Home / Private clients / Real estate / property / “Apartment protection” - insurance of the apartment against fire and flooding

Didn't find the insurance option you need? Leave a request and we will offer you a suitable insurance option.

Simple online registration in 5 minutes, without a trip to the office, home inspection, assessment of the value of the apartment and property - and you are calm and confident in any situation. Your property and everything in it is insured against the following risks:

- Fire or lightning strike;

- Domestic gas explosion;

- Flooding with water from a broken pipe or careless neighbors;

- Bay as a result of natural disasters.

Product benefits

- Simple online policy registration and easy resolution of insurance claims;

- Wide range of property and liability protection options;

- Professional assistance in choosing apartment insurance;

- Insurance protection is valid 24 hours a day throughout the year;

- Efficiency in servicing insurance holders.

Territory and period of insurance:

- Insurance territory: Russian Federation.

- Insurance period: 1 year. The agreement comes into force on the 15th calendar day after its payment.

Advantages of insurance in IC "Soglasie"

We are studying the insurance market and can confidently talk about the benefits of insuring an apartment in IC Soglasie.

- Flexible insurance conditions and wide coverage

- Low tariffs

- There are no limits on payments for structural elements, interior decoration and engineering equipment. The apartment is fully insured

- Regarding the interior decoration of the building, there is a “new for old” reimbursement system.

- The cost of obtaining all necessary certificates from the competent authorities is reimbursed.

You can get additional information by calling 8 or at any office of the Soglasie Insurance Company.

To submit a request for insurance, fill out the form below.

Insurance risks

When insuring property:

- Fire, lightning strike;

- Domestic gas explosion;

- Damage by water or other liquids from hydraulic systems and adjacent rooms;

- Natural disasters;

- Illegal actions of third parties.

For civil liability insurance:

- Causing harm to the life, health and/or property of third parties that occurred through the fault of the policyholder during the operation of the apartment (or the insured property in it).

Objects of insurance

- Apartment/room in a wooden *

or stone residential building - Structural elements

- Interior finishing (including windows + interior doors) and engineering equipment

- Movable property (drawing up an inventory at your request)

- Civil liability for causing harm to third parties

- Valuable property (item-by-item inventory)

*

To insure apartments in a wooden house, you will need to inspect the living space and agree on the terms of insurance.”

How to register a product

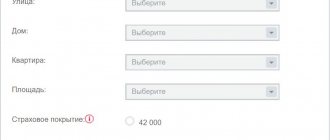

We calculate insurance for an apartment online:

- • Enter information about your home into the fields of the calculator;

• Select the sum insured;

- • Specify the insurance period.

5 minutes after payment you will receive the policy (signed using a qualified electronic digital signature).

Purchasing insurance is your protection against financial expenses in the event of a flood or fire. Payments are made upon the occurrence of an insured event and consideration of all necessary documents by the Head Office of SMP-Insurance LLC in Moscow.

Client requirements

- A capable individual over 18 years of age.

Documents for registration

- Passport of a citizen of the Russian Federation.

Title insurance

First, let's understand what title insurance is and how it differs from regular insurance. This is insurance of the ownership of a property upon its purchase. If with regular insurance you specifically protect your property from fires and natural disasters. That title insurance gives you the guarantee that if you cease to be the owner of your apartment, you will be reimbursed for its market value.

Important! An insured event will not occur if you lose your property rights through your own fault. The money will be returned to you if the apartment was sold by scammers or by a court decision.

Questions and answers

Who can be the Policyholder?

A legally capable individual is a Bank Client purchasing a policy who is over 18 years of age. In favor of whom is the policy concluded? In relation to the insured property:

- in favor of a person who has confirmed his legal property interest in relation to the insured apartment, the address of which is indicated in the policy or communicated during the activation of the policy (“insurance at the expense of whom it should be”).

Regarding civil liability:

- in favor of the persons to whom (or whose property) the damage was caused (usually neighbors).

Who can be the Insured Person (in case of harm to neighbors)? Insured persons are considered not only the owners of the apartment, but also all persons legally residing in the apartment (usually relatives or tenants).

How to cancel an insurance contract early or terminate an insurance contract? To early terminate (cancel) an insurance contract or cancel an insurance contract, you must fill out an application, prepare the necessary documents and send it to the insurance company in a way convenient for you:

- By letter to the address: 115035, Moscow, st. Sadovnicheskaya, 71, building 3;

- Hand it in person to the insurance company.

The day of filing an application is considered to be:

- The day of delivery of the application to the insurance company (authorized representative of the insurance company);

- When sent by mail - the date indicated on the postmark of the postal service organization at the place of departure of this application or the date of transfer to the courier service.

Please note that to speed up the process, it is additionally recommended to submit the following documents:

- A copy of the insurance contract;

- A copy of the payment document;

- Copy of the passport of the Policyholder / Person representing interests;

- A copy of a document confirming the authority of the person representing the interests of the Insured;

- Copies of documents confirming the reasons for refusal and other documents in accordance with the insurance contract or the insurance rules applicable under the insurance contract.

Verification of the policy for authenticity All electronic policies of SMP-Insurance LLC are signed using a qualified electronic digital signature certifying the authenticity of this document. To verify the authenticity of the policy, you can use the service of the Crypto-PRO certification center.

CHECK POLICY

Insurance restrictions

In any case, insurance does not apply to the following property:

- Any property that, at the time of concluding the insurance contract, is in a dilapidated, emergency, unsuitable for use condition; which is subject to demolition, reconstruction or major repairs;

- Movable property located on premises with the characteristics specified in subclause 3.6.1 of the Insurance Rules;

- Any property that, at the time of concluding the insurance contract, is located in an area recognized by the competent state authorities as a zone of a possible natural disaster, and (or) in a zone of military operations from the moment such a threat is announced in the prescribed manner, if such declaration and (or) recognition were made until the conclusion of the insurance contract;

- Consumable property (cosmetics, perfumes, sanitary products, medicines, food, any alcoholic beverages, animal feed, etc.; consumables for office equipment; construction and finishing materials intended for the construction (current repair) of a building/apartment ; spare parts, parts and accessories for vehicles);

- Saplings and seeds; animals and birds; documentation; blueprints; securities; banknotes; precious metals in nuggets, stones in the form of mineral raw materials; manuscripts; slides and photographs, photo and video materials; objects of religious worship (except for collections of icons, which can be insured as valuable property).

"Insurance Rosgosstrakh" – Policy Activation for Apartments and Houses

If insurance was purchased from Rosgosstrakh partners, it can be easily activated on the company’s website. To do this you need to know:

- envelope number;

- activation code;

- date of purchase;

- cost of the policy;

- check number.

You also need to enter the name of the policyholder, his contact number, address and date of birth.

Types of insurance

There are two ways to protect your property: the classic and express method.

Classic implies a comprehensive approach and guarantees a refund of all funds. A visit by an appraiser is required, who describes all the property, conducts an assessment and photographs the home. The process may take some time as a detailed assessment of the home is required.

With the express method, an expert visit is not required; the application can be filled out on the website and you can receive the policy in 15 minutes. The disadvantages of the express method in limiting payments and approximate assessment of damage are different for each company; generally, the limit is set to 1 million rubles. In this case, a minimum package of documents is required - a passport, and there is no need to meet with insurers.

"Rosgosstrakh" - Non-Insured Events for Apartments and Houses

The company will not compensate for damage in the following situations:

- precipitation got onto the insured items and into the insured apartment through the roof or other openings, as well as through open doors, windows, through a balcony, loggia, terrace;

- property has deteriorated due to natural processes, such as rotting, corrosion and other processes;

- the property has defects;

- the service life has expired;

- the damage was caused as a result of a military operation, terrorist attack, civil war and other similar incidents;

- damage may be compensated by the manufacturer's warranty.

Damage to property, its seizure, or confiscation by order of government agencies are also not considered insured events.

How to insure a transaction when buying a home?

Step 1. Find the apartment you want to purchase. You can find suitable housing yourself or contact realtors.

Let us immediately make a reservation that not all real estate objects are covered by title insurance. You can insure the transaction if you purchase:

- apartment on the secondary market ; this type of insurance does not apply to new buildings;

- any residential premises: rooms, apartments, country houses;

- plots of land, regardless of the presence of buildings on it;

- non-residential areas, entire factories or individual workshops can be insured.

"Rosgosstrakh" - Insured Event in an Apartment and House, What to Do?

Regardless of the type of program purchased, when an insured event occurs, the algorithm of actions is the same:

- Contact the responsible authorities and tell them what happened. For example, in case of an explosion, call the Ministry of Emergency Situations or the gas service, in case of a fire - in the department of the State Fire Service, in case of a flood - in the emergency service, DEZ, Housing Department, in case of theft - in law enforcement agencies.

- Try, if possible, to stop the destruction of the insured property or reduce the damage caused to it.

- Call Rosgosstrakh at 0553 or and report the event.

- Preserve the appearance of the event, that is, do not move the damaged property, but leave it in the condition in which it found itself after the insured event occurred.

The next step is to collect documents to receive compensation. Try to keep it within 1 day.

You must submit the following kit:

- statement;

- passport;

- agreement with Rosgosstrakh;

- payment receipt;

- documents confirming the policyholder's interest in preserving the property;

- documents that reflect the fact of the incident. If there was a flood, then you need to obtain a flood certificate from the Housing Office or another housing service. It indicates when and for what reason the flooding occurred, as well as the person involved in this incident. A list of damages is attached to the report. In the event of an explosion, fire, or theft - a copy of the resolution to initiate (refuse to initiate) a criminal case. If the insured object was hit by a vehicle, you must request a certificate of an accident (form 154), a resolution to initiate or refuse to initiate an administrative violation case;

- policy.

Let us dwell on the last point in more detail, because depending on the type of property, a different package of documents may be required.