Program features:

- To register, it is enough to pay the “Insurance” item in the housing and communal services payment invoice;

- the insurance organization pays up to 95% of the value of the destroyed property;

- the remaining amount is compensated by the Moscow Government;

- if the damaged housing cannot be used for further residence, the Moscow Government undertakes to allocate new property to the family.

You can calculate the cost of your policy remotely. To do this, you need to use the calculator located at the bottom of the next page - alfastrah.ru/individuals-housing-municipal. Here you can pay for the service using the “Pay online” button.

"AlfaCOUNTRY" – Country Real Estate Insurance

This product is aimed at suburban real estate, that is, private houses located outside the city limits (although exceptions are possible). Clients can order financial protection for a summer house, cottage, various outbuildings, household property and jewelry, and civil liability.

When applying for a policy, you can choose one of three insurance packages:

- "Economy". A basic insurance option that provides protection for real estate against insurance risks such as fire, gas explosion, lightning strike. The cheapest insurance option.

- "Standard". The difference from the previous program is an expanded set of insurance risks. Property is additionally protected from illegal actions of third parties and natural disasters.

- "Comfort". A policy option that includes the largest number of insured risks. In addition to those mentioned above, the contract also includes the following factors: accidents on water supply, sewer and heating systems, falling objects (including trees and power lines), collision with a vehicle.

You cannot issue a policy remotely. You can order insurance without inspecting the property by employees of the insurance company. The presence of security and fire safety systems allows you to get a discount when taking out a policy. Purchase in installments is allowed.

Property Insurance Programs at AlfaStrakhovanie – Theft Protection

Currently, it provides its clients with the opportunity to obtain real estate protection under one of several programs. The insurance coverage, risks included in the contract and, accordingly, the cost of its registration depend on the selected product.

“Title Insurance” – Protection against Loss of Title

The classic version of title insurance. Unlike other products, this program does not insure real estate and liability, but the financial condition of the insured person in the event that a property purchase and sale transaction is declared invalid.

Insurance parameters:

- the base cost is calculated using the formula – sum insured * 0.3% of the value of the purchased property (minimum price);

- the duration of the contract is not less than 1 and not more than 10 years;

- Persons who have purchased property insurance for a mortgage loan from the company can receive a discount.

Property title insurance will help avoid deterioration of the financial situation if the property alienation agreement is declared invalid in court. The insurer will compensate the insured person for all financial losses.

“All Inclusive” – Property, Life and Health Insurance

A special insurance program available only to AlfaStrakhovanie clients. It has no analogues in the domestic market. The main feature of contracts drawn up under this program is the possibility of introducing risks from different areas of insurance into them.

Thus, a client can use just one policy to protect:

- your health and life;

- bank plastic cards;

- real estate and movable property;

- civil liability;

- health in case of travel to other countries (travel insurance).

The user independently chooses which risks he wants to include in the contract. Thanks to this, several insurance programs can be combined into one policy.

“Protected Card + Health” – Bank Card and Money Insurance

Another comprehensive insurance program. Provides protection of funds on the card or cards, as well as protection of the client’s health from unforeseen injuries and disabilities.

In case of loss of funds or deterioration of health, the insurer undertakes to pay monetary compensation commensurate with the losses.

You can apply for a policy at one of the Alfa-Bank branches. This program is only suitable for persons who have Alfa-Bank plastic cards. Cards issued by other financial institutions are not insured.

“Purchase Protection” – Insurance of Household Appliances or Electronics against Theft

The program is aimed at customers who purchase expensive household appliances or electronics and want to protect them from the following insurance risks:

- theft;

- causing damage;

- breakdowns;

- illegal actions of third parties.

The insurance company is ready to compensate for damage up to 40 thousand rubles. The minimum cost of the policy is 499 rubles. You can purchase it at a retail outlet when purchasing the insured property. In the M.Video network, goods are insured under the Equipment Under Protection program.

"ALFASPORT" – Insurance of a Bicycle, Hoverboard, Skis or Snowboard

Another comprehensive insurance program aimed at citizens engaged in active recreation. Allows you to protect sports equipment, as well as the life and health of the client. It is allowed to issue a policy for:

- skis;

- snowboard;

- bike;

- hoverboard

You can purchase insurance either at the insurer's branch or in stores that sell sports equipment. The terms of the contract are selected individually.

“Insurance of Cultural Assets” – Avoiding Financial Losses

This program is aimed at collectors. Its action extends to objects of cultural and historical significance. The program allows you to protect the client’s financial position in the event of loss of valuable objects, their damage or theft.

You can insure:

- photographs (author's);

- objects of fine art (painting, graphics);

- icons and other items associated with different religions;

- sculptures;

- Jewelry.

You can also insure objects that are not objects of art, but have historical, ethnographic, artistic or cultural value. Among the insured risks: fire, explosion, vandalism, theft, natural disasters, terrorism and loss of part of the set.

“Bank Card Insurance” – Protection against Hacking and Loss of Funds

This product is aimed at bank card holders. Unlike the previous similar program, life and health insurance of the card holder is not included in the policy. Main insurance risks for this product:

- loss of funds stored on the card, including due to illegal actions of third parties;

- loss of funds withdrawn from an ATM due to robbery, robbery, hooliganism;

- loss of a plastic card (both due to an ATM malfunction and due to demagnetization).

You can insure cards issued by any financial institution in Russia. Registration takes place in the offices of the insurance company, as well as in the branches of the organization’s partners.

Civil liability insurance

Another insurance object that arose as a result of inexhaustible practice is civil liability insurance.

When an insured event occurs, not only a person’s property may be damaged, but also other people. For example, when there is a fire in a country house, the fire often spreads to neighbors' property.

In this case, the unfortunate fire victim will have to bear not only the restoration of his home, but also compensation for moral damage to his neighbor. Fortunately, today unfortunate fire victims are a rare occurrence.

People insure their properties not only against fires, floods and hurricanes; Increasingly, the risk of civil liability is imbued into the contract.

An insurance certificate taking into account this risk is a universal thing; its lucky owner is not afraid of practically anything.

Sample liability insurance contract.

Policy for Apartments and Houses from AlfaStrakhovanie – Buy Online

The method of purchasing a policy depends on the specific program. You can do this:

- at a branch of an insurance organization or Alfa-Bank;

- in the insurer’s partner stores, such as: “Euroset”, “M.Video”, “Svyaznoy” (only certain programs);

- through the insurance company's website on the Internet.

The last method is the most convenient, but it only works for certain products. The online registration procedure will be shown using the example of the AlfaREMONT program. You must proceed as follows:

- Select the program in the “Housing” tab on the website alfastrah.ru .

- Select an insurance package, then click on the “Buy online” button.

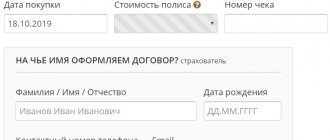

- Fill out the purchase form. You will have to enter your full name, email address, phone number, passport details and other information.

- Pay for your purchase using a bank card.

- Receive the policy to the email specified when filling out the form.

The cost of the service depends on the program and insurance coverage. The AlfaREMONT product will cost 1,200 – 3,600 rubles per year. The price of other programs is determined individually.

Which Product Should I Choose for an Apartment and House at AlfaStrakhovanie?

The company provides its clients with a wide range of insurance programs. However, since they are all specialized (except for the product “Even the Flood!”), there should be no problems with choosing a specific offer.

It is necessary to focus on the following nuances:

- you need to insure one area (only real estate) or also other objects (for example, health and a plastic card);

- which objects need to be protected;

- what is the cost of the insured property, taking into account its wear and tear;

- how much the user is willing to pay to complete the contract.

If you take into account all these nuances, you can weed out unsuitable programs and select the optimal product. It should also be remembered that the insurer only reimburses the cost of damaged property, taking into account wear and tear.

"AlfaStrakhovanie" - Questions and Answers on Property and Real Estate

On the insurance company’s website you can find information on products using the “Question and Answers” service. To do this you need to do the following:

- Go to address alfastrah.ru/faq.

- Select the category of interest in the “Property” or “Housing” section.

- Find the desired question on the page that opens, then left-click on its wording.

After that, the answer to it will open under the wording of the request. If the information provided is not enough, you can use the “Ask your question” function.

Who can insure?

Few people know that in order to insure a dacha, you do not have to be its legal owner , since this can be done without a certificate of ownership. However, only the one who is designated as the beneficiary under the contract can receive the insurance payment, and this is usually the owner.

Is it possible to insure buildings in a country house if they are not registered? If the house is unregistered, i.e. there are no documents on it, then it can also be insured. Most dachas in Russia are unregistered and do not have a certificate of ownership, and insurance companies are well aware of this.

But it will be quite difficult to receive insurance compensation without confirming your rights to property. The policyholder will have to present not only the insurance contract, but also at least a membership book or SNT certificate or other documents for real estate.

"AlfaStrakhovanie" – Policy Activation for Apartment, House and Equipment

If the insurance policy was issued at the company's office or branches of its partners, it may need to be activated. To do this you need to do the following:

- Go to the website of the insurance organization .

- Select the program under which the policy was issued.

- Click on the “Activate Policy” button located on the product description page.

- Fill out the form that opens (address of the property, place of purchase of the policy and its cost, contact and personal information).

- Click on the “Submit” button.

The policy will be activated after checking the entered data. You can find out at what stage the application review process is by using the “Check status” button on the page with the activation form.

24 hours notice

One of the points of the rules concerns the period during which the client is obliged to notify the insurer about an insured event that has occurred. In most companies, three days are allotted for this from the moment the client learned about what happened. But there are also exceptions. VSK, RESO-Garantiya and ROSNO, for example, only allocate 24 hours for this . Missing the deadline may result in refusal to pay the refund. “A person after an accident cannot always find his way in time, so a day may not be enough,” Dolgobaev emphasizes.

Renewal of the Apartment, House and Equipment Policy at AlfaStrakhovanie

On the company’s website on the Internet, you can also extend the validity period of a previously issued policy. You must proceed as follows:

- Go to the company's website .

- Select the item “Property insurance renewal” in the “Housing” tab.

- Fill out the form that opens (policy number, full name and date of birth, contact information).

- Calculate the cost of renewal.

- Pay for the service.

A new version of the policy (extended) will be sent to the email address specified by the user immediately after the funds arrive in the company’s account.

Reviews about Property Insurance at AlfaStrakhovanie - Apartment and House

On the Internet you can find positive reviews about the company’s work, in which users point out that the insurer fulfills its obligations in a timely manner. However, such comments are few. In general, users speak negatively about the work of AlfaStrakhovanie, paying attention to the following nuances:

- Imposing insurance services during the purchase of electronics and household appliances.

- Delaying the decision-making process on payments.

- Refusal to issue a real estate insurance policy without explanation.

- Difficulties that arise with prolonging the validity of an insurance contract when using the company’s website.

- Delaying the process of refunding money in case of refusal of insurance.

- Insurer employees providing false information and ignoring user requests.

The problems of some users who left their reviews were resolved after the intervention of the organization's employees. It is also clear that customers are more willing to leave negative reviews than positive ones. Meanwhile, the organization’s employees still have work to do to improve interaction with clients.

Required documents

To conclude an Insurance contract, you need to collect a certain set of documents.

First, let's look at the list of documents for the person registered in the insured home:

- Copy of passport with residence permit (registration).

- Photos of the house.

- A detailed inventory of the property to be insured.

- Valuation of property in monetary terms.

The required set of documents for a person who is not registered in the insured home:

- copy of passport (possible without registration);

- photographs of the home and property;

- inventory of property that is subject to insurance;

- valuation of property in monetary terms;

- a document confirming that you have the legal right to the insured property.

"AlfaStrakhovanie" - Is it worth buying a policy for an apartment and a house?

Real estate insurance is an inexpensive way to insure yourself in case of loss or damage to both your home and its individual elements. Insurance makes it possible to compensate for financial expenses at the expense of the insurance company. Taking out a policy is much cheaper than saving a few thousand rubles, subsequently spending tens and sometimes hundreds of thousands of rubles.

Thanks to this, you can maintain your financial position even if you lose your property. AlfaStrakhovanie provides clients with the opportunity not only to cheaply issue an insurance policy using ready-made programs, but also to add to it the risks that the client himself wants.

What it is

Home insurance is a type of property insurance. The client enters into an agreement with an insurance company. It clearly states all possible troubles that can happen to the property.

In accordance with the contract, the client pays the insurance company a set amount of money annually. If an insured event occurs (for example, flooding), the company compensates its client for losses in full.

What can be insured:

- ordinary house;

- Vacation home;

- structures on the plot of land where the house is built. Garages, sheds and outbuildings are the most common objects covered by insurance.