After the construction of a new task, reconstruction and major repair work, before using it for its intended purpose, it is necessary to confirm the safety and reliability of the facility. To do this, a comprehensive examination is carried out. The procedure allows you to determine the extent to which the building complies with fire safety requirements, urban planning, sanitary and other standards. If no violations are identified during the assessment, the control authorities will issue an act of putting the facility into operation.

A positive conclusion will not be issued if, during the control check, significant and unfounded deviations from the approved design solutions and legal requirements are discovered. Control structures will allow the facility to be put into operation only after the shortcomings have been eliminated and re-evaluated.

In the article we will consider what becomes the subject of the examination, who conducts it and how.

Reflection in accounting of an OS object put into operation: postings

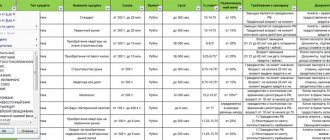

OS get into the organization in different ways: they can be bought, built, acquired through exchange or as a contribution to the authorized capital, it is also possible to receive them free of charge. Depending on how they got into the organization, the accounting system reflects the receipt and entries are made for the commissioning of fixed assets:

About postings reflecting the nuances of the gratuitous transfer of fixed assets, read here “Gratuitous transfer of fixed assets - postings”.

Important! Since 2022, PBU 6/01 “Accounting for fixed assets” has lost force, it was replaced by two new FSBU 6/2020 “Fixed assets” and FSBU 26/2020 “Capital investments”. ConsultantPlus experts explained in detail what the new standards have changed in asset accounting compared to PBU 6/01. Get trial access to the system for free and go to the Ready-made solution.

Wiring deserves special attention - fixed assets requiring installation have been put into operation. To capitalize such fixed assets, account 07 is used in accounting records. Its most relevant use is in construction companies. The debit of the account reflects the cost of incoming equipment and the costs of its delivery. For a loan - write off the cost of the equipment handed over for installation to the debit of account 08. Wages to workers, the cost of work by a third-party organization (if the installation was carried out by a hired team) - these and other installation costs are taken into account as part of capital investments. After the initial cost of the OS has been formed, the entry for commissioning of the OS is drawn up: Dt 01 Kt 08.

Is it possible to apply a VAT deduction for property recorded on account 07? The answer to this question will be given to you by a selection of law enforcement practices from ConsultantPlus. Get trial access to the system for free and go to the Encyclopedia of Disputed Situations.

Preparation for acceptance

After receiving written notification from the contractor about the readiness of the facility, the customer begins to organize acceptance in accordance with the contract agreement. After acceptance of the structure according to the act, the customer prepares it for commissioning. At the same time, he must provide:

- Individual and comprehensive testing of equipment.

- Carrying out commissioning work.

- Transfer of external communications and engineering structures for maintenance to operating organizations.

- Obtaining special permits, conclusions for the use of equipment and facilities from the relevant supervisory authorities.

How to properly put an operating system into operation: documents and date of acceptance for accounting

To document the process of commissioning fixed assets, enterprises can use standard forms No. OS-1 (a, b) or independently develop the form of this document. It is important that the act contains all the necessary details:

- date and number;

- information about the organization transferring the OS;

- information about the enterprise receiving the object;

- accounting information: initial cost, useful life, etc.;

- characteristics of the fixed asset, etc.

OS-1 is available for free by clicking on the picture below:

Read more about the preparation of this document in the article “Unified Form No. OS-1 - Certificate of Acceptance and Transfer of OS”.

To determine the readiness of the facility for operation, the manager issues an order to create a special commission. Its members will make a conclusion about the OS’s compliance with the technical specifications or the need for improvement. And based on the data received, the commission makes a conclusion and reflects it in the act.

Often an accountant is faced with the question: how to put into operation a fixed asset that the organization does not yet plan to use? To answer this, you need to decide what is considered the date of commissioning of fixed assets.

This date is the day when the fixed asset is completely ready for use, regardless of the moment when it actually begins to be used. After all, it is necessary to calculate depreciation according to the accounting book of the OS capitalized to the accounts. And until the fixed asset is put into operation, it will not be possible to charge depreciation.

General information

The procedure for commissioning of completed construction or reconstructed facilities, as well as their individual phases, structures, buildings, start-up complexes with quality assessment, is regulated by territorial and federal building codes.

Special commissions are formed to analyze the condition of buildings and structures. Objects completed by construction in accordance with approved projects are presented for acceptance by the customer-developer, and structures and buildings delivered on a turnkey basis are presented by the contractor and the customer jointly.

How are fixed assets that are not immediately put into operation reflected in accounting?

Not all operating systems received by an organization are immediately suitable for use. Some of them require installation and other work to bring them to a condition suitable for use.

Thus, a situation may arise that the operating system was received by the organization in one period, and was reflected in account 01 later. To ensure that tax inspectors do not have any questions, it is necessary to document that the asset is not ready for use. Such documents are acts for installation and commissioning of equipment, contract agreements, invoices for the purchase of components.

If objects are potentially ready for operation, but fixed assets have not yet been put into operation, it is advisable to reflect them separately in accounting. To do this, two sub-accounts are opened to account 01: the first will reflect fixed assets that are ready for use, but have not yet been put into operation, and the second will reflect property in operation.

The accounting entry reflecting the acceptance of fixed assets for accounting in this case looks like this:

- Dt 01 subaccount “Fixed assets in warehouse (in stock)” Kt 08.

The “OS put into operation” posting will be as follows:

- Dt 01 subaccount “Fixed assets in operation” Kt 01 “Fixed assets in warehouse (in stock)”.

Working commissions

They are formed to assess the quality of objects before their acceptance by the acceptance committees. The tasks of the working groups include checking:

- Compliance of objects and equipment installed in them with the project.

- Results of tests and comprehensive testing of installed equipment.

- Degree of readiness for normal operation.

- Quality of construction and installation works.

The commissioning of objects that are free-standing structures/buildings, attached or built-in premises, including auxiliary and production facilities, civil defense structures, is carried out by working commissions as they are ready and with their subsequent presentation to the acceptance commissions. These include, in particular, heat, energy, water supply structures, warehouses, access roads, household premises, and other facilities that are used by the contractor during construction.

Transfer of apartments to shareholders

After the house is officially put into operation, preparations begin for its transfer to new residents. The administration of the area where the new building is located is holding a competition to select a management company to service the building.

In contrast to the deadline for putting the house into operation, the deadline for transferring the object to shareholders is established by the agreement on participation in shared construction with investors. If the developer violates it, he faces penalties. If this deadline is violated, the shareholder has the right to receive compensation. Therefore, developers are keen to complete the transfer before this period ends. Even if the house is delivered ahead of schedule and there is time before the deadline for transferring the property established in the contract, it is not in the interests of the developers to delay the transfer of keys to equity holders. The costs of heating a house are quite significant, so companies are trying to transfer apartments to new residents as soon as possible.

If today only the deadline for transferring the property to shareholders is clearly defined in the contract, then according to the new rules, after changes to the law on shared-equity construction come into force, the developer is obliged to indicate both the deadline for putting the house into operation and provide a work schedule. Developers will have to make more efforts to meet all deadlines.

Housing fund

Completed residential buildings can be accepted by the commission only after the completion of the entire complex of construction and installation work, improvement of the adjacent territory, provision of inventory and equipment in full accordance with the design documentation and elimination of deficiencies.

The commissioning of a residential microdistrict is carried out in the form of a completed urban planning complex. By the time of acceptance by the commission, the construction of enterprises and institutions serving the population, the laying of utilities, landscaping, and landscaping must be completed. Recently, multi-storey buildings have attached and built-in premises for institutions and enterprises of trade, catering, consumer services, etc. Such objects are presented to the commission after the completion of construction and installation work, including in the specified premises.

Acceptance of an object without commission

According to the general rules, the territorial departments of state supervision, which control the completed structure, prepare and issue a conclusion within 15 days after receiving notification from the customer that the building is ready for use. Execution of as-built documentation upon commissioning of a facility is carried out only after establishing the compliance of the structure with the project and the requirements of the standards.

If a discrepancy is identified, within the specified 15-day period a reasoned refusal is drawn up, indicating comments on issues within the competence of the territorial divisions of the supervisory authorities, and sent to the customer (developer). All shortcomings cited in the refusal must be eliminated. After this, the customer (developer) sends a repeated application to the authorized structures about readiness for commissioning of the property.

When accepting a building without a commission, the customer, together with the investor (developer), on the basis of conclusions issued by state supervision authorities, an act of acceptance of the object from the contractor (with all attachments), draw up a new act of acceptance of the building for operation.

All of the above documents, together with a statement about the readiness of the structure for use, are submitted to the Inspectorate of Architectural and Construction Supervision. This structure prepares a final conclusion on the sufficiency of the materials received and compliance with the rules for commissioning the construction project.

The inspectorate may refuse to provide a positive conclusion only if violations of norms and regulations are detected on issues within its competence.

Further actions of the customer

Within five days from the date of receipt of the act from the acceptance committee or a positive final conclusion from the Inspectorate, the developer (investor, customer) sends all completed documents to the relevant executive body. This structure, in turn, must accept an operation certificate within a week or give a written refusal to do so. In the latter case, the decision of the executive body must be motivated. It is necessary to take into account that refusal is possible only in case of violation of the rules and regulations for commissioning of the construction project.

Industrial buildings

Commissioning of production facilities with the participation of acceptance committees is carried out only if they are staffed with operational personnel, provided with raw materials, resources, etc., and all defects are eliminated. At the same time, the installed equipment must begin producing the products provided for in the project in a volume that corresponds to the standards for the development of design capacities at the initial stage of production.

It is not permitted to put into operation production facilities in which the composition of the launch complexes has been changed in violation of the established rules. Reception of the last launch complex is carried out simultaneously with the acceptance of the entire facility or its last stage.

How are shareholders protected by law?

Buyers who do not receive the keys to their apartments on the day specified in the shared construction agreement are entitled to monetary compensation.

You can get it pre-trial or after trial. In the first case, the shareholder must send an appeal to the construction organization demanding voluntary payment of the penalty. This letter should indicate those clauses of the contract that contain information about the expected deadlines for delivery of the object and liability for their violation.

The amount of the penalty is determined as follows:

number of days of delay*1/300*rate of the Central Bank of the Russian Federation*cost of the contract.

For example, when purchasing an apartment worth 4 million rubles for a 50-day delay, the equity holder has the right to demand the following amount from the developer: 50*1/300*8.25%*4 million=55,000 rubles. In addition, the amount of the penalty can include expenses associated with delays in delivery of housing (for example, a monthly payment for forced rental housing).

This letter, along with photocopies of the passport and shared ownership agreement, must be sent to the developer’s office by registered mail.

If a peaceful resolution of the conflict is impossible, the shareholder will need to go to court to receive a penalty.