home

Services

For private individuals

Mortgage insurance

Get mortgage insurance from Sberbank in 30 minutes with a discount of up to 40%

hurry up to submit an application and receive an additional 5% discount when applying for an electronic policy

- To the begining

- Product Description

- Decor

- Insurance programs

- Advantages

- FAQ

- Documentation

Read detailed information about the service

We offer a mortgage insurance service for Sberbank. RESO-Garantiya is an accredited partner of Sberbank in life insurance and real estate pledged for mortgage lending. We save your time by offering mortgage insurance products in strict accordance with all Sberbank requirements. Experience shows how troublesome it is to prepare everything for signing a loan agreement, so we offer insurance products without questionnaires, tedious collection and sending of loan documents, and real estate valuation. If you have complete information about the transaction, paperwork takes no more than half an hour.

RESO-Garantiya issues borrower's life and real estate insurance policies both for new mortgage transactions and renews policies previously issued by any insurance companies. Thanks to a large portfolio of mortgage contracts, our mortgage policies are guaranteed to be cheaper than those from Sberbank. In addition, RESO-Garantiya life insurance policies contain a minimum number of exclusions and are fully consistent with similar programs of Sberbank insurance companies. Submit a request for a mortgage insurance quote and receive a cost estimate in 15 minutes. See also the section on insurance of apartments against fires and floods.

Mortgage insurance programs

Borrower's life insurance

The "Protected Loan" insurance program allows you to reduce the rate on a mortgage loan.

What's included?

Life insurance of the main borrower of the loan in the event of death or disability of the first and second groups as a result of an accident or illness.

How much is life insured for?

For the loan amount. The sum insured does not decrease during the validity of the policy.

What is the insurance period?

1 year with annual extension for the entire term of the mortgage loan.

How does the policy work?

24 hours a day around the world.

Who receives the insurance payment?

The policy is issued in favor of Sberbank. Payment is made to the bank in the amount of debt on the date of insurance payment. The difference between the insured amount and the amount paid to the bank is received by the insured or the heirs.

Apply for a policy

Real estate insurance

Insurance of the collateral is required to complete a mortgage transaction.

What's included?

The collateral property insurance program allows you to protect the insured object from the following dangers:

- fire; lightning strike; explosion;

- natural disasters;

- damage to the insured property as a result of an accident in plumbing, heating systems, as well as water penetration from neighboring premises;

- the fall of aircraft, their parts or other objects, the action of sound waves; collision with the insured property of vehicles, animals;

- illegal actions of third parties (hooliganism, vandalism, theft, robbery, robbery, intentional damage to property, damage through negligence).

What is insured?

Property (apartment, residential building, apartments, parking space or storage room). The minimum insurance coverage for a bank includes protection of the real estate structure without taking into account finishing, communications and plumbing equipment.

How much is real estate insured for?

For the loan amount. The sum insured does not decrease during the validity of the policy.

What is the insurance period?

1 year with annual renewal for the entire term of the mortgage loan.

Who receives the insurance payment?

The policy is issued in favor of Sberbank. Payment is made to the bank in the amount of debt on the date of insurance payment. The difference between the insured amount and the amount paid to the bank is received by the insured or the heirs.

Apply for a policy

Which companies are the cheapest for Sberbank mortgage insurance?

Let's look at which company is cheaper to insure life for a Sberbank mortgage on Policy812:

Which of the proposed insurances is better? Despite the fact that the cheapest option is the PARI company, it is better to give preference to the Ingosstrakh company.

Clients choose this insurance most often and speak about the insurer mostly in a positive way. Ingosstrakh is a reliable and at the same time affordable company.

Which comprehensive mortgage insurance is cheaper:

Some of the most affordable policies in this category will be BET policies paired with other insurers.

You can look at Polis812 for more than 20 available options when calculating insurance.

Why choose RESO-Garantiya?

Accreditation

RESO-Garantiya is annually accredited by Sberbank

Discounts up to 40%

Special promotion “Profitable mortgage”. Discounts on life insurance up to 40%

Age up to 65 years

Life insurance for borrowers under 65 years of age

We will issue it in 30 minutes

Registration of a policy in just 30 minutes in paper or electronic form

Minimum documents

To obtain insurance you will need a minimum set of documents

We do not require a medical examination

No requirements for medical examination or provision of medical documents

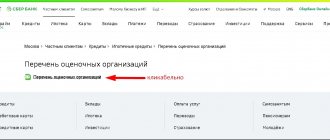

How to find out where it is cheaper to insure your Sber mortgage

There are mortgage calculators on the websites of insurance companies where you can calculate the cost of insurance. But not all companies provide the opportunity to pre-calculate life insurance.

To compare all prices, you need to select several companies from the list of Sberbank accredited mortgage insurance companies and calculate the cost in each of them.

You can do it easier and compare the cost of all insurance available to you on one website - Polis812. Our insurance center offers mortgage insurance at prices similar to those of insurance companies and even lower.

Each client can use a promotional code for a 5% discount on life or apartment insurance for a mortgage on Polis812.

FAQ

What information and documents are needed to take out a life insurance policy?

The policyholder's passport, details of the loan agreement and the amount (balance) of the loan, information about the type of activity, state of health, participation in dangerous sports, presence of disabilities, diseases.

What information and documents are needed to apply for a real estate insurance policy?

The policyholder's passport, details of the loan agreement and the amount (balance) of the loan.

- For apartments: address of the apartment, floor and number of storeys of the building, year of construction of the house, area of the apartment.

- For houses: address of the house, year of construction, area, construction material, presence of security elements for windows, doors, presence of a stove/fireplace, adjacent buildings

- For plots: cadastral number, plot address.

What affects the cost of insuring collateral for a mortgage loan at Sberbank?

- For life insurance: age, gender, occupation, presence of dangerous hobbies, presence of diseases, disabilities.

- For real estate insurance. For apartments: age of the building, floor. For houses: construction material, presence of stoves, fireplaces, locking elements for doors and windows, adjacent buildings, security of the facility.

When do you need mortgage insurance?

When purchasing housing on the secondary real estate market, life and real estate insurance policies are required to sign a loan agreement. In the future, both policies are renewed annually. When purchasing an apartment on the primary real estate market, only the borrower's life insurance policy is required for the transaction. A real estate insurance policy must be submitted to the bank after receiving an apartment from the developer, registering ownership of it and completing bank valuation procedures. In the future, both policies are renewed annually.

Mortgage loan issuance tomorrow. How long does it take to issue a policy?

Mortgage insurance is issued in about 30 minutes.

How to get a mortgage policy?

At the RESO-Garantiya office or by email when applying for an electronic policy. Delivery is possible within St. Petersburg.

How to pay for a mortgage policy. What document is issued to confirm payment?

You can pay for policies in cash at the RESO-Garantiya office, with a bank card in the office, with the RESO-Mobile mobile application or by QR call. For any policy registration option, you will receive a cash receipt by email or SMS.

Does only the bank receive insurance payments?

To protect yourself from losses in the event of an insured event, you should consider full real estate and life insurance, since mortgage insurance programs include policies only in favor of the bank for the amount of mortgage debt (the collateral is insured for incomplete amounts).

Is it possible to reissue insurance when refinancing?

Yes, policies can be reissued according to the requirements of a new bank. You will not incur any losses, since the insurance premium will be applied towards the payment of the new mortgage policy. Our specialists will accept the necessary documents and re-issue contracts.

What is an electronic policy certified by digital signature?

An electronic policy is a document that has the same legal force as a regular policy. Its difference lies in the signatures that the insurer and the policyholder put on it. An electronic digital signature is a requisite of an electronic document designed to protect this electronic document from forgery. Qualified digital signature used in JSC "RESO-Garantiya" is the most advanced type of electronic signature. It has the highest level of protection and reliability.

How to buy mortgage insurance for Sberbank online at a discount

You can get mortgage insurance at a discount for Sber on Polis812 in a few simple steps:

- Enter your mortgage information from Sberbank.

- Specify the type of insurance: life, apartment, comprehensive. Select.

- Fill in the information for the insurance contract and pay for your policy.

- The finished document will be sent by e-mail.

Mortgage insurance on the POLIS website

Large selection of insurance companies, low prices, receive an insurance policy by e-mail

Get insurance

Get insurance

Add a comment Cancel reply

Cooperation between banks and insurance companies

Often, when applying for a mortgage, the bank immediately offers insurance companies that will issue a policy on the property. In addition, they will also talk about the need and importance of taking out additional policies to protect the life and ability of the borrower, title (especially if secondary property) or civil liability.

Remember: when mortgage lending, only property insurance is mandatory in many banks (unless otherwise stated in the agreement). Life and health insurance, title, and civil liability insurance are issued voluntarily, at the discretion of the insured.

But banks have the right to raise mortgage interest rates without additional policies. For example: Sberbank Insurance, with additional health insurance for the client, gives a discount on the mortgage of 1% per year.

Banks initially offer insurance that is beneficial to them or those with whom they have concluded cooperation agreements. Despite this, the client has the right to choose any company from the list of those accredited by the bank and at the same time maintain a reduction in mortgage interest.

If none of the companies are suitable, then the person can select another insurance company and inform the bank about this (if there is no prohibition in the mortgage agreement). The credit institution will check this company, but this will take considerable time, effort and nerves, because... It is doubtful that employees will make concessions easily. It is quite possible that the general manager will have to be called to assert rights.

The agreement between banks and insurance companies is quite justified. The principle of cooperation is beneficial to all parties: banks can experiment with new services because expenses will be partially covered by the insurance company, and will also be more lenient in issuing loans to borrowers; the insurance company acquires new clients; if the borrower takes out a mortgage in a well-known bank, then the insurance company will be popular and well-established in the market.

Therefore, when concluding a mortgage agreement or changing an insurance company, the borrower has the right to independently select an insurance company:

- Only from the list of those accredited by the bank;

- Any insurance company, but only unless otherwise specified in the mortgage agreement.

What are the offline payment methods?

The contract is concluded for 1 year, after which an extension is required. Payment must be made for it to take effect.

The payment method is very individual. Everyone has different needs and wishes, so it is selected solely according to practicality for each person. Some people find it much more convenient to resolve issues in person and there are different extension options.

At the Sberbank office

If the client agrees to insurance at a banking institution, then the conclusion and payment of the corresponding agreement will most likely be there. The employee will issue a receipt and send it to the cash desk where funds are deposited.

In case of renewal, another payment is also made to Sberbank. To do this, select the required service in the terminal and take a coupon with a number.

Other offline methods

There are often queues at Sberbank, but you can use their services in other ways. To do this, the account details with the name of the payment are first taken from the employees. Together with them they contact such organizations as:

- Mail. Its location does not matter, so any convenient department can help;

- At the cash desk of another banking institution;

- In Euroset or Svyaznoy, but with the provision of an identity document.

Funds will arrive in your bank account with a delay of up to 3 days if you send them through a post office or an office of another bank. In salons, communications are received on the day they are deposited.

Where to make a payment with a minimum commission

Having considered different options, it should be noted that in offices the situation is most unfavorable, because... time is wasted on visiting, the likelihood of getting sick is higher, and the commission at the box office can reach up to 3%.

- ATMs are a little cheaper - up to 2%.

- The remote format has the smallest percentage, from 1% to 1.5% (calculated automatically).

- Other credit institutions should be clarified separately.

- Brokers often remove the percentage altogether or leave one as well.

Tips for renewal

Even when paying directly at a Sberbank branch, it is better to take a few days (at least 3) before the expiration date, because There may be interruptions in communication. It is necessary to take into account that during the pre-holiday periods, funds take much longer to arrive, which can lead to delays, penalties and deterioration of the history.

If the online format is most convenient, then the application has the ability to create templates. Thanks to them, there will be no constant need to re-register all the details, which will protect you from errors and typos. They will simply be saved and all you have to do is open them at a convenient moment.

Creating and deleting templates

Templates can be used via cell phone or on the website. In the “My Templates” section there is a “Management” item, where you enter current information and details. Careful verification will help reduce the likelihood of funds being sent to the wrong address.

After saving the changes, the form can be used on any device using the same login.

After paying off your debts, this form will no longer be in demand and should be deleted. It is also located in the “Management” tab. You can hide the template in the same menu, especially if you don’t want to see this reminder all the time.

Why change your mortgage insurance company?

Most people, when concluding an agreement with a bank, do not hesitate to choose the insurance offered by the banking institution. Very often the conditions turn out to be unfavorable for the client, but they understand this only over time.

The main reasons for changing mortgage insurance:

- Reducing insurance premiums;

- Expanding the list of insurance risks;

- Increase in insurance payments;

- Registration of a comprehensive policy (combines several types of insurance, for example: property and health);

- Improving or changing conditions, for example, when applying for a mortgage, additional flood protection was important, but after a few it is no longer necessary.

Most insurance companies offer additional conditions, cost reduction, increased risks, etc. for people changing insurance.

Where can I apply for a policy renewal?

Renewal of the policy is carried out by paying an annual premium for the next period, i.e. for the next 12 months.

Extension methods

Renewing an insurance policy is a technical procedure; the client does not need to collect a special package of documents. The table shows how to extend the contract and what documents will be required for this:

| Methods | Documentation |

| Through a Sberbank branch | You will need passports of the insured, documents for real estate, and an insurance contract. |

| At an insurance company | Passports, insurance contract |

| Online | If the contract was concluded through the service, no additional documents will be required |

How to renew a policy at Sberbank

You can renew your policy at a bank branch, but it is much more convenient to do it online.

At a Sberbank branch

To renew the policy, the borrower can visit a bank branch with a passport. The extension will be carried out by a bank employee, the client will receive a new insurance contract and will be able to immediately pay the insurance premium for the next year.

Online via the Internet

You can renew your policy via the Internet in several ways:

Through the insurance website. If the mortgage was issued at a subsidiary insurance company of Sberbank, you can renew the policy through its website. The new policy will be sent to the borrower's email address.

To renew the contract, you need to log in to the website and open the appropriate section of your personal account.

In Sberbank Online or mobile application. If the borrower uses the online banking of a credit company, he will be able to renew the agreement in his personal account in the appropriate section.

On the DomClick service. If the contract was concluded through DomClick, you can extend it in your personal account of the service. There is no need to provide additional documents; all necessary data will already be collected in the borrower’s profile. The client simply goes to his personal account, to the “Policy Renewal” section, enters the necessary information and pays for insurance.

If the insurance contract was originally concluded with another insurance company, the possibility of renewing it online should be found out in the insurer’s support service.

How to notify Sberbank about the extension

When renewing a policy through the services of Sberbank and its subsidiaries, there is no need to specifically inform the lender about the renewal of the contract; the system will automatically update information about the contract.

If the insurance contract for the next period was concluded with another insurance company, the bank must be informed about the changes by providing it with copies of the documents. Although often other insurance companies that have entered into an agreement with the client themselves notify the bank.

In the office

You can come to a bank branch with your passport and documents so that the responsible employee can make copies and enter the information into the system. It is recommended, in order to avoid possible questions, that the bank make a note about acceptance of the policy on copies of the client’s documents.

Via mail

You can send documents by registered mail with notification. In this case, the document informing the bank will be a notification of delivery of the package to the responsible employee.

Via courier

Sending documents using a courier service is expensive, but if you don’t have time to deliver the papers yourself, you can use this method.