The need to purchase your own apartment or build a country house can arise at any age. Due to the fact that it is very difficult to save money for real estate on your own, many Russian citizens choose mortgage lending. It is much better than renting an apartment, drawing up a rental agreement, or taking part in a housing savings cooperative. At the same time, a mortgage is a service that even pensioners can use. Russia's leading bank, VTB, offers older people to take out a loan for 10 years. The conditions in 2021 are quite favorable.

Lending terms

VTB has not developed special programs for pensioners as a separate segment of the population. From this we can conclude that older people can take out a mortgage under the same conditions as other Russian citizens. They boil down to the following:

| Annual interest rate | From 12.1% |

| Validity period of the loan agreement | Up to 10 years |

| Loan size | No more than 60 million rubles |

| Down payment amount | From 15% and above |

| Credit reputation | Positive |

Mortgage for military pensioners

For retirees who are military and have served for more than 10 years, the state has developed a special program. They are given a subsidy. Among other things, VTB is very loyal to military pensioners. In most cases, the loan application is approved. There are also favorable loan rates.

Basic conditions for repaying a mortgage loan at Sberbank

Sberbank provides favorable conditions for mortgage loans to its clients. Being one of the major lenders throughout Russia, Sberbank is developing many mortgage programs. There is an age limit for individuals - the debt must be paid before reaching 75 years of age.

Sberbank issues loans to non-working pensioners. According to the lender, this category is considered more reliable. Such clients often receive a positive decision on loans. When submitting an application, the bank also takes into account unconfirmed income.

To apply for a mortgage loan, a pensioner must fulfill the following conditions:

- have a stable additional income, in addition to pension payments;

- find guarantors;

- take out a life and health insurance policy.

When drawing up a preliminary schedule of monthly contributions, the bank takes into account when the client retires. Before this age, monthly contributions are larger than after retirement. The minimum loan payment is set based on the level of the average pension in the country.

Requirements for borrowers

The bank's requirements for pensioners are standard. They are practically identical to those that apply to other categories of citizens. Thus, the borrower must be registered in Russia, and his age should not be more than 65 years. It is important that he is solvent and can confirm his earnings with official documentation.

We should also talk about age. According to the terms of VTB, the maximum age of the borrower should not be more than 65 years. Based on this, retired women can take out a mortgage for a maximum of 10 years, and men - for 5.

As for the client’s solvency, if the pension is the only source of income, then you should not expect approval of the loan application. The fact is that VTB considers pensioners to be unreliable clients, and therefore tries in every possible way to protect itself from financial risks. This is due to the following reasons:

- The amount of pension contributions compared to the loan amount is relatively small, so the pension will not be able to fully cover the costs of the loan.

- The unstable situation in the labor market and the global crisis have led to the fact that anyone can unexpectedly lose their job. It is pensioners who are at increased risk of being laid off.

- Borrowers, due to their advanced age, have problems with their health, so there is a high probability that they may die without fully fulfilling their financial obligations to the bank, that is, without fully repaying the mortgage.

You can count on a positive response if the client is employed and can provide a certificate in form 2-NDFL - this is a document indicating the wages paid to the employee for a certain period.

The borrower's credit history also plays a big role. At the time of submitting an application for a mortgage to VTB, he should not have loans from other financial organizations. Willful defaulters are guaranteed to receive a refusal.

The borrower must find himself a guarantor. In this case, this person may be a person of retirement age. Most often this is the applicant's spouse. The presence of collateral, for example a car, will be additional points in favor of the client.

Age restrictions for obtaining a mortgage

It is not always possible to obtain a mortgage quickly and without problems. Sometimes the difficulty can be age. The following categories of borrowers may have problems when applying for a mortgage:

- Young people. They have an unstable income. In addition to this, boys at the age of 18 are called up for military service. Families are often created at a young age. All this is a risk for the bank, so the approval rate for mortgage applications for this category of citizens is low.

- Pensioners. Citizens of retirement age come under special attention of banking organizations. The reason is the possible loss of solvency with age. It would be best for the lender to limit the client’s age than to hope that he will be able to pay the loan in a difficult financial situation. In addition, pensioners often take out a mortgage in order to purchase housing for their children. Banks do not know what their solvency is. If an accident occurs with the client, the responsibility for paying the debt will pass to his children.

Real estate requirements

VTB offers pensioners to take out a mortgage loan on the secondary real estate market. In this case, the selected object must fully comply with the high requirements and demands of the bank. The main thing is high liquidity and good, residential condition of the apartment. So, it must have gas, electricity, water supply and other engineering systems. All redevelopment must be officially permitted by the housing stock and confirmed by relevant documents. The degree of wear and tear of the building in which the apartment is located should not exceed 60%. At the time of registration of the mortgage, the apartment should not have any debts for utilities and fines.

It is worth noting that in addition to a secondary apartment, the borrower can take out a mortgage:

- private house with plot;

- private house under construction;

- an apartment in a storey building under construction;

- garage for a car.

VTB allocates an average of 3 months to search for suitable living space. After this period, the pensioner must decide on an apartment.

Types of housing and possible options

Today on the market of financial programs you can find mortgage offers for pensioners, but their number is limited and not all credit institutions work with older borrowers. If you want to get approval, you must contact the largest banks, and to increase your chances, it is recommended to submit applications simultaneously to several addresses.

The largest number of financial offers is associated with the purchase of apartments in the primary and secondary markets. The realization of the desire to obtain a loan to purchase a private home may be associated with a limited number of programs.

Most banks have the following requirements for such an object:

- location within the city;

- capital structure;

- availability and operability of engineering systems;

- accessibility of transport interchanges.

In our country, there is a special type of lending program for pensioners, which is called a reverse mortgage. It consists in the fact that the party to the contract receives certain payments within a specified period. In return, after his death or a pre-agreed collateral event, the apartment becomes at the disposal of the bank. This mechanism makes it possible to obtain an additional source of income for single persons who do not have support from relatives and heirs.

It might be interesting!

What should the salary be in 2021 in order to get a mortgage?

Required documents

Since there is no special mortgage program for people of retirement age, the bank requires them to submit a standard package of documents for consideration. It includes:

- passport of the Russian citizen of the applicant and guarantor;

- any other document identifying the applicant and the guarantor;

- application for a mortgage loan;

- income certificate;

- SNILS;

- military ID (for retired military personnel).

In some cases, the bank may ask you to provide other documents. For example, statements of accounts in other financial organizations or a certificate of ownership of real estate and a vehicle.

Conditions of a home loan depending on the age of the borrower

A citizen who wants to apply for a mortgage from a bank must have a stable financial situation, a positive credit history, and a suitable age. Sometimes you need to find reliable guarantors.

The lending bank excludes the possibility of providing a mortgage loan to the client under the following circumstances:

- presence of disability (at young and retirement age);

- loss of a job and further search for it (due to lack of experience or lack of proper education).

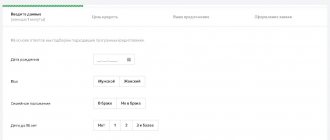

Registration procedure

Mortgages for VTB pensioners are issued according to the standard scheme. A bank client can leave a request on the bank’s website or come to the branch in person. There you need to write an application according to the proposed sample and fill out a form, answering questions about your income and the chosen loan program. The form also contains the borrower’s passport details. A standard package of documents is attached to the application.

Processing an application at VTB, as a rule, takes no more than three days. After this, the manager contacts the client and informs the credit institution of the decision. If it is positive, then the borrower must again visit the branch to draw up a mortgage agreement. After all the papers are signed and the bank approves the selected property, VTB issues the required amount of funds. Money is transferred to the card or issued in cash. The currency can be any: rubles, dollars or euros. In this case, a prerequisite for receiving money is the presence of a down payment from the borrower.

Purchasing an apartment under the “Young Family” program

Many banks offer young couples to take advantage of special programs with state support that allow them to take out a mortgage on more favorable terms. The smallest percentage is provided to large families with three or more children. At the same time, they can contribute maternity capital to the debt, and part of the housing loan will be repaid by the state. Making such concessions, banks impose strict age restrictions on borrowers: one of the family members should not be more than 35 years old at the time of signing the contract. If spouses have reached this age, they can receive a loan only on general terms.

Disadvantages of credit

A mortgage for people of retirement age is a chance to acquire their own home even in old age. However, it has a number of significant disadvantages associated with high costs and overpayments. Among them it is worth noting the following:

- The applicant must pay for the services of a professional appraiser who carries out an itemized assessment of the property and registration. The assessment will cost an average of 3 thousand rubles. Unfortunately, without this procedure it is not possible to get a mortgage, since the bank puts forward serious requirements for secondary market apartments.

- The pensioner must obtain title insurance for the purchased property. Based on this, he must pay monthly insurance premiums, the amount of which directly depends on the cost of the apartment.

- The interest rate on the loan is quite high, so the amount of the overpayment is almost equal to the principal amount of the debt. Large interest rates minimize the bank's financial risks.

- You will also have to pay for maintaining and opening a bank account. VTB charges 3% of the loan amount.

- The pensioner must regularly make the monthly mortgage payment, otherwise a penalty will be charged. Each day of delay will cost 0.5% of the loan.

Dependence of loan approval on age

According to the Central Bank, over the past years the maximum rate of active mortgage loans falls on the average age from 25 to 35 years. The second place in approval goes to citizens from 36 to 45 years old. These periods account for approximately 80% of all mortgage debt.

Important! The lowest percentage of mortgage approval is for young people under the age of 24 and for senior citizens over 60 years of age.

Banking experts say the same thing. In their opinion, the average age of the borrower gives a greater chance of mortgage approval and favorable interest rate conditions. Lenders are less likely to approve a mortgage for very young or elderly citizens, regardless of their solvency.

Reasons for refusal

According to the law, any bank, including VTB, has the right to refuse a loan to a client without giving reasons. However, often the main reasons why older people do not receive approval for a mortgage are the following:

- Providing false information. All information that a VTB client provides in order to approve his application is carefully checked. If the client kept silent about the availability of other loans, increased his income, or otherwise tried to deceive the bank, then he will be denied a mortgage.

- Insolvency. A low level of income is not acceptable when applying for a loan of several hundred thousand rubles or more.

- Unpaid financial obligations to other credit institutions and bad credit history. If a client has outstanding loan obligations, especially for a large amount, tax debts, then VTB will not trust him. It is better to pay off existing debts before taking out a mortgage.

- Age discrepancies. As practice shows, it is very difficult to obtain a loan for pensioners. VTB gives preference to borrowers under 55 years of age. However, for older people there are no restrictions on lending, except that the term of the mortgage loan will be shorter.

Pensioners can also acquire their own housing through mortgage lending. The main thing is to meet VTB requirements, be solvent (have a job) and provide an impressive package of papers. Money is issued both for the construction of housing and for the purchase of an apartment. It is worth noting that mortgages are issued to pensioners on general terms. A special program is developed only for those pensioners who are military. The purchased housing can be used for any purpose.

List of requirements for issuing special mortgage loan programs

Let's look at what basic requirements banks set for certain home loan programs.

Young Family Program

Young families have the opportunity to receive benefits under this lending program. The main condition of the mortgage is the age criterion. At least one of the spouses must be no older than 35 years. The mortgage is issued at a minimum interest rate, which does not change during the entire payment period.

Large families with at least three children have a high probability of receiving a mortgage under the Young Family program. Owners of the salary card of the bank in which the mortgage is issued have the right to this type of lending. These categories of individuals obtain a loan with a low interest rate.

This type of loan can be obtained from Sberbank. The offer is valid for finished properties. It also doesn’t matter what status the seller has. He can be an ordinary individual or an individual entrepreneur.

Military mortgage

This program was created in 2015 and operates throughout Russia. Russian military personnel can apply for a mortgage. Thanks to this opportunity, borrowers can obtain a cash loan on preferential terms, developed individually for each client.

One of the main conditions of a military mortgage is payment of the loan in installments issued to the client by the state itself. An additional condition is the borrower’s obligation to take out a military mortgage before the age of 45. Military work experience in the Armed Forces of the Russian Federation must be more than 3 years.

Mortgage for pensioners

It is known that several years ago banks provided loans to pensioners at high interest rates, based on sufficient risk in repaying the debt. Today, pensioners receive general standard lending conditions along with other categories of citizens.

The chances that a pensioner will be approved for a mortgage from a bank increase if the borrower has an official job or can provide his relatives as guarantors.

Most often, pensioners receive loans from banks such as Sberbank and Transcapitalbank.

Mortgage for the purchase of housing

A young family or a person who has reached the age of 21 at the time of applying to the bank can count on loan approval.

A mortgage loan is a long-term type of agreement, therefore, the bank seeks to minimize the risks of non-repayment of debt.

The main requirements that are put forward to a young client are the presence of an official place of employment with work experience of at least 6 months. The total experience must be at least 1 year.

Considering that at the age of 18 young citizens only enter educational institutions to receive specialized education, having the required work experience is quite problematic. Based on this, banks increased the minimum age limit to 21 years.

The practice of mortgage lending shows that citizens mainly apply for a mortgage in the age range from 25 to 30. During this period of life there is already a chance to get a stable and well-paid job and be financially independent. However, married women without children at this age may be refused, since there is a possibility of going on maternity leave, and, as a result, there is a risk of a decrease in income.

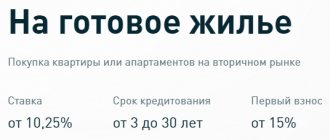

Conditions of the largest banks in the Russian Federation

Sberbank is a leading bank in issuing housing loans. Here you can take out a mortgage to purchase an apartment in a new building or in an old building on favorable terms:

- interest – from 8.6% per annum;

- term – up to 30 years;

- down payment – from 10%.

Young families receive loans under a preferential program with state support and a 6% annual rate. At the same time, age restrictions apply: the agreement is signed only with a borrower at least 21 years old, and the age for final repayment of the debt is 75 years old. The borrower must receive a regular income in the form of a pension or salary. If the potential borrower does not work and has not received pensioner status, more stringent limits are applied regarding his age - at the time of final repayment of the loan, his age should not exceed 65 years.

Gazprombank

In recent years, Gazprombank has improved the conditions for obtaining mortgages, imposing more lenient requirements on borrowers both in terms of age and work experience. Thus, the applicant must have worked for six months at the last place of duty (total length of service - at least 1 year), and also not be older than 65 years at the time of repayment of the last payment. It is advisable that he pay an initial payment - 20% of the cost of the residential premises, but for large partners this figure is reduced to 15%, and for company employees - reduced by 2 times. The loan can be spent on housing both in a new building and on the secondary market.

The maximum loan term is 30 years. Individuals are provided with a large limit - 45 million rubles. On average, money is issued at 10%, but the figure can be reduced if the person being loaned receives a salary on a bank card, provides a down payment of 50%, or has any benefits (maternity capital, pension, etc.). Another advantage of getting a mortgage from Gazprombank is that the lending conditions are individual for each specific borrower and may differ from those indicated above, although he may be denied a loan without explanation.

VTB

VTB Bank stands out for its profitable mortgage programs that it provides to potential borrowers for the purchase of finished or under construction housing. The amount issued varies from 300 thousand rubles to 30 million rubles at 9.1% per annum. To get a mortgage loan, it is enough to make a down payment of 10% of the cost of housing. The maximum loan period is 30 years. Now let’s figure out up to what age the bank gives a mortgage. Pensioners and people aged 21 to 65 years are credited, and their total income from both their main place of work and part-time work is considered.

VTB is one of the few banks that agrees on the conditions for obtaining a mortgage on an individual basis. A significant advantage of lending is the absence of a requirement for permanent residence in the region in which the potential borrower is applying for a housing loan. If the client agrees to purchase an apartment or house from the collateral fund, he can take out a loan on more favorable terms, including age restrictions.

Note. When applying for a mortgage on secured housing, you need to be prepared for various legal problems. Former borrowers may live in the purchased apartment, in which case an eviction procedure will be required.

Rosselkhozbank

Despite its “telling” name, Rosselkhozbank is a bank with 100% state participation, providing all types of credit services, including mortgage lending. He strives to attract clients with a variety of programs for the purchase of both apartments in multi-storey buildings and country real estate: a plot of land, a dacha in a gardening community or a finished cottage. A mortgage is provided for the construction of a private house, and at the same interest rates.

Until what age do Rosselkhozbank provide mortgages? This bank has introduced the same restrictions as most organizations - the minimum age of the loan recipient is 21 years, and the maximum is 65 years at the time of full repayment of the loan. Moreover, the borrower can apply for a loan until the age of 64 years. Of course, the maximum loan amount offered by Rosselkhozbank as part of housing lending is small - 20 million rubles, but can be provided for a period of up to 30 years. The down payment is 15%, young families are offered a 0.25 discount in the following cases:

- housing costs over 3 million rubles;

- real estate is purchased through partners.

Note. Rosselkhozbank actively works with pensioners, offering them preferential mortgage lending conditions. Moreover, the age of the borrower at the time of full repayment of the loan is 75 years, but such an upper limit is allowed in the absence of various encumbrances. The agreement is drawn up with both workers, unemployed people and military pensioners.

Oriental

Vostochny Bank issues mortgages for up to 30 years to all citizens of the Russian Federation who are over 21 years old. The borrower is required to repay the loan until he turns 76 years old. You can take out a loan to purchase a house, a plot of land, an apartment, or residential real estate under construction. The bank gives a maximum of no more than 80% of the cost of the premises being pledged as collateral, but if there are benefits, it can pay 85% for the residential premises, and the remaining 15% will remain to be paid to the borrower.

To study the mortgage conditions provided in more detail, clients of large banks can use the calculators provided on official websites. In just a couple of minutes, they will calculate the interest, terms and monthly loan payments, depending on the age, income level and marital status of the potential borrower.