The person assigning his rights receives the name “assignor”. This is the original creditor who owned the rights to demand the debt and benefit from the provision of something for compensation under the relevant agreement. The new creditor is called the assignee. The assignor, or the original creditor, cedes his rights to him.

An assignment agreement is an agreement between the original creditor and any person who becomes the assignee and receives the rights of the assignor. Such a transaction differs from an ordinary assignment of rights in that the assignment transfers exclusively the rights of the assignor, while an ordinary agreement also transfers the responsibilities associated with the implementation of these rights. For example, the assignment of the right to lease commercial real estate is not recognized as an assignment and cannot be, because such a transaction provides not only the right to use it in business activities, but also entails the obligation to pay for the premises as follows from the terms of the original agreement. Most often, the rights to claim a debt are transferred through an assignment. A bank, credit organization or other creditor may assign its right to receive money under a loan issued to an organization or an individual. This is used not only to sell rights to so-called collectors, but also to organizations specializing in this, which carry out their activities primarily at the time of bankruptcy of a person.

Debt assignment agreement - what is it?

A creditor under a monetary or other obligation may transfer his rights to another person.

Such a transfer is formalized by an assignment of rights agreement, which in legal language is called an assignment agreement. The original creditor transferring rights is called the assignor, and the new creditor is called the assignee. Assignment agreements can be concluded by both individuals and organizations. The need to transfer the debt to another creditor may be caused by various reasons (for example, reluctance to collect the debt through the court). A typical example of an assignment is the transfer of debt under a loan agreement to a collection agency.

As a rule, the assignment of the right to claim a debt is compensated, that is, the new creditor pays the original creditor a fee, the amount of which is specified by agreement between them. The amount of such payment is most often less than the amount of the transferred debt, because otherwise the new creditor will have no reason to purchase the debt. At the same time, the law does not prohibit the gratuitous assignment of the right of claim to a new creditor.

Norms of the Civil Code of the Russian Federation

The procedure in accordance with which the assignment agreement is concluded is established in Chapter. 24, par. 1. The essence of this procedure is disclosed in Articles 382-390. The assignment of debt itself between legal entities and citizens is described in Art. 391, 392. The parties to the assignment agreement include:

- Assignor. He acts as the original owner transferring the right.

- Assignee. He is the new claim holder.

The debtor is also present in the transaction. He is obliged to fulfill the terms of the contract.

When can you transfer a debt?

The law says that debts under any obligations can be assigned to a new creditor, except for cases provided for by law.

In particular, rights of claim cannot be transferred under an assignment agreement if they are inextricably linked with the identity of the creditor (for example, the right to alimony, compensation for moral damage, etc.). As a general rule, the transfer of a debt by way of assignment usually does not require prior consent from the debtor. However, in a number of cases, assignment of rights is possible only with the consent of the obligated person, in particular:

- if an agreement between the creditor and the debtor establishes that the transfer of debt is possible only with the consent of the latter;

- if regulations provide that the transfer of the right of claim is permissible only with the consent of the debtor;

- if the fulfillment of the obligation is closely related to the identity of the creditor.

The rights are transferred to the new creditor to the same extent as they belonged to the previous creditor.

In addition, along with the main debt, the obligations securing it (penalty, etc.) are transferred. Other terms of the agreement under which the debt is transferred to the assignee also remain unchanged. It should be noted that the debt can be transferred even when there is already a court decision to collect the debt in favor of the original creditor. In this case, after drawing up the assignment agreement, you will need to go to court, which will make a ruling on replacing the party in the case. Next, with this definition and the assignment agreement, you need to contact the bailiff service.

Key Features

The right to assign debt can be exercised in a variety of situations. But, in accordance with domestic legislation, not every material obligation can be transferred through assignment. Exceptions include, for example, personal requirements:

- Alimony.

- Compensation for damage to life/health

- Compensation for moral damage.

These obligations are not subject to assignment. The need for an assignment arises in cases where the creditor cannot collect the required amount himself. Citizens, for example, by agreement share obligations during a divorce.

The assignment of debt between legal entities may arise during the reorganization of a company. In this case, the obligation can be transferred both for compensation and gratuitously. The entity on whom the obligation is entrusted is sent a corresponding notification - a letter about the assignment of debt. However, his consent is not required. If the debtor assigns the debt, then he is obliged to not only notify the creditor about this in advance, but also to obtain the latter’s approval.

Form and essential terms of the assignment agreement

Sample contract.

The agreement on the assignment of rights should be concluded in the same form as the agreement under which the rights are transferred to the new creditor. That is, if the main agreement is concluded in simple written form, then the assignment agreement must be drawn up in simple written form. If the main agreement is certified by a notary, then the assignment of debt, accordingly, must be notarized. If the transaction, the rights under which are transferred to a new person, is registered in Rosreestr, then the assignment agreement is subject to registration (unless otherwise provided by regulations).

The only essential condition of the assignment agreement is its subject. The subject is the right of claim, which is transferred to the new creditor. The text of the agreement should describe the essence of the transferred right of claim and indicate on the basis of which documents it arose. At the same time, it is not at all necessary to reflect in the contract the reasons and motives for such a transfer.

The agreement or court decision from which the transferred right arises must be attached to the assignment agreement.

If such an agreement has annexes, then they also need to be transferred to the new creditor. All other terms of the agreement on the assignment of rights are considered additional and are included in the text of the agreement at the discretion of the parties. All of the above is presented more clearly in a sample agreement for the assignment of the right to claim a debt, available on our website.

Assignment in insurance

In this area, the concept of “risk cessation” is used. Simply put, it is “reinsurance,” or the transfer of risk to another company, which in turn becomes the lender. In Art. 965 of the Civil Code states that the policyholder’s right to receive compensation for damage under the contract passes to the insurer. This provision becomes very relevant, for example, in car insurance in cases where the vehicle is resold by proxy. But not all companies go for this. For example, in MTPL insurance, a ban on assignment was introduced as cases of fraud have become more frequent.

Nuances of the assignment agreement

When concluding an assignment agreement, you need to take into account a number of nuances:

- It is advisable to reflect in the text of the agreement a condition regarding which of the parties and within what period of time informs the debtor about the transfer of the right of claim to the assignee. It is more logical to assign this responsibility to the new creditor, since by virtue of the law it is he who bears the risk of the consequences of failure to notify the debtor.

- If the debtor, who has not been notified of the transfer of debt, fulfills the obligation to the original creditor, then he is considered to have fulfilled his obligation. And in this case, the new creditor will have to recover from the previous creditor the amount of debt that he unreasonably received.

- The transfer of the right of claim can be formalized not only by a bilateral, but also by a tripartite agreement (with the participation of the debtor).

- The compensation agreement should specify the amount and procedure for payment of the remuneration paid by the assignee. If the parties enter into a gratuitous agreement, it is best to explicitly state in the agreement that the new creditor has no obligation to pay remuneration.

- The former creditor is not responsible for the fulfillment of the obligation by the debtor. An exception will be the situation when he acts as a guarantor of the obligated person to a new creditor.

Contents of the agreement

The contract must necessarily contain:

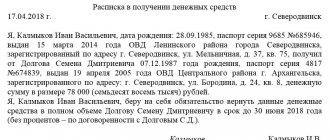

- full data of the parties to the agreement - the assignor (transferring the debt) and the assignee (accepting the debt);

- the most described subject: the essence of the transferred obligation or its size, the grounds for its occurrence, details of the court decision, information about its entry into force, details of the issued writ of execution;

- the procedure for notifying the debtor about the replacement of the creditor and about concluding an assignment agreement;

- termination procedure;

- the act of transferring the originals of all documents on the basis of which the transferred obligation arose.

IMPORTANT. If, before concluding an agreement on the assignment of a claim (cession) under writs of execution, part of the monetary obligation was previously fulfilled by the debtor, it is necessary to reflect the amount of the remaining claim, the rights to which are being assigned (Part 2 of Article 384 of the Civil Code).

Sample form of an agreement for the assignment of the right to claim a debt

In the event that an agreement on the assignment of the right of claim is required, a sample form for it will look something like this:

TRANSFER AGREEMENT _g.________________ “___” ______________ _____ g. ___________________________________________________________________, referred to as the “Assignor”, represented by ________________________________________, acting on the basis of ______, and _________________________________, referred to as the “Assignee”, represented by ____________________________________, acting on the basis of ________, have entered into an Agreement as follows:

|

VAT – 2022

The best speaker on tax topics, , will prepare you for filing your return on January 14 . There are 10 out of 40 places left for the online workshop . The flow is limited, as there will be live communication with the teacher live. Hurry up to get into the group. Sign up>>>

Bankruptcy

One of the common options for reducing accounts receivable is the sale of obligations in bankruptcy. As a rule, in such situations, money is needed urgently, and the payer’s deferment will not end soon. If the deal is concluded before the company is officially declared bankrupt, it may be considered invalid. In this case, an explanatory memo is drawn up indicating the inability to collect the debt and justifying the price of the transferable right.

List of applications

When signing the assignment, all three parties provide original documents confirming their identity and authority. The contract is accompanied by copies of passports of individuals, powers of attorney, and constituent forms for organizations. The lender transfers the full set of the original agreement, including all agreements, decisions to change the terms of the transaction, and payments.

In relation to real estate and transport, registration forms and forms confirming the ownership of the person making the transfer are transferred. In addition to the assignment agreement, reconciliation acts, repayment schedules, restructuring, and protocols of disagreements are attached. The full list of applications is determined by the participants.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Debt Transfer Agreement (tripartite)”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |