Although the cancellation of the donation itself does not in any way affect the change in the donee’s ownership of the property donated to him . Therefore, while still alive and having registered ownership of the item of gift, he can dispose of it at his own discretion and make any transactions with it, including alienation to third parties. In this case, the donor's consent is not required .

Is it possible to donate an apartment received by inheritance?

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

After registration of ownership, the recipient becomes the full owner of the apartment. The owner can sell, donate or transfer the property by inheritance. Typically, inheritance is accepted without any restrictions.

However, there are exceptions to the law. For example, if the testator made a testamentary refusal (Article 1137 of the Civil Code of the Russian Federation). One of the conditions of the will may be the provision of living space to the legatee.

The order may contain a clause for a specific period or may remain in effect for the life of the beneficiary. Under such circumstances, alienation of the apartment may become impossible.

Few people would agree to live under the same roof with a stranger. After all, the right of use remains with the legatee even if the owner of the apartment changes. To solve the problem, the heir will have to negotiate with such a person on mutually beneficial terms. For example, offer him something in return for renouncing his rights.

Conditions under which a gift can be canceled after the death of the donee

The absence in the deed of gift of a basis that provides for the donor’s right to cancel the gift if he survives the donee makes such cancellation impossible . That is, in order to implement it, only the death of the donee is not enough. Based on this, it follows that the main condition for canceling a gift agreement is the presence in it of the basis provided for in paragraph 4 of Art. 578 Civil Code of the Russian Federation. If at the time of the death of the donee the donated property was in his ownership, then the donor, having canceled the donation, has the right to return this property in kind .

The absence of donated property after the death of the donee does not prevent the donor from exercising his right to revoke the donation. During his lifetime, the recipient could dispose of the gift that had become his property by selling or donating it to a third party. But this does not mean that the donor’s attempts to cancel the gift will not be successful. If it is impossible to return the donated property in kind, the law provides for the obligation to return its actual value .

Example

Citizen Svetlichny R. received a car, a garage and a workshop for minor repairs of passenger vehicles as a gift from his uncle. After the recipient had an accident, he had practically no chance of recovery. His close relatives took advantage of this. With persistent persuasion, they convinced citizen Svetlichny R. to sell the property donated to him, so that in the event of his death it would not be returned to the donor. A few months after the donee died, his uncle (donor) turned to his relatives with a demand to return the car, garage and vehicle repair shop in accordance with the donation agreement, which stipulated the possibility of canceling the donation if the donor survives the donee. The relatives of the deceased refused to even talk to him, arguing that the donated property did not belong to them and that the deceased voluntarily sold it during his lifetime. The donor has no right to demand the return of property in kind from a third party. Therefore, he exercised his right and went to court with a claim to cancel the donation on the basis of clause 4 of Art. 578 of the Civil Code of the Russian Federation and the application of the consequences of such cancellation provided for in paragraph 5 of the same article and paragraph 1 of Art. 1104 and 1105 of the Civil Code of the Russian Federation. The court, having studied all the circumstances of the case, may take them into account and decide to cancel the gift agreement and oblige the relatives of the late Svetlichny R. to return to the donor the actual value of the donated items at the time of their acquisition.

There are also cases when the donee remains in debt after death. The cancellation of the donation and the return of the donated property to the donor will violate the interests of the creditor of the deceased. In such situations, the donor will be equated to the donee’s creditor and his claims, as well as the creditor’s claims, will be satisfied from the total inheritance mass.

Expenses of the assignee

It all depends on many factors. The full list includes the following possible costs:

- Transport. Relevant for residents of remote areas.

- Accommodation. Taken into account by applicants living in other cities.

- State duty according to the tariffs of a notary office.

- Payment for the services of a law firm (lawyer's office).

- Legal costs. If there is a conflict that can be resolved in court.

- Fees for restoring duplicates of lost documentation.

It is difficult to calculate costs initially.

The donated apartment may be followed by debts incurred by the testator during his lifetime. They will have to be repaid. If the amount is so large that inheritance is impractical, it makes sense to abandon the procedure. Refusal of an inheritance after acceptance of an inheritance is difficult, and sometimes even impossible, to formalize.

Basic rates

Standard notary and court services can be obtained from consultants or viewed in the price list. However, despite the fact that taxes are not imposed on transactions within the framework of inheritance or when accepting donated valuables, you will have to pay a state duty, which is calculated based on the value of the property. However, the interest rate differs depending on the degree of relationship. And if, during inheritance, the apartment donated to the testator is subject to sale, you will also have to pay tax.

For close relatives

These include successors from the first line of succession. Living in a donated apartment, the presence of mentions in the will and other arguments do not allow using the benefits provided to a close circle of relatives. And these are children, parents, spouses. They will pay 0.3% of the value of the accepted property for inheritance. The money is credited to the personal account provided by the notary. The receipt is kept and attached to the application for inheritance.

For strangers

In this case, the inheritance tariff is the same as for relatives from the second to eighth queues. You have to transfer 0.6% of the market price of the apartment donated to the deceased. The procedure for depositing funds is the same. But, if it is decided to sell the real estate inheritance, the seller (since he receives money, and therefore benefits) pays personal income tax, which is 13%. When the purchase and sale after inheritance is carried out by a non-resident of the Russian Federation, the rate increases to 30%.

On what basis is the amount calculated?

The basis is the price of the donated real estate, transferred by right of inheritance. The assessment can be ordered from specialized companies. Valuation based on cadastral documents is allowed. Then the wear and tear of the structure, its service life, materials of supporting structures, and footage are taken into account. They also look at the availability of amenities specified in the project documentation. The location, prestige of the area, and its infrastructure are not taken into account. This is how the cadastral value differs from the market price.

Payment for notary services

Standard services have fixed rates indicated in the price list. The first, mandatory expense is the state fee for filing an application. The following amount is paid at the time of receipt of the inheritance certificate for subsequent re-registration. But, if you have to use additional notary services, each action is paid. The amounts are small and depend on the workload (location of the office) and the complexity of the procedure. If necessary, a notary will come to your home.

The procedure for canceling a donation upon the death of the donee

a special procedure for canceling a deed of gift in the event of the death of the donee . Certain regulations and methodological recommendations propose the application of various legislative provisions, including paragraph 1 of Art. 452 of the Civil Code of the Russian Federation on the procedure for amending and terminating the contract. In this case, disputes arise for the reason that other agreements are bilateral transactions, while the gift agreement is unilateral.

Therefore, the absence of a special application form for cancellation of donation refers us to Art. 159 of the Civil Code of the Russian Federation, according to which it can be committed in any form . But it is obvious that it is more expedient for the donor to use a written form of the application, having it notarized to eliminate future problems with proving the fact and timing of the cancellation of the gift. This procedure is based on the provisions of Art. 578 of the Civil Code, since in relation to each of the grounds it specifically indicates the need for a procedure for canceling a donation in court or out of court . In paragraph 4 of this article there is no instruction for considering the issue in court. This means that the cancellation of the donation in this case occurs out of court at the will of the donor in the form of his application.

To notarize such a statement, the donor must provide the notary with a number of documents :

- a gift agreement, which must stipulate the donor’s right to cancel the gift in the event of the death of the donee;

- documents confirming the transfer of the donated property into the ownership of the donee, since cancellation of the donation is possible only in relation to the executed agreement;

- death certificate of the donee.

The requirement of some notaries, referring to existing methodological recommendations, to confirm the presence of the donated property in kind or the fact of its transfer to third parties, a certificate of inheritance issued to the heirs of the donee, is unlawful . Since the cancellation of a donation is associated with the return of the object of donation to the donor, in practice, as a rule, this is associated with great difficulties. Nobody wants to give up their property voluntarily . Therefore, most often the cancellation of a gift occurs in court. To do this, the donor must apply to the court with a statement of claim to cancel the deed of gift, which must be supported by documentary additions and evidence that his demands are legal.

How to draw up and register a deed of gift for an apartment?

Very often, deeds of deeds are signed by old people who are about to die and do not want to pit their descendants against each other after their death, as they may be able to claim an inheritance by inheritance. Although there are other cases where it is necessary to formalize a deed of gift.

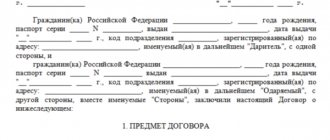

Regardless of the reason for which a person approaches a notary to register a gift, a number of documents must be submitted. The required package of papers includes:

- general civil identity cards of participants, SNILS;

- extract from the Unified State Register;

- extract from the house register;

- certificate from the registry office about relationship (if available);

- permission from the board of trustees (if required);

- notarized power of attorney (required if the deed of gift is issued to an incapacitated person or a minor);

- official consent from the co-owner for the donation (the gift agreement itself);

- certificate of absence of debts for housing and communal services;

- consent of the spouse;

- cadastral passport;

- technical documentation for real estate or vehicle;

- documents on the ownership of the donor's property;

- check for payment of state duty.

After the notary checks all the documents, ownership will be registered within 7 days, after which the recipient will be able to come for a cadastral extract, which replaces the certificate of ownership. With this extract you need to contact the State Registration Chamber and take ownership.

If a privatized apartment with several owners is subject to donation, then the deed of gift can be issued exclusively for the share of the donor. The rest of the apartment will belong to another owner. Therefore, in order to receive his part of the property, the gifted person will subsequently have to negotiate with the second owner on the method of dividing the property.

Deadline for revoking a gift after the death of the donee

Norms Art. 578 of the Civil Code of the Russian Federation do not contain a period during which the donor can exercise his right to cancel the donation on this basis. Accordingly, the donor can do this at any time after the death of the donee .

For your information

However, in practice it happens differently. The concept and limitation periods established in Chapter 12 of the Civil Code apply to the cancellation of a donation. The limitation period is established to protect the violated right of the plaintiff (Article 195 of the Civil Code of the Russian Federation). Cancellation of a gift does not constitute a violation of the donor's right as such. Clause 4 art. 578 of the Civil Code is of a regulatory nature. In any case, it is beneficial for the donor to cancel the contract as quickly as possible , so as not to face the succession of inheritance of the donated property.

After the death of the donee, all his property, including that given to him during his lifetime, will be transferred to the ownership of the heirs by law within a six-month period from the date of opening of the inheritance . In practice, to cancel the deed of gift, in accordance with Art. 181 of the Civil Code of the Russian Federation, a period of three years is applied from the date of its conclusion and one year from the date of filing a statement of claim for its cancellation .

Can relatives challenge the deed of gift?

The relatives of the donor of real estate, who, by inheritance law, lay claim to his property, can submit a corresponding application to the court. Also, the Guardianship Authorities, which protect the rights of minor children who are left without an inheritance or incompetent persons who claim an obligatory share in the property, can go to court to challenge the deed of gift.

The grounds for challenging a gift agreement may be:

- Incapacity of the donor, his insanity when signing the contract, which was caused by alcohol intoxication or drug influence.

- Registration of a deed of gift under duress or under the influence of threats or blackmail.

- Illegal actions that were taken by the donee himself and his family members in order to obtain the property of the donor.

- The donor did not realize the essence of his actions due to his advanced age.

- Lack of consent of the spouse that he is a co-owner of the property under the gift agreement.

It will be interesting to know that there is a set deadline for challenging the gift agreement by the donor himself and his relatives. It is 3 years from the date of signing the agreement for the donor.

Relatives can challenge the agreement after the death of the donor within three years from the date of determination of a violation of the rights of the donor or infringement of the interests of his dependents. For example, if 3 years have passed since the death of a person, but the Guardianship Authorities learned about the gift agreement only 4 years later, then if there is a minor or incapacitated dependent, they can go to court to challenge it, and the claim will be satisfied.

You can file an application to dispute property with a public or private notary by presenting your documents and evidence of the presence of grounds for challenging. The application to challenge the property is considered for a month and is either rejected or granted, and the case is considered by the court.

Now, you know how a donated apartment is inherited and how to draw up a gift agreement. Knowing the intricacies of such legal procedures, you will never become the object of fraudulent tricks and will be able to fully protect your interests.

During his life, a citizen becomes the owner of various property. The grounds for acquiring property are contracts of gift, exchange, purchase and sale, and certificates of inheritance rights.

In the event of the death of the owner, the order of inheritance of various objects directly depends on the basis for the creation of rights to them by the testator. Let's consider the features of inheriting a donated apartment.

Consequences of cancellation of donation

As a result of the cancellation of the deed of gift, the donee becomes unjustly enriched, since the subject of the donation has increased his property and continues to belong to him. In accordance with paragraph 1 of Art. 1104 of the Civil Code of the Russian Federation, property that constitutes unjust enrichment must be returned in kind to the injured party . Therefore, the consequence of the cancellation of the donation is the return of the donated property to the donor by the donee (Clause 5 of Article 578 of the Civil Code of the Russian Federation).

Attention

If the donated property was alienated, damaged or became unusable during its consumption, then a situation arises in which it is impossible to return it in kind. In this case, paragraph 1 of Art. 1105 of the Civil Code of the Russian Federation imposes an obligation on the heirs of the donee after his death to compensate the actual value of the donated property.

It is necessary to note the following: the cancellation of the donation itself does not entail an automatic transfer to the donor of the right of ownership of the subject of the gift , since it can only be a consequence of the fulfillment by the heirs of the donee of the obligation to return it, which arose as a result of the cancellation of the deed of gift. The donor can direct his demands for the return of the donated property only to the donee. If it was alienated to a third party, then the donor cannot make demands on him for return, since he is not currently the owner of the object of donation.

Important nuances

If the right to own the property is already in the hands of the donee, taking the gift back becomes a little more difficult. The most important, reasonable decision when drawing up a gift document would be to include a clause in it that does not allow the gifts received to be transferred or sold to a third party.

Information!

As the Civil Code of the Russian Federation states, it is unacceptable to impose obligations of a counter nature on a second party. Otherwise, the document will have grounds for recognition of nullity, which means invalidity, since this state of affairs will contradict the condition that the contractual document of donation is gratuitous in nature.

All possible reasons for returning gifts are reflected in the provisions of the Civil Code. The end of the life of the donee is one of the main reasons for the cancellation of a previously completed transaction.