Mortgage lending has made purchasing their own home much more affordable for Russian families. However, at present, the interest rate at which the loan is issued continues to be quite high, which causes difficulties in repaying the debt. The situation was aggravated by the fall in income of the population due to the worsening economic situation in the country. The increase in the number of overdue mortgage loan payments was the main reason for the country's leadership to decide to implement a special government program designed to support such borrowers. The AHML mortgage program involves providing state support to families that meet the established requirements. It has been running since 2015.

About the program

The state program to assist mortgage borrowers with existing loans experiencing financial difficulties was developed at the level of the federal government structure and is being implemented by restructuring current debt on housing loans.

The key conditions of the program are determined by Government Decree No. 961 of August 11, 2017 “On the further implementation of the program to assist mortgage borrowers.” Let's look at them in more detail.

Resolution

The main conditions of the Resolution under consideration include:

- A special interdepartmental commission has been created to consider applications and make competent decisions on compensation for losses of creditors.

- You can use state support only once (this requirement is strictly monitored by authorized bodies).

- The right to make a decision on the advisability of restructuring a mortgage belongs to the creditor bank, which accepts a corresponding application from the client.

- The restructuring process can be carried out either by changing the conditions/parameters of the concluded loan agreement through an additional agreement, or by drawing up a new loan agreement or a peace agreement between the parties.

- The maximum amount of potential compensation cannot exceed 30% of the remaining amount of debt to the credit institution (in monetary equivalent, no more than 1.5 million rubles will be reimbursed).

By decision of the Government of the Russian Federation, the implementation period of the assistance program has been extended. The expiration date has not yet been announced.

Requirements for mortgage housing

>

Strict requirements for participation in the program apply not only to borrowers, but also to housing. The area of the property on which the mortgage is taken cannot exceed:

- for one-room housing – 45 m2;

- for a two-room apartment – 65 m2;

- for a three-room apartment – 85 m2.

List of required documents

| Participant requirements | Supporting documents |

| 1. The client is a Russian citizen falling into one of the following categories: | Russian passport. |

| 1.1. families with children; | Birth or adoption certificates for all children (under 18 years of age). |

| 1.2. guardians of children; | A decision of the guardianship authorities or court confirming guardianship. |

| 1.3. veterans of various wars; | Veteran's ID. |

| 1.4. families whose members have disabilities; | Certificates of disability issued by VTEC or medical and social examination. |

| 1.5. citizens who support schoolchildren, students or full-time graduate students not older than 24 years of age. |

|

| 2. The average monthly family income for 90 days does not exceed two subsistence minimums (minus the mortgage payment). |

|

| 3. The mortgage payment has increased by at least 30% since the contract was signed. | |

| 4. The total area of mortgaged housing does not exceed the established norm. | Documents on registration or assessment of housing |

| 5. The mortgage contract was signed at least one year before submitting the application for restructuring. | Mortgage contract |

| 6. Application for restructuring in free form | |

| 7. Consent to the processing of personal data | |

| 8. Questionnaire according to the bank form | |

| 9. Insurance documents for mortgage housing | |

What help can be provided

It is important to understand that borrowers in need are not completely exempt from making monthly loan payments and from paying premiums for property or personal insurance. However, a number of options have been developed to provide effective assistance in housing lending, which will help mitigate the current situation.

Among the types of such assistance in 2022:

- changing the loan currency (relevant for clients who received a loan before the end of 2014 in a foreign currency);

- lowering the current lending rate (it cannot be higher than the value in force on the date of conclusion of the restructuring agreement for ruble loans and higher than 11.5% for foreign currency loans);

- reduction of residual debt to the bank by 30%, but not more than 1.5 million rubles;

- write-off of accrued penalties, penalties and fines that have already been paid by the client by court decision.

IMPORTANT! Which assistance option will be used will depend on the nuances of the current situation in the borrower’s life. Each application is considered individually.

What is AHML?

The abbreviation AIZHK stands for Housing Mortgage Lending Agency. The agency is well known to borrowers whose financial well-being has deteriorated to such an extent that they can no longer pay their mortgage in full. The agency was created in 1997 by government order No. 1010. Since its establishment, it has been providing assistance to citizens who took out foreign currency or ruble mortgages and whose monthly payments increased by more than 30% due to the crisis in the real estate market and the collapse of the ruble exchange rate. The government has allocated two billion rubles for mortgage support.

Duration of the program

The project to help mortgage borrowers, according to the adopted Government Resolution, resumed its operation on August 22, 2021. For these purposes, more than 2 billion rubles were allocated from the state budget.

The government has not indicated a specific end date for the program. However, it is not difficult to guess that it will stop working when the funds run out.

The project was periodically suspended, then continued its work to restructure problematic mortgages.

Sberbank Help for Mortgage Borrowers 2021 Document Pocket: changes and amendments

- be citizens of Russia (foreign citizens cannot take out a mortgage);

- the legal spouse must also have Russian citizenship;

- the legal spouse(s) automatically become co-borrowers, and their solvency, age and number of children are not taken into account in this case;

- The co-borrower can also be the second parent of the borrower’s second/third child, with whom he is not legally married and provided that this child is also his second or third;

- If a marriage contract is concluded between the spouses, providing for separate property ownership, the borrower's spouse cannot be a co-borrower.

Citizens cannot apply for a loan directly through a mortgage lending agency. Cooperation between partner institutions is possible in two ways:

How to participate in the program

In order to take advantage of the AHML mortgage assistance program, the borrower should contact the existing lender and mortgagee with a personally completed and signed application requesting loan restructuring. You should contact the credit department or the overdue debt department.

Then the application, along with the attached set of all papers, will be sent directly to AHML for consideration and a final decision on the advisability of providing support with the participation of the state. The interdepartmental commission reviews each application on average about 30 calendar days. You can find out about the decision, again, through your bank.

Outdated projects

Until 2014, several more AHML programs were implemented: “Young Family” and “Moving”. These types of AHML programs were adopted with the aim of creating favorable conditions for obtaining a loan for young families with children and citizens who own residential property but want to move to a new building.

Young family

The idea was to provide a reduced loan rate for families with at least one minor child. In this case, one of the parents had to be no older than 35 years. The AHML program provided for repayment of the difference in the interest rate with the help of government subsidies.

Moving

Another outdated AHML program. It was provided to citizens who owned their own housing, but wished to move out of it. There were 3 types of project: 1. Economy. The borrower sold his apartment, in exchange for which he received cheaper housing; he could dispose of the remaining funds at his own discretion. The option was relevant if the borrower could not cope with the existing mortgage loan. Then he sold the house (apartment) purchased with a mortgage, and in return received a more modest residential property. 2. Intercity. The applicant sold his home to the agency, moved to another locality and purchased an apartment there with the proceeds. To participate in the project, it was necessary for a citizen to get a job in a new city and undergo a probationary period there. 3. Comfort. The client was selling his house and moving to a new, more expensive one. The option was popular when purchasing housing in new buildings. Then the main amount for shared construction had to be paid immediately, but for this it was necessary to sell your home. The agency allowed citizens to remain in their old home, but at the same time own the space in the new building. As soon as the apartment was completed, the clients moved to a new house. The main disadvantage of this type of loan is the short loan period: from six months to 2 years. If there was a greater difference between the cost of the old and new housing, the client had to pay larger monthly premiums.

List of banks participating in the program

Only credit institutions of the Russian Federation accredited by the Central Bank of the Russian Federation, which have high performance results and have proven their reliability, take part in the program of assistance to AHML mortgage borrowers.

The list of participating banks includes:

- Sberbank.

- Alfa Bank.

- Gazprombank.

- Rosselkhozbank.

- UniCredit Bank.

- Rosbank.

- Credit Bank of Moscow.

- Absolut Bank.

- Raiffeisenbank.

- Binbank.

- RRDB.

- Globex Bank.

- Vostochny Bank.

- Zapsibkombank.

- Bank Zenit.

- Credit Europe Bank.

- Loko-bank.

- Bank Levoberezhny.

- MTS bank.

- Mosoblbank.

- Uralsib.

- Sovcombank.

- Bank Russia.

- Promsvyazbank.

- Kuban-credit.

- Delta-Credit.

- AK Bars Bank.

- Bank opening.

- OTP bank.

- Russian Capital Bank.

- RosEvroBank.

- Communication bank.

- SMP Bank and others.

The total number of agent banks is 99 units, including the Federal Agency.

Also among the project participants are regional AHMLs for each constituent entity of the Russian Federation and mortgage agents who have the authority to accept applications from Russian mortgage borrowers.

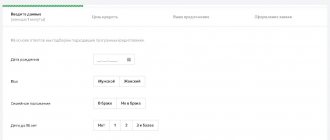

Criteria for borrowers

Individuals applying for the mortgage restructuring program must meet strict requirements. Firstly, the family’s monthly income cannot exceed two subsistence minimums ( the value is set separately for each region of the Russian Federation ). Secondly, the mortgage payment must increase by more than 30% from the moment the contract is signed. By the way, the mortgage agreement itself must be concluded at least a year ago, and the apartment indicated on the paper must be the only home for the family.

In addition, applicants for AHML assistance must fall into one of the following categories:

- families with children, including disabled people;

- adults with disabilities;

- veterans of various wars;

- citizens supporting full-time schoolchildren, students or graduate students not older than 24 years.

Even those who have already participated in a similar program before 2017 can apply to refinance a Sberbank mortgage with AHML. To do this, you just need to collect a complete set of documents confirming your right to participate in the program.

Mortgage rates from Dom.RF

Since the organization is entirely government-owned, most programs have preferential rates that best suit the interests and needs of ordinary citizens.

Available mortgage offers include:

- “Purchase of housing” – from 8%;

- “Refinancing” – from 7.3%;

- “Military” – 7.3%;

- “Family” – from 4.7%;

- “Far Eastern” – from 1.2%.

At the same time, according to the company’s terms and conditions, clients have the right:

- Buy any real estate: under construction, a finished apartment in a new building, a house or real estate from the secondary market.

- Use the maternity capital certificate - both as a down payment and an additional amount that increases the maximum loan size.

- You can also get money to build your own home.

- Opportunity to buy housing that is on the balance sheet of Dom.RF as collateral.

- Young and large families are offered additional discounts and benefits.

Security of investment

The reliability of AHML agency bonds is determined by investments in the public sector of the economy.

The risk of default is minimal even in the long term. The international agency Fitch assigned AHML a BBB- reliability rating with a stable long-term outlook. This is an important indicator that confirms that the organization is not facing a significant drop in the value of securities or any other economic shocks in the coming years. The state agency works with the largest partner banks, and its activities continue to expand.

The main stages of a real estate acquisition transaction

In general, the scheme of the transaction for the purchase of a property with a Dom.rf mortgage is as follows:

- Submitting documents and applications for a mortgage;

- Ordering a real estate appraisal from an accredited appraiser;

- Providing a package of documents for the property;

- Insurance of the property, life and health of the borrower;

- Signing a loan agreement;

- Transfer of the down payment to the seller, signing of receipts;

- Submitting documents for registration to the MFC;

- Providing the Dom.rf specialist with a list of documents issued by the MFC and transferring the loan amount to the buyer’s account;

- Transfer of borrowed money to the seller, signing of a receipt;

- Receiving a registered agreement and an extract from the Unified State Register of Taxes at the MFC;

- Providing Dom.rf with documents on the buyer’s ownership.

If the borrower is about to sign a purchase and sale agreement, it is useful to read the information in the article: Sale and purchase agreement with a mortgage - important points for the seller and buyer.

If a buyer asks to inflate the price of a property, then it is important to read the article: Overpriced mortgage: risks for the seller and the buyer.

Pros and cons of investing

Investments in AHML securities are beneficial for those who are interested in long-term receipt of small passive income. Although the rate is low, you can be sure of receiving regular coupon payments. This is an important advantage over investing in organizations in the commercial sector that are not controlled by the state.

Investing has several advantages:

- Fixed income at a strictly defined time. Unlike paying dividends on shares, the company pays the required amount for any performance results.

- Possibility of resale on the exchange at any time for a quick refund. AHML agency bonds are in demand among individuals and organizations.

- Reliability. The risk of losing financial investments is minimized.

- Long-term investment. You can reliably save capital and turn it into a tool for generating passive income.

The disadvantages include the relatively low yield of securities, as well as the impossibility of direct purchase for individuals without the participation of a broker. There is a need to pay a commission for buying and selling.