A taxpayer can return from the budget 13% of the amount spent on paying for medical services and purchasing medicines, provided that in the same period he paid personal income tax on his income at a rate of 13%, and treatment expenses meet the requirements of the Tax Code for such costs. To get back part of the money spent, the taxpayer needs to claim a social deduction for treatment by submitting a declaration to the Federal Tax Service (subclause 3, clause 1, clause 2, article 219 of the Tax Code of the Russian Federation). We will tell you how to draw up a document and provide a sample of filling out the 3-NDFL declaration for treatment.

What to consider when filling out the 3-NDFL declaration for treatment

A taxpayer can receive a deduction for treatment if he paid from his own funds for himself, as well as for his relatives (spouse, parents, minor children):

- medical services provided by medical organizations and individual entrepreneurs;

- purchasing medications prescribed by a doctor;

- amounts of contributions under voluntary medical insurance contracts.

The maximum amount of accepted expenses is 120,000 rubles, that is, you can return up to 15,600 rubles. tax (120,000 x 13%). But it includes all social deductions: for education, for savings contributions to the Pension Fund and for treatment. Therefore, there is no point in presenting costs that exceed the limit value - they will not be accepted anyway. But this restriction does not apply to expensive treatment. The list of expensive types of treatment is given in Government Decree No. 458 dated 04/08/2020.

How to distinguish whether treatment costs are limited or not:

- if the certificate issued by a medical organization for submission to the Federal Tax Service contains code “1” - the treatment is normal, the maximum value is limited to 120 thousand rubles. (the cost of purchased medications is also included in the total limit);

- if the certificate indicates code “2” - the treatment is expensive, these costs are accepted in full.

The total amount of the deduction cannot exceed the income received and subject to personal income tax.

What documents should I attach to 3-NDFL for a tax deduction for treatment?

In addition to the 3-NDFL declaration itself, inspectors are presented with documents confirming treatment expenses for verification. What you will need:

- a copy of the agreement with the medical institution;

- a copy of the license of the medical organization (not needed if its number is indicated in the text of the contract);

- a certificate of payment for services issued by the medical institution for the tax authorities (original if a paper copy of the declaration is sent to the Federal Tax Service);

- a copy of the prescription for medications issued by the attending physician;

- copies of payment documents for the purchase of medicines (cash receipts, sales receipts, receipts, etc.);

- certificate of income and withheld tax from the employer (2-NDFL).

When applying in the 3-NDFL declaration for a refund for the treatment of relatives (spouses, children under 18 years of age, including adopted children, parents, adoptive parents), an additional copy of a document confirming a close relationship, for example, a birth or marriage certificate, is attached.

Insurance premiums paid under a VHI agreement can also be deducted. For verification, copies of the policy or agreement, licenses, documents on payment of amounts under the agreement are attached.

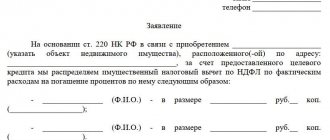

Appendix 7

This is a property deduction calculation.

If you purchased several residential properties, then for each property you need to fill out a separate application. Then lines 100 – 180 are filled in only on the last sheet. Fill in the lines:

- Line 010. Property code. 01 – house, 02 – apartment, 03 – room. Full list here: .

- Line 020. Taxpayer attribute code, see here: . Owners indicate code 01.

- Line 030. Filled in if code 1 or 7 is indicated in line 010 (house or house with a plot). We put 1 for the construction of a new house and 2 for the purchase of a finished one.

- Line 031 and 032. In line 031, indicate which of the number codes listed on the form is known to you. On line 032 write the number itself.

- Line 033. Do not fill out this line if you wrote down the object number in line 032. If there is no number, write down the location of the object.

- Line 040. Date of execution of the act of acceptance/transfer of the apartment, if new construction.

- Line 050. Date of registration of ownership of a house or apartment, if purchased under a sales contract.

- Line 060. If you are filing a deduction for a land plot, indicate the date of registration of ownership of this plot.

- Line 070. If the property is shared, indicate the share in ownership. If you are one owner, enter the fraction 1/1.

- Line 080: The amount you paid for the property under the contract, up to the maximum deduction you are entitled to. This value is equal to 2 million rubles. For example, if an apartment costs 2.5 million rubles, indicate the maximum allowable 2 million rubles. If the apartment costs 1.2 million rubles, write the amount under the contract - 1.2 million rubles.

- Line 090. If the property was purchased with a mortgage, indicate here the amount of interest paid, but not more than the maximum allowable deduction for interest (3 million rubles).

- Line 100. Amount of previously used tax deduction.

- Line 110. The amount of the previously used tax deduction for interest.

- Line 120. The amount of the deduction that your employer provided to you based on the notice from the Federal Tax Service. To be completed if you contacted the tax office to receive payment through your employer.

- Line 130. Interest deduction amount if you applied for payment through your employer.

- Line 140. Calculation of the tax base minus deductions already provided. We calculate using the formula: value of line 110 – line 150 of application 3 – 060 of application 3 – 120 of application 4 – 070, 181, 200 and 210 of application 5 – 160 of application 6 – 120 and 130 of application 7 – 040, 052, 060, 070 of application 8 .

- Line 150. The amount of property deduction that will be used in the current year. Must not exceed line value 140.

- Line 160. The amount of interest deduction that will be used in the current year. Should not exceed the difference between lines 140 and 150.

- Line 170. The deduction amount that will carry over to the next year. We count using the formula: line 080 – lines 100, 120 and 150.

- Line 180. The amount of the interest deduction that will carry over to the next year.

Fill out the declaration calmly and carefully, avoiding mistakes.

How to fill out the 3-NDFL declaration for treatment

In 2021, to reflect the deduction for treatment, the form from the Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

Tax refunds can be made only for the period in which the treatment was paid. If expenses for treatment are declared in 3-NDFL for previous years, the forms valid in the corresponding period are used. You cannot transfer the deduction (including its unused balance) to another year.

The Federal Tax Service will accept both paper and electronic versions of reporting. A declaration sent via the Internet (through special communication operators, the State portal) must be certified with an electronic digital signature.

There is no specific deadline for filing a 3-NDFL declaration for treatment. But the Federal Tax Service recalculates the tax and returns the overpayment only for the previous 3 years. For example, if a citizen reports a deduction in the 2020 tax return (3-NDFL) for the treatment of himself or a relative, the overpayment of tax for 2021 will be returned to him if he submits the return no later than December 31, 2023.

If the return only claims a deduction, it can be filed throughout the year. 3-NDFL, in which, in addition to deductions, the income of an individual is also declared, must be submitted no later than April 30 of the year following the reporting year.

Tax authorities have 3 months after receiving the declaration to verify the information, and another 1 month to transfer funds to the taxpayer.

Where to file a tax return 3‑NDFL

The declaration is submitted to the tax office at the place of permanent registration of the Federal Tax Service of the Russian Federation dated 06/02/2006 N GI-6-04/ [email protected] “On the direction of information” href=”https://www.consultant.ru/document/cons_doc_LAW_60810/c1b8be8ab11626a8435ecb996e2ab6a3cfce8001 /» target=»_blank» rel=»noopener noreferrer»><Letter> Federal Tax Service of the Russian Federation dated 06/02/2006 N GI‑6‑04/ [email protected] “On the direction of information”. This can be done at the place of temporary registration only if you do not have a permanent one. Luckily, you don't have to plan to travel to file your declaration—more on that in the next paragraph.

You can find out which inspection is yours on the Federal Tax Service website.

3-NDFL for treatment: sample filling

You do not need to fill out all sheets of the deduction declaration. Only the necessary pages are used. For paper declarations, only one-sided printing is allowed.

If the taxpayer reports only a deduction for treatment, it is sufficient to include in the composition:

• title page;

• section 1 and its appendix – application for tax refund;

• section 2;

• Annex 1;

• Appendix 5.

The TIN of the individual is written at the top of each page of the declaration, the date and signature are placed at the bottom, empty fields are crossed out.

The tax in the declaration is indicated in whole rubles, the remaining cost indicators (income, expenses) are in rubles and kopecks.

Encoding used

Some data in the declaration is indicated in the form of special codes, some of which are given in the appendices to the Procedure for filling out the declaration, for example:

- The number of the Federal Tax Service Inspectorate and OKTMO is determined by the taxpayer’s place of residence; they can be clarified in your inspectorate or on the ]]>website]]> Federal Tax Service.

- The title page indicates period codes “34”, country (RF) “643”, taxpayer category for individuals (not individual entrepreneurs) – “760” (Appendix No. 1 to the Procedure), status “1” (residents - persons who were in territory of the Russian Federation more than 183 days a year).

- In section 1 on page 010, the code “2” is placed, indicating that the tax is subject to refund; below is the BCC of the tax - 18210102030011000110.

- In section 2 the tax rate is 13%, on page 002 “Type of income” the code “3” is indicated - other.

- The codes of types of income indicated in Appendix 1 are selected from Appendixes No. 3, 4 to the Filling Out Procedure.

The rest of the information is taken from the taxpayer's documents.

Recommended filling algorithm

The following procedure for filling out 3-NDFL for treatment is recommended:

• Start with the title page.

• Then reflect data on income received in Appendix 1 (in the general case - according to information from 2-NDFL certificates).

• Then go to deductions in Appendix 5. The amount of costs for expensive treatment is indicated on page 110, for regular treatment - on page 140, the purchase of medicines is reflected on page 141, contributions under voluntary health insurance contracts - on page 150. The final indicators are displayed ( pp. 120, 180, 190, 200).

• The results obtained must be sequentially transferred to section 2, then the refund amount is indicated in section 1 of the declaration.

• To receive a refund, you must fill out an application (Appendix 1 to Section 1), which indicates the bank details of the taxpayer - the tax authorities will use them to transfer the money.

All completed sheets must be numbered; their total number is indicated on the title page. The total number of sheets with copies of supporting documents is also calculated, the result obtained is recorded in the corresponding cell of the title page.

To make the information clearer, we will give an example of filling out 3-NDFL for treatment - a sample of filling out 2021.

Example

In 2021, Svetlana Aleksandrovna Novikova applied for services at a private dental clinic. In 2021, Novikova decided to return part of the funds paid, reflecting the deduction in 3-NDFL for dental treatment. A sample will be given below.

Data required to prepare the declaration:

- Salary at the place of work for 2021, according to certificate 2-NDFL for 2021, amounted to 384,200.10 rubles.

- When paying income, the employer withheld tax of 13% - 49,946 rubles. No tax deductions were applied.

- The cost of paying for dental services according to the contract and a certificate from the medical clinic amounted to 38,700 rubles.

As a result of the calculations, it turned out that Novikova is due 13% of the paid medical services - 5,031 rubles - as a refund from the budget. (38,700 x 13%).

In April 2021, Novikova sent to the Federal Tax Service a completed copy of the 3-NDFL declaration for treatment, a sample of which looked like this:

Second section

Here you calculate the amount of tax that will be returned to your account.

Fill out in order:

- Line 001. Enter the tax rate – 13.

- Line 002. Put 3 - other.

- Line 010 – annual income. You need to calculate using the formula: line 070 of application 1 + line 070 of application 2 + line 050 of application 3 + line 220 of application 5.

- Line 020 – the total amount of income that is not taxed. If there are any, move from line 120 of Appendix 4.

- Line 030. Line 010 – 020.

- Line 040 – deduction amount. Add the rows of Appendix 7: 120, 130, 150 and 160.

- Line 050. These are losses on transactions with securities (Appendix 8 line 040 + 050). If there were no such operations, set it to 0.

- Line 051. Income from participation in foreign companies. Move application 2 from line 070 or set it to 0.

- Line 060. Tax base. It is calculated as follows: lines 030 + 051 – 040 – 050. If the value is negative or zero, put 0.

- Line 070. We count 060*13.

- Line 080. Move line 080 of application 1.

- Up to line 150, indicate taxes paid in different cases. If there were none, we put 0 everywhere.

- Line 160. The amount that will be returned to you. We count using the formula: lines 080 + 090 + 100 + 110 + 120 + 130 – 070.