June 21, 2021 GetHom expert 13,569

You can buy an apartment yourself, or through a real estate agency. If in your case a real estate agency was looking for an apartment, then we will analyze the developments in this situation.

After you have looked through several options and chosen the one that is suitable for purchase, the agency representative will immediately invite you to meet with the seller at the agency and draw up an agreement for the transfer of the deposit.

In our article we will tell you what kind of agreement can be signed at a real estate agency. What is the difference between an advance and a deposit and what legal consequences occur after signing a particular agreement. What risks may arise and how best to proceed.

This information will be useful for both buyers and sellers of their apartments or houses who decide to use the services of the agency.

We will tell you why you cannot give original documents to the agency. What is an act of acceptance and transfer of completed work? What other agreement might the agency force you to sign?

What are the legal consequences of the parties if the terms of the signed agreement are violated? Why does the agency always try to take away the original signed contract from you after the transaction has taken place?

How to buy an apartment without a deposit from a real estate agency

When purchasing real estate on the secondary market, some buyers resort to the services of intermediaries in finding a suitable property. These can be real estate agencies and their realtors, as well as private brokers.

But you can buy an apartment yourself, without resorting to the services of real estate agencies and without involving intermediaries. We have a useful article that details how to do this.

Related article: How to buy an apartment without intermediaries in Ukraine

How to buy apartments through a real estate agency

As a rule, each real estate agency has its own information base of apartments for sale. If a buyer calls or comes to the agency, he may be offered to view several options for apartments according to the stated parameters.

Safe period of cooperation with the agency

Selecting the right options and viewing apartments in the presence of an agency representative is usually free of charge. The realtor takes you to addresses and shows you apartments.

This is the so-called safe period of cooperation with the agency. It is so called because even if the buyer makes some mistakes at the initial stage, they can still be corrected without any losses.

Typically, at the preliminary stage, the agency announces the cost of its services for purchasing an apartment with their participation in the amount of 5% of the cost of the apartment. This price is not final; it can be adjusted and reduced in negotiations with the agency.

Dangerous period of cooperation with the agency

After the option you need has already been selected and reviewed by you, the most crucial period begins in the process of preparing for the upcoming transaction. This is a dangerous period of cooperation with the agency. Any mistake or inaccuracy in behavior at this stage can lead to loss of money or apartment.

Advice for real estate buyers

As a rule, the price of an apartment being sold is also a subject of negotiation. But reasoned bargaining is needed, so at this stage we recommend contacting a lawyer to check the documents for the apartment, the owners, the scheme of the upcoming transaction and the presence of certain risks.

We recommend that you negotiate the price of the upcoming purchase after the apartment has been checked by a lawyer. This way, you can point out the shortcomings and significantly reduce the cost, or you can decide to refuse the purchase if the item is problematic.

An example of buying an apartment through an agency

For example, after viewing several apartments, you stopped your attention on one of them, which the owner is selling for 32 thousand dollars. You liked this apartment, the lawyer checked the documents, you agreed on a second viewing, bargained with the owner and agreed on a price of 30 thousand, which suited you - you decided to buy.

After that, you agreed to pay the agency representative not 1,500 dollars for their services (that’s 5%), but only 1,000. The agency also agreed. Thus, 30 thousand to the owner, plus a thousand to the agency. Total 31 thousand.

How to secure preliminary agreements

But you agreed verbally. To confirm these agreements, you will be asked to meet at the agency and sign an agreement of intent and at the same time transfer a certain pre-agreed amount, which should guarantee the fulfillment of all the terms of the agreement. For example, 2 thousand dollars.

Each agency calls the contract you will sign differently. It could be:

- Agreement on transfer of deposit;

- Agreement on reservation of real estate;

- Preliminary purchase and sale agreement.

- Agreement on transfer of advance payment;

- Agreement of intent;

You need to understand that this agreement is signed between the buyer and seller. In this case, the agency plays the role of an outside observer, although it has its own interest here.

Various expenses when buying an apartment

In addition to the basic cost, the buyer has to take into account additional expenses in the process of searching, transacting and registering property to the new owner.

- Consider the cost of drawing up a purchase and sale agreement, which will be at least 3,000 rubles or more.

- The next expenses are the state fee for registering housing, as well as the registration itself.

- If the buyer uses the services of a bank to pay the seller, then commissions and other fees are inevitable. Especially when it comes to mortgage payments, etc., then the bank will also require home and life insurance for the owner.

- Married couples notarize a mutual agreement for the sale and purchase of an apartment. Without this paper, the transaction is impossible.

- A power of attorney (if necessary) to sign the transaction instead of the buyer will cost less than 1,000 rubles.

- Tax on the acquisition of real estate sometimes entails large expenses. Especially if you are buying or selling an apartment that changed ownership less than 3 years ago due to inheritance, sale, etc.

Real estate commissions: how not to overpay

You may need real estate or agency services to search and register. Here you need to choose: either time or money. Either you look for an apartment yourself, or you pay money and this process is carried out for you. Such institutions take on average 3-6% of the cost of purchased housing . In fact, the amount is not small. In addition, the cost of several parallel services and specialists is usually attributed, so it will be more expensive than initially promised. It includes:

- monitoring the real estate market according to the buyer’s specified parameters;

- inspection of the apartment;

- checking and preparing documents of the parties to the transaction.

Fraud is very common in the real estate market, where agencies with little experience and newcomers participate. Therefore, it is better to contact time-tested companies, although their costs are higher.

All services provided must be specified in the contract between the buyer and the agency.

Therefore, all kinds of duties, taxes, and additional expenses are paid by the buyer independently and the realtor has nothing to do with this.

Discuss in advance with the agent the services that will be provided, as well as possible additional services. After this, they sign a paper on cooperation.

There are 2 types of tariffs for intermediary services:

- fixed rate for specific services with any type of real estate;

- percentage of the cost of housing, especially high fees are requested for suburban properties.

If the agency works on a percentage basis, then highlight the question of what it will be based on the expected amount, and what determines the rate increase. After all, in such transactions, even 1% is a serious amount.

How an agency intervenes in a deal and protects its interests

As a rule, to give significance to the signing process and to justify the need for the agency’s presence in this action, a clause is included in the contract stating that it is executed in the presence of an agency representative who is a witness to everything that happens. The representative puts his signature on the document and certifies it with the agency’s seal.

For example, with this form of agreement, the agency signs another separate agreement with the buyer, which obliges the buyer to pay for the agency’s services in a pre-agreed amount. In our example, this amount is $1,000.

According to the agreement, the buyer makes an advance payment for the agency's services in the amount of, for example, $200. He undertakes to pay the remaining amount of $800 after execution of the main contract.

In some cases, the deposit agreement between the buyer and the seller and the buyer’s agreement with the agency are combined into one 3-party agreement, which states who pays whom how much and for what. But this does not change the essence.

Agency task

The agency’s task is to receive a deposit from the buyer and a promise to pay the remaining amount at the final stage of the transaction.

In addition, the agency strives to bind both parties as strongly as possible with mutual obligations so that the main agreement is ultimately concluded. After all, only in this case the agency will receive its reward in the amount of $800. This is the agency's interest in the transaction.

In order to tie the buyer more tightly to the upcoming transaction, he is “tied” with two deposits - one deposit is transferred to the seller, and the second to the agency. In our example, this is 2 thousand and 200 dollars.

The original documents must remain with the seller

As a rule, when transferring the deposit to the seller, the agency representative takes the original documents from him and leaves them at the agency “for safekeeping”. It should be noted that such actions are not legal. Never leave original documents at the agency.

For “literate” sellers who do not want to leave documents with the agency , a compromise option is provided. The agency retains “for safekeeping” the amount of money that the buyer transfers to the seller.

For example, this is 2000 dollars. The clause stating that the deposit remains in storage at the agency is included in the contract. That is, in this case, the buyer’s deposit does not go to the seller, but remains with the agency. But this does not solve the problem.

Is it necessary to make an advance payment when buying an apartment?

In the case when a transaction for the purchase and sale of secondary real estate takes place between close relatives and good friends, it is not at all necessary to make an advance payment for the apartment; you can completely do without prepayment for the apartment and take their word for it.

In other cases, an advance payment is most likely inevitable; it is unlikely that you will be able to break the foundations of business turnover accepted in the secondary market, however, it is worth noting that cases of optional payment of an advance payment for an apartment are not isolated...

Why do agencies draw up a deposit agreement?

The whole point of this idea is that the buyer will be forced to transfer a certain amount of money to the seller, for example $2,000 in our case, as confirmation of the seriousness of his intentions.

This amount can also be called differently:

- Deposit;

- Prepaid expense;

- Pledge;

- Security deposit;

- Guarantee amount.

What is a deposit

According to Article 570 of the Civil Code of Ukraine:

- A deposit is a sum of money that is given to the seller from the buyer on account of further payments under the contract and serves as confirmation of the obligation and ensures its fulfillment. If the deposit secures the contract, then it is written directly into the purchase and sale agreement or in an additional agreement.

- If it is not established that the amount paid by the buyer under the contract is a deposit, it will be automatically recognized by the court as an advance.

Functions of the deposit

- Payment - issued against future payments under the agreement.

- Evidentiary – confirms the fact of concluding a contract.

- Security – encourages the parties to fulfill the obligation.

Please note that the deposit is drawn up after the conclusion of the main contract or simultaneously with it.

The deposit secures obligations arising from contracts. This is an additional guarantee of the fulfillment of the main contract. Therefore, if there is no main agreement, then there cannot be an agreement on the deposit.

Thus, in our case, you do not sign the purchase and sale agreement, therefore the transferred amount is not a deposit and it will be recognized as an advance .

What is an advance

An advance is an advance payment that the buyer gives to the seller in order to confirm his intentions to buy real estate.

But it does not have enforcing function.

As a rule, the advance is transferred before the counter obligation to re-register the apartment occurs, as a sign of the seriousness of intentions to buy it. It is considered part of the future payment.

You transfer the advance and undertake to sign the main contract in the future.

Advance functions

- Evidentiary – confirms the fact of concluding a contract.

- Payment – counted towards the final payment.

As you can see, if you compare it with a deposit, there is no third function - security .

The advance payment does not provide the main payment, but confirms the agreement to buy an apartment in the future.

What is the difference between an advance and a deposit from a deposit when buying an apartment with a mortgage?

Many of us often confuse the concepts of advance, deposit and deposit, throwing them “into one pile” and equating them to each other. However, experts argue that there are significant differences between these methods of ensuring the fulfillment of obligations.

Today, the word “collateral” is often used for other purposes. If the buyer says: “I paid a deposit for the apartment,” then in fact he may mean both a deposit and an advance. Most likely, we are talking about concluding an agreement between individuals or investing funds in a company.

[offerIp]

At the same time, the economic dictionary states that a pledge is one of the ways a debtor fulfills his obligations when he pledges real estate or other valuables to the creditor (pledgee). And now it becomes clear that the use of this term in the above example was inappropriate.

The concept of “advance” is well known to each of us. In terms of real estate transactions, it means that the buyer transfers a certain amount of funds, which is only part of the cost of housing, towards the purchase of an apartment. As for the seller, he may well dispose of the money received at his own discretion, but if the transaction is cancelled, he will have to return it. The buyer makes an advance payment, as if confirming his word of honor, but no official obligations on either side are recorded.

Deposit is a more complex concept. Its task is to determine the mutual obligations of the parties in accordance with the norms of the Civil Code. Having transferred the deposit to the seller when purchasing an apartment on a mortgage, but refusing for one reason or another from the transaction in the future, the buyer loses this amount. If the refusal to complete the transaction comes from the seller, then, by law, he is obliged to return the deposit to the buyer in double amount. If the transaction is successful, the deposit amount is included in the cost of housing.

As you can see, the scheme is quite understandable and fair, however, as practice shows, it is not always implemented. To avoid problems in the future, it is important to conclude a purchase and sale agreement in writing with a mandatory indication of what exactly the buyer paid - a deposit or an advance payment. Strict adherence to all formalities disciplines all participants in the transaction.

Differences between a deposit and an advance

If we consider the preliminary contract for the purchase and sale of real estate, the main difference is that the deposit cannot be transferred at all. This contradicts the very concept of a deposit.

You can only transfer an advance or a security deposit with penalties , since the terms of the transaction are being discussed and there is no main purchase and sale agreement yet. And this is done in a preliminary agreement.

In other cases, the deposit and the advance may seem similar to each other. That's why they are often confused. But in terms of legal consequences, these are different agreements.

The advance is returned

The advance payment is always returned to the buyer in case of any failure of the transaction, regardless of the reasons. This is beneficial if you are a buyer. If something goes wrong, your money will be returned.

The deposit is not refundable

The deposit is not returned to the buyer. This form of agreement is beneficial to the seller. The deposit remains with the seller in case of failure of the transaction due to the fault of the buyer.

If the seller himself breaks the deal, then he must return the deposit to the buyer in double amount. Article 571 of the Civil Code of Ukraine.

This is the main difference between a deposit and an advance payment when concluding contracts.

Advance and deposit: what to choose when making a transaction

Today, simply shaking hands is no longer enough to conclude an agreement. For this reason, in the practice of carrying out various transactions, including real estate transactions, deposits and advances are increasingly used. Advance and deposit are the most common methods of prepayment for a transaction. However, people often do not see the difference between a deposit and an advance, and this, in turn, can lead to undesirable consequences for the parties to the transaction. What kind of agreement should be concluded - about an advance or a deposit? To understand, it is necessary to understand the very legal nature of the terms “deposit” and “advance”.

So, what is a deposit? A deposit is a sum of money given by one party to the other against future payments under a transaction to ensure its execution and confirm the seriousness of intentions to carry out the transaction.

A deposit is a way to ensure the fulfillment of obligations, i.e. It is worth resorting to a deposit in order to ensure the fulfillment of the contract. The concept of a deposit is defined in Article 380 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation). What is an advance?

An advance is an amount that is transferred before a transaction is completed by one party to the other against payments due under the transaction. The purpose of paying an advance is similar to a deposit - confirmation of the reality of intentions in completing a transaction, but without ensuring performance. The Civil Code does not contain separate articles devoted to advance payments.

What is the difference?

The difference lies in the consequences of termination and failure to fulfill the obligation - the security function of the deposit. If the transaction is completed, the parties do not notice the differences between the advance and the deposit. However, if the transaction does not occur in the case of an advance, it is simply returned. The party guilty of disrupting the transaction does not bear any sanctions under the advance agreement, unless the parties have provided for some kind of fine in the advance agreement. If the transaction did not take place due to the fault of the party who transferred the deposit (buyer), the deposit is lost and remains with the recipient of the deposit (seller). If the transaction did not take place due to the fault of the recipient of the deposit, the deposit amount must be returned in double amount, i.e. if the deposit is 100 rubles, then the recipient of the deposit is obliged to return 200 rubles. This rule is contained in Article 381 of the Civil Code of the Russian Federation and determines the most significant differences between an advance and a deposit. The deposit allows the parties to control each other. The recipient of the deposit controls the money, and the payer is liable in the form of a penalty in the amount of the deposit. This is the security function of the deposit.

Should I deposit money without drawing up documents?

In real estate transactions, deposits always exceed these amounts, so the deposit agreement should always be in writing. This norm is enshrined in Article 380 of the Civil Code of the Russian Federation. This allows the parties to confirm that money has been deposited. The deposit agreement can be drawn up in any form in the form of an agreement on the letterhead of an organization or real estate agency, etc. The most important thing is that it is drawn up correctly and contains the amount of the deposit and the following details: Full name. the parties or the name of the organization, their place of residence or legal address, passport data or details of the organization, deadlines for fulfilling obligations, the subject of the agreement (real estate) indicating the address and other characteristics that make it possible to accurately determine the object, signatures of the parties. The same rules apply to the advance agreement. Although in the case of an advance, it is possible to draw up a one-sided receipt from the recipient of the advance.

Doubts – deposit or advance?

An oral agreement on a deposit entails the consequences provided for in Article 162 of the Civil Code of the Russian Federation, that is, the parties are deprived of the right to refer to witness testimony, but can provide written evidence. Agreement to receive a deposit or advance indicates the conclusion of a contract. In case of doubt about the purpose of the amounts paid under the agreement, these amounts will be considered not a deposit, but an advance, which does not perform a security function, but is part of a future payment. Violation of the form of the deposit agreement, until proven otherwise, leads to the same consequences.

In the practice of realtors, there is the concept of “deposit”, however, if the money is paid to a real estate agency, this term is more suitable for an advance payment or a security deposit. The only function of this amount is to confirm the seriousness of the intentions to carry out the transaction, since this “deposit” is usually returned in the event of failure of the transaction by either party. For this reason, there is serious confusion in terms and in the professional real estate community. However, if, due to such confusion, a document is drawn up in which the amount is called a deposit, and it is indicated that this money is paid to the seller, this will trigger the rules on the deposit with all the ensuing consequences.

Restrictions on the use of the deposit

There are several groups of contracts that are considered concluded from the moment of state registration. Such agreements include all transactions with residential real estate. Agreements with non-residential premises and land plots are considered concluded from the moment they are signed. This creates a situation where the inclusion of a provision on a deposit in an agreement that comes into force from the moment of state registration, and the payment of the deposit amount before the state registration of such an agreement will not lead to sanctions provided for by the provisions on a deposit. This is due to the fact that such contracts are considered concluded from the moment of state registration by virtue of clause 3. Article 433 of the Civil Code of the Russian Federation. Fortunately, when such situations arise, the courts tend to recognize this amount as an advance, and it is still returned to the owner, but in this situation you will have to forget about a double return.

The same rule applies to lease agreements concluded for a period of more than a year, since agreements concluded for a shorter period are not subject to state registration. The general practice of realtors working with such amounts is to draw up a separate document on the payment of the deposit.

To exclude such a situation, these relations are usually included in a separate agreement, for example, a preliminary agreement. Such an agreement is not subject to state registration and comes into force from the moment of signing.

Obviously, an advance is unprofitable for the buyer, since if the transaction does not take place, the money is simply returned. The buyer lost time, did not purchase the property and did not receive any interest from the use of his money by the seller. Some unscrupulous sellers may specifically take advances. The purpose of such an operation may be the interest-free use of other people's funds, for example, of several potential buyers.

An earnest money agreement is the most reliable way to achieve the execution of a transaction. Even if the deal falls through due to the fault of the other party, the person who transferred the deposit will be able to compensate for their losses. However, for the same reason, the recipients of the deposit do not want to accept responsibility. This contradiction is resolved by using a simple advance payment, which does not carry a security function that is so useful for the payer (buyer).

Author: Anton Lebedev, lawyer AF "YURINFORM-CENTER" SPbSCA

VAT – 2022

The best speaker on tax topics, , will prepare you for filing your return on January 14 . There are 10 out of 40 places left for the online workshop . The flow is limited, as there will be live communication with the teacher live. Hurry up to get into the group. Sign up>>>

Why you can’t give a deposit to a real estate agency

The contradiction to the law in our case is obvious. Article 570 of the Civil Code is categorical - a deposit can be used to secure an obligation that has already arisen.

When purchasing an apartment, the obligation arises only after signing the purchase and sale agreement. But in our case such an agreement has not yet been signed. Therefore, armed with Article 215 of the Civil Code, the deposit agreement may well be declared invalid in court.

Article 216 of the Civil Code contains the phrase: an invalid transaction does not create legal consequences other than those related to its invalidity.

Let's explain what this means:

- Firstly , the parties are not obliged to fulfill their obligations under such an agreement;

- Secondly , they are obliged to return to each other everything that they received under this transaction.

Such a contested agreement benefits the buyer, since he will be able to return the amount paid under the deposit agreement, even if he himself is guilty of violating his obligations. The seller will be obliged to return the amount received from the buyer in full in any case.

Registration of collateral and deposit

The advance and deposit are drawn up on paper between the seller and the buyer independently. Notary and legal services are not required. Although the presence of witnesses when drawing up and signing such guarantees is allowed and encouraged.

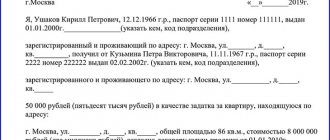

The deposit agreement contains the following items :

- real estate price;

- its characteristics - area, number of rooms, features;

- address of the apartment being sold;

- deposit amount;

- information about the parties to the transaction - full name, passport details;

- deadlines for fulfilling the obligations of the participating parties.

The written advance agreement also stipulates the terms of the purchase and sale transaction, the terms of return, and penalties for refusing the transaction.

The pledge is often prepared with the participation of a notary. The pledge agreement contains many positions that outline the obligations of the parties - the pledgor and the pledgee - before the transaction. Main provisions of the agreement :

- distribution of roles of the parties - pledgor and pledgee;

- information about the requirements that the pledge secures, that is, information about the main contract;

- information about the property that is the subject of the pledge, a description of the exact characteristics;

- whether the collateral can be replaced, under what conditions;

- obligations, rights of the pledgor and pledgee in detail (rights to use the subject of pledge by the pledgee, conditions for return, non-return of property, etc.);

- in what proportion the pledged property covers the claims;

- what risks do both parties bear, as well as responsibilities;

- validity periods, conditions for change, etc., details of the parties to the transaction.

An excellent additional step would be to insure the property against collateral. The transfer of the property itself occurs after signing the pledge agreement.

Why it makes no sense to enter into a deposit agreement with a real estate agency

Whatever agreement you enter into with a real estate agency, the amount of money transferred within its framework cannot be considered a deposit.

This amount will be recognized as an advance and must be returned to the buyer in full if the transaction fails. Moreover, the reason why this transaction did not take place does not matter.

Even if the buyer changes his mind about buying an apartment, his plans or mood have changed - according to the law, the money must be returned to him. If the seller cannot or does not want to enter into a transaction, then he is also obliged to return the amount transferred by him to the buyer.

Thus, the transfer of an advance or deposit to a real estate agency under any of the proposed agreements cannot have a security function.

The deposit will be considered an advance and must be returned to the buyer if the transaction fails, regardless of the reasons.

What contract should be concluded when selling an apartment?

There are two types of preliminary agreements:

- Preliminary agreement

- Agreement of intent.

What is the right thing to do in this case? Which agreement is better to conclude?

The letter of intent does not impose any obligations on the parties to the transaction. In the future, it is possible not to conclude the main agreement on the terms that were in the agreement of intent. Refusal to perform it does not cause any consequences. This is simply a written plan to buy an apartment.

The optimal solution is to conclude a preliminary purchase and sale agreement . As a rule, under such an agreement the parties, for a specific period of time, undertake to subsequently conclude the main agreement on the terms specified in the preliminary agreement (Article 635 of the Civil Code). Failure to comply may result in legal consequences.

Conditions of the preliminary purchase and sale agreement

It must contain the following items:

- Details of the parties to the agreement;

- Duration of concluding the main agreement;

- Description of the object;

- Price;

- The procedure and form of calculation;

- Moment of transfer of ownership;

- Penalties for failure to comply with the terms of the contract.

Money transferred under a preliminary agreement can be called a security deposit or a guarantee amount. The transferred amount confirms the seriousness of the parties’ intentions.

If at the same time penalties are prescribed for failure to fulfill the contract, then this amount will have the functions of a deposit.

For example, it often happens that at the time of concluding a preliminary agreement, the seller may not yet have title documents for the property, or there may be no separate documents without which it is impossible to complete a real estate purchase and sale transaction.

Form for concluding a preliminary purchase and sale agreement

The preliminary agreement must be concluded in the same form as the main one. That is, its notarization is required (Article 657 of the Civil Code). This may not always be convenient, but there is no other option.

According to Article 220 of the Civil Code of Ukraine, a transaction made in non-compliance with the notarial form does not oblige the parties to anything. And at the same time, it is not required to be declared void by the court.

Very often, when concluding a preliminary agreement, the parties try their best to save on notary services , but this should not be done.

Refund of deposit

Upon expiration of the pledge agreement, taking into account the fulfilled obligations of both parties, the previously pledged property passes to the primary owner - the pledgor. You can return the deposit for other reasons if the conditions specified in the contract allow this. In most cases, it all depends on the collateral. After all, the pledge of various types of property, not only real estate, is regulated by separate laws. The legal relations of the parties may not even be regarded as collateral.

How to return a deposit or advance payment for an apartment

There are controversial situations with deposits and advances.

The advance payment is returned to the buyer in any case. If the preliminary agreement did not indicate penalties, then simply ask the seller to return your money to you. It is better to negotiate everything peacefully and not bring the matter to court.

For example, problems arise when the seller refuses to return the money for any reason. Then you need to draw up a statement of claim and go to court. And based on the evidence provided, act in accordance with the court decision.

Both parties to the transaction may go to court in the following cases:

- violation of the terms of the preliminary agreement;

- the emergence of disagreements between the buyer and seller;

- refusal to voluntarily return money in case of violation of agreements.

As a rule, if there are disagreements, the only legal way to return the advance or deposit under a preliminary agreement is to go to court.

A decision will be made based on the documents provided.

What decision can the court make?

- If the court decides that it was an advance , then it will be returned to the buyer, since it is refundable in 100% of cases.

- If the court recognizes that a deposit option was issued, the seller will have to pay the amount received in double the amount or in the amount stipulated by the contract. This is the case if the deposit was formalized as a security payment with penalties.

Deposit, advance or something else

First difficulty

It is customary to pay a deposit according to a preliminary agreement. The reasons why a preliminary agreement is drawn up are very different: the realtor worked out a scheme that never failed, documents for the apartment were not prepared, etc.. According to Art. 429 of the Civil Code of the Russian Federation, a preliminary agreement confirms the desire of the parties to conclude a transaction on the terms and conditions defined in this agreement. Property (monetary) obligations do not arise in this case. In addition, the deposit secures only contracts that have entered into force.

The conclusion suggests itself that the deposit does not perform all three functions and ceases to be such. Therefore, if doubts arise regarding the amount paid, the court will consider this amount as an advance without applying the provisions on the deposit, and, therefore, it will not be possible to receive a deposit in double the amount provided by law. Is a deposit different from an advance payment when buying an apartment and how? It’s worth paying attention to these nuances. After all, the advance has only a payment role, and if the deal falls through, it is returned to the buyer in full, in which case the seller loses compensation; if the buyer changes his mind, he himself does not risk money if he has to cancel the deal.

It should be remembered that if, within the framework of the preliminary contract, the agreement on the deposit will not be valid, and, therefore, refusal of the transaction does not allow the seller to appropriate the received advance. This money is returned to the buyer, otherwise such an action is classified as unjust enrichment (Article 1102 of the Civil Code of the Russian Federation).

Second difficulty

A deposit when purchasing an apartment is paid under an agency agreement. Before starting work with a client, the realtor offers to sign an agency agreement, which determines his commission. At the same time, the most persistent ones manage to take a deposit from inexperienced clients for an apartment that still needs to be found. The amount of the deposit here will be a fixed amount or calculated based on data on the preferred property option. It must be taken into account that what is declared as a deposit in this case is not actually one. This amount cannot even be called an advance, since the money is intended for the intermediary, and not for the seller or authorized person. In fact, this amount can be considered enrichment and demand its return through the court in your favor (according to Chapter 60 of the Civil Code of the Russian Federation).

It is better not to deal with such realtors and not to enter into agency agreements with them. Within the framework of an agency agreement, an agreement on a deposit is appropriate when it is paid as payment for the services of a realtor.

Difficulty three

The seller receives the deposit without putting it in writing. Such a careless attitude towards money can still be found when in business relationships they trust only their word of honor. It is important to remember: the agreement on the deposit must be drawn up in writing and in accordance with all the rules, regardless of the amount of the deposit (Article 380p.2 of the Civil Code of the Russian Federation). If this condition is not met, the client may refer to witness testimony in court (Article 162 of the Civil Code of the Russian Federation). As a last resort, you can try to declare the transaction illegal and invalid (Article 168 of the Civil Code of the Russian Federation). So, money is transferred in the presence of executed documents, the contents of which reflect the true picture of the transaction.

Difficulty Four

Judicial. When considering cases in court, a deposit is often recognized as an advance payment, since the determination of the nature of obligations is treated very carefully. The key argument in court is receipts, payment and other documents confirming the fact of transfer of money. If the deposit is indicated only in the contract, but there is no mention of this in the receipt, the court will recognize the money as an advance.

Difficulty five

If the obligations are not fully fulfilled, the buyer cannot demand a double refund of the deposit. Unfortunately, judicial practice has developed when the provision on the deposit is not applied due to a violation of the fulfillment of obligations. For example, a buyer cannot move into an apartment because the former owner or unauthorized persons live there. The deadlines for vacating the living space specified in the contract are violated and discourage any desire to continue the deal. But in court it turns out that the seller fulfilled part of his obligations (for example, he deregistered).

If the contract is partially fulfilled (even with violations of deadlines), it is pointless to demand a double deposit. Next time, such a buyer will choose housing that is free of registered or resident citizens.

What kind of agreement should be concluded when selling an apartment - conclusions

As a rule, to minimize risks, you need to enter into a notarized preliminary purchase and sale agreement with clearly stated penalties for non-compliance. It protects the interests of the buyer and seller as much as possible.

If the agreements are violated, the court may recognize the security amount as an advance or deposit . Wherein:

- The advance is returned in any case if the transaction fails, and it does not matter who is to blame for the failure of the transaction.

- The deposit is returned in double amount if the transaction does not take place due to the fault of the seller. If the buyer breaks the deal, the deposit is not returned, it remains with the seller.

Recommendations - how to protect yourself when applying for a deposit through a real estate agency

Recommendations to the seller

- Do not leave original documents with the agency for storage under any circumstances. If necessary, the agency can make copies for itself. All originals can only be handed over to a notary for the execution of the main purchase and sale agreement.

- If the advance payment transferred by the buyer remains in storage at the agency and you have not received it in your hands, this must be clearly stated in a separate clause in the contract.

- Do not give away the original contract with the agency after the transaction. He must stay with you. This document confirms the agency’s participation in the transaction and can help if problems arise later at the stage of litigation.

Recommendations for the buyer

Why does the agency not check documents, but only creates the appearance of such a check:

Checking documents at an agency is usually just words. The agency receives its fee only if the transaction is completed. Therefore, even if there are problems with the documents, the buyer will not be told about it. Let's explain why.

It is important for the agency to bind the buyer and seller with mutual obligations with conditions unfavorable for both parties (for example, a large advance with penalties in case of a failed transaction). This factor will deter the buyer from refusing to complete the transaction.

And the problem with the documents (if any) will be resolved by the seller at his own expense. How he will do this and how legal and correct this is is not of interest to this agency. At the same time, the agency seems to be on the sidelines and patiently waits for the day the deal is concluded in order to receive its fee.

Why you can’t buy an apartment without checking

There are situations when it is possible to formally carry out a transaction, the documents allow this to be done and the notary will draw up a purchase and sale agreement. But problems can begin only later, after the purchase.

However, now this will only apply to the new owner. The seller will be far away at this time and will never voluntarily return the money for the sold apartment. Only by court decision.

You need to insure yourself against such a situation at the very beginning. Therefore, checking the documents by an independent lawyer, and not by a representative of a real estate agency interested in the transaction, will help to objectively assess the situation and make the right decision if there are any problems with the apartment.

The task of an independent lawyer is to check the apartment and the owners. If you find any negative aspects, inform the buyer about it. The decision whether to buy or not to buy such an apartment will be made by you based on complete information. Therefore, a check should always be done before the advance payment is transferred.

First CHECK, and then ADVANCE. This is the position the buyer should have during negotiations and it is the most correct one.

Buyer mistakes after viewing an apartment

If you looked at the apartment and liked it, then before making a final decision to purchase, you need to ask for documents for the apartment and documents of the owners for verification.

If you are in an apartment and the owner shows it, you can immediately ask for documents for review. Until the documents have been verified, no further action needs to be taken.

Typical situation

It happens that after viewing, a realtor offers to meet at the agency . In this case, you need to discuss and CLEARLY understand the purpose of such a meeting.

Why do the parties to the transaction meet at the agency?

As a rule, realtors are programmed in such a way that the meeting at the agency should be timed to coincide with the signing of the down payment agreement. But if you want to meet to receive documents for verification, meet the seller and discuss the terms of the deal, then such a meeting may end in conflict.

The realtor expects to receive an advance from you, but you are not going to give it. The realtor will insist on signing the contract, but you will refuse to sign it because the documents have not been verified and you have not yet made the final decision to purchase.

What is the result - possible consequences

Moral and psychological pressure will be put on you, as a result you will sign an advance agreement in a form that is unfavorable for you, and you will never receive a full package of documents for verification. This is the most likely outcome. Further developments of events may occur according to different scenarios, but you will not be able to change anything.

To avoid finding yourself in such a situation, use our recommendations.

How to do the right thing - recommendations

If you offer to meet at an agency, you need to directly tell the realtor that you are not ready to give an advance and will not sign anything until the final decision to purchase is made. Such a decision can be made only after checking the documents. In this case, there are only two options for the development of events:

- They will agree to provide you with documents for verification before making an advance payment. This is the most favorable option.

- If they refuse to provide you with documents without signing an agreement, then you must in advance to provide you with a COMPLETED advance agreement with all the details - parties to the transaction, object of purchase, terms, full cost, amount of the advance, expenses of the parties to the transaction, transaction scheme, place of conclusion of the transaction, method , form and place of payment, the seller’s obligation to personally attend the transaction. It is necessary to stipulate in the contract that when transferring the advance payment, you will be provided with a complete package of documents for the apartment (listed item by item) and documents of the owners for subsequent verification. This advance must be refundable, without penalties in relation to the parties to the transaction.

Who should I transfer the advance to?

The advance must be transferred exclusively to the owner. In this case, no matter what happens in the future, if the deal fails, the advance must be returned to you.

Sequence of actions after viewing the apartment:

- Before signing an agreement with the agency, you must check the documents for the apartment. To do this, you need to make copies (for example, photocopies or photographs) and submit them to an independent lawyer for review.

- Further actions depend on the results of the check. Only after checking the apartment, the owners, the scheme of the upcoming transaction and receiving a positive opinion from a lawyer, can you sign an advance payment agreement and transfer the money to the seller. Apartments can be problematic and you can’t buy them even cheaply.

- It is necessary in advance a COMPLETED advance agreement from the agency with detailed conditions for the scheme of the upcoming transaction, indicating the amount of the advance, the price of the object, the list of necessary documents and the timing of their provision, the procedure for payment by the parties of all related expenses, taxes and services with the unconditional condition of returning the advance in the event of a failed transaction regardless of the reasons.

- The advance payment is transferred to the owner (seller of the apartment).

- Do not make an advance payment or deposit for agency services. It is enough that you pay an advance to the seller. This step will protect the buyer from losing money if the transaction does not go through.

- Independently choose a notary who will draw up the contract.

- Payment for agency services must be made after signing the main purchase and sale agreement. As a rule, when transferring money, the agency must draw up, sign and provide you with an acceptance certificate for the work performed.

- Do not give away the original contract with the agency after the transaction. He must stay with you. As a rule, an agreement with an agency and an acceptance certificate confirm the fact of the agency’s participation in the transaction. For example, these documents can help in the future if problems arise with the purchased property.

Article 380 of the Civil Code of the Russian Federation. The concept of a deposit. Form of deposit agreement (current version)

1. Earnest money - a sum of money given as payment in advance. According to paragraph 1 of the commented article, the deposit ensures the fulfillment of obligations with the participation of any subjects of civil law: citizens, legal entities. The Civil Code abandoned the rule of paragraph 2 of Art. 186 of the Civil Code of 1964 on providing a deposit only for relations between citizens or with their participation. Thus, the existing restrictions in the previous civil legislation on the range of obligations secured by a deposit, depending on their subject composition, are eliminated.

2. From the provisions of paragraph 1 of Art. 380 of the Civil Code of the Russian Federation, which states that the deposit is issued “by one of the contracting parties in payment of payments due from it under the contract”, the following follows. Firstly, a deposit differs from all other methods of ensuring the fulfillment of obligations in that it can only ensure the fulfillment of obligations arising from contracts. Consequently, it cannot be used to ensure the fulfillment of obligations arising from harm, unjust enrichment and some others.

However, it should immediately be noted that civil legislation provides for two types of application of a deposit: the first is the use of a deposit when concluding contracts as one of the general ways to ensure the fulfillment of contractual obligations, and the second is the use of a deposit during the conclusion of an agreement at an auction. Bidding is a way to conclude a contract. The obligation of the auction participant to make a deposit is established in order to ensure the conclusion of an agreement between the auction organizer and the person who won the auction. The legal regulation of this type of application of the deposit, including the grounds and procedure for returning the deposit paid for participation in the auction, is established by special legal norms on the organization and procedure for conducting auctions. See, for example: clause 5 of Art. 448 of the Civil Code of the Russian Federation, see also paragraph 6 of Art. 18 of the Federal Law of December 21, 2001 N 178-FZ “On the privatization of state and municipal property.”

So, according to paragraph 5 of Art. 448 of the Civil Code of the Russian Federation, even before concluding a contract, bidders make a deposit in the amount, within the time frame and in the manner specified in the notice of bidding. When concluding an agreement with the person who has won the auction, the amount of the deposit paid by him is counted towards the fulfillment of obligations under the concluded agreement. If the auction does not take place, the deposit will be returned. The deposit is also returned to persons who participated in the auction but did not win it. As follows from the legal regulation, the deposit paid by bidders does not have an identification (evidential) function, since it is paid at the stage of submitting documents for the purpose of participating in the auction, during a period when there are no contractual relations between the organizer and the bidder.

Secondly, as can be seen from the above-mentioned fragment of paragraph 1 of Art. 380 of the Civil Code of the Russian Federation, a deposit can only secure the fulfillment of a monetary obligation. In other words, the provision on the deposit does not apply to relations between the parties that are not related to the use of money as a means of payment.

In recent years, deposits are mainly actively used when concluding contracts for the sale and purchase of residential and non-residential premises, rental of non-residential premises, rental of residential premises, and contracts.

3. The subject of the deposit can only be a monetary amount. The commented article contains neither minimum nor maximum restrictions on the amount of the deposit. It is determined by agreement of the parties and, as a rule, is not the whole, but only part of the amount due from the party issuing the deposit.

4. Ensuring the fulfillment of an obligation is the main, main function of the deposit. Based on paragraph 1 of the commented article, in addition to the main one, the deposit performs two more functions: certification (evidence) and payment.

The certifying (evidential) function of the deposit means that, being a way to ensure the fulfillment of an obligation, it is simultaneously issued as “evidence of the conclusion of the contract.” Consequently, the deposit confirms and certifies the fact of the conclusion of the agreement for which it is provided as payment. This means that if the issuance and receipt of the deposit are not disputed by the parties or, although disputed, are supported by relevant evidence, the main (secured) agreement between these parties should be considered concluded. The above also means that if the contract is not concluded, then, therefore, no obligation has arisen between the parties in the sense of Art. 380 of the Civil Code of the Russian Federation, i.e. an obligation that can be secured by a deposit, and the amount of money transferred to secure its fulfillment is not a deposit.

The payment function of the deposit is manifested in the fact that it is issued against future payments under the contract for work performed, services rendered, etc. The deposit is given by the party to whom payments are due under the contract - the customer, the tenant, the buyer, etc. The money is paid to the lender in advance, i.e. are paid even before the transfer of goods, performance of work, or provision of services. Consequently, during the subsequent execution of the contract and settlement between the parties, the person who issued the deposit has the right to withhold its amount from the payments due from him for the transferred goods, work performed, services rendered. This feature of the deposit is expressed in its name and makes it similar to an advance payment. The advance, like a deposit, is counted against future payments (payment function). Moreover, the advance also serves as evidence certifying the fact of the conclusion of the contract (evidential function). As is known, when concluding a contract in writing, acceptance (i.e. consent to conclude a contract) is considered, among other things, to be the performance of actions to pay the appropriate amount (see commentary to Article 434 of the Civil Code of the Russian Federation and Article 438 of the Civil Code of the Russian Federation). However, unlike a deposit, an advance does not perform a security function. Therefore, regardless of which party is responsible for the failure to fulfill the obligation, the party that issued the advance has the right to demand its return in all cases of failure to fulfill the contract. The party that received the advance cannot, under any circumstances, be obliged to return it in a larger amount.

5. According to paragraph 2 of Art. 380 of the Civil Code of the Russian Federation, an agreement on a deposit, regardless of its amount and the form of the main agreement, must be concluded in writing. It is allowed that a written agreement on the deposit can be drawn up either in the form of a separate document or included as conditions in the text of the agreement itself.

However, unlike a pledge and a guarantee (clause 3 of Article 339 of the Civil Code of the Russian Federation, Article 362 of the Civil Code of the Russian Federation), failure to comply with this requirement does not entail the invalidity of the deposit agreement. An oral agreement on a deposit only complicates the situation of the parties in the event of a dispute between them. The parties to the agreement are deprived of the right to refer to witness testimony, but have the right to involve written and other evidence (clause 1 of Article 162 of the Civil Code of the Russian Federation).

6. In paragraph 3 of Art. 380 of the Civil Code of the Russian Federation provides for a rule on the presumption in favor of an advance, according to which, in case of doubt as to whether the amount paid in advance is a deposit or an advance, it should be considered an advance. In particular, if the rule on the written form of the deposit agreement is not observed, the amount is recognized as an advance unless otherwise proven.

7. In paragraph 4 of Art. 380 of the Civil Code of the Russian Federation provides for a rule on the admissibility of using a deposit in a preliminary agreement. This rule is a novelty introduced by Federal Law dated 03/08/2015 N 42-FZ.

By virtue of the provisions of paragraph 4, in this case, the deposit proves the conclusion of the preliminary agreement, ensures the fulfillment of the obligation to conclude the main agreement and is counted against the payments specified in the preliminary agreement in the event of the conclusion of the main agreement.

Failure to conclude the main agreement cannot indicate the unjustified enrichment of the party who received the deposit from the funds contributed as a deposit under the preliminary agreement. The fate of the deposit due to the above provisions of paragraph 2 of Art. 381 of the Civil Code of the Russian Federation should be determined based on an assessment of the behavior of the parties when deciding to conclude the main contract.

Comment source:

“CIVIL CODE OF THE RUSSIAN FEDERATION. PART ONE. ARTICLE-BY-ARTICLE COMMENT"

S.P. Grishaev, T.V. Bogacheva, Yu.P. Sweet, 2019

Why does the agency seek to take away the deposit agreement after the transaction:

Avoid responsibility

As a rule, the agency’s task in a transaction is to receive its commission and not be responsible for anything else. For example, many of the agency's actions violate current legislation.

At the same time, an agreement with an agency is the only document that confirms the agency’s participation in a transaction and can serve as the basis for holding officials accountable.

What laws do agencies violate?

- Law of Ukraine on the protection of consumer rights;

- Tax Code of Ukraine;

- Law of Ukraine “On Advertising”;

- Financial legislation.

Hide illegal activities

The contract specifies some actions that the agency does not have the right . Namely:

- keep funds for safekeeping;

- accept payments in foreign currency;

- seize original documents from the owner and store them at home.

Don't pay taxes

In this case, the agency works according to a “gray” scheme. Hides income and does not pay taxes. And each such agreement is evidence of receiving a large sum of money on which taxes have not been paid.

Conclusions regarding a deposit to a real estate agency

Despite the fairly common practice of filling out a deposit in the form of an independent agreement at a real estate agency, we do not recommend doing this.

How to do the right thing

The purchase and sale of real estate is a responsible step. In such a situation, only a preliminary agreement will serve as a better alternative to a deposit agreement.

At the same time, at the moment, a preliminary agreement with prescribed conditions and possible penalties is a reliable tool when purchasing real estate on the secondary market. The main thing is to get it through a notary and not skimp on this point. It's not particularly expensive.

Receipts and advance or deposit agreements at an agency are nothing compared to the quality and reliability of a preliminary agreement certified by a notary.

Contact real estate lawyers to protect your interests and support the transaction. Or at least get some advice. Because an experienced lawyer simply will not allow your rights to be infringed.

Giving a deposit does not always mean buying an apartment. You may lose your deposit and not be able to buy an apartment.

It is better to draw up a preliminary agreement with the advance amount through a notary.