Citizens of the Russian Federation in most cases apply for a mortgage to purchase an apartment in a new building, a house or secondary housing. However, every year there is an increasing number of people who want to leave noisy cities and settle outside the city, which requires having their own plot of land. To bring these desires to life, you can also use a mortgage. According to the Mortgage Law, it is possible to pledge a land plot in a mortgage agreement if it is not excluded from land circulation and is not limited in circulation (Article 62). You can find out in detail about those land plots whose circulation is limited and lands withdrawn from circulation by consulting Article 27 of the Land Code of the Russian Federation. You can take out a mortgage on a land plot subject to additional conditions, the first of which is compliance with land law. You can draw up a land mortgage agreement at almost any bank in the Russian Federation.

Choose a profitable mortgage

Obtaining a mortgage on a land plot for the construction of a residential building

If you intend to take out a mortgage on a plot of land for individual housing construction, you must first find a suitable option for the land plot, and then only contact the bank to apply for a loan. The fact is that each financial and credit organization has its own conditions for lending on land mortgages. It is easier to select an allotment based on certain criteria.

On the DomClick website you can personally select a program.

After filling out the first block of the questionnaire, the following sections will become available, in particular the one where you need to indicate the desired object:

At Sberbank, a mortgage loan for land for the construction of a country house is issued on the basis of an application submitted by a potential borrower. You will also need to provide a significant package of documents, which are checked by credit analysts. Then the bank gives a final answer about the possibility of issuing a loan for individual housing construction to a specific person.

Usually the review takes no more than 5 working days. On the appointed date, several contracts are signed at once: mortgage, purchase and sale and insurance.

Registration of a land loan has a number of nuances:

- Establishing the value of an object is a rather complicated procedure. When assessing, it is necessary to take into account many factors that influence the formation of the final price (distance from the city limits, liquidity of the site, infrastructure, area, etc.).

- Any buildings erected on the site (residential, non-residential) by default fall into the category of collateral. If there are several buildings, then it will take a lot of time to complete the design.

- It is permitted to build a house only on land suitable for residential construction. It is unacceptable to use agricultural objects for the construction of a cottage.

When concluding a pledge agreement for a plot of land under individual housing construction, the borrower’s rights to carry out construction work on the land at his own discretion, without the consent of the lender, are indicated. The document must include the most significant points. The agreement is drawn up in writing and certified by a notary. You also need to register the land mortgage with Rosreestr.

Features of lending to citizens

Construction planning begins with choosing the site on which the cottage or garden house will be located. Applying for a loan to purchase land has the following features:

- High interest rates. If the borrower fails to fulfill its obligations, the bank will have difficulty selling the collateral. That is why the credit institution compensates for the financial risk with an increased interest rate;

- Determining the value of an object is a rather complex process. The appraiser will have to take into account many factors that form the final cost of the land (distance from the city, prestige of the area, availability of infrastructure, area, etc.);

- Any residential buildings and non-residential buildings erected on the site will automatically become classified as collateral. Registration of a large number of buildings can take a long time;

- You can only build a house on land intended for residential construction (agricultural properties cannot be used to build a cottage).

A land plot used as collateral does not require mandatory insurance against the risk of damage or loss. An exception may be land that is located in regions with specific climatic and geographical conditions. In this case, real estate is insured against natural disasters (earthquake, floods, landslides, sharp rise in groundwater level, etc.). The insurance contract is renewed annually. The amount of the insurance premium depends on the balance of the loan.

Alternatives I will collect for a mortgage for building a house

Mortgages for construction are provided not only by Sberbank; the table below shows the most popular banks for mortgage lending:

| Bank | Loan amount, up to | Bid | Mortgage term |

| up to 30,000 rub. | from 9.8% | up to 30 years old | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

Lending conditions for a mortgage on a plot of land for construction

Sberbank has the most favorable conditions for obtaining a loan for a plot of land for a dacha or a residential building. With a low interest rate, the down payment is not much higher than with classic mortgages.

Mortgage conditions for a land plot in Sberbank:

- currency – Russian rubles;

- minimum amount – 300,000 rubles;

- interest rate - 8.8%;

- maximum limit – not less than 75% of the estimated value of the loaned object;

- installment period – up to 30 years;

- initial payment – from 25%;

- commission – no;

- Loan collateral is the collateral of the building or other living space being financed.

If the collateral is a private house or a share in it, it is necessary to issue a mortgage on the land on which the building is located, or on the lease of the land plot.

Collateral property must be insured against possible loss/damage for the entire loan period. An exception will be land taken out on a mortgage from Sberbank. On the DomClick website you can independently select profitable insurance using a special form.

Requirements for borrowers

To get a mortgage from Sberbank, the applicant must meet certain requirements:

- age limit – from 21 to 75 years (at the time of debt repayment);

- citizenship of the Russian Federation;

- work experience at the current place of work - from 6 months, total - at least one year;

- stable monthly confirmed income sufficient for living and loan repayments.

Clients with an unblemished credit history are guaranteed to receive a positive decision.

Requirements for land plot

The bank sets quite strict requirements when lending for individual housing construction, in contrast to a mortgage on a plot of land with a house. In Moscow, there are plenty of similar offers from Sberbank partner developers (you can choose a suitable option on the DomClick website).

A loan for a land plot is issued on the following conditions:

- the land plot should not be listed in the reserve, located in a forest belt or water protection zone, or be owned by the state or municipality;

- the demand for the area and the distance from the city no more than 100 km;

- the smallest plot area is 6 acres;

- It is desirable to have a road suitable for travel to the construction site year-round;

- individual housing construction can be carried out on land;

- there must be one owner.

A significant advantage will be the presence of communications (operating or prepared for connection).

Mortgage interest rate

Land mortgages from Sberbank are issued at a base rate of 8.8% with a down payment of 25% for a period of 1 to 30 years.

Under certain circumstances, the rate may increase:

- +0.5% – if the borrower is not a salary client of Sberbank;

- +1% – in case of refusal to insure life and health;

- +1% – at the time of registration of the transaction in Rosreestr.

You can make a preliminary calculation of a mortgage for the purchase of land yourself by using the online calculator on the bank’s website.

Bank conditions

The size of the mortgage loan cannot exceed 75% of the value of the collateral. The loan amount can vary from 300 thousand to 30 million rubles. The interest rate on the loan is 9.5% per annum. The down payment amount is at least 25% of the market value of the property. A guarantee from individuals or real estate can be provided as collateral for a loan. The loan is provided for a period of up to 30 years.

Here is a standard list of bank requirements that must be complied with:

- The property should not be located in a forest or water protection zone;

- The minimum area of the loaned plot is 6 acres;

- The cadastral passport of the property must contain a note stating that it can be used for construction and economic activities;

- The site should not be owned by the state;

- The object must belong to one owner;

- All necessary communications must be provided;

- The distance from the facility to the nearest bank office should not exceed 100 km;

- The real estate should not be burdened with any encumbrances (rent, outstanding loan, arrest, etc.);

- Access roads must be equipped.

The borrower should take into account the ecology of the area, climate, soil composition and depth of groundwater. All this information will be needed by the construction team that will build the house or cottage.

Involving co-borrowers in obtaining a loan makes it possible to increase the credit limit. Clients who are participants in Sberbank salary projects can apply for a loan on special terms. If the application is approved, the borrower receives a credit card with a limit of up to 600 thousand rubles.

Terms for consideration of a loan application for a mortgage on a land plot

This mortgage lending option is the most risky for the bank, so the applicant is checked more thoroughly, which prolongs the waiting period for a decision on the application. The standard review period is 8 working days.

Verification steps:

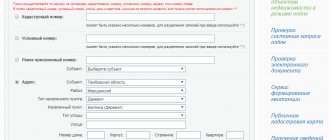

- Entering the provided information into the general database – 1-2 days. But in practice, the questionnaire data is entered on the day of sending. If it was a day off, the procedure is postponed until the first working day.

- Studying your credit history – no more than 3 hours.

- Identification of the applicant – 2 days. Passport data, work activity, marital status, and presence of children are checked.

- Security checks take about 2 days. Here all persons involved in the transaction are studied.

- Underwriting – up to 3 days. At this stage, the bank calculates possible risks and sets acceptable conditions for issuing a loan.

Required documents

To buy a plot in Sberbank, the client must submit the following documents:

- Russian passport;

- income certificate in form 2-NDFL;

- an employment contract or work book certified by the employer;

- documents on the pension received (for pensioners);

- documents confirming other sources of income.

Some categories of borrowers must verify their income differently. For example, the judge must bring a special form of income certificate. Individual entrepreneurs must provide a tax return. Now you know that a mortgage for the purchase of land in Sberbank is available to most clients. To do this, you just need to collect a package of documents, select a site and submit an application.

The procedure for obtaining a mortgage on a plot of land from Sberbank

To apply for a mortgage for the purchase of land at Sberbank, you must go through the following steps:

- Search for an object that meets the bank's criteria.

- Signing a preliminary agreement with the seller.

- Collection of necessary documentation that will be attached to the application.

- Submitting an application to a bank branch and filling out a standard form. You can submit an application online through the DomClick portal.

If the decision is positive, the transaction is registered. Then the client makes a down payment, which, together with the borrowed funds, will be stored in a safe deposit box until the future owner registers ownership of the purchased plot. After this, funds for the purchase of land are transferred to the seller.

An encumbrance is placed on land purchased with a mortgage. The relevant papers are also subject to registration with Rosreestr.

Required package of documents

A client wishing to purchase land with a mortgage should submit the following documents to the bank:

- statement;

- passport of a Russian citizen from the borrower;

- a certificate of financial solvency (not needed for Sberbank salary clients);

- proof of income (optional);

- a copy of the work book;

- certificate of state registration of the right to a land plot, certified by a notary;

- land extract from the Unified State Register of Legal Entities;

- a document confirming the payment of the initial deposit.

If the borrower is an individual entrepreneur, he must additionally provide a tax return for a specific period, a certificate of registration as an individual entrepreneur.

Requirements for borrowers

Sber imposes the following requirements on borrowers and purchased land when obtaining a mortgage for the purchase of a land plot:

- age – 21 – 75 years;

- experience in the last position for at least six months;

- total experience more than 1 year;

- having a stable income of the required level;

- the plot meets the bank's requirements;

- the land has an area of 6-50 acres;

- the site is equipped with communications;

- There are road communications near it.

If at least one of these requirements is not met, Sber will refuse to issue a loan to the client.

The procedure for repaying a mortgage loan on a land plot

The mortgage loan is repaid every month with annuity payments. The borrower adheres to the payment schedule drawn up by the bank.

Early loan repayment

According to the terms of Sberbank, the term of the mortgage loan is up to 30 years, but it is permissible to pay the bank earlier (in part or in full). To do this, the borrower submits an application indicating the date of planned repayment of the debt, the amount and the write-off account. The date indicated in the application must fall on a working day.

The minimum amount threshold for early repayment is not limited. There is no commission fee for this transaction.

Penalty in case of late repayment

Delay in payments threatens the borrower with a penalty. Its size depends on the key rate of the Central Bank of Russia, current on the date of signing the loan agreement. Penalties are accrued from the first day of delay and range from 0.1-0.5% of the amount of the payment not paid on time.

What is mortgage insurance and why is it needed?

When a bank issues a long-term mortgage, it takes a certain risk. Mortgage insurance reduces the risk of loss or damage to the real estate pledged as collateral, and also helps protect the lender from non-payment of the loan. This is a mandatory procedure when applying for a home loan. Mortgage insurance provides protection not only to the lending institution, but also to the borrower.

Types of mortgage insurance

The subject of insurance, that is, the object of financial protection, can be:

- Property. A house, apartment or land purchased under a mortgage agreement. Insurance covers the integrity of the collateral, the safety of its supporting structures and main elements.

- Life and health. The insurance provides payments in the event of temporary loss of ability to work due to disability, as well as the premature death of the borrower. This type of insurance is voluntary, but if you refuse it, the bank may increase the interest rate on the loan.

- Insurance of title or ownership of an apartment or other type of real estate. When purchasing a home with a mortgage, this type of insurance will help protect both the bank and the borrower from unpleasant situations. You can lose your right of ownership, for example, by encountering scammers when buying an apartment on the secondary market, or because of the seller’s relatives suddenly showing up.

Real estate, health, or title insurance helps the bank get reimbursed if unexpected circumstances arise. Even if the real estate burns down or the borrower becomes seriously ill and cannot pay the debt, the lender will still receive the money in full.

For the borrower, insurance is associated with additional expenses, but there are also benefits:

- •

in the event of disability, loss of the opportunity to work, or in the event of the death of the borrower, the insurance organization will pay off the remaining balance of the debt;

- •

you will not have to pay the bank for real estate lost as a result of a fire or transferred into the possession of another person by court decision.

Insurance cases

It all depends on what type of insurance is taken out. For example, in life and health insurance, guaranteed cases include permanent loss of ability to work due to disability, as well as in the event of the borrower’s passing away. The list of insurance items is compiled individually and depends on the age and health of the borrower.

Real estate is most often insured against damage as a result of fires, natural disasters, domestic gas explosions, acts of hooliganism and vandalism.

What is covered under title insurance? This is the termination/restriction of the right of ownership of housing purchased with a mortgage by a court decision:

- •

when making a transaction under duress, fraudulently, etc.;

- •

if the transaction is declared invalid due to the lack of the owner’s right to sell the joint property;

- •

when registering illegal transactions involving minors - sale of real estate without the consent of legal representatives (guardians);

- •

upon confirmation of the seller’s insanity at the time of the purchase and sale transaction.

The insurance company will not pay compensation if the residential premises were damaged as a result of:

- •

intentional actions on the part of the owner or other interested party;

- •

military actions, man-made disasters, atomic explosions;

- •

natural wear and tear or collapse due to disrepair;

- •

carrying out repair or construction work;

- •

storage of flammable or explosive substances.

There is no single list, since each insurance company independently determines the composition of the financial compensation program.

The occurrence of an insured event is documented. The list of required papers must be indicated in the insurance contract. In case of problems with real estate, an act drawn up by a representative of the management company or employees of the Ministry of Emergency Situations is required. After the occurrence of an insured situation, the policyholder must report the incident to the company where he purchased the policy: send a written statement.

Insurance payments

In most cases, the beneficiary of the insurance is the bank. If an insured event occurs, the insurance organization will compensate the creditor for the damage. For example, it will pay off the remaining portion of the mortgage debt in the event of disability or death of the borrower. The situation is similar with damage and loss of real estate.

If the insurance payment exceeds the balance under the loan agreement, the insurance company will transfer to the bank the required amount to repay the loan, and transfer the difference between the insurance payment and the balance of the loan to the borrower or his relatives.

If the balance of the loan debt exceeds the insurance payment, the insurance payment is transferred in full in favor of partial early repayment of the loan, and the balance must be paid by the borrower or his heirs in the event of the borrower’s death.

Procedure for obtaining insurance

You can insure your life, apartment or title in an organization offered by the bank when applying for a mortgage or in any other organization at your discretion. After choosing an insurer, it is important to decide on the type of insurance program.

To obtain insurance, the insurance company provides:

- •

mortgage agreement number;

- •

copy of the passport;

- •

application of the established form;

- •

questionnaire.

In some cases, the insurer may require a health certificate, a home assessment report, certificates from the BTI and other documents.

After collecting all the papers, a representative of the insurance company will prepare an insurance policy. The original remains with the borrower, and a copy must be provided to the bank that issued the mortgage loan. You can draw up an insurance contract both before receiving a mortgage loan and on the date of signing the loan agreement.

The insurance policy is issued for a year, and then renewed annually until the mortgage loan is fully repaid. If the mortgage is closed early (partially), a recalculation is made. To do this, the policyholder and the insurer draw up an additional agreement in which they indicate the current balance taking into account the last payment. If the mortgage is fully repaid, for example, if this happened at the beginning or middle of the insurance period, a refund of policy premiums is possible.

Insurance cost calculation

The cost of an insurance policy when taking out a mortgage is influenced by many factors. Insurance premiums may vary depending on the total mortgage amount and interest rate, as well as the type and characteristics of the property purchased. The cost of insurance is affected by the age and health of the borrower, his profession, hobbies and other parameters.

When insuring title, the following are taken into account:

- •

total number of property owners;

- •

tenure of housing;

- •

presence and number of minor owners.

The cost of the policy may increase if the borrower has chronic diseases, extreme hobbies, etc.

You can apply for a mortgage loan and choose the best insurance option at any Alfa-Bank branch. We accept applications online and provide a preliminary decision within one day. Calculate the cost of your mortgage using the calculator on the website to find out the amount of your mortgage payments. Mortgage programs are available for secondary real estate, housing in new buildings at 5.99%, as well as refinancing at a minimum rate of 7.99% per annum.

How to get a mortgage payment deferment

If financial difficulties arise during construction, you can contact the bank with a request to provide a deferment on loan payments. Sberbank can give it for up to 2 years. In this case, 2 options are offered:

- temporary exemption from principal payment, but interest remains;

- extension of the loan period with reduced monthly payments.

To obtain approval from the bank, the borrower must have strong documentary evidence of his insolvency.

The rate of 6% is subsidized by the state corporation DOM.RF. The program is valid until October 1 of the current year.

Photo: www.tvoysberbank.ru

The Sberbank press center presented in more detail the main conditions of preferential mortgages for individual housing construction projects (IHC) - land plots, private houses and cottages. These conditions are:

• The maximum loan amount is RUB 12 million. for Moscow, St. Petersburg, Moscow and Leningrad regions and 6 million rubles. — for other subjects of the Russian Federation;

• The maximum loan term is 20 years, the down payment is 20%.

• the construction of a house must be carried out under a contract with a contractor from the list recommended by Sberbank (today it has 65 such organizations) on a land plot owned by the borrower;

Photo: www.avtopravo51.ru

• mortgages can also be obtained for individual housing construction projects built by developers using Sberbank loans - for such projects the minimum available rate will be 4.6% per annum (including discounts as part of the bank’s comprehensive offer for developers and buyers of houses and land plots);

• when constructing a residential building with the involvement of a contractor from the list recommended by the bank, a pledge of the land plot on which construction is planned is issued as collateral;

• additional collateral for the construction period will not be required if the loan amount does not exceed 3 million rubles, and for Moscow, St. Petersburg, Moscow and Leningrad regions - 6 million rubles, or if the house and land are purchased from developers receiving project financing ;

• You can apply for a product online on the profile resource DomClick.ru.

Photo: www.cdn.postnews.ru

First Deputy Chairman of the Board of Sberbank Alexander Vedyakhin (pictured above) expressed confidence that the new program will contribute to the development of individual housing construction in the country, and the rate of 6% per annum is an excellent opportunity to get a mortgage.

Deputy General Director of DOM.RF, General Director of the DOM.RF Foundation Denis Filippov

(pictured) noted that the individual housing construction market in Russia has enormous potential for development - about half of all housing under construction falls in this segment.

Photo: www.kommersant.ru

“By analogy with the federal program, we developed a preferential mortgage for individual housing construction and financed it from our own profits (profits of DOM.RF - Ed. ),” Filippov emphasized.

He recalled that the pilot program of preferential mortgages, launched for the first time in the country by Bank DOM.RF at the end of 2021 with the support of the parent state corporation, received great demand.

“I am confident that Sberbank’s participation will allow us to scale the program throughout the country and will bring us closer to the development of a federal program of preferential mortgages for individual housing construction,” said a representative of DOM.RF.

As the portal ERZ.RF previously reported, in April of this year the Government of the Russian Federation approved a roadmap for the development of individual housing construction. According to this document, before the end of this year it is planned to ensure:

• legislative introduction into practice of specialized mechanisms for affordable mortgages and a scheme for financing them using escrow accounts;

• creation of a register of standard designs of private houses (including wooden structures);

• formation of a regulatory framework that facilitates the construction of individual housing construction facilities and infrastructure for them.

Photo: www.note.taable.com

Other publications on the topic:

DOM.RF: Individual housing construction must be legally transferred to escrow

Sberbank was the first to use a project financing mechanism for individual housing construction projects

Over the year, the volume of mortgages issued by Sberbank for individual housing construction tripled – to 3 billion rubles.

The government has approved a roadmap for the development of individual housing construction in Russia

Mortgages for individual housing construction from Bank DOM.RF are of interest to both citizens and developers

Sberbank: borrowers' interest in mortgages for private homes is growing

The share of individual housing construction in the volume of housing commissioning increased over the year by 2.1%

Bank DOM.RF conducted the first transaction within the framework of the pilot state program of preferential mortgages for individual housing construction projects

Sberbank plans to enter the market with a finished product “turnkey private house”

You can now build a private house with a loan at 6.1% from DOM.RF Bank

Advantages and disadvantages of obtaining a mortgage on a land plot in Sberbank

Like any other financial product, a land mortgage issued at Sberbank has both advantages and disadvantages.

| pros | Minuses |

|

|

Existing risks of mortgage lending for construction at Sberbank

The bank, by issuing a loan to purchase land for construction, takes a great risk. The erected building may not recoup the costs. Therefore, the borrower secures its obligations by attracting a guarantor and providing collateral in the form of the loaned or other residential property.

Since the loan is issued for a long period, there is a high probability of the borrower’s death or loss of ability to work. As a result, the citizen will not be able to fulfill his debt obligations. In this case, insurance is provided. If the applicant refuses to take out such a policy, the interest rate increases significantly.