The issues of guaranteeing the integrity of one’s real estate and the inviolability of property do not lose relevance throughout the entire history of human existence. And today, citizens of our country want to have guarantees that they can count on material compensation for the loss of material assets, damage or destruction of housing. The home insurance program from Rosgosstrakh, which has quite a lot of reviews, deserves the attention of citizens who care about their future.

Read more about home and cottage insurance

02/25/19 09:43 We offer two insurance programs.

This product is for insuring houses of the lower and middle segment, built in gardening associations, settlements, villages, hamlets, and cottage communities. This policy allows you to insure most types of buildings, including cottages and outbuildings.

Insurance of a dacha or home under the Rosgosstrakh-dom “Active” program is especially relevant for those who are used to vacationing outside the city only in the warm season and are forced to leave their property unattended for the rest of the year.

- You can insure a house, outbuildings, interior and exterior decoration of premises, movable property and especially valuable items, engineering and equipment, as well as civil liability during the operation of buildings (including damage to life, health and property of third parties).

- We help you accurately and quickly determine the cost of insurance for your cottage and property.

- Conclude an agreement promptly without an application.

- Pay your insurance premium in one lump sum or in installments.

This is an insurance program for private homes with an individual architectural solution and interior design. The “Rosgosstrakh-dom “Prestige” policy can be issued for a cottage located in a guarded village.

Insurance of country houses at Rosgosstrakh is reliable protection in unforeseen situations.

What may be covered?

When deciding to insure a house against fire, Rosgosstrakh allows you to take out a policy for a small dacha designed only for seasonal residence, for a country cottage or a residential building located within the city. When taking out insurance, you can protect not only existing objects, but also finishing materials, engineering equipment, acquired property, and garden equipment. The maximum expansion of coverage becomes available when taking out an individual policy, where the company’s client has the right to independently list all property that needs protection.

Fire insurance allows you to protect not only a private cottage, but also other objects located on the land plot:

- garden houses designed for year-round and seasonal use;

- greenhouses for growing plants;

- winter gardens;

- gazebos;

- baths;

- sheds;

- garages;

- summer kitchens;

- outbuildings.

The main task is to list all objects in the drawn up agreement, which will subsequently determine the coverage. Based on the terms of the current contract, the cost of providing services by Rosgosstrakh is determined. Typically, the annual cost of an insurance policy varies between 1,750 – 6,750 rubles.

Factors on which the cost of a private home insurance policy depends

Mortgage insurance Rosgosstrakh

An owner who wants to protect his property pays attention primarily to the cost of services. The final price of an insurance policy depends on several factors and is the main criterion when choosing an insurance company

Let's take a closer look at the most significant characteristics that influence the formation of the final cost of the policy.

- Number of selected risks When taking out insurance, you can limit yourself to only a few risks or include as many insured events as you like in the policy. Costs will vary in proportion to the number of risks indicated in the contract.

The client has the right to independently determine the number and types of risks that are important to him. Life experience will certainly help you make the right choice and make the final decision.For example, why insure your home against earthquakes if it is located in a seismic zone with no activity for hundreds or thousands of years? Or why include the risk of flooding in the policy if there is not a single river at a distance of more than 100 kilometers from the house?

Let's say the building is located near a noisy highway, then it makes sense to insure the property against collision with ground transport. There are cases when people want to protect their home from an aircraft crash, otherwise they simply cannot calm down.

- Features of using a house If the owners live in a country house only in the summer months, the price of the policy will be higher.

At the same time, the presence of stove heating entails the risk of fire, and this will also raise the cost of insurance by several points. Another factor that increases insurance rates is the lack of flood protection for your home. It will affect the price and condition of utilities adjacent to the house. If electrical wires have not been replaced for many years, there is a risk of a short circuit, which will inevitably affect the cost of insurance. - Availability of security systems and alarms If the insurance agent sees that the owner is making every effort to preserve his property, the cost of the insurance policy is reduced.

The fact that the owner installs fire and security alarm systems in the house, and also uses non-combustible materials when insulating the walls, allows him to save money when taking out insurance. - Cost of construction and finishing materials The materials used in the construction of the building play an important role.

The more expensive and high-quality the finish, the higher the insurance premiums and payments, respectively. This means that buying an insurance policy to protect a wooden house will cost a pretty penny, but taking out insurance for a brick building will cost less. - Lifespan of a building Risks directly depend on the age of the building. Representatives of insurance companies have difficulty agreeing to issue insurance for an old and dilapidated building. There are companies that adhere to clear regulations - if the building is more than 50 years old, then an insurance policy cannot be issued.

How to choose a company

When choosing an insurance organization, you should be careful when using the services of small companies that, as a rule, do not have sufficient experience in working in different situations and a sufficient material base.

Medium-sized companies often stand out for their individual approach to each client, which is not always found in large organizations, the cost of policies in which may be slightly higher.

When choosing an insurance company, you should pay attention to:

- period of presence on the market;

- reliability of the company;

- terms for insurance payments;

- amounts of payments, special conditions of payments (in the absence of certificates from the traffic police);

- the smoothness and complexity of the procedure for submitting documents in the event of an insurance situation;

- the predominant presence of positive reviews.

You can find out which company is better by comparing it with competitors yourself or by clarifying the intricacies of service from an independent specialist.

Real estate, which has increased value due to its purpose for long-term use, is one of the most common objects of insurance.

The services provided for the insurance of material assets, including real estate of citizens, are fully aimed at reducing risks in the event of any unfavorable situations.

Find out how to insure an apartment against flooding in the article: apartment flood insurance. What is the object of property insurance, read here.

This article describes mortgage insurance at Sberbank.

Features of Apartment, House and Equipment Insurance at Rosgosstrakh

"Rosgosstrakh": insurance of civil liability of apartment owners. features and procedure

First, let’s determine what the specifics of this type of insurance are. The following key points are highlighted:

- the policyholder must be interested in preserving the object that is insured, that is, have a property interest in it;

- the damage that may be caused to such an object must have a monetary value. It is determined by the policyholder or an employee of the company;

- Property can be insured in favor of the policyholder or a third party;

- houses and apartments are usually insured for a year, but other periods may be established;

- the amount for which property is insured should not be higher than its value. However, during the validity of the contract this cost may change;

- the insurance premium paid by the client depends on the set of risks against which the property is insured, the type of building, the materials from which it is built, its location and other factors.

Also, the features of property insurance include a deductible - part of the losses that the owner undertakes to cover independently.

"Rosgosstrakh" - Apartment Insurance against Flood, Fire and Theft

Mortgage insurance at AlfaStrakhovanie: online calculator, customer reviews, policy for houses and apartments

Apartment insurance has its own specifics. In addition to the real estate itself and its elements, insurers recommend insuring the property that is located in it, as well as civil liability. After all, in an apartment building they can cause damage not only to the property of the owner, but he himself can cause damage to the property of other residents: a flood, a fire, an explosion.

What most often happens to apartments:

- Fires. In 2021, 132,074 fires were recorded, of which 93,678 were residential buildings.

- Bays. According to insurers, 9 out of 10 insured events in apartments are flooding.

- Theft. Every 12th kidnapping is a burglary.

Most often, insurers recommend insuring an apartment in the following cases:

- The apartment is for rent. Moreover, not only the landlord, but also the one who rents the apartment can insure the property.

- Left unattended for some time.

- Purchased with a mortgage.

- Contains expensive property.

In addition, expensive renovations made from exclusive materials should also be considered as a reason for concluding a contract.

Apartment Insurance Programs at Rosgosstrakh - Asset and Prestige

Rosgosstrakh has developed three different products for clients insuring apartments:

- “Asset fixed”;

- “Individual asset”;

- "Prestige".

The table shows the main parameters of these programs.

| Fixed asset | Individual asset | Prestige | |

| Purchasing on the website | + | — | + |

| Purchase in the office | + | + | + |

| Franchise | + | + | + |

| Structural parts of the apartment | + | + | + |

| Exterior decoration | + | + | + |

| Finishing inside the apartment and various engineering systems | + | + | + |

| Property | + | + | + |

| Civil responsibility | + | + | + |

| Expensive property | — | — | + |

| Various combinations of insurance objects | — | — | + |

| Any period of insurance | — | — | + |

| Risks | Risks | Risks | |

| Fires | + | + | + |

| Explosions | + | + | + |

| Accidents | + | + | + |

| Bays | + | + | + |

| Vehicle collision | + | + | + |

| Falling on an object | + | + | + |

| Lightning strike | + | + | + |

| Natural disasters | + | + | + |

| Theft, robbery | + | + | + |

Usually the contract is concluded for 1 year, but under the “Prestige” program you can set a period of six months.

Apartment in "Rosgosstrakh" - Policy Cost Calculator

The price of the policy is affected by:

- location of the property, including region, city, area of location;

- apartment area;

- the amount of the insurance premium – that is, how much the apartment is insured for. The larger it is, the more expensive it is;

- what elements will be included in the insurance contract - interior decoration, exterior, civil liability, property inside the apartment, its cost.

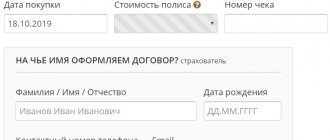

The insurer’s website has one that allows you to calculate the cost of the policy. The calculation itself consists of several stages:

Indicate the city where the apartment is located and the number of rooms in it.

Select a program. You can choose all three programs, or you can choose just one.

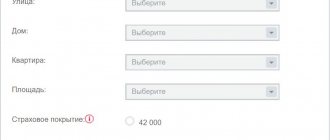

Click the icon next to the list to select the coverage amount. For interior decoration, 3 options are available: 300 thousand, 450 thousand and 900 thousand rubles.

As the amount of insurance increases, the price of the policy increases. For example, for coverage of 900 thousand rubles you will have to pay 9,210 rubles.

Home property can be insured for an amount from 200 thousand to 1 million rubles, civil property from 40 thousand to 500 thousand rubles, finishing inside an apartment for an amount from 300 thousand to 900 thousand rubles.

Price

Each insurance company may have different policy prices. Usually it is 0.3-1.7% of the insurance payment. The price is affected by the date of construction, the condition of the house, and the materials used for construction. Homes built using high-tech materials will be cheaper to insure.

An important factor is the coverage of risks and the territory of protection. The amount of contributions will increase with the repairs carried out on the premises and the rental of the property. The amount is affected by the size of the city where the housing is located. If you want to save money, it is better to purchase collective insurance, issued by several residents of the same entrance.

The amount is reduced by purchasing a regular policy, which includes home insurance along with civil liability. The policyholder can provide contributions every year, month, and the payment procedure does not affect the price of insurance.

Thus, insurance is considered important in modern life. In order not to incur large financial losses, you need to use such services, especially if you have to be away from your property for a long time.

"Rosgosstrakh" - Insured Event in an Apartment and House, What to Do?

Regardless of the type of program purchased, when an insured event occurs, the algorithm of actions is the same:

- Contact the responsible authorities and tell them what happened. For example, in case of an explosion, call the Ministry of Emergency Situations or the gas service, in case of a fire - in the department of the State Fire Service, in case of a flood - in the emergency service, DEZ, Housing Department, in case of theft - in law enforcement agencies.

- Try, if possible, to stop the destruction of the insured property or reduce the damage caused to it.

- Call Rosgosstrakh at 0553 or and report the event.

- Preserve the appearance of the event, that is, do not move the damaged property, but leave it in the condition in which it found itself after the insured event occurred.

The next step is to collect documents to receive compensation. Try to keep it within 1 day.

You must submit the following kit:

- statement;

- passport;

- agreement with Rosgosstrakh;

- payment receipt;

- documents confirming the policyholder's interest in preserving the property;

- documents that reflect the fact of the incident. If there was a flood, then you need to obtain a flood certificate from the Housing Office or another housing service. It indicates when and for what reason the flooding occurred, as well as the person involved in this incident. A list of damages is attached to the report. In the event of an explosion, fire, or theft - a copy of the resolution to initiate (refuse to initiate) a criminal case. If the insured object was hit by a vehicle, you must request a certificate of an accident (form 154), a resolution to initiate or refuse to initiate an administrative violation case;

- policy.

Let us dwell on the last point in more detail, because depending on the type of property, a different package of documents may be required.

Tariffs for real estate insurance in Rosgosstrakh

The cost of real estate insurance services is calculated for each individual case and is related to the type of property, its characteristics, as well as the risks expected to be insured.

You can find out the preliminary cost using a special calculator on the company’s website.

To calculate the cost on the company's website, you need to enter a phone number and send an SMS. A fee is required for this service.

Depending on the type of property, the tariff and amount of payments in the event of an insurance situation differ.

The consequence of the low percentage of the minimum tariff and the most simplified registration procedure will be a small amount of compensation for damage.

A higher tariff using the procedure for assessing real estate, contents and repairs of premises implies a larger amount of payments upon the occurrence of an insured event.

The cost of home insurance in the company is up to 1.5% of the value of the client’s property. In this case, payment in installments is possible, the first part is paid immediately after the conclusion of the contract, the second - a few months later.

When registering in the summer, there is a discount on tariffs (“Beneficial Insurance Season”), allowing you to save up to 15% on apartment insurance. Discounts are provided for insuring two properties at the same time (up to 12%).

Home Insurance Programs at Sberbank - Apartment and House

IC "Sberbank Insurance" provides its clients with the opportunity to obtain insurance under one of several programs. The following products are currently in use at the institution:

"Protection of the home." A classic insurance program that includes insurance against most risks.

"Live comfortably." Product for privileged clients of the institution. Registration is possible only at Sberbank Premier offices. Features increased amounts of insurance coverage.

“Protection of an apartment, house or cottage.” This program is completely consistent with the first one. The only difference is the duration of the contract. The document is signed for 5 years. Payment occurs every year.

- “Protection of apartments, Premier houses.” As in the case of “Live with Comfort,” the product is intended for VIP clients.

- "Insurance of an apartment in Sberbank Online." Basic insurance option. Issued via Internet banking, valid for no more than 1 month.

The difference between these products is minimal and lies in the maximum amounts of insurance amounts, registration costs and client status. In this regard, it makes sense to consider in more detail only the flood/fire insurance of the apartment and the home protection program.

Apartment flood and fire insurance at Sberbank

The Home Protection program provides insurance for your apartment against various emergencies. The list of insurance risks included in the policy includes not only fire or flood, but also the following factors:

- explosion;

- hacking, theft and other illegal actions of third parties;

- damage to property due to repairs or reconstruction of neighboring apartments;

- damage to property due to the fall of an aircraft or its parts;

- natural disasters.

In addition, insurance compensation can be obtained in the event of property damage due to a terrorist attack, freezing of liquids in engineering systems of equipment, or smoke.

Home Protection Program - Peace of Mind for Your Home

The program for protecting a private home provides for the inclusion in the contract of the same risks as in the previous case. In addition, regardless of what kind of property the client insures (an apartment or a private house), he can include civil liability insurance in the policy.

With civil liability insurance, the insurance company will pay compensation to a person injured due to an incident involving the insured's real property. The product also includes protection of interior decoration and engineering equipment, movable property (shoes, clothing, interior elements).

Property insurance reviews

As for property insurance in IC "RGS", here, too, customer reviews are contradictory.

Maxim, 42 years old, Stavropol

The neighbor on the top floor was doing renovations, changing the heating and plumbing, and this alarmed me. I insured expensive paintings and antique furniture with the RGS, each item separately. When hot water was supplied to the system in the fall, I was completely flooded. Everything that was written in the contract was spoiled. I called an agent, who brought a restorer who estimated the cost of restoring the property. The payment took place within 2 weeks, although the insurance company withheld 10% for wear and tear. Okay, thanks for that.

Andrey, 33 years old, Krasnodar

I bought a car in a dealership in January 2021 and immediately purchased CASCO and MTPL from the Rosgosstrakh agent. A month later, the car was set on fire and it burned out completely, the death of the vehicle was diagnosed. I contacted the insurance company, but they told me that they wouldn’t pay me anything because I didn’t take measures to protect the property. Unfortunately, this was specified in the contract (garage or paid parking).

Elena, 43 years old, Rzhev

There are a lot of family jewels at home. I keep them in a safe, but just in case, I insured them with the RGS insurance company. Within a month, the apartment was robbed, the safe was opened, and the jewelry disappeared. I reported it to the police and the insurance company. To the company's credit, they paid in full. True, they warned that if the loss was found, it would be her property. Let's see, maybe I'll buy it.

Despite the many difficulties that clients of IC Rosgosstrakh have to face, the company pays enough attention to working on errors, drawing appropriate conclusions for each.

Article on the topic: Insurance "Tinkoff Insurance", reviews about the company and car insurance in it

Features of pricing policy and solving financial issues

The cost of the insurance policy is calculated individually. If a company's client chooses an individual product instead of a standard one, it is necessary to detail the object and take into account the wishes of the policyholder.

Before you insure your house against fire in Rosgosstrakh, you can better use the calculator on the company’s official website. The virtual calculator will allow you to make preliminary calculations and find your bearings regarding the cost of policies. However, the final information will become known only after consultation with a specialist and an accurate determination of the coverage. The insured amount is determined only by agreement of the two parties, but one should focus on the market value. In this regard, you should take care to have the house inspected by an insurance expert or an independent expert, having previously agreed on the event with Rosgosstrakh.

Insurance premiums, the amount of which is determined by documents, are collected every month. If there are continuous delays and failure to comply with the agreed conditions, the policy loses legal force.

To save money when applying for insurance, it is recommended to apply online, as this method allows you to reduce payments. Choosing a standard policy provides a limited amount of financial assistance after a fire, but also guarantees savings when obtaining an insurance policy.

Peculiarities

Real estate insurance in the event of an insured event implies payment only for the risks specified in the concluded contract, and not for any incident that happens to the property.

No compensation is paid if an insured event occurs as a result of the direct participation of the policyholder.

The case of partial influence of the policyholder on the situation that led to the need for material compensation by the company is a controversial issue. The influence will be exerted by the intentionality of actions (behaviors) or the negligence of the insured.

In case of intentional damage to property for the purpose of obtaining material gain, there will be no compensation from the insurance company.

In case of negligence or carelessness that causes an insured event, the company is obliged to compensate the established amount.

The likelihood of proving the occurrence of an insured event during the period of repair or construction work exists when it is carried out by specialists and if there is a clear regulation of the actions by official contract agreements.

You should not overestimate the value of the insurance object. After all, the amount of compensation will not exceed the cost of its restoration, but the cost of the policy itself will increase.

Rules for insurance of property of individuals.

Apartment insurance.

Country house insurance

The cost can be assumed by analogy to be a maximum (if the house is in excellent condition) from 5,000,000 rubles. You will have to pay for insurance per year from 42 thousand. You can also insure for a smaller amount.

But then the increasing coefficient is 1.14 (“underinsurance”). You can reduce the cost of the house, bringing it to the desired value.

Then you won’t have to apply the coefficient for underinsurance. In short, you can immediately go to the insurers in Moscow with the documents.

I always do this. Just provide them with a photo so that they can see the two walls of the house from the outside, the foundation and the ridge (view of the house from the corner). You’ll figure it out in the office what it’s built from. There are tables there. And specialists.

And beautiful girls. Here. You will say what amount you are interested in and they will get it (but not more than the maximum).

Contract time

The insurance period is determined by mutual agreement. If this period is 1 year or more, then the period is calculated in years. But the document can be terminated for several reasons:

- Liquidation of an insurance institution.

- Refusal of the heir to assume the rights and obligations under the insurance.

- Housing is transferred to another person.

Contract extension

Upon expiration of the insurance contract, the applicant may apply for an extension of the contract. Moreover, if the policyholder does not want to change the conditions, then there is no need to write an application. In some cases, the company may ask for papers on a new assessment of the property or assess the deterioration of the building itself. If the conditions change, the contract will need to be drawn up again.

The Rosgosstrakh company is chosen by a huge number of people. This can be explained by the huge selection of insurance programs and the reliability of the organization. This organization has also proven itself in the insurance of private houses, the nuances of which were described above.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Source

Insurance rules Rosgosstrakh house classic

// There should not be any difficulty in this, since the insurance company employees help their clients fill out the application. On a special form you must indicate the applicant’s full name, address of the house, insured events that are covered by insurance, as well as the property that needs to be insured.

Anyone over 18 years of age can become an insurer of a private home.

It is not even necessary that he be the owner of the property.

In addition to individuals, applicants may be legal entities or individual entrepreneurs.

- Mortgage insurance. The program provides financial support for the client in fulfilling obligations under a bank mortgage loan in situations of loss of ability to work, loss of ownership of an object, restoration costs in case of damage to real estate and others specified in the agreement.

- Title. Title insurance of any property (house, apartment, non-residential building) is highly desirable when purchasing on the secondary market.

- accessibility of services for all categories of the population and legal entities of the Russian Federation, achieved through the functioning of more than 400 specialized centers.

A number of services are available on the network website online without visiting offices;

- simplicity, transparency and reliability of activities;

- literacy and clarity when drawing up agreements;

Brief overview of available products

Rosgosstrakh offers three product options: Fixed Asset, Individual Asset, and Prestige. Current programs differ in the degree of protection of residential real estate, and therefore in cost - this is a program that includes a minimum list of risks. The ready-made sample policies offered are usually concluded for one year, but if necessary, the insurance can be extended. A minimum financial payment is provided in the event of a house fire, but the cost of available services is also significantly reduced. For example, for a one-room apartment in Moscow, the policy will cost 3,240 rubles per year, if an insurance payment of 200 thousand rubles is provided. If you plan to insure a private home, you should take care of additional payment.

“Individual asset” expands the list of property that is covered when taking out a policy that is valid in case of fire. The client of Rosgosstrakh has the right to independently determine all objects that need protection, taking into account personal financial capabilities.

“Prestige” is a program that allows you to protect even expensive property and collections of valuable substances. By choosing this product, you can count on any insurance period and the ability to choose available risks from those offered. Any restrictions are excluded, so the level of protection becomes maximum. However, the cost of the services provided will be the most expensive.

Another option for classic insurance products is the possibility of using assistance provided by the municipality. It is expected that the policy's coverage will include interior decoration as well as structural elements of the home. Rosgosstrakh is one of the largest insurers, therefore representatives of the target audience have the right to carefully study all proposals and make the right decision regarding the issuance of a valid policy.

"Rosgosstrakh" - Apartment Insurance against Flood, Fire and Theft

Apartment insurance has its own specifics. In addition to the real estate itself and its elements, insurers recommend insuring the property that is located in it, as well as civil liability. After all, in an apartment building they can cause damage not only to the property of the owner, but he himself can cause damage to the property of other residents: a flood, a fire, an explosion.

What most often happens to apartments:

- Fires. In 2021, 132,074 fires were recorded, of which 93,678 were residential buildings.

- Bays. According to insurers, 9 out of 10 insured events in apartments are flooding.

- Theft. Every 12th kidnapping is a burglary.

Most often, insurers recommend insuring an apartment in the following cases:

- The apartment is for rent. Moreover, not only the landlord, but also the one who rents the apartment can insure the property.

- Left unattended for some time.

- Purchased with a mortgage.

- Contains expensive property.

Apartment Insurance Programs at Rosgosstrakh - Asset and Prestige

Rosgosstrakh has developed three different products for clients insuring apartments:

- “Asset fixed”;

- “Individual asset”;

- "Prestige".

The table shows the main parameters of these programs.

| Fixed asset | Individual asset | Prestige | |

| Purchasing on the website | + | — | + |

| Purchase in the office | + | + | + |

| Franchise | + | + | + |

| Structural parts of the apartment | + | + | + |

| Exterior decoration | + | + | + |

| Finishing inside the apartment and various engineering systems | + | + | + |

| Property | + | + | + |

| Civil responsibility | + | + | + |

| Expensive property | — | — | + |

| Various combinations of insurance objects | — | — | + |

| Any period of insurance | — | — | + |

| Risks | Risks | Risks | |

| Fires | + | + | + |

| Explosions | + | + | + |

| Accidents | + | + | + |

| Bays | + | + | + |

| Vehicle collision | + | + | + |

| Falling on an object | + | + | + |

| Lightning strike | + | + | + |

| Natural disasters | + | + | + |

| Theft, robbery | + | + | + |

Usually the contract is concluded for 1 year, but under the “Prestige” program you can set a period of six months.

Apartment in "Rosgosstrakh" - Policy Cost Calculator

The price of the policy is affected by:

- location of the property, including region, city, area of location;

- apartment area;

- the amount of the insurance premium – that is, how much the apartment is insured for. The larger it is, the more expensive it is;

- what elements will be included in the insurance contract - interior decoration, exterior, civil liability, property inside the apartment, its cost.

The insurer's website has a calculator that allows you to calculate the cost of the policy. The calculation itself consists of several stages:

Indicate the city where the apartment is located and the number of rooms in it.

Select a program. You can choose all three programs, or you can choose just one.

Click the icon next to the list to select the coverage amount. For interior decoration, 3 options are available: 300 thousand, 450 thousand and 900 thousand rubles.

As the amount of insurance increases, the price of the policy increases. For example, for coverage of 900 thousand rubles you will have to pay 9,210 rubles.

Home property can be insured for an amount from 200 thousand to 1 million rubles, civil property from 40 thousand to 500 thousand rubles, finishing inside an apartment for an amount from 300 thousand to 900 thousand rubles.

Cost of property insurance programs

The table presents data on the cost of apartment insurance for the “Asset Fixed” program in Moscow as of 2017.

| Program | Number of rooms in the apartment | Insured risks | Sum insured, rub. | Cost of insurance, rub./year |

| “Fixed asset” from Rosgosstrakh insurance company | 1 |

| internal finishing - 200,000; house. property - 200,000; citizen liability - 40,000. | 4 080 |

| 2 | internal finishing - 300,000; house. property - 200,000; citizen liability - 40,000. | 4 890 | ||

| 3 | internal finishing - 400,000; house. property - 200,000; citizen liability - 40,000. | 5700 |

General parameters of the comprehensive insurance product ROSGOSSTRAKH HOUSE “Classics”

The comprehensive insurance product ROSGOSSTRAKH DOM “Classics” has the following structure by types of underwriting:

ROSGOSSTRAKH HOUSE “Classics”

- Ш Building (without interior finishing and engineering equipment).

- Ш Additional buildings on the site (bathhouse, garage, utility block, etc.).

- Ш Household property (mainly buildings and additional buildings).

- Ш Civil liability to other persons during the operation of a building.

Insurance risks: damage, complete destruction (destruction) of the insured object.

- Ш Accidents: fire, explosion, accidents of water supply systems, collision with vehicles, falling of trees, aircraft, their parts or cargo onto the insurance object.

- Ш Natural disasters: strong wind, typhoon, hurricane, tornado, earthquake, flood, high water, hail, precipitation unusual for the area, landslide, landslide, mudflow, avalanche, tsunami.

- Ш Crimes against property: theft, robbery, robbery, deliberate destruction (damage) of property by other persons.

Insurance is one of the largest organizations in the Russian insurance market, operating for about 15 years. Voluntary property insurance programs offered by the company help protect property and protect the client from unexpected financial costs.

"Rosgosstrakh" - Non-Insured Events for Apartments and Houses

The company will not compensate for damage in the following situations:

- precipitation got onto the insured items and into the insured apartment through the roof or other openings, as well as through open doors, windows, through a balcony, loggia, terrace;

- property has deteriorated due to natural processes, such as rotting, corrosion and other processes;

- the property has defects;

- the service life has expired;

- the damage was caused as a result of a military operation, terrorist attack, civil war and other similar incidents;

- damage may be compensated by the manufacturer's warranty.

Damage to property, its seizure, or confiscation by order of government agencies are also not considered insured events.

Why is it necessary to insure your home?

Insurance of private houses, summer houses and country cottages is perhaps even a more expedient and reasonable procedure than insurance protection of “ordinary” apartments. Private buildings, by definition, are more vulnerable and defenseless to the elements and other external factors, including the criminal intentions of third parties.

It is especially dangerous to leave a country house without insurance, which the owners visit only periodically - during the warm season, and even then not every day. A good-quality cottage left unattended is a headache for every responsible owner.

Security systems, numerous locks and locks do not guarantee inviolability. There will always be craftsmen who can turn off the alarm and unlock the lock. I'm not even talking about natural factors and natural disasters. The house may be damaged by flood, fire, hurricane, or falling trees.

And this is far from the most dangerous event that can happen to your property. Another friend of mine’s house burned down a couple of years ago. It was a miracle that the fire did not spread to neighboring buildings.

Conclusion: private buildings need to be insured. They are often robbed, set on fire, hacked, and are not spared by the elements and seasonal natural phenomena.

The cost of the policy (insurance premium) is negligible in comparison with the amount you will receive for reimbursement if an insurance situation arises.

The owner of the house has the right to insure:

- the whole house at once;

- only load-bearing structures (walls, ceilings, windows, doors, balconies);

- façade (from the elements, vandalism, illegal acts of third parties);

- interior decoration, interior (this type of protection is especially relevant for those who have recently made expensive repairs);

- internal engineering communications, plumbing, electrical wiring;

- movable property located in the house (appliances, electronics, furniture);

- any other values.

It is definitely worth taking out a policy for those whose dachas and houses are located in a flood zone. Everyone has seen reports on TV about the damage that spring floods cause to citizens’ personal property every year.

In Russia, property insurance is traditionally viewed with distrust. Only a limited percentage of the total number of homeowners purchase policies. The situation is diametrically opposite in the West - almost every residential building there is insured.

The reason for such a short-sighted attitude towards one’s property is the low level of financial literacy of the population. Fortunately, according to statistics, the consciousness of Russians has been growing steadily over the past 5-10 years: owners are signing more and more property insurance contracts.

If you want to know more about the rules and principles of risk management, read the review article about what insurance is.

About PJSC Rosgosstrakh

The history begins in 1992. Initially, it was known as a large state enterprise Gosstrakh of the USSR. 100% of the shares were owned by her. During the period 2001–2003. Investment acquired 75% of the shares. In 2010, it purchased the last securities, after which a unified federal government was created.

In 2015, the business entity was reorganized into PJSC IC Rosgosstrakh. In 2021, it was sold to the Otkritie FC bank. Over the entire period of work in the insurance industry, the insurer has established itself as reliable. After assessing the financial indicators and performance parameters, rating agencies assigned a high rating and included it in the list of recommended ones on the website.

PJSC IC "Rosgosstrakh" is a member of the All-Russian Union of Insurers and the Association of Life Insurers. Participation in these organizations is mandatory for serious institutions and is necessary to obtain permits to conduct insurance activities.

ABOUT

OJSC Russian State Insurance Company (RGS) is the legal successor of the organization operating during the Soviet era, which is a de facto monopolist in this field of activity. After the collapse of the country, it was created, which, throughout its existence, went through stages of disintegration, consolidation, stabilization and reorganization, which continues to the present day.

Today, PJSC is the largest player in this area of business, occupying a leading position in terms of the scale of presence in the constituent entities of the federation, the size of the authorized capital, equity capital, collected bonuses and paid compensation.

The company has perpetual licenses from the Central Bank of the Russian Federation, allowing it to conduct all types of insurance activities provided for by domestic legislation.

This is interesting! The organization's network includes more than 1.5 thousand offices and branches, with a staff of more than 70 thousand employees. The agreements cover more than 9 million individuals and 200 thousand legal entities. At the end of 2021, RGS PJSC received the highest rating as a reliable company with a long-term positive outlook.

"Rosgosstrakh" - Insured Event in an Apartment and House, What to Do?

Regardless of the type of program purchased, when an insured event occurs, the algorithm of actions is the same:

- Contact the responsible authorities and tell them what happened. For example, in case of an explosion, call the Ministry of Emergency Situations or the gas service, in case of a fire - in the department of the State Fire Service, in case of a flood - in the emergency service, DEZ, Housing Department, in case of theft - in law enforcement agencies.

- Try, if possible, to stop the destruction of the insured property or reduce the damage caused to it.

- Call Rosgosstrakh at 0553 or and report the event.

- Preserve the appearance of the event, that is, do not move the damaged property, but leave it in the condition in which it found itself after the insured event occurred.

The next step is to collect documents to receive compensation. Try to keep it within 1 day.

You must submit the following kit:

- statement;

- passport;

- agreement with Rosgosstrakh;

- payment receipt;

- documents confirming the policyholder's interest in preserving the property;

- documents that reflect the fact of the incident. If there was a flood, then you need to obtain a flood certificate from the Housing Office or another housing service. It indicates when and for what reason the flooding occurred, as well as the person involved in this incident. A list of damages is attached to the report. In the event of an explosion, fire, or theft - a copy of the resolution to initiate (refuse to initiate) a criminal case. If the insured object was hit by a vehicle, you must request a certificate of an accident (form 154), a resolution to initiate or refuse to initiate an administrative violation case;

- policy.

Let us dwell on the last point in more detail, because depending on the type of property, a different package of documents may be required.

How to act in case of an insured event

If a fire does occur, Rosgosstrakh employees should be notified of the incident within one working day. You should also take care to provide the following package of documents:

- a valid passport to confirm the identity of the victim;

- insurance documents confirming the existing cooperation of the citizen with the Rosgosstrakh company: the original policy and the current contract, all attachments;

- payment receipts confirming compliance with all financial obligations;

- a written statement about the need for financial assistance;

- documents confirming property rights to certain housing;

- a certified copy of the decision regarding the initiation or dismissal of a criminal case, taking into account the circumstances that caused the fire in the home (this document is required in the event of a fire, which can occur for various reasons).

Providing the established package of documents is only one of the main conditions. In the event of a fire, it is mandatory to report the incident to the OGPN employees, which also complies with the current legislation of the Russian Federation. To conduct an assessment and determine the exact amount of compensation required, you should save a picture of the event until the arrival of Rosgosstrakh employees, who must be notified promptly. Only fulfillment of all conditions guarantees the possibility of receiving financial assistance under a valid policy.

Who can insure?

Few people know that in order to insure a dacha, you do not have to be its legal owner, since this can be done without a certificate of ownership. However, only the one who is designated as the beneficiary under the contract can receive the insurance payment, and this is usually the owner.

Is it possible to insure buildings in a country house if they are not registered? If the house is unregistered, i.e. there are no documents on it, then it can also be insured. Most dachas in Russia are unregistered and do not have a certificate of ownership, and insurance companies are well aware of this.

But it will be quite difficult to receive insurance compensation without confirming your rights to property. The policyholder will have to present not only the insurance contract, but also at least a membership book or SNT certificate or other documents for real estate.

"Rosgosstrakh" - Insurance of Homes and Cottages against Flood, Fire and Theft

Most often, country houses are insured by those who do not live in them permanently. Typical incidents for a country house: floods, fires, natural disasters, thefts, explosions. Mechanical damage also often occurs: falling trees, lighting poles.

This program insures not only the house itself, but also the bathhouse, fences, outbuildings, landscaping elements, self-propelled vehicles, gardening and work tools and equipment.

Home and Cottage Insurance Programs at Rosgosstrakh - Finishing and Elements

On this line, Rosgosstrakh also offers 2 programs:

"Rosgosstrakh-dom "Active". You can insure with it a dacha, house, buildings erected in a gardening partnership, town, village, village, cottage community.

"Rosgosstrakh-dom "Prestige". This program insures private houses with exclusive architecture, interior and exterior design. This includes, at the client’s request, insurance of landscape design, antiques, and collections.

The website does not have a service for calculating the cost of a home insurance policy, but after registration you can order free delivery to your home or office.