Insurance conditions for the Home Protection program

What to do if it starts dripping from the ceiling? Neighborhood boys broke the window glass, and someone robbed or destroyed the house itself? Faced with troubles, many fall into a stupor, because the costs of restoring real estate are measured in tens, or even hundreds of thousands of rubles. For such cases, the “Home Protection” policy from Sberbank Insurance comes in handy. Complete it and you will be spared the following expenses:

- for the restoration of interior decoration;

- to replace damaged machinery and equipment;

- for the purchase of new movable property;

- to pay compensation to neighbors whose apartments were damaged because of you.

The policy is valid for a year. If you want to extend your protection, please contact the insurer's office directly.

Risks included in insurance

According to the terms of the insurance program “Home Protection” from Sberbank Insurance, you can count on compensation if your property is damaged:

- from fire, smoke and other consequences of a fire;

- from exposure to water or steam;

- from robbery or hooliganism, vandalism;

- from an explosion or lightning strike;

- from redevelopment/repairs carried out by third parties without your knowledge/consent;

- from natural disasters and related disasters;

- from aircraft crashes.

A complete list of situations when the client has the right to demand compensation for the occurrence of an insured event is described in clause 3 of the current “Insurance Rules”.

Irina Bolshakova

Bank loan officer

In 1 minute! Let's calculate overpayments using a calculator. We will offer a sea of profitable offers on loans, credits and cards, very flexible conditions. Shall we try?)

Why choose RESO-Garantiya?

Accreditation

RESO-Garantiya is annually accredited by Sberbank

Discounts up to 40%

Special promotion “Profitable mortgage”. Discounts on life insurance up to 40%

Age up to 65 years

Life insurance for borrowers under 65 years of age

We will issue it in 30 minutes

Registration of a policy in just 30 minutes in paper or electronic form

Minimum documents

To obtain insurance you will need a minimum set of documents

We do not require a medical examination

No requirements for medical examination or provision of medical documents

How to apply for a policy

Previously, it was possible to protect your property under the “Home Protection” program from Sberbank Insurance only by personally contacting the insurer’s office. Now you can apply for a policy online, without leaving your home. Let's consider each option separately.

Design methods

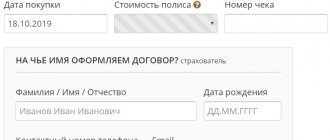

Issuing a policy remotely is becoming increasingly popular today. To do this, you just need to have free access to the Internet and perform the following sequence of actions:

- Go to the official website of Sberbank Insurance.

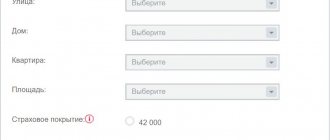

- We indicate the type of object insured and the amount of insurance coverage.

- Enter the promotional code (if you have one) and click on the “Buy” button.

- Fill out the order form (indicate your contact details and other mandatory information).

- We check that there are no errors, then click “Continue”.

- We receive a letter to the specified email. We pay.

Done, the registration procedure is completed. The policy will take effect 2 weeks after payment is made.

If you do not trust electronic documents, you can also receive a “Home Protection” policy from Sberbank Insurance in paper form. To do this, contact the insurer's office, providing a standard application indicating your passport details, name of property and other information. You can familiarize yourself with the application form and the list of additional documents that the insurer has the right to request in the current “Insurance Rules”.

Policy activation and renewal procedure

When applying for insurance online, no additional actions are required from the client. If you received the policy in paper form (at the insurer’s office), do not forget to activate it within the next 2 weeks. For this:

- Open the Sberbank Insurance website and go to the Activation section.

- In the list provided, we find the Sberbank program for home protection and click on it.

- Fill out the form provided, check the data, and click the “Activate” button.

As for the renewal of the policy, things are different here. Initially, when you request a policy from the insurer, you automatically enter into an agreement with him to provide the relevant services. Whether it provides for an extension is determined individually in each case. You will be advised on this issue in more detail by calling the number or in your personal account on the Sberbank Online website.

Requirements

None of the victims will refuse to receive financial compensation after the occurrence of an insured event. However, the Home Protection program imposes certain restrictions on the subjects and objects that can participate in it. So:

- Only citizens of the Russian Federation who have reached the age of majority and have full legal capacity can take out a policy.

- The insurance does not apply to housing that is in dilapidated or unsafe condition.

- Both the insurance object and the client involved in its registration must fully comply with the conditions specified in the current “Insurance Rules”.

If the insurer reveals a violation of at least one of the points, the policy will be refused.

Documentation

If you apply for a policy through the website, you will not need to have any documents (except for those needed to fill out the electronic form) on hand. However, if the policyholder has questions regarding your application, he, according to the insurance contract, has the right to request additional documents. Which ones are determined individually for each case. The full list of documents is listed in clause 6. current Insurance Rules.

Reviews about insurance and real estate insurance at Sberbank Insurance

There will be no complete picture of the company without studying real customer reviews. Of course, a big plus is that there is a customer support service and its specialists will help in resolving conflict situations. However, the number of negative reviews outweighs the positive ones.

Oleg, 03/31/2020. 12:26

The assessment of the work of the employees of the insurance department, the hotline and the bank as a whole is disgusting. It was not possible to receive compensation for an insured event due to the inaction of the personal manager or a malfunction of the online application. The hotline operator hangs up the phone, refusing to provide advice. Upon receipt of a copy of the offer policy, errors were found in indicating the registration address. Considering that the problem has not been resolved by contacting the branch, by calling the hotline, or by contacting the post office, I am forced to turn to the Banki.ru portal.

Julia, 03/23/2020 23:49

I am outraged by the work of the insurance company Sberbank! On February 18, 2020, two amounts were paid online: 3545 and 6088 rubles for the renewal of life and property insurance. They assured me over the phone that the contracts would be sent by mail. As of March 22, 2020, no forms have been received. More than 10 applications were left by phone. hotline, and also submitted applications at the bank office in Voronezh, st. Osipenko. There is no result.

When choosing an insurance company, read not only customer reviews, but also study the insurance rules (published on the website). When drawing up a contract, do not hesitate to ask questions and, of course, check the completed data. These simple steps will help you avoid unpleasant surprises when an insured event occurs, and insurance will become a real guarantor of financial protection.

Cost and prices

The price of the issue depends on what property (house or apartment) you plan to insure, as well as for what amount. In 2021, prices for the Home Protection program are as follows.

| 600 thousand rubles | 1 million 400 thousand rubles | 2 million rubles | |

| Finishing | 250 thousand rubles | 600 thousand rubles | 1 million rub. |

| Movable property | 200 thousand rubles | 400 thousand rubles | 500 thousand rubles |

| Civil responsibility | 150 thousand rubles | 400 thousand rubles | 500 thousand rubles |

Up-to-date information on this issue can be found on the policy registration page.

Advantages

This proposal has several undeniable advantages:

- Efficiency – payments in the amount of up to 100,000 rubles. may be carried out without relevant certificates.

- Convenience – no need to inspect the property.

- Benefit – using THANK YOU bonuses, you can save up to 10%.

What to do if an insured event occurs

If you don’t want trouble to take you by surprise, adopt the following sequence of actions.

- Ask for help. Call utility workers or emergency services who will help minimize the consequences of the incident and document its occurrence.

- If the situation does not pose a threat to your health, try to save as many valuables as possible, documents, money.

- Within 24 hours, notify the insurance company about the occurrence of an insured event by calling the number. Dictate your name and insurance contract number to the consultant. Submit a written application to the insurer within 5 days.

- Describe what happened in as much detail as possible, specify when the expert from the insurance company will arrive, and what documents need to be prepared for his visit.

- Collect all the papers (you can find out more about them from your consultant or read in paragraph 10 of the “Insurance Rules”).

- Talk to an expert, provide him with as much information as possible about what happened. Complete the necessary applications.

- Wait for the result. According to the terms of the “Home Protection” insurance from Sberbank Insurance, within 15 business days from the date of transfer of documents, the insurer is obliged to provide the client with either a notification of the date and amount of the approved payment, or a reasoned refusal to provide compensation.

If everything goes well, the money will be credited to your account no later than 15 business days after sending the notification. You can learn more about the responsibilities of the insurer in clause 8 of the Insurance Rules.

Documentation

The borrower requires notarized copies of the following documents:

- passport of a citizen of the Russian Federation with registration information;

- TIN;

- document on ownership of the apartment and registration certificate for this right;

- conclusion on expert assessment of housing;

- application in a standard form.

The insurance contract for the apartment and the insurance itself are prepared for signing after the client fills out the application. Then all copies of the documents are sent to Sberbank.

Useful lifehacks

When obtaining a mortgage loan, a document is required that covers the risks of damage or loss of the collateral property. Life and health insurance for the borrower is not mandatory, but Sberbank increases the rate if the client refuses this service. When assessing the need to conclude an insurance contract, the borrower needs to calculate the long-term benefits and decide which option will be less expensive:

- refusal of insurance with an increased interest rate on the mortgage;

- registration of insurance against risks associated with the borrower at a standard mortgage rate without penalties.

When renewing your insurance terms, do not forget about the deadlines required for registration. You should worry about making payment three business days before the document expires (this is exactly the period of time spent on crediting funds sent by bank transfer not through the Sberbank website). Otherwise, the lender has the right to charge penalty interest. When using the online banking functionality and mobile application, you need to save the payment template. For a subsequent deposit, all you need to do is click the tab and immediately proceed to selecting an account to debit funds from.