Cession is not the most common term, and when meeting it in documents, most cannot immediately say what is being said. Meanwhile, the phenomenon described by this word is increasingly becoming relevant.

An assignment agreement is an agreement that regulates the alienation of rights to a loan debt to another individual or legal entity. Naturally, not just like that, but by law.

Sometimes such an operation is called an “assignment of claims.” It is usually carried out without obtaining consent from the debtor himself.

Features of the assignment

When they talk about assignment, they mean a waiver of demands for repayment of a debt in favor of another. But not all of them can be conveyed in reality. For example, if we talk about obligations that are of the personal type. For example, alimony, compensation (and this can be compensation for any harm). All this is not subject to legal transfer.

Why is an assignment agreement used? Because (most often), the one who should receive a certain “debt” has no way to collect it. Situations can be different - from the division of obligations between private owners, to the reorganization of companies.

The claim is transferred and sold, depending on the situation, and the person on whom the obligation remains is later sent a written notification that the assignment contract has been concluded.

Object to the new creditor and pay less or not pay at all

The debtor can present to the new creditor any claims that he had against the old one : the craft is of poor quality, delivery was delayed, one package was missing. Now dealing with claims is the responsibility of the new creditor.

It is better not to delay with claims, but to notify them in writing as soon as possible after notification of the assignment. Otherwise, the new creditor will have the right not to respond. If the debt is resold again and again, the debtor makes a claim against each new creditor.

If it turns out that the new creditor himself owes money or is obliged to take less from the debtor, the parties offset counterclaims. As a result, the debtor pays less or does not pay at all.

The company ordered the construction of a house from a contractor. The house was built, but defects were found. A dispute ensued, and the company underpaid the contractor RUB 1,400,000 for improvements. The contractor did not want to sort it out and sold the debt under the assignment agreement to another entrepreneur.

The new creditor went to court for his 1,400,000 rubles. But the company insisted on the shortcomings, asked for an examination of the house and proved that it was necessary to spend 600,000 rubles on improvements. The court offset the counterclaims and reduced the debt. As a result, the company will pay the new creditor only 800,000 rubles.

Case No. A03-16108/2017.

Civil legal basis of the assignment agreement

This procedure is regulated by the Civil Code of the Russian Federation. Namely, the 1st paragraph of the twenty-fourth chapter. To understand this issue yourself, you need to refer to several articles. In particular, articles 382 to 390 regulate the essence, and articles 391 and 392 consider the transfer of debt.

In a relationship of assignment there are several parties who are participants in this relationship.

The one who initially has the right to the debt is called the CEDENT .

The one who receives the rights to the debt is the ASSIGNEE .

There is also a debtor . Accordingly, the one who bears the obligation to pay.

Debt transfer agreements can also be divided into subtypes.

Assignment of debt

Typically this type is positioned between legal entities. Typically, this procedure applies to the reorganization of a company. In this option, the name of the debtor usually changes, but the company remains the same.

An example for those who deal with accounting: when a change of legal entity occurs, the company has not yet reduced the balance according to the reconciliation report to zero. And so a contract is concluded, reconciliations of mutual settlements are signed. Then in the accounting program you will need to change the current counterparty (subaccount).

All documents have official status, so they must be stamped on both sides.

The second option is an agreement between individuals

As we have already written, various situations arise - from the division of property in the process of divorce, inheritance of debt, and so on.

Since we are not talking about legal entities here, there is no point in talking about seals. But any agreement will imply the presence of passport data of the parties to the agreement. It is also required to indicate the amount, time and method in which the funds will be returned.

Unlike the previous option, the document does not require the intervention of a notary for certification. The parties sign it independently. And the signatures in this case will be confirmation.

The third option is transfer of debt between a legal entity and an individual

This is called transfer of debt (because essentially the debtor himself changes). The simplest example to explain is the bankruptcy of a company, after which its former manager becomes the bearer of obligations to pay the debt, but as an individual.

The debt itself does not change either in size or terms of payment. Here you already need to affix the seal of the organization and the personal signature of the individual indicating the data from the passport.

The fourth option is a trilateral assignment agreement

Unfortunately, there is an option when the party that bears the debtor’s obligations specifically (or not specifically) does not receive notice of the transfer of debt. He simply doesn't pay attention. But when an agreement is concluded with the participation of all three parties, certain guarantees arise (at least that the debtor is aware of the changes taking place). Moreover, he also puts a signature or seal on this agreement confirming his consent.

Contents of the agreement

The parties to the transaction can be any persons, not only legal entities, but also individuals, and the goal is only the transfer of rights. An assignment agreement is quite often called a title, thereby emphasizing its independence from agreements on the transfer of rights of other types.

The contract must contain information about the subjects. Moreover, not only about the assignor and assignee, but also about the debtor, as well as information about the original agreement, on the basis of which the right to claim the debt arose from the assignor.

It is important that the assignment agreement must have the same form as the original agreement by virtue of which the obligations arose. This rule is established by paragraph 1 of Art. 389 of the Civil Code of the Russian Federation. If the original agreement was drawn up in writing, then the assignment agreement must also be drawn up in writing. If the original transaction was notarized, then the assignment agreement must also be certified by a notary.

The subject of the agreement is always the transfer of rights, which the agreement secures. Most often this happens at the time of signing, but a different period may be specified.

The main terms of the agreement include the amount of payment and the method of transferring funds from the original creditor to the assignee.

The law does not require the consent of the debtor, except in cases where this is stipulated in the original agreement or follows from some regulations. It is understood that the very fact of drawing up the title indicates that the original agreement did not contain conditions contrary to this. Therefore, the assignee is only obliged to inform the debtor that the right to claim the debt has transferred to him. All this is most often reflected in assignment agreements, although there is no particular need for this, since the law obliges assignees to inform debtors about the transfer of rights to the debt to them.

All risks associated with non-fulfillment or incorrect fulfillment of the provisions on informing the debtor are borne by the assignee. For example, if the debtor, due to insufficient information about the transfer of rights, continues to fulfill his obligations to the previous creditor, then in court this will most likely be attributed to the unfavorable consequences that arise for the assignee, and not for the debtor.

The assignor is responsible for transferring an existing debt that is supported by genuine documentation. Regressive demands on the assignor are impossible. If the debtor disputes the debt or evades repayment, then no claims will be made against the original creditor.

Documents for the assignment agreement

Since there are several types of transactions, the set of documentation required to confirm the legal basis also varies.

The contract itself is of paramount importance. It is concluded between the assignor and the debtor initially. For example, if we analyze a situation where the buyer must return the debt to the supplier, then this agreement will serve as a supply contract, or a purchase and sale agreement.

The second most important document in cases of debt transfer is the act of reconciliation of mutual settlements.

Then there are expense and receipt documents, with the help of which you can confirm or deny the existence of a debt.

When it comes to a debt to a bank, the loan agreement is put at the forefront, respectively. To such a basis, you can additionally attach debt payment schedules, papers confirming agreement with payment deadlines, account statements, and so on.

A debt assignment agreement may also be accompanied by an additional agreement. This must be done if there are any conditions that were not included in the official original contract.

Tax circumstances of assignment

The transfer of rights has a direct impact on the tax obligations of all parties to the transaction:

- For the debtor, from the point of view of taxes, nothing changes, VAT is not restored, as explained in paragraph 3 of Art. 170 of the Tax Code of the Russian Federation;

- the transferor does not pay VAT as a seller, despite the fact that the transferred property right must be subject to taxation. In Art. 155 of the Tax Code of the Russian Federation there are no direct instructions for calculating VAT upon assignment of debt.

- the assignee , who has received the right to claim the debt, will have to pay VAT only if we are talking about transactions subject to this tax (sale of goods, fees for services, performance of work). If the former creditor provides an invoice, the “secondary” one will be able to provide VAT for deduction (Article 171-172 of the Tax Code of the Russian Federation).

Types of assignment agreements

Tripartite agreement

We have already mentioned it above. And the purpose of the contract is to obtain the official consent of the third party, that is, the debtor. Such guarantees are very important for the assignee, because a bilateral agreement only provides the opportunity to notify the person who will pay the debt, nothing more.

Agreement of paid and gratuitous assignment

A contract that sells the obligations of the assignor for a specific amount of money will be called a compensated agreement. In the case of a company that is selling debt, this may be a necessary measure. After all, in this way she repays the debt, although, of course, not in full. As a standard, such procedures take place between companies and collectors who have already “taken the cake on the debtors.” The conditions remain the same as always. Neither the amount of debt nor payment methods change.

Paid and free debt transfer

The essence is the same. But we are talking about the debt transfer operation itself. The receivables are transferred to the new debtor under a free or paid agreement.

Assignment of claims under a writ of execution

It's mostly about litigation. Rights under this document can also be transferred free of charge or sold for a certain amount. To do this, you will need to provide evidence that the person collecting the debt has changed. And evidence can serve as an assignment agreement and applications to the arbitration court. In court, rights are sometimes transferred not in full, but partially. Thus, the result will be several copyright holders.

Peculiarities

Real estate assignment agreement

A standard situation for the real estate market is when apartments or other property are sold while the mortgage or loan is still outstanding.

In such a situation, the requirement becomes a notification to the bank that the person who is the borrower must change. At the same time, the banking organization conducts an inspection. After all, not only does the bank have to give its consent to this. He must also make sure that the person is able to repay the outstanding debt. Consent from the bank must be obtained in writing. After this, the bank designates the debt figure for the new “owner”.

Insurance Assignment Agreement

The term “risk allocation” is important here. It means that one insurance company transfers the risk to another. The lender changes accordingly.

The governing law here is Art. 965. Civil Code of the Russian Federation. O According to it, the rights of the insured to be compensated for the material damage described in the concluded contract are transferred to the insurer.

The most common option is selling a car by proxy.

But not all insurance agents agree to this course of action. Again, turning to practice, it should be noted that in insurance under a compulsory car insurance policy there is a ban on assignment. This is explained by the fact that it is in this area that fraud schemes are not uncommon.

Assignment agreement under a supply agreement

Here we are primarily talking about cases where a banking organization acts as an intermediary between firms. One company assigns its rights to claim debt from another company to the bank (factoring). The bank itself receives a certain percentage from this.

In this procedure, the factoring organization will control the receivables. Typically, banks themselves make a request for a package of documents that could confirm the completion of work or the sale of goods with a delay - that is, the completion of a certain service. Assignment agreement under a work contract

The most important thing to understand here is that the customer can assign his duties to the contractor to a third party only if the contractor himself gives his consent in writing. And since all parties are endowed with their own responsibilities, it is impossible to do without concession of demands. The third participant, along with the obligation to pay for the work, also receives the opportunity to demand this work be performed.

Assignment in credit operations

The most common cases of using this type of assignment agreement are violations under loan agreements by the debtor. A banking organization sometimes uses its legal right to terminate the contract with the borrower, after which it demands the entire amount of the debt in its entirety. And the debt is transferred to collectors.

In this scenario, the collection agency receives the status of assignee and, in its own ways, “knocks out” the debt. As we all know, these very “methods” of collectors are currently a topic that has received resonance in society and the media, so they are already beginning to say that transferring debts to collectors is, in principle, not at all legal. After all, in order for the debt to be transferred to another “agency”, this agency must have a license. And banks, who do not know, do not have the right to advertise information about their clients.

The only advice we can give here is to read the contract. It’s as old as the hills, but nevertheless, 99 percent of people don’t follow it. But in vain.

Bankruptcy assignment agreement

We have already mentioned this in passing above. The point is that a company, during its bankruptcy, is trying to reduce its accounts receivable at least a little. Moreover, there is a risk that the tax authorities will later recognize the transaction as invalid, precisely because of the bankruptcy procedure. In this option, you need to draw up a document in the form of a memo, which will explain that it is no longer possible to collect the debt.

If you need a sample assignment of debt, you can freely find it on the Internet or download it from our website.

Debt assignment agreement - what is it?

A creditor under a monetary or other obligation may transfer his rights to another person.

Such a transfer is formalized by an assignment of rights agreement, which in legal language is called an assignment agreement. The original creditor transferring rights is called the assignor, and the new creditor is called the assignee. Assignment agreements can be concluded by both individuals and organizations. The need to transfer the debt to another creditor may be caused by various reasons (for example, reluctance to collect the debt through the court). A typical example of an assignment is the transfer of debt under a loan agreement to a collection agency.

As a rule, the assignment of the right to claim a debt is compensated, that is, the new creditor pays the original creditor a fee, the amount of which is specified by agreement between them. The amount of such payment is most often less than the amount of the transferred debt, because otherwise the new creditor will have no reason to purchase the debt. At the same time, the law does not prohibit the gratuitous assignment of the right of claim to a new creditor.

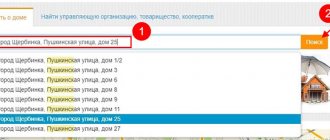

Registration of the assignment agreement in the state register

This requirement applies if the assignment agreement is formed during transactions with real estate.

Important! Until registration, the document will not be considered valid.

What do you need to do for this? It’s simple - you transfer copies of documents to the Federal Reserve System (information), which will be certified by a notary. What are these documents:

- Share participation agreement (it also had to be previously registered in the register).

- An assignment agreement for the right to claim or transfer debt (must be included in the package of documentation and papers that will confirm the process).

- Certificate of registration of a legal entity.

- Extract from the Unified State Register of Legal Entities

- Documents confirming the right of the person submitting them.

Don't forget to plan your time. The registry will take up to 30 days to review.

Registration of transactions with non-residents

This niche is of interest primarily to those companies that are involved in the import or export of goods.

In this type of transaction, when the legal entity is a resident and the debtor is not a resident, it is also required to issue a transaction passport (analogy with foreign exchange processes). And in the case when a foreign person changes to another, the passport is issued again. The regulating document in this case is the law “On Currency Regulation and Control”.

Accounting and taxes

We must not forget that if the assignment agreement is not just transferred, but is compensated, then VAT is charged!

How exactly to calculate the tax: the tax base will be taken as the result after deducting the price of the debt and the price for which it is sold.

And the difference between the initial debt and the amount paid by the new creditor is written off at a loss.

According to the accounting entries, transactions are also carried out both on the part of the assignor and on the part of the assignee.

When rights cannot be ceded

It is not always possible to sell a debt or change sides in a contract. There are complete prohibitions, and sometimes there are conditions and risks.

Creditor's identity

You cannot assign rights that are associated with the identity of the creditor. These are rights to alimony, pensions, payment for harm to life and health, money for moral damage, and a fine for violating consumer rights. An agreement on the assignment of such rights is a useless piece of paper. The debtor has the right not to pay a penny to the new creditor.

It happens that the role of the creditor’s personality follows from the essence of the contract. For example, a cleaning company washes the floor of a pensioner for free once a month. A pensioner cannot give up the right to cleaning services to someone.

Contract at auction

Rights under contracts concluded through an auction or competition are prohibited from being given to someone else. The exception is the right to cash payments. For example, it is impossible to transfer the right to rent a street point to a partner, because it was obtained from the administration through a competition. This cannot be done without a new tender. But you can safely cede your rights to a refund of overpaid rental payments.

Donation between legal entities

Commercial organizations can assign rights and debts to each other only for a fee. Otherwise, this is a donation, which is prohibited by Art. 575 of the Civil Code of the Russian Federation.

Entrepreneur on the verge of bankruptcy

It is dangerous to cede a receivable if the entrepreneur anticipates the collapse of the business and wants to withdraw assets. If bankruptcy occurs over the next year, creditors may cancel the sale of receivables at a reduced price. Such a withdrawal of assets is called a suspicious transaction under Art. 61.2 of the Bankruptcy Law.

Risks under the assignment agreement

- When an assignment agreement is signed, all parties are advised to carefully read each clause of the document. Particular attention should be paid to individual points.

- Subject of the agreement. The object will be considered a specific amount of debt, which must be confirmed with the necessary documents.

- Basis of the agreement. Here there is a reference to the specific agreement between the transferor and the debtor, which was originally.

- It happens that in addition to a personal signature or company seal, agreement with the terms of the contract is expressed by a separate addition to the document in the form of, for example, an information letter.

- If all parties to the agreement are legal entities, a thorough check of all details, constituent documents that will confirm rights and registration in the state register is required.

- If errors are made, or information is displayed in such a way that it can be misunderstood, then you can achieve a negative result under the contract, or even come to its invalidity.

- When a draft contract is being created, do not hesitate to contact lawyers, even paid ones. A professional will save you time and avoid many risks.

Invalidation of the assignment agreement. Court.

Options when an assignment agreement can be terminated or declared void:

- Debt obligation refers to personal obligations (we are talking about, for example, alimony).

- The right to recovery is not supported by supporting documents.

- The agreement was not registered in the state register (if we are talking about an assignment in a real estate niche).

- The original agreement between the debtor and the claimant contained a clause stating the impossibility of transferring the right to another person.

- The document does not indicate the basis of the right to collect the debt between the first creditor and the payer.

- The assignee did not pay under the compensation agreement of the assignment.

- The responsibility for debt collection is given to a person who is not legal and does not have a credit agency charter.

- If one of the violations is identified, then in order to invalidate the assignment agreement for this violation, it is necessary to apply to the arbitration court in a specific region.

The court may not fully satisfy the claim.

What to include in the document

Regardless of who the parties are, it must contain the following information:

- Names and details of the parties. For individuals - full name, passport details, registration address. For legal entities - name, INN, OGRYUL, legal address.

- Subject of the agreement. It is necessary to indicate exactly what rights the assignor transfers to the assignee and for what amount.

- Rights and obligations of the parties. Here it is advisable to mention what obligations are credited to the parties after fulfillment of the conditions.

- Deadlines and responsibilities.

- Additional terms and conditions (if any).

The form (simple, notarial, with state registration) depends on the form of the original transaction, which recorded the rights that are now subject to transfer.