A mortgage for a room in a communal apartment is a good, and often the only option for people moving to another city who cannot afford to purchase full-fledged housing.

Many banks are wary of this type of mortgage, but there are conditions under which a mortgage loan will be guaranteed.

Today we will tell you about the conditions for purchasing a room in a communal apartment and the banks that establish them

Is it possible to buy a room with a mortgage?

A mortgage in many banks can be taken out not only for separate housing, but also for part of it, which includes a room in a communal apartment.

The most common option for such an acquisition is the purchase of part of the property from other owners in order to own the apartment completely (most often this happens if the last room remains, and the rest of the housing already belongs to the borrower).

In this case, banking institutions willingly issue mortgage loans to clients, and the amount required is quite small.

However, it should be remembered that the bank pledges the entire apartment, not part of it.

Banks can issue a mortgage loan secured by a room that is not necessarily purchased in accordance with Article 6 of Federal Law No. 102.

Another mortgage lending option is to purchase one room (or a certain part) in a communal apartment.

Banks are quite wary of issuing mortgages to such clients, since the liquidity of the collateral is called into question, and they additionally check the borrower’s solvency, as well as the availability of permission to buy out part of the property from other co-owners.

Requirements

Since buying part of an apartment is quite a risky undertaking for banks, they set increased liquidity requirements for real estate so that it can cover all the costs of a mortgage loan in the event of the borrower’s non-payment of debt.

The client’s solvency and the purpose of his purchase of the room are also carefully checked.

The requirements of banking institutions can be identified as conditions for the candidacy of the borrower and directly for the purchased property.

Requirements for the borrower

In order to issue a mortgage to a borrower to purchase part of a home, the bank checks his candidacy for compliance with the following requirements:

- By age - reaching 21 years of age at the time of registration of the mortgage and no more than 65-70 years of age to fully repay the mortgage debt;

- For length of service - having at least six months of experience at the last place of work, and total experience - 1.5-3 years;

- To attract co-borrowers or guarantors - a guarantee may be required in case of low income; spouses are required to act as co-borrowers under some programs, regardless of their desire.

Where can I buy a room?

The type of housing for this type of lending is determined only by the type of property in which there is the possibility of purchasing one room.

Among these are dormitories and communal apartments, as well as parts of an ordinary apartment in which there is more than one owner.

In dorm

A mortgage for the purchase of a dorm room is quite a risky undertaking for banks, since the liquidity of such real estate is very questionable.

Therefore, the borrower may be required to provide a document confirming the availability of additional real estate that can be considered by the bank as collateral.

Also, the possibility of opening a mortgage increases if the borrower wants to buy the last room in the hostel in order to become the full owner of the entire complex.

In a communal apartment

For communal apartments, as well as dormitories, banking institutions set increased requirements.

The object must not be demolished, nor be unfit for habitation.

You will also need written confirmation of the consent of other owners to buy out part of the communal apartment.

You can also significantly increase your chances of successfully obtaining a mortgage loan by purchasing additional real estate or purchasing the last part of the apartment.

Insurance

The collateral that you provide to the lender is subject to mandatory insurance, according to the mortgage law, but the bank, wanting to protect itself, may include other types of insurance in the program.

Until the statute of limitations expires and the threat of challenging the transaction passes, the lender has the right to require insurance for the risk of material losses in the event of loss of rights to the acquired property due to a defect in the title. The amount of insurance depends on the liquidity of the collateral property.

If you decide to refuse the mandatory part of the insurance, you may receive a refusal, and in other cases this will entail an increase in the interest rate.

Read our article about what to do if a bank refuses a loan and the possible reasons.

Which banks are ready to provide a mortgage?

Many banking institutions are afraid to work with communal housing and issue a mortgage for the purchase of a room.

But you can still find conditions in the largest and regional banks that allow you to become the owner of a room in a communal apartment.

You can find recommendations for choosing a mortgage bank here.

Sberbank

Sberbank has been successfully offering mortgage lending for the purchase of a room in a communal apartment for many years, as it became one of the first in this business.

Interest rates will range from 9.5% to 14% per annum with a down payment of 10%.

The maximum amount you can receive is from 45,000 rubles to 15,000,000 rubles for a period of up to 30 years, and a deposit is also issued for the purchased housing.

Documents that may be needed:

Certificate of income in the form of Sberbank;

Sample of filling out an application form for a housing loan at Sberbank;

Application form for obtaining a mortgage loan from Sberbank;

General conditions for housing loans at Sberbank.

VTB 24

VTB 24 is more willing to issue a mortgage for a room in a communal apartment if the borrower buys the last part of such real estate.

Required package of documents

Since the procedure for applying for a room loan is not particularly different from conventional mortgage lending, the package of documents will be almost the same.

You need to submit to the bank:

- Statement of the established form;

- Passport and its copies for concluding an agreement;

- Certificate 2-NDFL or in the prescribed form of the bank;

- Documents of guarantors and their corresponding statements with certificates of income;

- For military personnel, it is necessary to provide documents indicating the duration of the contract;

- Pensioners provide a pension certificate;

- Documents on ownership of the room;

- An extract from the house register confirming the absence of third owners;

- Technical passport for the room.

Since the state has been introducing new family support programs for the last 3 years, in order to receive more favorable conditions or a reduced rate, you may need a certificate of maternity capital, a certificate of participation in the program for young families and other benefits provided by law and documented.

Comparative characteristics of banks

Table characterizing the conditions of banks that issue loans for a room:

| Bank's name | Bank logo | Interest rate | An initial fee |

| Sberbank | from 9.5% | from 10% | |

| VTB 24 | from 11.25% | from 10% | |

| Rosevrobank | from 9.75% | from 15% | |

| Gazprombank | from 11.75% | from 20% | |

| Tinkoff Bank | from 10.5% | — | |

| Deltacredit | from 11.25% | from 25% | |

| SKB bank | from 12% | from 12% | |

| AK Bars | from 13.5% | from 0% |

Can I take advantage of a preferential mortgage?

A mortgage for the purchase of part of the housing in a communal apartment can be obtained using preferential programs, since they do not prohibit the purchase of this type of real estate.

You just have to find a suitable bank that cooperates with programs and this type of housing.

Is it possible to buy a room with a military mortgage?

A military mortgage provides for payments under the mortgage-savings system to the military personnel participating in it.

Quite large amounts of these savings, as well as the period for starting to use them after 3 years of participation, allow you to purchase separate housing, but to buy out the last part of a communal apartment in order to become its sole owner, you can obtain this right quite profitably without your own investments.

Is it possible to buy a room with a mortgage using maternity capital?

Maternity capital is provided to families after the birth of two or more children.

This amount is enough to buy out a room, but banking institutions are more willing to agree to buy out the last part of the apartment if the client is already the owner.

Is it possible to sell the loan premises?

In the process of paying mortgage payments, situations quite often occur when the owner, for various reasons, decides to sell the premises. In order to fulfill such a desire, you first need to obtain permission from the bank. Due to the fact that the room has a credit encumbrance, it will be extremely difficult to find a buyer for the property, and as a result, the price will have to be greatly reduced.

In addition, when selling a room, for example in Sberbank, you will have to fully pay off the balance of the mortgage debt. Otherwise, the bank simply will not allow the transaction.

Related Posts

Registration of a mortgage

After choosing a banking institution that is ready to provide a mortgage for the purchase of part of the housing in a communal apartment, the potential borrower must submit an application form.

After approval of the client’s candidacy and approval of the mortgage loan, the borrower selects a room and provides all the necessary documents for this property.

The bank carries out the assessment at the borrower's expense. If it is planned to pledge not only the purchased housing, but also existing property, then it is also assessed by a professional appraiser.

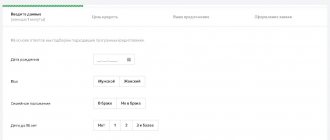

Filling out an application: step-by-step instructions

The questionnaire, as a rule, consists of two parts - information about the borrower and the loan itself.

- Your role. Here you need to indicate who you are: a borrower, a co-borrower or a mortgagor.

- Personal Information. Full name, date of birth, gender, Taxpayer Identification Number.

- Passport details. As usual, write the series, number, by whom and when issued, and department code. Please indicate if you have a passport.

- Information about income. Where do you work, the salary, what can you offer as collateral.

- Contact details. Please provide contact numbers and email address.

- Address. Permanent registration, temporary or place of actual residence.

- Relatives. There is no need to indicate all relatives, up to the third generation, only close ones. Write if you have children.

- Education and marital status.

With the second part, everything is much simpler: write down the amount and period for which you are taking the money, the account number for transferring funds and the signature.

You can learn more about how to properly complete and submit an application here.

Advantages and disadvantages

It seems that it is better to purchase a full-fledged apartment with a mortgage instead of a room, but for some this is the only opportunity to stay in the city or find housing after a divorce.

The advantages and disadvantages of mortgage lending for such real estate are shown in the table:

| Advantages | Flaws |

| High availability due to low prices. | You should always take into account the fact that you are close to other people. |

| A good opportunity to buy the last room from your neighbors to own a large communal apartment alone. | The liquidity of such real estate is often questioned by tanks and does not always withstand the assessment procedure. |

| Short payment period in case of a small mortgage amount. | The acquisition is complicated by the need to collect signatures from other registered parties. |

| — | It is necessary to take into account your solvency so that the bank does not have a reason to seize the collateral. |